India Over the Top (OTT) Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD1674

October 2024

106

About the Report

India Over the Top (OTT) Market Overview

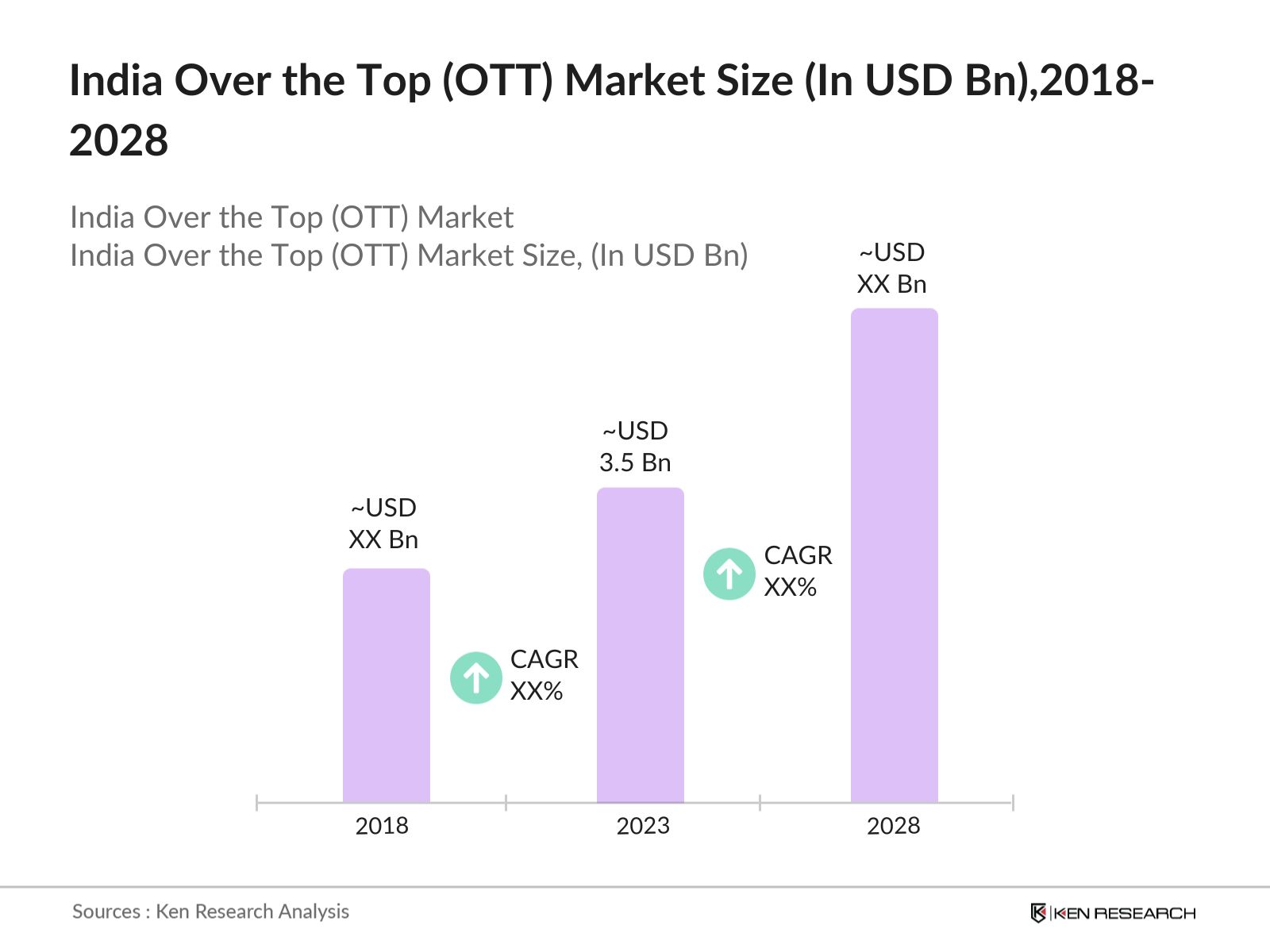

- The India OTT Market was valued at USD 3.5 billion, reflecting a robust expansion driven by increasing internet penetration, smartphone adoption, and shifting consumer preferences towards on-demand content. This growth is further supported by the proliferation of 4G and upcoming 5G networks, which enhance streaming quality and accessibility.

- Major players in the Indian OTT market include Netflix, Amazon Prime Video, Disney+ Hotstar, Zee5, and Sony Liv. These platforms offer a wide range of content, including movies, TV shows, and original programming, catering to diverse audience preferences across the country.

- In 2023, Disney+ Hotstar announced its partnership with major Indian film studios to enhance its content library, including exclusive rights to upcoming blockbuster releases. This strategic move aims to attract and retain subscribers amid growing competition, further consolidating its position in the market. This development underscores the platform's commitment to delivering premium content and maintaining a competitive edge.

- Mumbai dominates the OTT market in 2023, due to their high population density, internet penetration, and disposable income levels. And the stands out with its significant media and entertainment industry presence, contributing to a higher adoption rate of OTT services. These cities also have a higher concentration of affluent consumers who are more likely to invest in subscription-based services.

India Over the Top (OTT) Market Segmentation

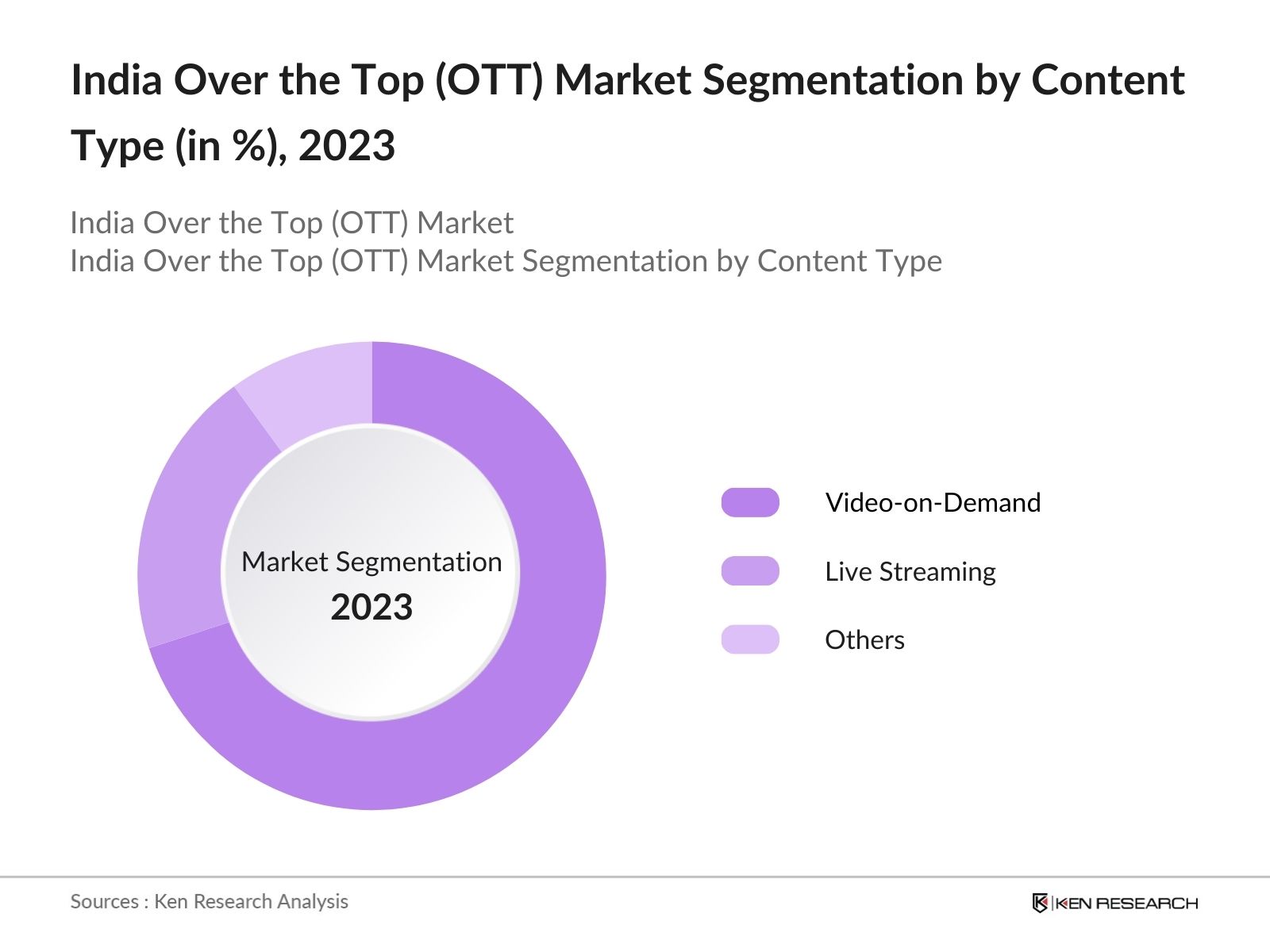

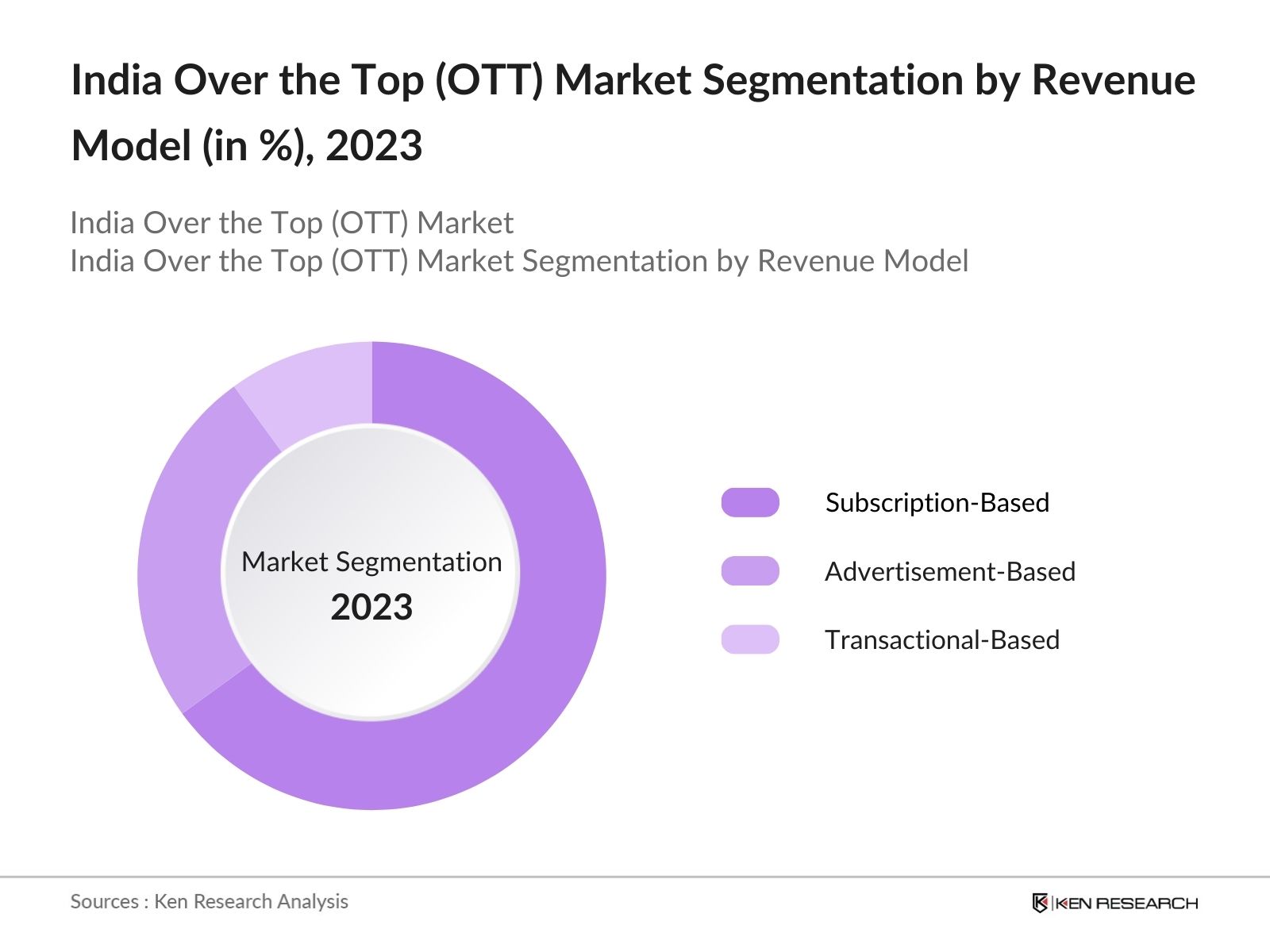

The India Over the Top (OTT) Market is segmented into different factors like by content type, by revenue model and region.

By Content Type: The market is segmented by content type into video-on-demand (VoD), live streaming, and others. In 2023, video-on-demand held the largest market share due to its convenience and diverse content offerings. The popularity of VoD platforms like Netflix and Amazon Prime Video has driven this segment's dominance. The ability to watch content at any time and the availability of original programming have made VoD a preferred choice for consumers.

By Revenue Model: The market is segmented by revenue model into subscription-based, advertisement-based, and transactional-based models. In 2023, subscription-based models accounted for the majority of market share due to their steady revenue stream and the consumer preference for ad-free, high-quality content. Major platforms like Netflix and Disney+ Hotstar have successfully implemented this model to attract and retain subscribers.

By Region: The OTT market in India is segmented into North, South, East, and West regions. In 2023, the North region held the largest market share due high population density, advanced digital infrastructure, and greater disposable incomes. The large number of internet users and the presence of major OTT platforms contribute to the North region's leading market share. Additionally, the region's high concentration of media and entertainment industries, along with a significant urban population that prefers digital content consumption, enhances its market position.

India Over the Top (OTT) Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Netflix |

1997 |

Los Gatos, California |

|

Amazon Prime Video |

2006 |

Seattle, Washington |

|

Disney+ Hotstar |

2015 |

Mumbai, India |

|

Zee5 |

2018 |

Mumbai, India |

|

Sony Liv |

2013 |

Mumbai, India |

- Amazon Prime Video: In 2024, Amazon Prime Video has expanded its regional content offerings, launching new original series in Tamil, Telugu, and Kannada. The platforms investment in regional content aims to cater to diverse linguistic audiences and enhance its appeal across different regions of India.

- Sony Liv: By the end of 2024, SonyLiv plans to enhance its presence in South India by expanding its regional content offerings. The platform is investing in local language content and partnering with regional creators to attract more subscribers. This strategy aims to strengthen SonyLivs market share in the South and cater to the growing demand for vernacular content.

India Over the Top (OTT) Market Analysis

India Over the Top (OTT) Market Growth Drivers

- Increasing Internet Penetration: As of 2024, India has 821 million internet users and the Internet penetration rate in India was 55% of the total population in early 2024. This growth in internet penetration is driven by the expansion of 4G and 5G networks, facilitating greater access to OTT services. The rise in digital connectivity supports the increasing consumption of online content, with more consumers accessing OTT platforms from various devices. Enhanced network infrastructure, including the rollout of 5G technology, is expected to further boost online video consumption, providing high-speed connectivity and improving user experience.

- Rising Mobile Device Usage: A total of 1.12 billion cellular mobile connections were active in India in early 2024, with this figure equivalent to 78.0 percent of the total population. This trend significantly impacts the OTT market as mobile devices are a primary medium for accessing streaming content. The proliferation of affordable smartphones and improved data plans has led to a rise in mobile streaming, with users consuming content on-the-go. The shift towards mobile consumption is evident as mobile internet traffic is expected to constitute a significant portion of overall internet traffic, driving OTT viewership.

- Expansion of Local Content Production: The market has seen a substantial increase in local content production, new original series and movies produced in 2023. The emphasis on local content caters to diverse regional preferences, driving subscriber growth. Platforms like Netflix and Amazon Prime Video have significantly invested in regional content, including Bollywood and regional language films. This focus on localized content enhances market appeal and attracts a broader audience, contributing to the growth of the OTT sector.

India Over the Top (OTT) Market Challenges

- Regulatory Hurdles: The OTT industry faces regulatory challenges, with the Indian government considering stricter content regulations and compliance requirements. Proposed regulations include content censorship and additional taxation measures, which could increase operational costs for OTT platforms. These regulatory uncertainties create challenges for market participants in maintaining compliance while navigating the evolving legal landscape.

- Data Privacy Concerns: Data privacy concerns are growing as OTT platforms collect vast amounts of user data. In 2024, regulatory scrutiny over data protection has intensified, with new privacy regulations being implemented. Platforms must invest in robust data security measures to protect user information and comply with legal requirements. Failure to address data privacy issues could lead to legal repercussions and loss of consumer trust.

India Over the Top (OTT) Market Government Initiatives

- Information Technology Rules: In February 2022, the government notified the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules 2021 to regulate OTT platforms. The rules establish a soft-touch self-regulatory architecture with a Code of Ethics and three-tier grievance redressal mechanism for OTT platforms.

- M&E Sector: A 2024 EY report projects India's media & entertainment sector to cross INR3 trillion ($37.1 billion) by 2026, driven by robust digital infrastructure, widespread OTT adoption, gaming growth, and affordable options for consumers. Despite the digital boom, traditional media is also experiencing steady growth, making India a "Linear and Digital Market".

India Over the Top (OTT) Market Future Outlook

The Indian OTT Market is expected to grow exponentially by 2028. The growth will be driven by advancements in technology, increased content localization, and the expansion of 5G networks, which will enable seamless streaming experiences. Additionally, the rise of regional content and niche genres is anticipated to attract a broader audience base, further enhancing market dynamics.

Market Trends

- Enhanced Regional Content and Localization: Over the next five years, the India OTT market will increasingly focus on regional content and localization to cater to diverse linguistic demographics. By 2028, investments in regional content are expected to exceed 5,000 crore annually, driven by the rising demand for localized programming. This trend will be propelled by OTT platforms expanding their libraries with more content in languages like Tamil, Telugu, Kannada, and Bengali, aiming to attract and retain regional audiences.

- Integration of Advanced Technologies: The integration of advanced technologies such as AI and machine learning will significantly shape the OTT market. By 2028, the OTT platforms are projected to leverage AI for personalized content recommendations and content creation. This will enhance user experience and engagement, as AI-driven algorithms will provide more tailored content suggestions and optimize streaming quality. Additionally, advancements in 5G technology will further improve streaming speeds and quality, contributing to a better user experience.

Scope of the Report

|

By Content Type |

Video-on-Demand Live Streaming Others |

|

By Revenue Model |

Subscription-Based Advertisement-Based Transactional-Based |

|

By Region |

North South West East |

Products

Key Target Audience Organizations and Entities who can benefit by subscribing this Report:

Media and Entertainment Companies

Consumer Electronics Companies

E-commerce Platforms

Streaming Equipment Manufacturers

Video Production Houses

Event Management Companies

Banks and Financial Institutions

Investor and VC Firms

Government Agencies (Ministry of Information and Broadcasting (MIB), Ministry of Electronics and Information Technology (MeitY))

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Netflix

Amazon Prime Video

Disney+ Hotstar

Zee5

Sony Liv

ALTBalaji

Voot

MX Player

JioCinema

Eros Now

Aha

Hotstar Specials

Viacom18

Ullu

YuppTV

Table of Contents

1. India OTT Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. India OTT Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. India OTT Market Analysis

3.1. Growth Drivers

3.1.1. Enhanced Regional Content and Localization

3.1.2. Growth in Subscription-Based Revenue Models

3.1.3. Integration of Advanced Technologies

3.1.4. Expansion of Original Content Production

3.2. Restraints

3.2.1. High Subscription Costs

3.2.2. Content Licensing Challenges

3.2.3. Regulatory Hurdles

3.2.4. Market Saturation

3.3. Opportunities

3.3.1. Emerging Tier-II and Tier-III Cities

3.3.2. Technological Advancements

3.3.3. Increased Mobile Penetration

3.3.4. Collaboration with Local Content Creators

3.4. Trends

3.4.1. Rise of Interactive and Immersive Content

3.4.2. Adoption of AI for Personalization

3.4.3. Growth of Ad-Supported Streaming Options

3.4.4. Expansion into Regional and Vernacular Languages

3.5. Government Regulation

3.5.1. Content Regulation Policies

3.5.2. Taxation and Revenue Regulations

3.5.3. Data Protection and Privacy Laws

3.5.4. Support for Local Content Production

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. India OTT Market Segmentation, 2023

4.1. By Content Type (in Value %)

4.1.1. Video-on-Demand

4.1.2. Live Streaming

4.1.3. Others

4.2. By Revenue Model (in Value %)

4.2.1. Subscription-Based (SVOD)

4.2.2. Ad-Supported (AVOD)

4.2.3. Transactional (TVOD)

4.3. By Device (in Value %)

4.3.1. Mobile Devices

4.3.2. Smart TVs

4.3.3. Laptops/Desktop Computers

4.3.4. Tablets

4.4. By Region (in Value %)

4.4.1. North India

4.4.2. South India

4.4.3. East India

4.4.4. West India

5. India OTT Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Netflix

5.1.2. Amazon Prime Video

5.1.3. Disney+ Hotstar

5.1.4. SonyLiv

5.1.5. Zee5

5.1.6. MX Player

5.1.7. ALTBalaji

5.1.8. Voot

5.1.9. Eros Now

5.1.10. JioCinema

5.2. Cross Comparison Parameters (Revenue, Subscriber Count, Market Presence, Content Offerings)

6. India OTT Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. India OTT Market Regulatory Framework

7.1. Content Regulation Policies

7.2. Taxation and Revenue Regulations

7.3. Data Protection and Privacy Laws

8. India OTT Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. India OTT Market Future Segmentation, 2028

9.1. By Content Type (in Value %)

9.2. By Revenue Model (in Value %)

9.3. By Device (in Value %)

9.4. By Region (in Value %)

10. India OTT Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Indian OTT Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indian OTT industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple OTT platform companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from OTT platform companies.

Frequently Asked Questions

01 How big is the India OTT Market?

The India OTT Market was valued at USD 3.5 Bn in 2023. The market is growing due to the expansion of internet infrastructure, increasing smartphone penetration, and a rising preference for on-demand content.

02 What are the challenges in the India OTT Market?

Challenges in India OTT Market include high content licensing costs, regulatory complexities, intense competition among platforms, and the risk of market saturation. Additionally, issues related to content piracy and the need for continuous technological upgrades pose significant challenges.

03 Who are the major players in the India OTT Market?

Major players in India OTT Market include Netflix, Amazon Prime Video, Disney+ Hotstar, SonyLiv, and Zee5. These platforms lead the market with extensive content libraries, strong brand recognition, and substantial investments in original content.

04 What are the growth drivers of the India OTT Market?

Growth drivers in India OTT Market include increased internet penetration, the rising adoption of smartphones and smart TVs, expanding content offerings, and a growing preference for subscription-based models. The market is also boosted by investments in original and regional content.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.