India Railway Equipment Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD4740

October 2024

96

About the Report

India Railway Equipment Market Overview

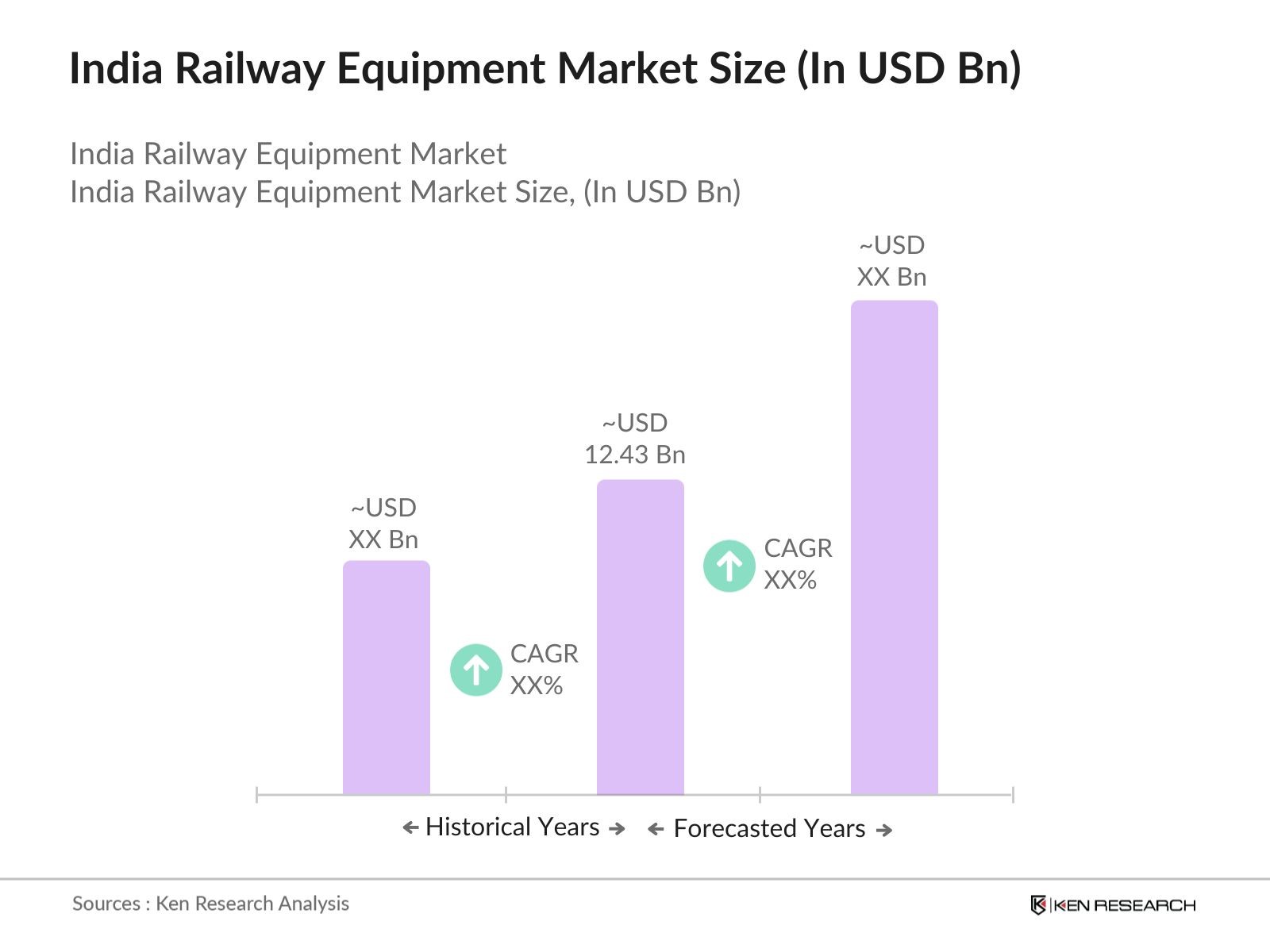

- The India Railway Equipment Market, valued at USD 12.43 billion, has been primarily driven by government-led initiatives to modernize and expand the railway infrastructure. The push towards high-speed rail networks and electrification of existing lines has created a surge in demand for railway equipment, including rolling stock, signaling systems, and electrification technologies. This demand has also been fueled by the growing need to accommodate both passenger and freight traffic in urbanizing areas, increasing the scope for private sector participation in the sector.

- Major cities like Mumbai, Delhi, and Bangalore are key drivers of the railway equipment market due to their rapidly expanding metro rail projects and the government's focus on reducing traffic congestion through the use of public transportation. Additionally, regions such as North India and South India lead the market in railway development due to their high population density and strong freight transport networks. These areas dominate the market because of strategic investments in infrastructure development and the establishment of key rail manufacturing units.

- The Indian Railways Vision 2030 outlines a strategic plan to modernize railway operations, enhance safety, and improve efficiency by upgrading infrastructure and implementing green technologies. The plan includes investments of over INR 3 lakh crore to upgrade railway stations, introduce high-speed trains, and electrify the entire rail network by 2025. This vision aims to transform Indian Railways into a future-ready, sustainable transport system that can meet the demands of a growing economy.

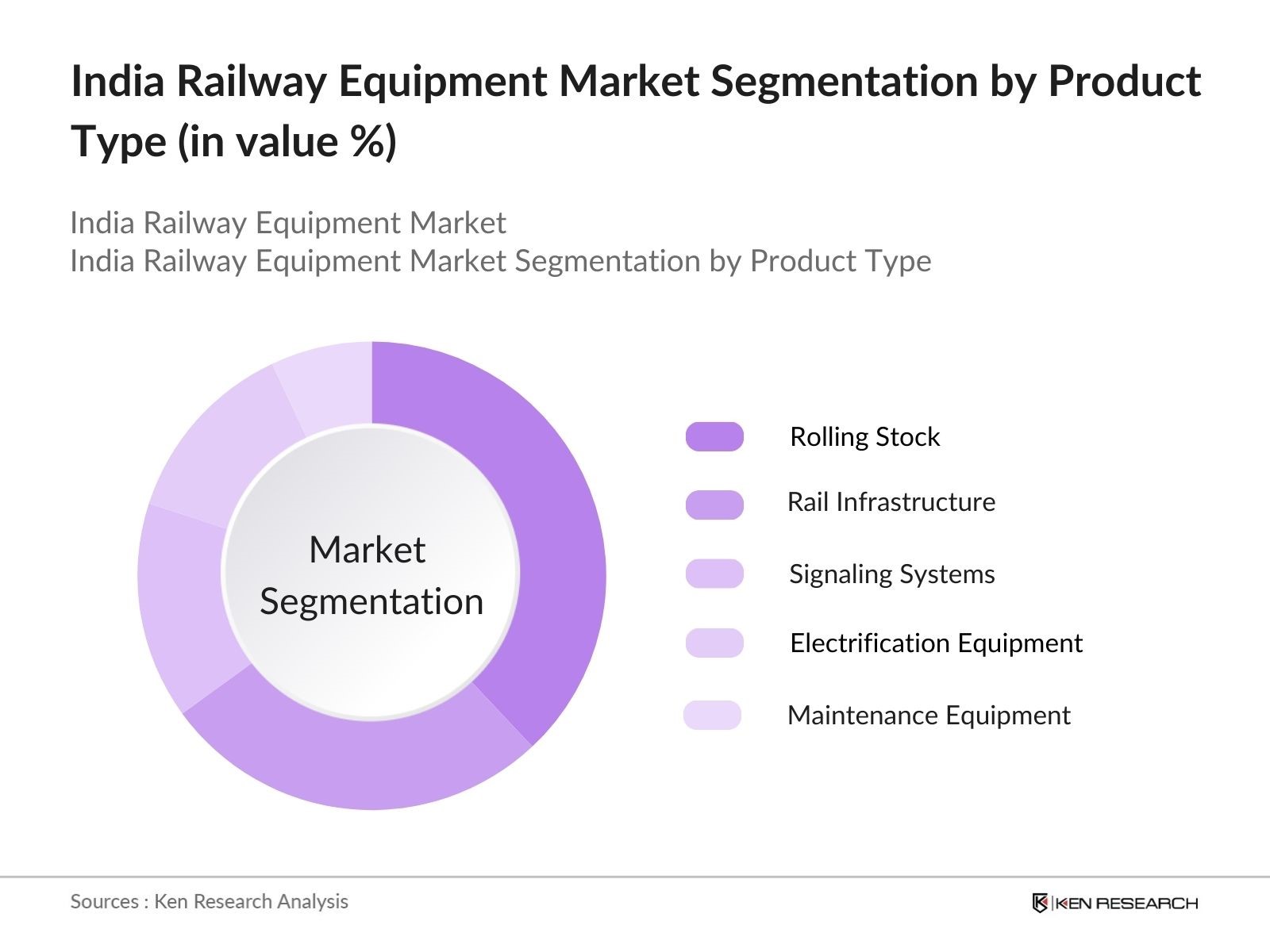

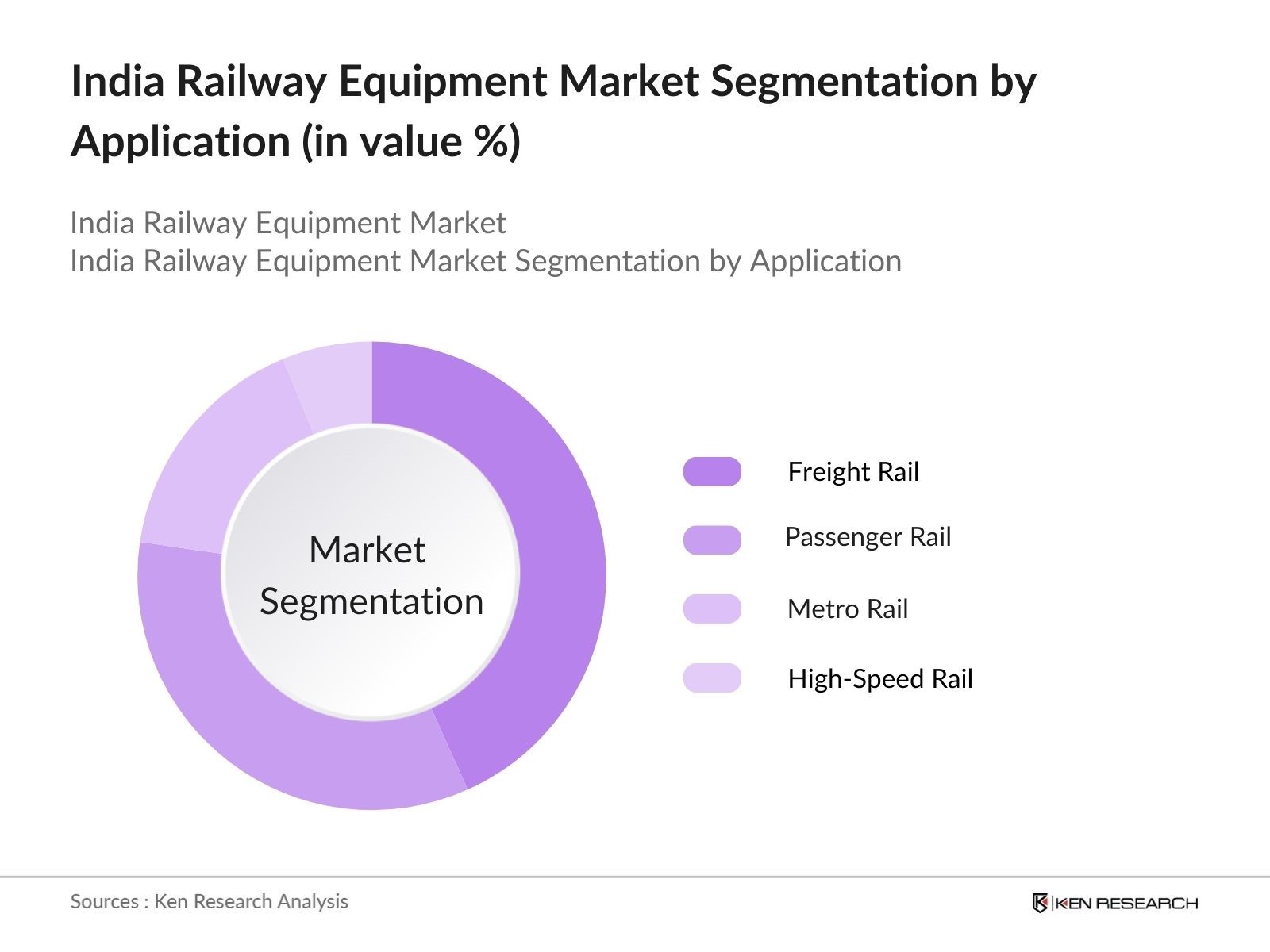

India Railway Equipment Market Segmentation

By Product Type: The market is segmented by product type into rolling stock, rail infrastructure, signaling systems, electrification equipment, and maintenance equipment. Rolling stock, which includes locomotives, coaches, and wagons, currently holds the dominant market share. This dominance is due to the significant investment made by the Indian Railways in upgrading and expanding its fleet to support both passenger and freight traffic. In particular, the modernization of locomotives and the introduction of semi-high-speed trains, such as the Vande Bharat Express, have contributed to the expansion of this segment. The demand for rolling stock is further supported by the government’s push towards indigenization under the "Make in India" initiative, which has incentivized local production and manufacturing of railway equipment.

By Application: The market is also segmented by application into passenger rail, freight rail, metro rail, high-speed rail, and light rail/tram. Freight rail is the leading application in the market due to India's reliance on railways for bulk transportation of goods such as coal, iron ore, and other raw materials. The Indian Railways’ Dedicated Freight Corridor (DFC) project has further bolstered this segment by enhancing the efficiency and capacity of freight movement across the country. Additionally, with India's increasing focus on sustainable transportation, the government is looking to shift more freight to railways, providing further impetus to this segment.

India Railway Equipment Market Competitive Landscape

The India Railway Equipment Market is dominated by a mix of domestic and international players, with leading companies engaged in manufacturing a wide range of products from rolling stock to advanced signaling systems. The market is characterized by intense competition among a few major players, who have established strong partnerships with the Indian Railways for equipment supply and development projects. Companies such as Alstom and Siemens lead the industry with their focus on automation and high-speed rail technologies, while domestic firms like Bharat Heavy Electricals Limited (BHEL) and Titagarh Wagons play a significant role in rolling stock production under the government’s indigenization initiatives.

|

Company Name |

Establishment Year |

Headquarters |

Revenue |

Production Capacity |

Product Portfolio |

R&D Investment |

Technology Partnerships |

Key Contracts |

|

Alstom India |

1990 |

Bangalore, India |

- |

- | - | - | - | - |

|

Siemens Limited |

1922 |

Mumbai, India |

- | - | - | - | - | - |

|

Bharat Heavy Electricals |

1964 |

New Delhi, India |

- | - | - | - | - | - |

|

Titagarh Wagons Ltd. |

1997 |

Kolkata, India |

- | - | - | - | - | - |

|

Bombardier Transportation |

1942 |

Berlin, Germany |

- | - | - | - | - | - |

India Railway Equipment Industry Analysis

Growth Drivers

- Increasing Railway Infrastructure Investments: India's railway infrastructure is undergoing significant expansion, with the government allocating a record INR 2.40 lakh crore in the Union Budget 2023–24 for rail projects, a substantial increase from previous years. This includes investments in upgrading existing lines, building new high-speed rail corridors, and enhancing station infrastructure. Additionally, World Bank data indicates that India's overall infrastructure investment in transportation (including rail) reached $91 billion in 2023. These investments are crucial for supporting the rapidly growing passenger and freight traffic demands across the country, fostering economic growth.

- Government Focus on Railway Modernization: The Indian government’s strong focus on railway modernization is evident through initiatives like the Indian Railways Vision 2030. This plan aims to modernize 100% of its rolling stock, including locomotives, wagons, and passenger coaches by 2025. Moreover, the government has set aside INR 75,000 crore for modernization, which involves upgrading signaling systems, automating train operations, and replacing outdated rolling stock with state-of-the-art technology. These modernization efforts align with the country’s goal to make Indian Railways a modern, efficient, and green transport mode.

- Urbanization and Rising Freight Demand: India is witnessing rapid urbanization, with over 35% of its population now residing in urban areas, leading to an increased demand for efficient transportation. Additionally, freight demand is rising exponentially, with Indian Railways handling 1,418 million tons of freight in 2023, up from 1,233 million tons in 2022. The increasing need for faster and more efficient freight movement, especially in sectors like coal, steel, and agriculture, is a key growth driver for the railway equipment market, necessitating large-scale investments in new wagons and locomotive equipment.

Market Challenges

- High Initial Capital Investment: Railway infrastructure projects require massive upfront capital investments. For example, the Mumbai-Ahmedabad high-speed rail project alone has a budget of INR 1.08 lakh crore. The high initial cost of establishing modern railway infrastructure—such as track laying, rolling stock procurement, and station upgrades—poses a significant challenge, especially for small and medium-sized players in the railway equipment market. Financing these large-scale projects often requires complex public-private partnerships (PPP) and sustained government funding.

- Technological Obsolescence: Indian Railways has long struggled with outdated technology. For instance, over 35% of the locomotives currently in operation are more than 20 years old, making them less efficient and more prone to failures. The high cost and complexity of adopting new technologies like advanced signaling systems, automatic train operation (ATO), and predictive maintenance tools are limiting factors for modernization. Additionally, rapid advancements in global rail technologies make it challenging for India to keep pace without significant investments.

India Railway Equipment Market Future Outlook

Over the next few years, the India Railway Equipment Market is expected to grow steadily, driven by several key factors, including the government's increased focus on railway electrification, infrastructure modernization, and the development of metro rail networks in urban areas. The introduction of new high-speed rail projects and the expansion of dedicated freight corridors are also expected to provide further opportunities for market players. Additionally, technological advancements such as automated signaling systems and electric propulsion technologies are likely to influence the market's growth trajectory, aligning with India's broader goals of achieving sustainability in its transport sector.

Future Market Opportunities

- Digital Transformation of Railway Operations: Indian Railways is in the process of digitizing various operational aspects. The government has initiated projects worth INR 55,000 crore for the digital transformation of signaling and control systems. This includes the adoption of AI-powered predictive maintenance solutions, real-time data monitoring, and the integration of IoT for better asset management. Such advancements promise to increase operational efficiency by reducing maintenance downtimes by over 30%, thereby improving the overall network's performance.

- Public-Private Partnerships (PPP) in Railway Infrastructure: Public-private partnerships are playing a growing role in India’s railway expansion. In 2022, Indian Railways launched the first privately-operated passenger train under the Tejas Express service, showcasing the potential for greater private-sector involvement. Additionally, the government has set aside INR 20,000 crore to encourage private investment in railways by offering concessions on freight corridors, port connectivity, and the development of logistics parks. These partnerships are crucial for unlocking additional capital and speeding up the deployment of modern railway technologies.

Scope of the Report

|

By Product Type |

Rolling Stock

Rail Infrastructure Signaling Systems Electrification Equipment Maintenance Equipment |

|

By Application |

Passenger Rail Freight Rail Light Rail/Tram High-Speed Rail |

|

By Technology |

Conventional Rail Systems Automated Rail Systems Electric Propulsion Systems Hydrogen-Powered Rail Magnetic Levitation Technology (Maglev) |

|

By Component |

Wheels and Axles Couplers Power and Traction Systems Braking Systems Onboard Information and Control Systems |

|

By Region |

North East West South |

Products

- Railway Equipment Manufacturers

- Railway Infrastructure Developers

- Indian Railways and Associated Agencies

- Government and Regulatory Bodies (Ministry of Railways, Indian Railway Board)

- Investment and Venture Capitalist Firms

- Public-Private Partnership Developers

- Banks and Financial Institutes

- Railway Contractors and Engineering Firms

- Electrification Equipment Suppliers

Companies

Major Players in the India Railway Equipment Market

- Alstom India

- Siemens Limited

- Bharat Heavy Electricals Limited (BHEL)

- Bombardier Transportation

- Titagarh Wagons Ltd.

- Texmaco Rail & Engineering Ltd.

- Jindal Steel & Power Ltd.

- Kirloskar Electric Company

- Hind Rectifiers Ltd.

- Escorts Limited

- Integral Coach Factory (ICF)

- Rail Vikas Nigam Limited (RVNL)

- Larsen & Toubro Limited (L&T)

- CRRC Corporation Limited

- Texmaco Hi-Tech Pvt Ltd.

Table of Contents

India Railway Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

India Railway Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

India Railway Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Railway Infrastructure Investments

3.1.2. Government Focus on Railway Modernization

3.1.3. Urbanization and Rising Freight Demand

3.1.4. High-Speed Rail Projects Initiatives

3.2. Market Challenges

3.2.1. High Initial Capital Investment

3.2.2. Technological Obsolescence

3.2.3. Regulatory and Environmental Constraints

3.3. Opportunities

3.3.1. Digital Transformation of Railway Operations

3.3.2. Public-Private Partnerships (PPP) in Railway Infrastructure

3.3.3. Expansion of Electrification and Green Rail Technologies

3.4. Trends

3.4.1. Adoption of AI and IoT in Rail Management Systems

3.4.2. Focus on Sustainable Rail Technologies (Electric and Hydrogen Trains)

3.4.3. Shift Towards High-Speed Rail Projects

3.5. Government Regulations

3.5.1. Indian Railways Vision 2030

3.5.2. Make in India Initiatives for Local Manufacturing

3.5.3. Safety and Emission Standards in Rail Transport

3.5.4. Electrification Policy for Rail Networks

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competitive Ecosystem

India Railway Equipment Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Rolling Stock (Locomotives, Coaches, Wagons)

4.1.2. Rail Infrastructure (Tracks, Bridges, Tunnels)

4.1.3. Signaling Systems (Automated Signaling, Communication Systems)

4.1.4. Electrification Equipment (Catenary Systems, Transformers, Switchgear)

4.1.5. Maintenance Equipment (Track Maintenance Machines, Rail Grinding Systems)

4.2. By Application (In Value %)

4.2.1. Passenger Rail

4.2.2. Freight Rail

4.2.3. Metro Rail

4.2.4. High-Speed Rail

4.2.5. Light Rail/Tram

4.3. By Technology (In Value %)

4.3.1. Conventional Rail Systems

4.3.2. Automated Rail Systems

4.3.3. Electric Propulsion Systems

4.3.4. Hydrogen-Powered Rail

4.3.5. Magnetic Levitation Technology (Maglev)

4.4. By Component (In Value %)

4.4.1. Wheels and Axles

4.4.2. Couplers

4.4.3. Braking Systems

4.4.4. Power and Traction Systems

4.4.5. Onboard Information and Control Systems

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

India Railway Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Alstom India

5.1.2. Siemens Limited

5.1.3. Bharat Heavy Electricals Limited (BHEL)

5.1.4. Bombardier Transportation

5.1.5. Titagarh Wagons Ltd.

5.1.6. Texmaco Rail & Engineering Ltd.

5.1.7. Jindal Steel & Power Ltd.

5.1.8. Kirloskar Electric Company

5.1.9. Hind Rectifiers Ltd.

5.1.10. Escorts Limited

5.1.11. Integral Coach Factory (ICF)

5.1.12. Rail Vikas Nigam Limited (RVNL)

5.1.13. Larsen & Toubro Limited (L&T)

5.1.14. CRRC Corporation Limited

5.1.15. Texmaco Hi-Tech Pvt Ltd.

5.2. Cross Comparison Parameters (Revenue, Market Share, Production Capacity, Geographic Reach, Product Portfolio, R&D Investment, Technology Partnerships, Key Contracts)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

India Railway Equipment Market Regulatory Framework

6.1. Government Standards for Railway Safety

6.2. Compliance Requirements for Green Rail Technologies

6.3. Certification Processes for Equipment and Technology Providers

India Railway Equipment Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

India Railway Equipment Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

India Railway Equipment Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key market drivers and constraints that shape the India Railway Equipment Market. Detailed desk research is conducted to gather data from government reports, industry whitepapers, and proprietary databases to create a comprehensive map of stakeholders, including manufacturers, suppliers, and regulatory bodies.

Step 2: Market Analysis and Construction

In this phase, historical data on production capacity, sales, and market penetration are analyzed. We assess the financial performance of key players and their influence on the market's overall growth. Revenue estimates are validated through market penetration metrics and supplier data to ensure the accuracy of the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts and railway equipment manufacturers provide insights into operational challenges, emerging technologies, and potential future demand. These consultations help validate the initial hypotheses and refine the data used in the report.

Step 4: Research Synthesis and Final Output

The final report is compiled based on the insights gained from primary research and desk analysis. Data is synthesized to provide a holistic view of the India Railway Equipment Market, highlighting key trends, future growth opportunities, and strategic recommendations for industry stakeholders.

Frequently Asked Questions

How big is the India Railway Equipment Market?

The India Railway Equipment Market, valued at USD 12.43 billion, is driven by the government's focus on infrastructure modernization and expanding its railway network to meet growing demand for passengessr and freight transport.

What are the challenges in the India Railway Equipment Market?

The India Railway Equipment Market’s key challenges include high initial capital investment, technological obsolescence, and the need to comply with stringent environmental and safety regulations. Additionally, the slow pace of project approvals and land acquisition hurdles pose significant challenges.

Who are the major players in the India Railway Equipment Market?

Major players in the India Railway Equipment Market include Alstom India, Siemens Limited, Bharat Heavy Electricals Limited (BHEL), Bombardier Transportation, and Titagarh Wagons Ltd. These companies dominate the market due to their technological expertise and long-term contracts with Indian Railways.

What are the growth drivers of the India Railway Equipment Market?

The India Railway Equipment Market is driven by increased investments in railway electrification, metro rail expansion, and high-speed rail projects. Government initiatives such as "Make in India" and public-private partnerships are also contributing to market growth.

What are the opportunities in the India Railway Equipment Market?

Opportunities in the India Railway Equipment Market include the development of dedicated freight corridors, metro rail projects in Tier 2 cities, and the adoption of advanced signaling and electrification technologies to enhance operational efficiency and sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.