India Internet of Things Market Outlook to 2030

Region:Asia

Author(s):Samanyu Maan

Product Code:KROD268

June 2024

81

About the Report

India Internet of Things Market Overview

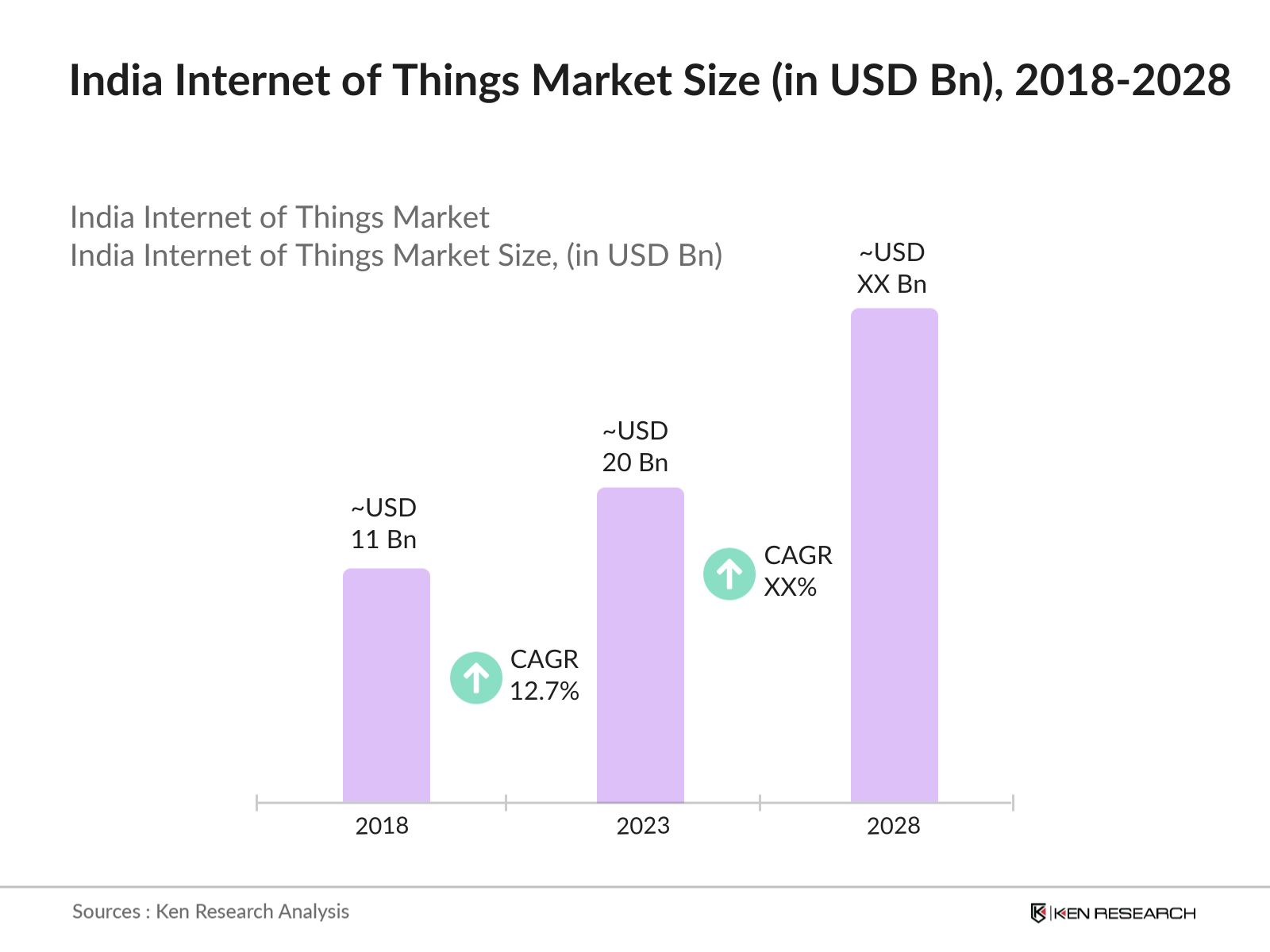

- The Indian IoT market reached USD 20 Bn in 2023, growing from USD 11 Bn in 2018, driven by extensive digital transformation across sectors like manufacturing and healthcare.

- Key players include Tata Communications, Reliance Jio, Wipro, Infosys, and others, leveraging comprehensive IoT solutions and strong market presence.

- Challenges include data privacy concerns, high implementation costs, lack of standardization, and the need for skilled professionals in IoT management.

- Growth drivers include the Digital India initiative, expanding internet connectivity, technological innovations, and rising demand for smart solutions in urban and industrial sectors.

India Internet of Things Current Market Analysis

- The Indian IoT market is rapidly expanding across sectors like manufacturing, healthcare, and smart cities, supported by government initiatives and private investments in digital transformation.

- Key products include IoT sensors, devices, and platforms crucial for industrial automation and smart city deployments, enhancing operational efficiencies and service delivery.

- IoT sensors and devices are highly demanded, especially in manufacturing and smart city projects, enabling real-time data collection and analysis for informed decision-making.

- Consumers prefer integrated IoT solutions offering robust connectivity, security, and analytics capabilities, with smart home devices like lighting and security systems gaining popularity.

- Tata Communications leads with extensive network infrastructure, comprehensive IoT solutions, and strategic global partnerships, enabling scalable IoT deployments across diverse sectors.

India Internet of things Market Segmentation

The India Internet of Things Market can be segmented based on several factors:

By Application: In 2023, the Indian IoT market is segmented as follows: Manufacturing dominates due to automation needs, utilizing IoT for predictive maintenance. Smart cities follow, driven by urban management initiatives.

Healthcare adopts IoT for remote patient monitoring amid COVID-19. Retail grows for enhancing customer experience and operations with IoT solutions. These sectors highlight the diverse applications propelling IoT growth in India.

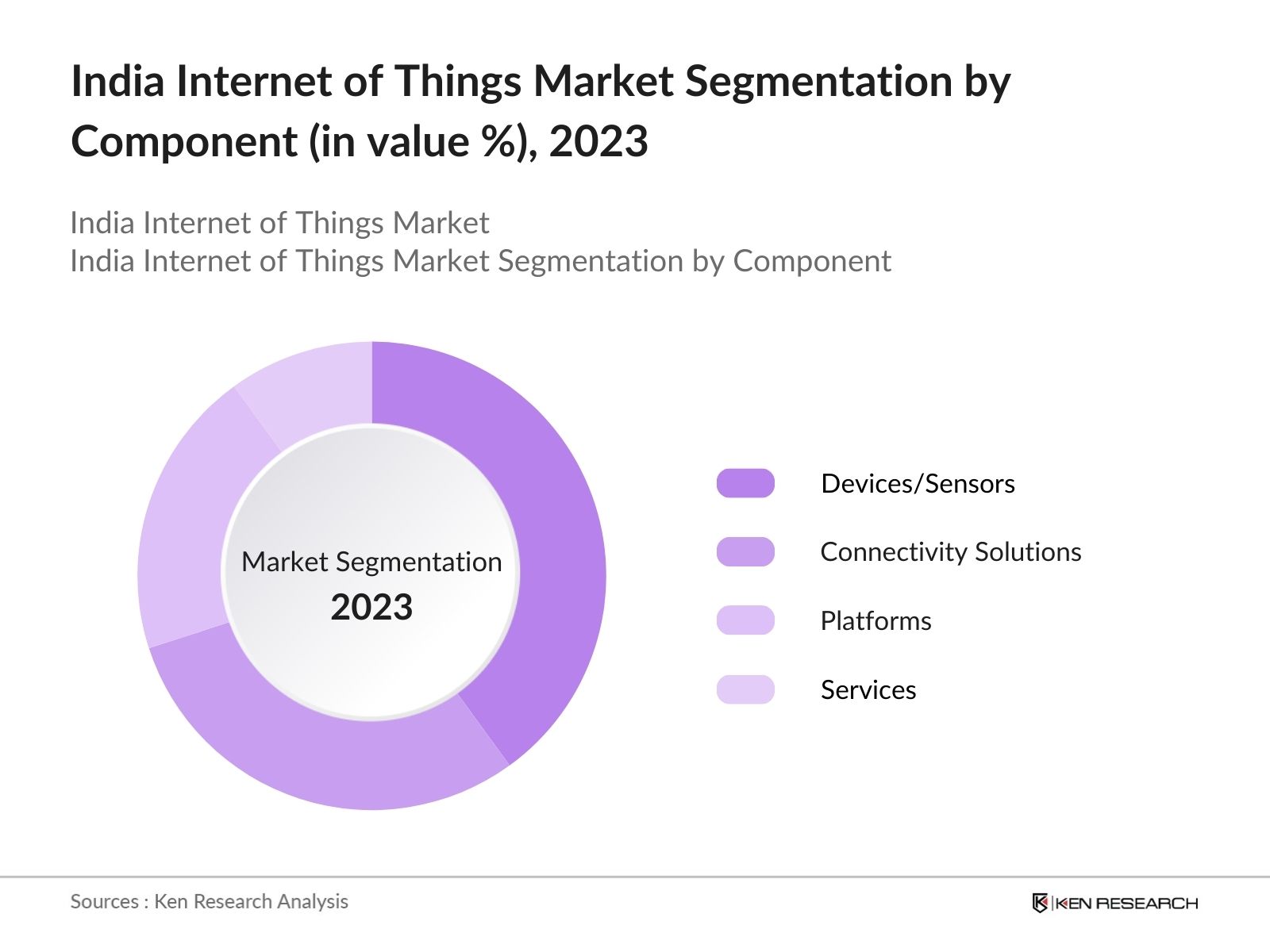

By Component: In 2023, the Indian IoT market is segmented by component as follows: Devices and sensors lead, crucial for real-time data in IoT applications. Connectivity solutions, powered by technologies like 5G and LPWAN, ensure efficient data transmission.

IoT platforms are essential for device management, analytics, and integration. Services such as consulting support effective deployment and management of IoT solutions, enhancing performance and ROI.

By End-User: In 2023, the Indian IoT market is segmented by end user is divided into industrial, consumer, enterprise and government. The industrial sector leads with IoT used extensively for automation and predictive maintenance, driving efficiency and cost reduction.

The consumer segment grows rapidly with smart home devices and wearables adoption. Enterprises utilize IoT for operational efficiency and customer engagement, while government investments in smart cities and infrastructure drive IoT adoption across sectors.

India Internet of Things Market Competitive Landscape

- Continuous technological innovations drive the IoT market competitiveness, seen in Tata Communications' LoRaWAN-based network covering 2,000 communities in India.

- Strong market presence is crucial, with Reliance Jio leveraging extensive telecom infrastructure and Wipro offering comprehensive IoT services across industries

- Companies like Infosys provide end-to-end IoT solutions, including device management and analytics platforms, catering to diverse customer demands and enhancing market position.

- Tech Mahindra focuses on customer-centric IoT solutions, fostering long-term partnerships and enhancing operational efficiency for enterprises.

- Global collaborations, such as Bosch's partnerships for smart city projects in India, bring advanced technologies and global expertise, boosting local market competitiveness.

India Internet of Things Industry Analysis

India Internet of Things Market Growth Drivers:

- Expanding Internet Connectivity: With over 700 million internet users in India as of 2023, widespread connectivity facilitates the adoption of IoT. The Digital India initiative has connected over 250,000-gram panchayats, enhancing the reach of IoT applications.

- Increasing Adoption in Agriculture: IoT in agriculture, like precision farming and automated irrigation, has improved crop yields by 15-20% and reduced water usage by 25-30%, encouraging further adoption among farmers.

- Smart Cities Projects: The project receives government investments to integrate IoT-enabled infrastructure, enhancing urban living through sustainable development and efficient public services under initiatives like the Smart Cities Mission.

- Industry 4.0: The adoption in manufacturing integrates IoT, AI, and robotics for automation and predictive maintenance, optimizing production processes to meet global efficiency standards and improve product quality.

India Internet of Things Market Challenges:

- Data Privacy and Security Concerns: With over 1.4 million cybersecurity incidents reported in 2022, data privacy and security are significant concerns, necessitating robust measures to protect IoT systems.

- Lack of Standardization: The absence of standardized IoT protocols leads to compatibility issues. Efforts by the Bureau of Indian Standards (BIS) to develop national standards are ongoing but not yet widely adopted.

- High Implementation Costs: Initial costs for IoT adoption can be prohibitive, especially for SMEs. According to FICCI, 60% of SMEs cite cost as a major barrier, despite the long-term benefits.

- Limited Skilled Workforce: There's a shortfall of approximately 150,000 IoT professionals in India, as per NSDC, highlighting the need for targeted training programs to bridge this skills gap.

India Internet of Things Market Trends

- Rise of Smart Homes and Consumer IoT: The popularity of smart home devices is growing, with a 40% increase in urban households in 2023. This trend reflects a strong consumer interest in home automation solutions.

- IoT in Healthcare: IoT in healthcare has led to a 20% reduction in patient readmissions and a 15% improvement in treatment outcomes, demonstrating its transformative potential.

- Growth of IoT in Retail: IoT solutions in retail, such as smart shelves and automated checkouts, have reduced inventory costs by 25% and increased sales by 15%, enhancing customer experiences and operational efficiency.

- Advancements in IoT Connectivity: The rollout of 5G networks, expected nationwide by 2025, promises faster, more reliable IoT connectivity, crucial for real-time applications

India Internet of Things Market Government Initiatives:

- National Digital Communications Policy (NDCP) 2018: Aims to enhance digital communications infrastructure. Plans to connect all 2.5 lakh gram panchayats with broadband in 2024 are underway.

- Pradhan Mantri Kaushal Vikas Yojana (PMKVY): Provides skill training across sectors. Over 1.7 Cr candidates have been trained, including programs in emerging technologies such as IoT

- BharatNet Project: Aims to provide broadband connectivity to all gram panchayats. In 2023, it aims to connect over 6 lakh villages, facilitating digital inclusion and enabling IoT applications

India Internet of Things Future Market Outlook

The India Internet of Things Market is expected to show a significant growth driven by advancements in IoT technology and increasing demand for connected devices

Factors Influencing Growth

- Technological Innovations: Future advancements in IoT technologies, such as AI-driven analytics and edge computing, will enhance operational efficiencies across industries. AI-driven predictive maintenance is expected to reduce equipment downtime by up to 50%, while edge computing will improve response times in critical applications.

- Government Support: Future initiatives like India's Smart Cities Mission will allocate significant funding to IoT infrastructure, accelerating digital transformation and urban development. The mission plans to invest over $30 billion in smart solutions for 100 cities, integrating IoT for efficient urban management.

- Private Sector Investments: Companies like Tata Group and Infosys will intensify investments in IoT R&D, driving innovation in IoT platforms and solutions. Tata Group plans to establish an IoT center of excellence, while Infosys aims to expand IoT capabilities in smart buildings and energy management.

- Global Collaborations: Future partnerships between local and international firms will bring advanced IoT technologies and expertise to India. Bosch's collaborations for smart city projects will introduce cutting-edge IoT solutions for urban management, enhancing local IoT capabilities and improving urban services.

Scope of the Report

|

By Application |

Manufacturing Smart Cities Healthcare Retail Others |

|

By Component |

Devices/Sensors Connectivity Solutions Platforms Services |

|

By End-User |

Industrial Consumer Enterprise Government |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunication Companies

Banks and Financial Institutions

Government Agencies & Regulatory Bodies

IoT Device Manufacturers

IT and Software Development Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Tata Communications

Reliance Jio

Wipro

Infosys

Tech Mahindra

Bosch

Cisco

Siemens

IBM

Microsoft

Intel

Huawei

HCL Technologies

GE Digital

Oracle

Table of Contents

1. India Internet of Things Market Overview

1.1 India Internet of Things Market Taxonomy

2. India Internet of Things Market Size (in USD Bn), 2018-2023

3. India Internet of Things Market Analysis

3.1 India Internet of Things Market Growth Drivers

3.2 India Internet of Things Market Challenges and Issues

3.3 India Internet of Things Market Trends and Development

3.4 India Internet of Things Market Government Regulation

3.5 India Internet of Things Market SWOT Analysis

3.6 India Internet of Things Market Stake Ecosystem

3.7 India Internet of Things Market Competition Ecosystem

4. India Internet of Things Market Segmentation, 2023

4.1 India Internet of Things Market Segmentation by Application (in value %), 2023

4.2 India Internet of Things Market Segmentation by Component (in value %), 2023

4.3 India Internet of Things Market Segmentation by End-User (in value %), 2023

5. India Internet of Things Market Competition Benchmarking

5.1 India Internet of Things Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. India Internet of Things Future Market Size (in USD Bn), 2023-2028

7. India Internet of Things Future Market Segmentation, 2028

7.1 India Internet of Things Market Segmentation by Applications (in value %), 2028

7.2 India Internet of Things Market Segmentation by Component (in value %), 2028

7.3 India Internet of Things Market Segmentation by End-User (in value %), 2028

8. India Internet of Things Market Analysts’ Recommendations

8.1 India Internet of Things Market TAM/SAM/SOM Analysis

8.2 India Internet of Things Market Customer Cohort Analysis

8.3 India Internet of Things Market Marketing Initiatives

8.4 India Internet of Things Market White Space Opportunity Analysis

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on India internet of things market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for India internet of things market. we will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple internets of things service companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from internet of things service companies.

Frequently Asked Questions

01 How big is India Internet of Things Market?

The India Internet of Things Market was valued at USD 20 Bn in 2023 driven by extensive digital transformation across sectors like manufacturing and healthcare.

02 What are the key challenges faced in India Internet of Things Market?

The key challenges faced in India Internet of Things Market are data privacy concerns, high implementation costs, lack of standardization, and the need for skilled professionals in IoT management

03 Who are some of the major players in the India Internet of Things Market?

Some of the major players in the India Internet of Things Market include Tata Communications, Reliance Jio and Wipro.

04 What are the key factors driving India IOT market?

Growth drivers include the Digital India initiative, expanding internet connectivity, technological innovations, and rising demand for smart solutions in urban and industrial sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.