India Insurance Broking Market Outlook to 2030

Driven by Boost in Insurance Awareness Initiatives, Reduction in Capital Requirement by IRDAI, and Digital Transformation

Region:Asia

Author(s):Rishabh and Rajat

Product Code:KR1445

September 2024

81

About the Report

India Insurance Broking Market Overview

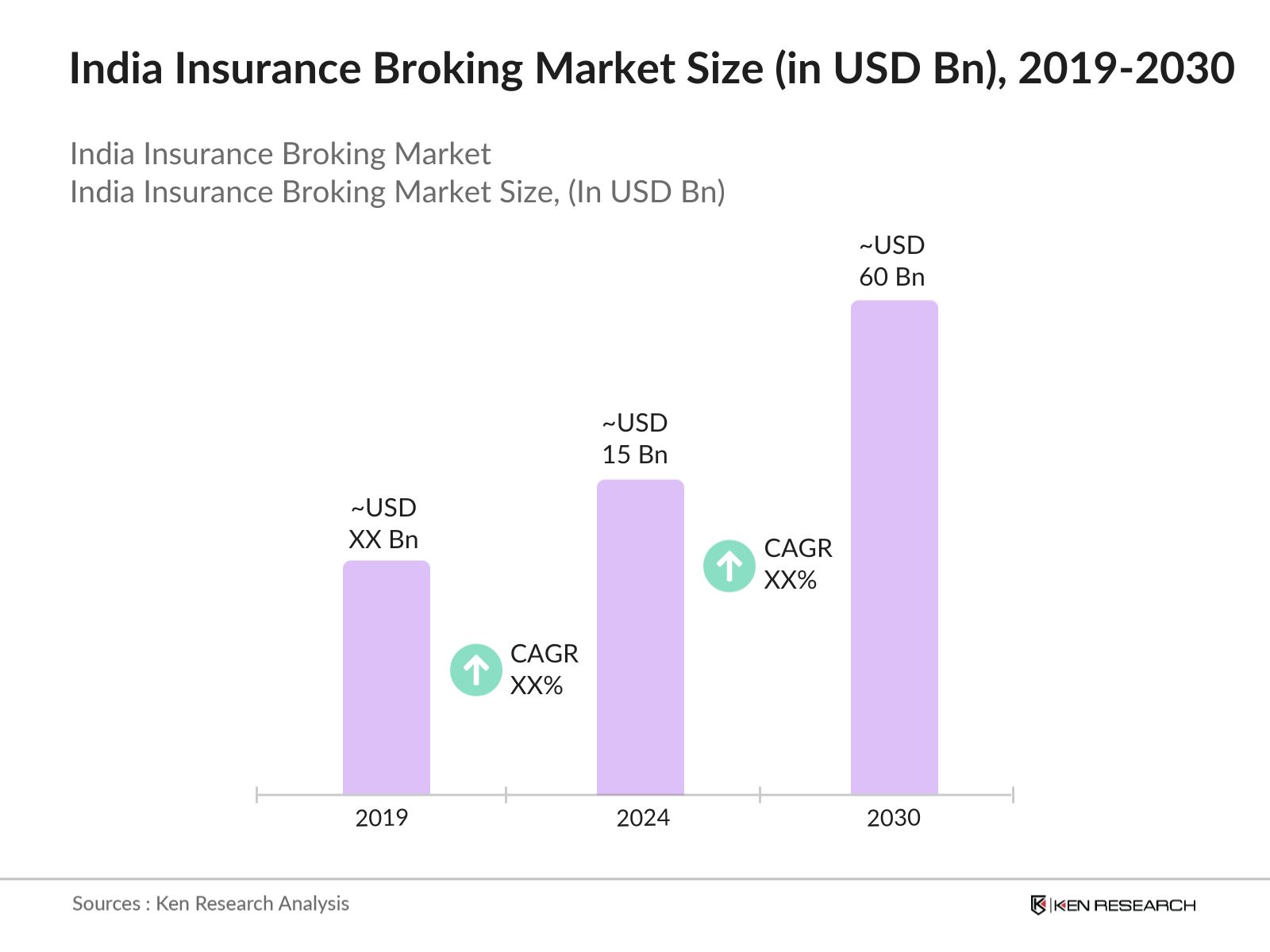

- In 2024, India insurance broking market was valued at USD 15 Bn driven by an increased awareness of insurance products, regulatory advancements, and digital transformation within the financial sector. The rise in disposable incomes and the growing middle-class population have fueled demand for varied insurance products, especially health and motor insurance.

- The market is dominated by key players such as Marsh India Insurance Brokers, Policy Bazaar, Maruti Suzuki Insurance brooking, and Tata Motors Insurance Broking. These companies have established strong market positions due to their comprehensive service offerings, strategic partnerships with global insurers, and a focus on digital solutions.

- The cities of Mumbai, Delhi, Bengaluru, Chennai, and Hyderabad dominate the Indian insurance broking market due to their high concentration of corporate headquarters, affluent populations, and advanced financial ecosystems. Mumbai, as the financial capital, leads the market with a significant share, driven by the presence of major insurance companies and a large number of high-net-worth individuals.

- In June 2023, Marsh India Insurance Brokers announced a strategic partnership with OneWeb to ensure its satellite launches from the US and India. This collaboration covers an aggregate insured value exceeding INR 8,265 crore. The partnership underscores Marsh’s expertise in high-value, complex insurance solutions and strengthens its presence in the aerospace sector.

India Insurance Broking Market Segmentation

The India Insurance Broking market is segmented by various factors like broker, insurance, and region.

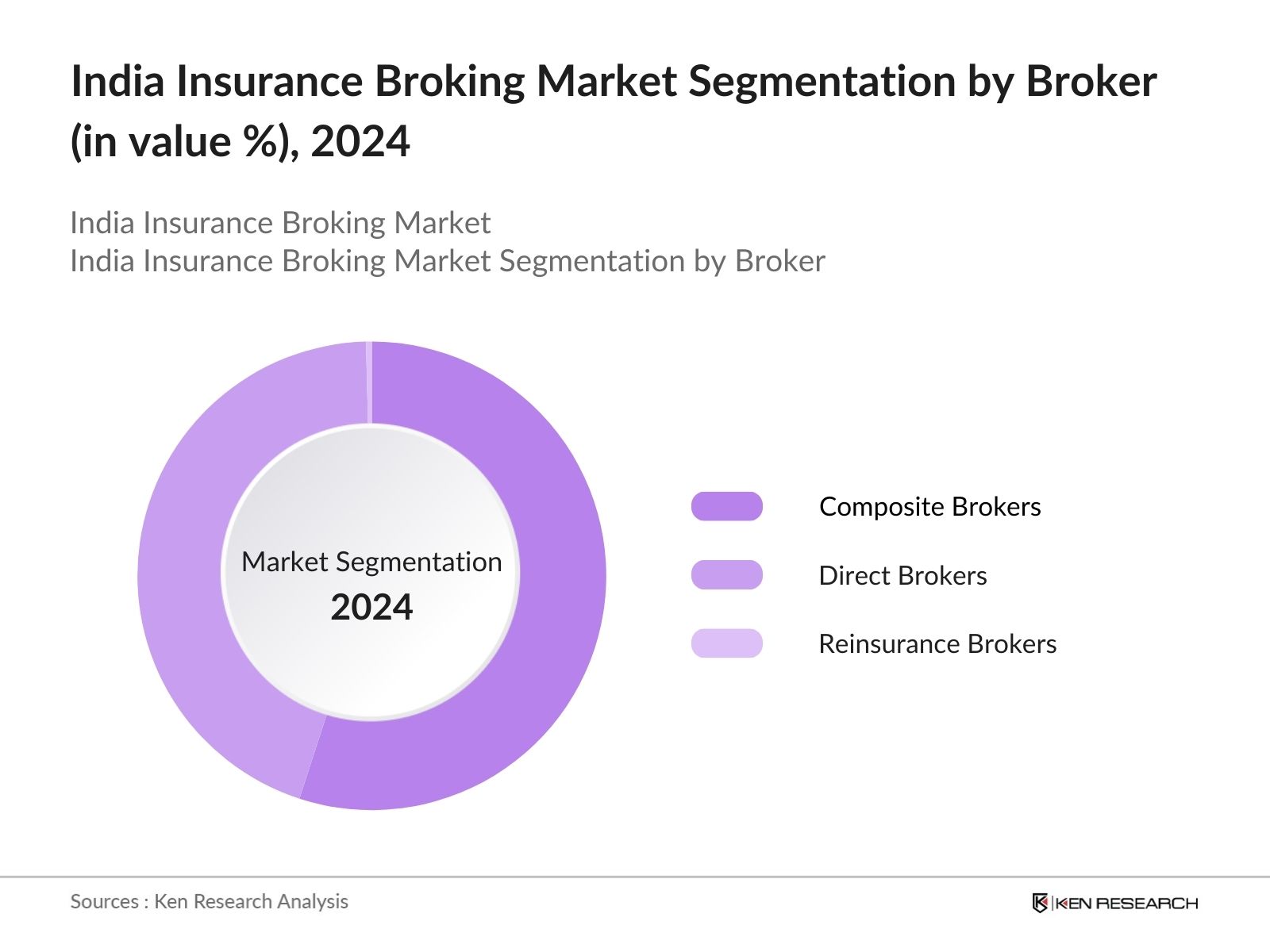

- By Broker: The India insurance broking market is segmented by broker type into composite brokers, direct brokers, and reinsurance brokers. In 2023, Composite Brokers dominated the market due to their ability to offer a wide range of insurance products and services, addressing various client needs. Their strong relationships with both insurers and clients, coupled with their comprehensive expertise, make them the preferred choice, especially among large corporations and high-net-worth individuals.

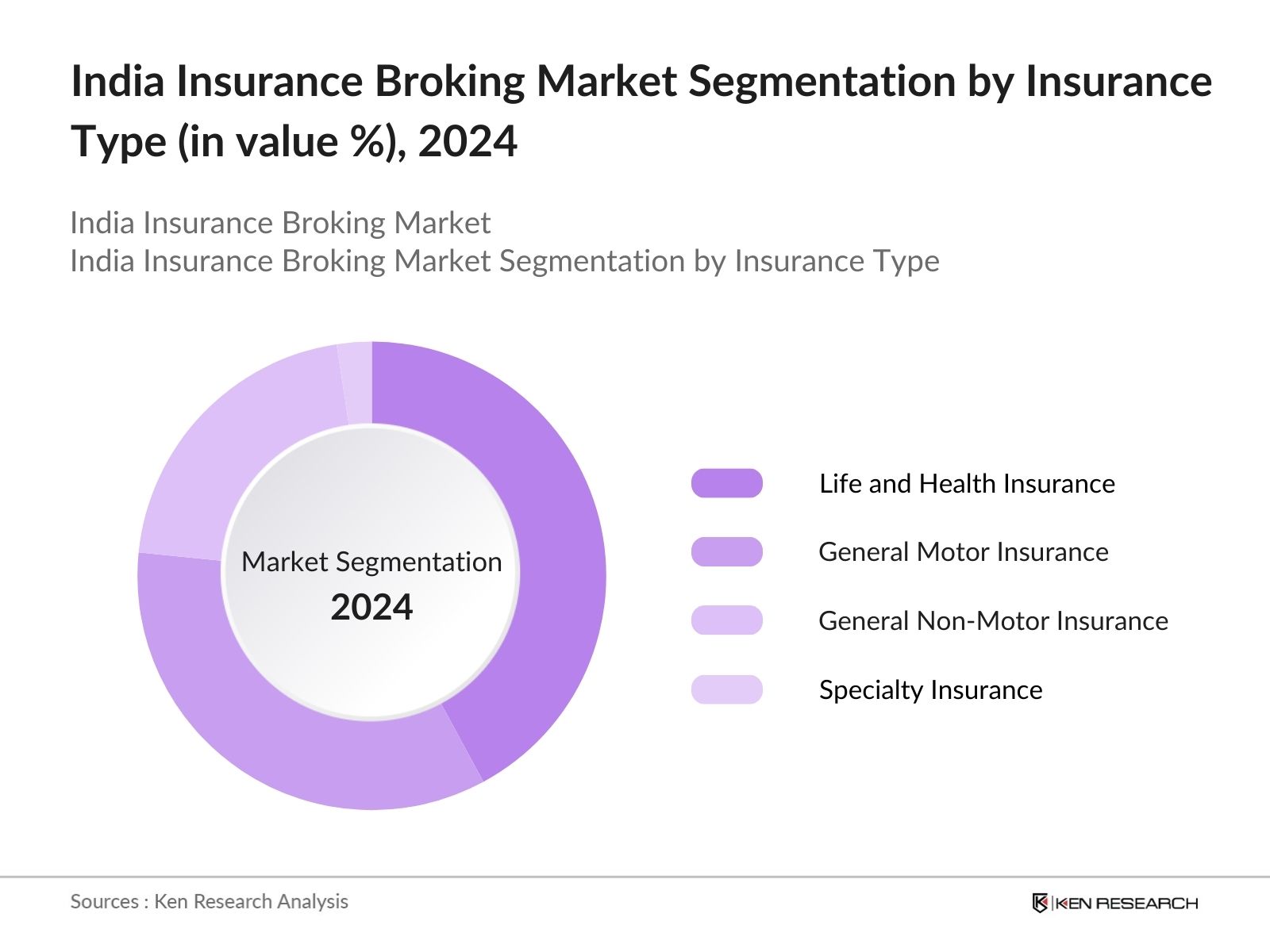

- By Insurance: The market is segmented by the type of insurance into life and health insurance, general motor insurance, general non-motor insurance, and specialty insurance. In 2023, Life and Health Insurance dominated the market, driven by increasing awareness and demand for financial protection and healthcare coverage. The growing importance of life and health security among the middle-class population has fueled this segment’s growth.

- By Region: Regionally, the India insurance broking market is divided into Tier I, Tier II, and Tier III cities. In 2023, Tier I cities dominated the market, mainly due to the concentration of corporate clients, affluent populations, and advanced financial ecosystems. These cities, including major metropolitan areas like Mumbai and Delhi, attract significant insurance activities, driven by their economic significance and the presence of major insurance companies.

India Insurance Broking Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Marsh India Insurance Brokers |

2003 |

Mumbai |

|

PolicyBazaar Insurance Brokers |

2008 |

Gurugram |

|

Maruti Suzuki Insurance Brokers |

2002 |

New Delhi |

|

Tata Motors Insurance Broking |

2008 |

Mumbai |

|

Aditya Birla Insurance Brokers |

2003 |

Mumbai |

- Maruti Suzuki Insurance Brokers: In 2024, Maruti Suzuki Insurance Broking has collaborated with Universal Sompo General Insurance to launch an initiative aimed at enhancing insurance penetration and awareness in Andhra Pradesh. This partnership is part of Universal Sompo's commitment to aligning with the Insurance Regulatory and Development Authority of India's (IRDAI) vision of "Insurance for All by 2047.

- Tata Motors Insurance Broking: Tata Motors Insurance Broking has partnered with Universal Sompo General Insurance Co. Ltd to offer vehicle insurance through Tata Motor dealers. This collaboration aims to enhance insurance accessibility and awareness among customers. The initiative aligns with Universal Sompo's broader mission of increasing insurance penetration in India, particularly through dealer networks, ensuring comprehensive coverage for vehicle owners.

India Insurance Broking Market Analysis

India Insurance Broking Market Growth Drivers:

- Boost in Insurance Awareness Initiatives: The Indian government and various industry bodies have launched extensive insurance awareness campaigns to educate the population about the importance of insurance. These initiatives, often conducted through mass media, social media, and grassroots programs, have significantly increased the penetration of insurance in both urban and rural areas. The heightened awareness has led to more individuals and businesses seeking insurance products, thereby driving growth in the insurance broking market.

- Reduction in Capital Requirement by IRDAI: The Insurance Regulatory and Development Authority of India (IRDAI) has taken a significant step by reducing the capital requirement for insurance companies and brokers. This reduction has lowered the entry barriers for new players in the market, fostering increased competition and innovation. As a result, there has been a surge in the number of insurance brokers, leading to greater product diversity and more competitive pricing. This regulatory change has also encouraged smaller firms to enter the market, contributing to the overall growth and dynamism of the industry.

- Rapid Digital Transformation: The digital transformation sweeping across the insurance industry is another major growth driver. The adoption of digital platforms has streamlined the insurance buying process, making it more accessible, convenient, and transparent for consumers. Insurtech companies are leveraging technology to offer personalized insurance products, instant quotes, and faster claim settlements. This shift towards digital solutions has not only enhanced customer experience but also expanded the reach of insurance products to previously underserved segments, including rural areas and the gig economy.

India Insurance Broking Market Challenges

- Rigorous Due Diligence: The insurance broking market faces the challenge of adhering to increasingly rigorous due diligence requirements. Regulatory bodies like the IRDAI mandate thorough checks and balances to ensure that brokers are compliant with legal and ethical standards. This includes verifying the financial health and credibility of clients, ensuring transparent transactions, and maintaining comprehensive records. While these measures are crucial for maintaining market integrity, they add significant operational complexity and cost for brokers.

- Changing Customer Expectations: The evolving expectations of customers present another challenge for insurance brokers. Today’s customers demand more personalized, transparent, and convenient insurance experiences, driven by the rise of digital platforms and Insurtech solutions. They expect quick response times, seamless digital interactions, and products tailored to their specific needs. Meeting these expectations requires brokers to constantly innovate and adapt their service offerings.

India Insurance Broking Market Government Initiatives

- Relaxation of FDI Limits: In recent years, the Government of India has relaxed the Foreign Direct Investment (FDI) limits in the insurance sector, allowing up to 74% foreign ownership in insurance companies and broking firms, up from the previous 49%. This move has attracted substantial foreign investment, fostering greater competition and innovation in the market. The increased FDI has enabled insurance brokers to access more capital, and enhance their service offerings.

- Introduction of the Insurance Amendment Act 2021: The Insurance Amendment Act of 2021 was a significant legislative step that strengthened the regulatory framework governing the insurance sector. Among its key provisions, the Act enhanced the powers of the Insurance Regulatory and Development Authority of India (IRDAI) to supervise and regulate insurance brokers more effectively.

India Insurance Broking Future Market Outlook

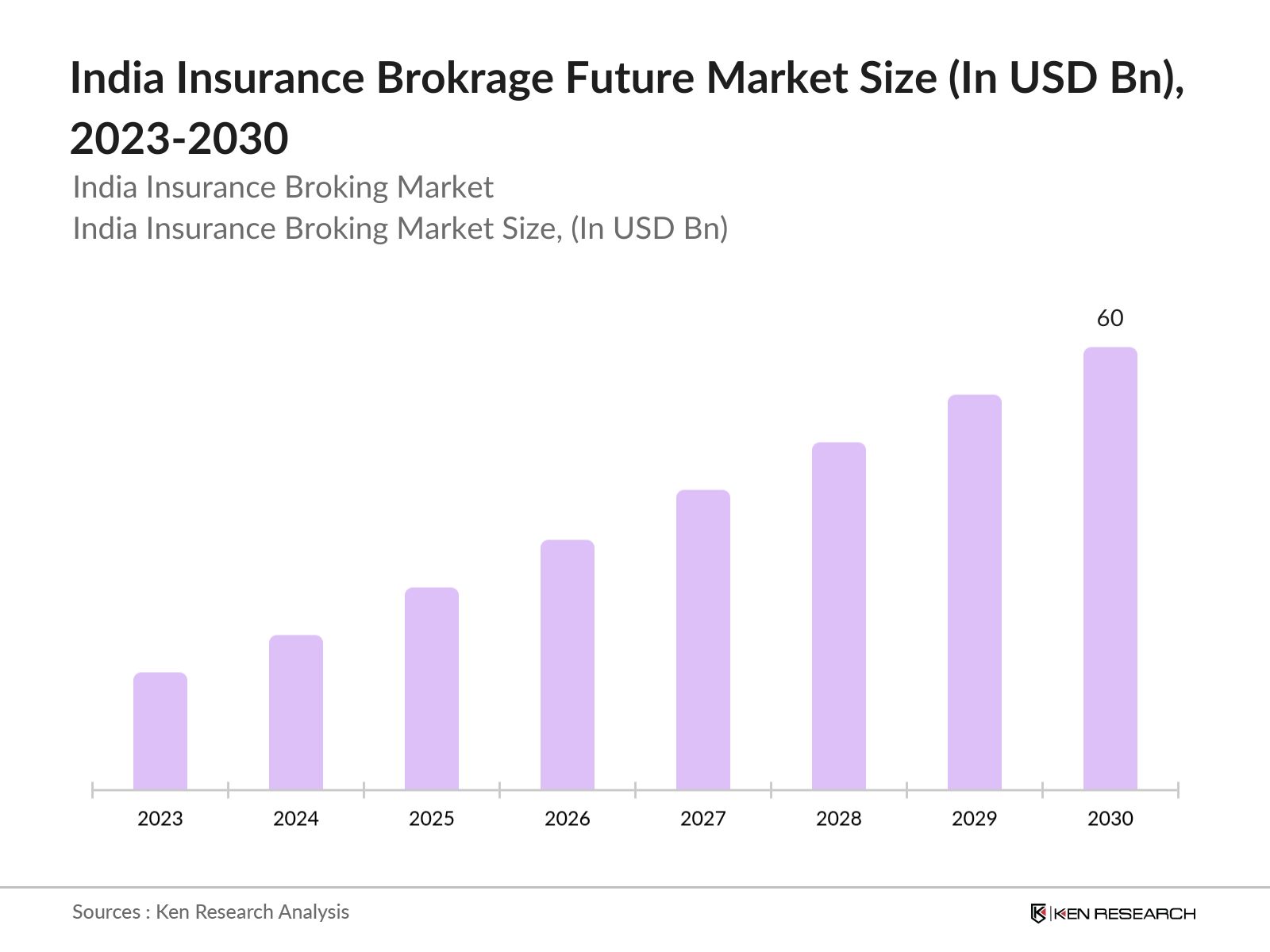

The India insurance broking market is poised for remarkable growth reaching a market of USD 60 Bn by 2030, driven by a combination of regulatory advancements, technological innovations, and increasing insurance awareness among the population.

Future Market Trends

- Expansion of Digital Insurance Platforms: The ongoing digital transformation in the insurance sector is expected to continue accelerating. Insurance brokers are likely to increasingly adopt advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain to enhance customer experience, streamline operations, and provide more personalized insurance products.

- Increasing Role of Data Analytics: Data analytics is set to play a crucial role in the future of the insurance broking market. Brokers will leverage big data to gain deeper insights into customer behaviour, risk assessment, and market trends. This will allow them to offer more tailored products and services, improve risk management, and optimize pricing strategies.

Scope of the Report

|

By Broker |

Composite Brokers Direct Brokers Reinsurance Brokers |

|

By Insurance |

Life and Health Insurance General Motor Insurance General Non-Motor Insurance Specialty Insurance |

|

By Region |

Tier I Tier II Tier III |

|

By Enterprise |

Large Enterprises Small and Medium-sized Enterprises |

Products

Key Traget Audience

- Insurance Companies

- Small and Medium Enterprises (SMEs)

- Large Corporations

- High-Net-Worth Individuals (HNWIs)

- Fintech and Insurtech Companies

- Digital Payment Platforms

- Banks and Financial Institutions

- Venture Capitalists

- Government Agencies and Regulatory Bodies (IRDAI and Ministry of Finance)

Time Period Captured in the Report:

- Historical Period: 2019-2024

- Base Year: 2024

- Forecast Period: 2024-2030

Companies

Major Players Mentioned in the Report:

- Marsh India Insurance Brokers

- Maruti Suzuki Insurance Broking

- Aditya Birla Insurance Brokers

- Policybazaar Insurance Brokers

- Mahindra Insurance Brokers (MIBL)

- Tata Motors Insurance Broking and Advisory Services

- Toyota Tsusho Insurance Broker

- SMC Insurance Brokers

- Prudent Ins. Brokers

- Willis Towers Watson India Insurance Brokers

- Turtlemint Insurance Broking Services

- HERO INSURANCE BROKING INDIA

- Alliance Insurance Broking

- Howden Ins. Brokers India

Table of Contents

1. Executive Summary

1.1 Executive Summary

2. Market Overview

2.1 Impact of Macro-Economic Factors on Insurance Broking Industry

2.2 India Insurance Broking Industry – Ecosystem

3. Industry Analysis

3.1 Growth Drivers of India Insurance Broking Market

3.2 Key Challenges in India Insurance Broking Market

3.3 Challenges & Recommended Solutions Pertaining to India Insurance Broking Market

3.4 Key Trends in India Insurance Broking Industry

3.5 Growth Opportunities Catering India Insurance Broking Market

3.6 India Insurance & Broking Market Evolution

3.7 IRDAI Regulations on Establishing a Broking Company in India

3.8 Requirements to get the Insurance broker License

3.9 Procedure to Get the Insurance Brokers License

3.10 Comparative Analysis of Organizational Structures: Domestic vs. International Insurance Brokers

4. Market Size and Segmentation

4.1 Market Size of India Insurance Broking Premium Written Market, FY’19-FY’30

4.2 India Insurance Broking Premium Written Market Segmentation (INR Cr) & Share (%), By Broker Type, FY’19, FY’24 & FY’30

4.3 India Insurance Broking Premium Written Market Segmentation (INR Cr) & Share (%), By Insurance Type, FY’19, FY’24 & FY’30

4.4 India Insurance Broking Premium Written Market Segmentation (INR Cr) & Share (%), By Enterprise Size, FY’19, FY’24 & FY’30

4.5 India Insurance Broking Premium Written Market Share (%), By Regions, By Tier 1 Cities, FY’19, FY’24 & FY’30

4.6 Market Size of India Insurance Broking Revenues Market, FY’19-FY’30

4.7 India Insurance Broking Revenues Market Segmentation (INR Cr) & Share (%), By Broker Type, FY’19, FY’24 & FY’30

4.8 India Insurance Broking Revenues Market Segmentation (INR Cr) & Share (%), By Revenue Type, FY’19, FY’24 & FY’30

4.9 India Insurance Broking Revenues Market Segmentation (INR Cr) & Share (%), By Insurance Type, FY’19, FY’24 & FY’30

4.10 India Insurance Broking Revenues Market Segmentation (INR Cr) & Share (%), By Revenue Stream, FY’19, FY’24 & FY’30

4.11 India Insurance Broking Revenues Market Segmentation (INR Cr) & Share (%), By Business Type, FY’19, FY’24 & FY’30

4.12 India Insurance Broking Revenues Market Segmentation (INR Cr) & Share (%), By Enterprise Size, FY’19, FY’24 & FY’30

4.13 India Insurance Broking Revenues Market Share (%), By Regions, By Tier 1 Cities, FY’19, FY’24 & FY’30

5. Competitive Landscape

5.1 Insurance Broker Market Positioning, Basis of Gross Written Premium

5.2 Insurance Broker Market Positioning, Basis of Number of Policies

5.3 Insurance Broker Market Positioning, Basis of Gross Written Premium Excluding Reinsurance

5.4 Insurance Broker Market Positioning, Basis of Broking Revenues

5.5 Insurance Broker Market Positioning Basis Gross Written Premium for OEM Transactions

5.6 Insurance Product Coverage vs. Enterprise Type Matrix

5.7 Case Study of Phygital Players

5.8 Cross Comparison of Top 10 Insurance Broking Companies in India

5.9 Company Profiling

6. Analyst Recommendations

6.1 Analyst Recommendations

6.2 Opportunity Analysis: Emerging Insurance Products in India

6.3 Building a Robust Phygital Insurance Broking Business in India

6.4 Next Phase of Steps and Ken Research’s Assistance

7. Research Methodology

7.1 Market Definitions and Abbreviations

7.2 Market Sizing Approach

7.3 Consolidated Research Approach

7.4 Sample Size Inclusion

Disclaimer

Contact Us

Research Methodology

Step:1 Identification of Major Players and Product Mapping:

Identification of major players operating in India's Insurance Broking market and mapping their product offerings across various types of insurances. Gross Written Premium Market has been calculated from the data obtained from IRDAI, specifically focusing on brokers. Additionally, IRDAI's annual reports, statistical publications, and broker-specific data releases have been considered.

Step: 2 CATI (Computer-Assisted Telephonic Interviews):

CATIs with the key stakeholders, such as C-level executives, managers, brokers, etc., to understand their margins, on the basis of different insurance products. Conducting exhaustive secondary research for ascertaining average margins for different types of insurance products. Then, multiplying GWP with average margins and estimating market size of India's Insurance Broking Market.

Step: 3 Exhaustive Secondary Research:

Our team adopted Bottom-Up approach in order to evaluate the segmentation shares, including broker type, insurance type, enterprise type, revenue type, and regional shares. Market size and segmentation shares were sanity checked on the basis of broker revenues of key segments, including life, health and general insurance from IRDAI statistics.

Step: 4 Bottom-Up Market Estimation Approach:

Conducted another level of sanity checking from industry veterans, insurance professionals (i.e. brokers, territory managers), and proxy variables, such as insurance penetration, number of policies sold, number of active brokers, average policy size, and other demographic and economic indicators.

Frequently Asked Questions

01 How big is the India Insurance Broking Market?

The India insurance broking market, valued at INR 131235 Cr in 2024, is driven by increasing insurance awareness, digital transformation, and regulatory support from the government.

02 What are the challenges in the India Insurance Broking Market?

Challenges in the India insurance broking market include rigorous due diligence requirements, changing customer expectations, and increased competition among brokers. Navigating these challenges is essential for sustaining growth and profitability in the market.

03 Who are the major players in the India Insurance Broking Market?

Key players in the India insurance broking market include Marsh India Insurance Brokers, PolicyBazaar, Maruti Suzuki Insurance Brokers, Tata Motors Insurance Broking, and Aditya Birla Insurance Brokers. These companies dominate due to their strong market presence, extensive service offerings, and strategic partnerships.

04 What are the growth drivers of the India Insurance Broking Market?

The India insurance broking market is propelled by factors such as the boost in insurance awareness initiatives, reduction in capital requirements by IRDAI, and the rapid adoption of digital platforms. These elements are creating new opportunities and expanding the market's reach.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.