India Recreational Vehicle Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10588

November 2024

100

About the Report

India Recreational Vehicle Market Overview

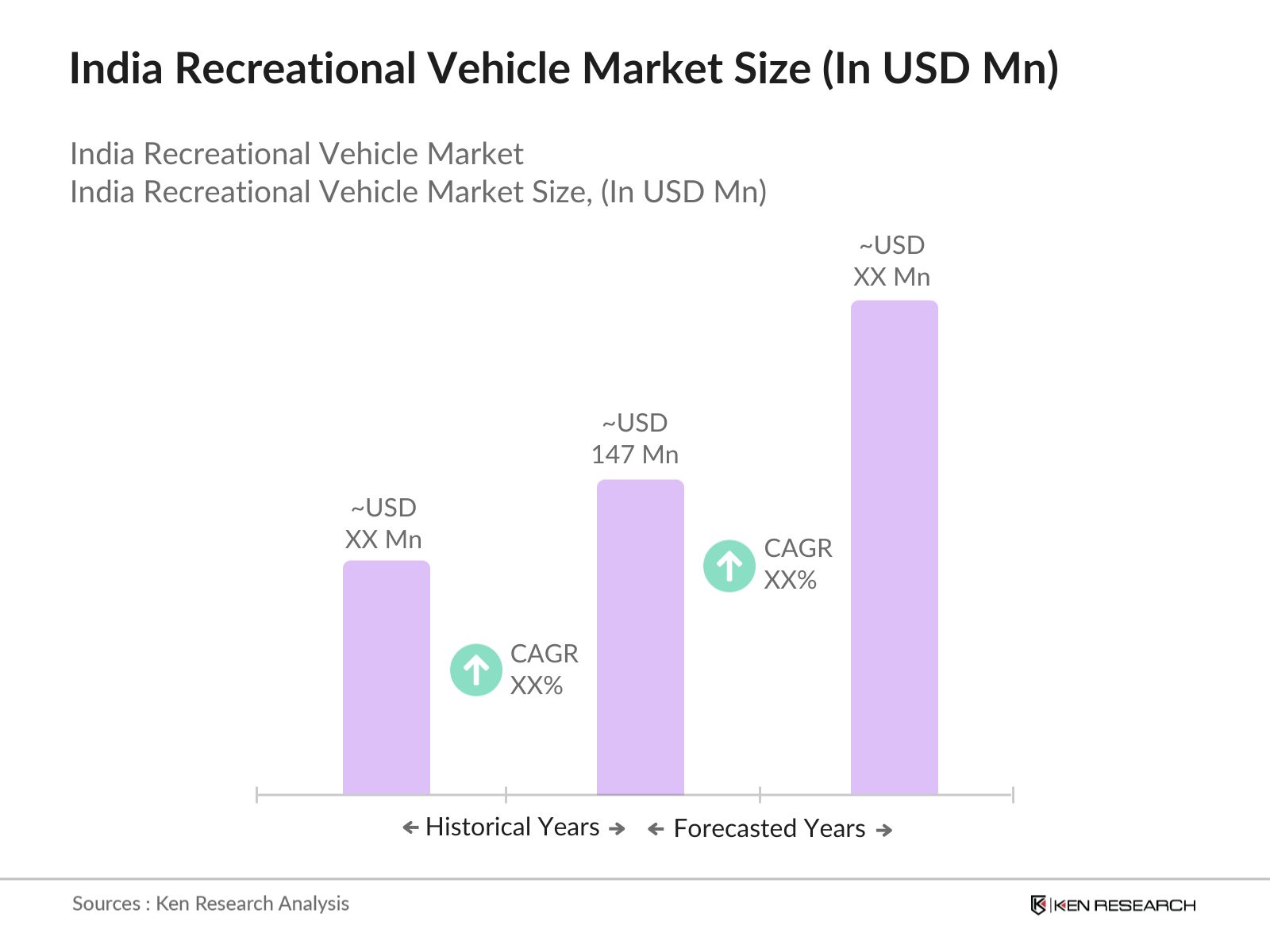

- The India Recreational Vehicle (RV) market is valued at USD 147 million, based on a comprehensive five-year historical analysis, driven by the growth in domestic tourism and increased disposable incomes. Consumers' desire for flexible, cost-effective travel solutions has also contributed significantly to this demand. A cultural shift toward experiential travel, where travelers opt for RVs for convenience, self-sufficiency, and outdoor experiences, is boosting market growth further. Rising awareness regarding environmental sustainability is also pushing the adoption of RVs with eco-friendly features, adding to this upward trend.

- The Indian states of Maharashtra, Karnataka, and Himachal Pradesh dominate the RV market due to their well-established tourism infrastructure, scenic landscapes, and increasing RV camping facilities. Maharashtra, with its diverse topography and cultural sites, attracts a significant number of local and international tourists. Karnataka is emerging as a hub for RV tourism due to its government support for eco-tourism, while Himachal Pradesh, with its natural beauty, attracts adventure seekers, contributing to the RV markets growth in these regions.

- India enforces stringent emission standards under the Bharat Stage (BS) norms, which RV manufacturers must comply with to minimize pollution. With BS-VI norms enforced as of 2023, RVs are required to meet lower emission limits to mitigate environmental impact. This regulation has spurred RV manufacturers to adopt cleaner technologies, aligning with the countrys environmental objectives and enhancing RV appeal among eco-conscious consumers.

India Recreational Vehicle Market Segmentation

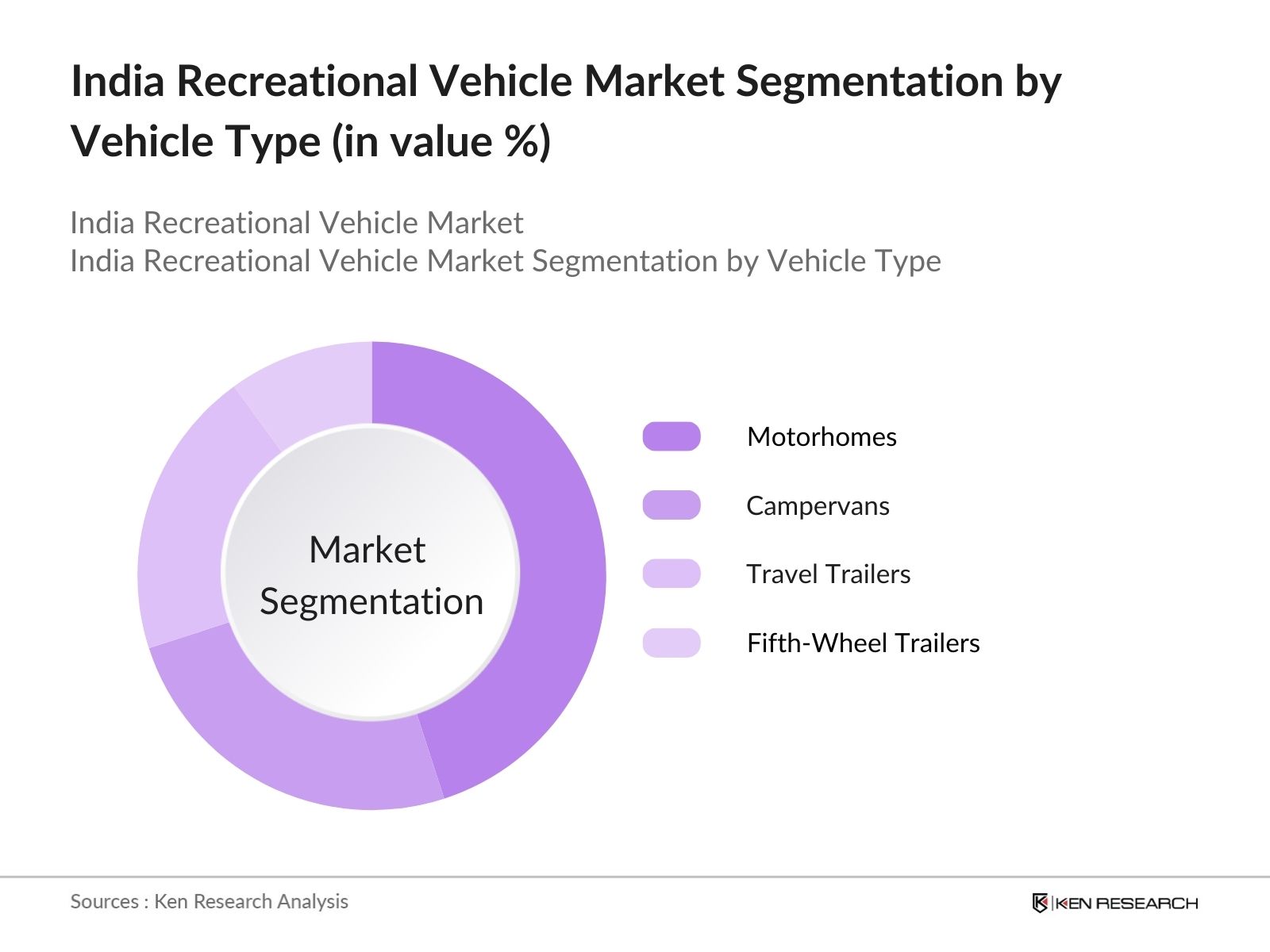

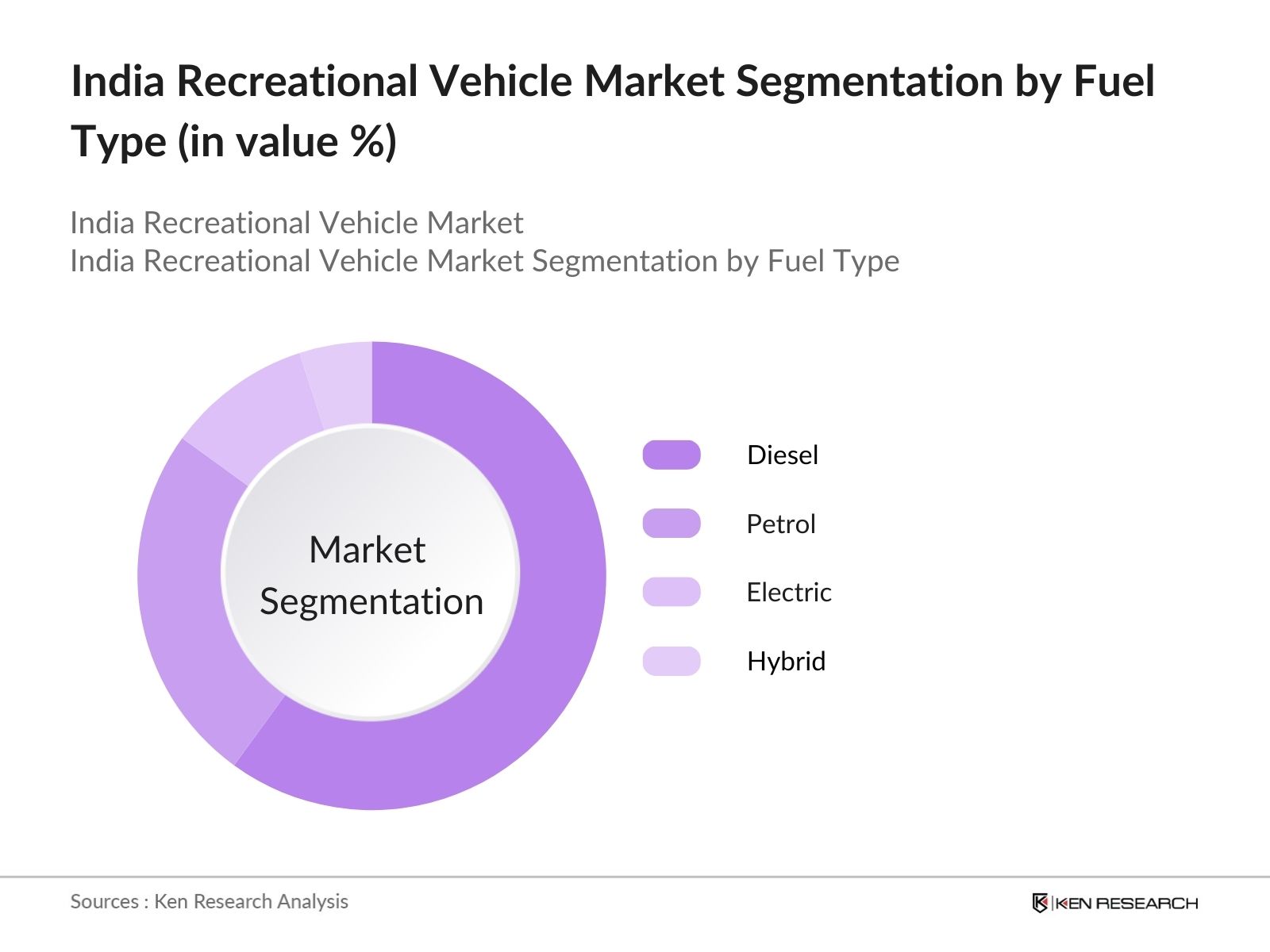

Indias RV market is segmented by vehicle type and by fuel type.

- By Vehicle Type: Indias RV market is segmented by vehicle type into Motorhomes, Campervans, Travel Trailers, and Fifth-Wheel Trailers. Currently, motorhomes hold a dominant share in the vehicle type segment within the RV market, as they offer a comprehensive package of comfort, amenities, and utility. Motorhomes are particularly popular among families and long-distance travelers due to the integrated facilities such as kitchens, bathrooms, and sleeping areas, making them ideal for extended trips. The demand is driven by rising middle-income groups seeking affordable family travel solutions.

- By Fuel Type: The RV market is also segmented by fuel type into Diesel, Petrol, Electric, and Hybrid. Diesel RVs currently dominate this segment due to their extended fuel efficiency and power, which are especially suitable for long-distance travel across varied terrains. Diesel engines offer better mileage, essential for extended road trips, and their availability across Indias fueling infrastructure makes them a preferred choice. Additionally, diesel engines are generally more robust and suited for towing and transporting heavier loads, key factors for the dominant share of diesel RVs in the market.

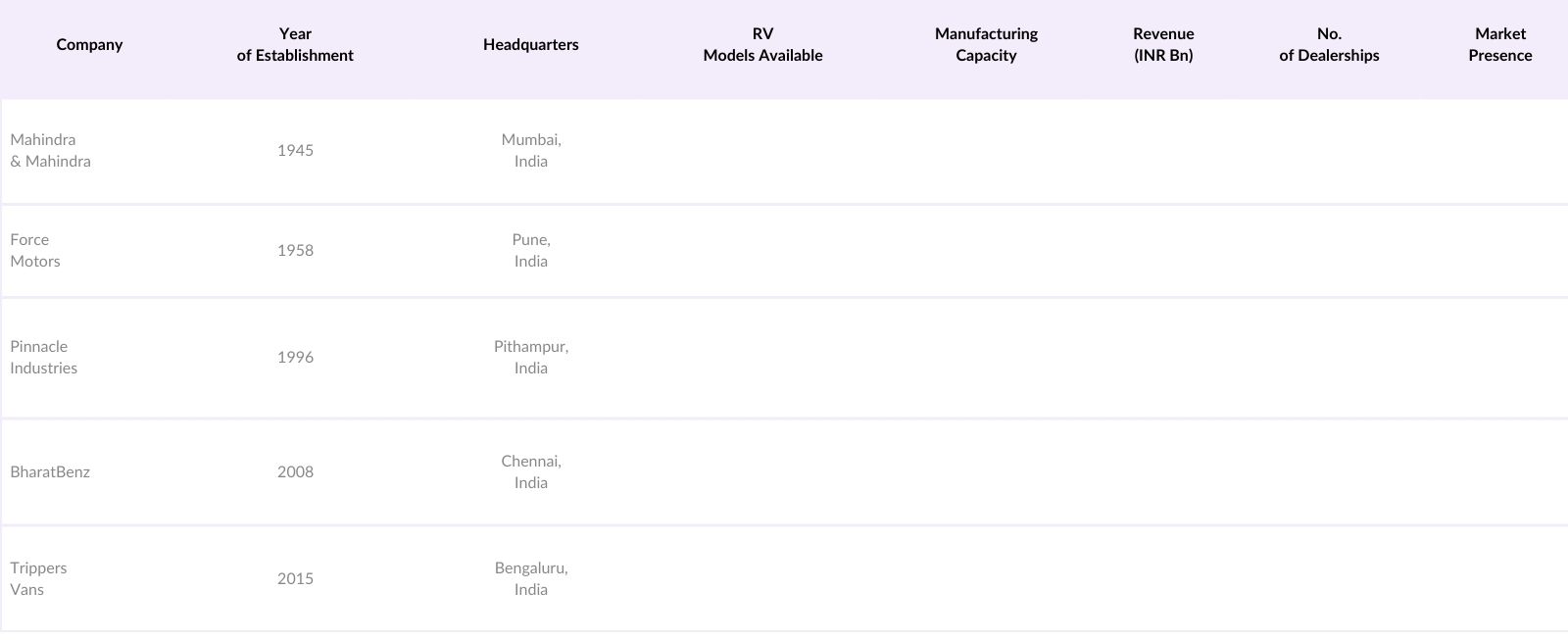

India Recreational Vehicle Market Competitive Landscape

The India RV market is led by a few prominent players who dominate in terms of technology innovation, vehicle customization, and customer service. The market features a combination of domestic manufacturers and international brands, leading to a competitive landscape characterized by a focus on eco-friendly features, advanced technology integration, and robust after-sales service.

India Recreational Vehicle Market Analysis

Growth Drivers

- Rising Disposable Income (Economic Indicator): Indias rising disposable income has bolstered consumer purchasing power, making recreational vehicles (RVs) more accessible. According to the World Bank, Indias per capita income increased to USD 2,180 in 2023, up from USD 1,960 in 2022, reflecting a higher disposable income among middle-class households. With increased income, middle-income families are exploring leisure activities, including RV ownership. Additionally, the governments tax reforms and benefits in the last budget, particularly focusing on income tax rebates for individuals earning up to INR 7 lakh annually, have further encouraged disposable income for leisure spending Ministry of Finance.

- Growth in Domestic Tourism (Tourism Data): Domestic tourism in India saw a notable rise, with over 1.8 billion tourist visits in 2023, highlighting a robust interest in exploring local destinations. The governments Dekho Apna Desh campaign has spurred domestic tourism, with increased demand for unique travel experiences such as RV vacations. The surge in domestic tourism has bolstered the RV market as travelers seek comfortable, flexible travel options to explore remote areas while maintaining amenities. This trend is further strengthened by government support for eco-tourism zones, pushing local tourism expansion.

- Increased Awareness of RV Benefits (Consumer Insights): Rising awareness of RVs as versatile travel options has contributed to increased adoption among Indian travelers. The recent Caravan Tourism Policy, implemented by the Ministry of Tourism in 2022, has played a significant role in promoting RV awareness and incentivizing rentals and purchases. As a result, urban consumers are increasingly valuing the benefits of RV travel, such as convenience and flexibility. RV rentals grew by an estimated 20% between 2022 and 2023, providing an affordable entry point for consumers to experience RV travel without full ownership.

Market Challenges

High Initial Investment Costs (Financial Metrics): High upfront investment costs limit RV ownership in India, with prices for basic models starting from INR 20 lakh, making it unaffordable for many middle-income households Although the government provides subsidies on electric and hybrid vehicles, RVs lack financial incentives, impacting affordability. Moreover, high interest rates, which averaged 8.3% in 2023 for vehicle loans , further inhibit potential buyers from investing in RVs, restraining market penetration in lower economic segments.

Lack of Dedicated RV Infrastructure (Infrastructure Analysis): India lacks the necessary infrastructure to support RV travel, such as designated RV parks, charging stations, and campgrounds. Currently, only a few states, like Maharashtra and Kerala, have dedicated RV parking zones and related facilities . This infrastructure gap limits RV travel, particularly in rural regions and smaller towns. The absence of maintenance stations and campsites along highways discourages potential RV buyers, as they often face logistical challenges and limited accessibility, impacting the overall RV ownership experience.

India Recreational Vehicle Market Future Outlook

Over the next five years, the India Recreational Vehicle market is anticipated to experience significant growth driven by evolving travel preferences toward RV tourism, increasing affordability, and growing interest in eco-tourism. Government initiatives supporting infrastructure development for camping sites and eco-friendly travel options will further bolster the adoption of RVs. Additionally, advances in technology, such as the introduction of electric RVs, are expected to shape the markets trajectory, appealing to environmentally-conscious consumers and paving the way for new market entrants.

Market Opportunities

- Partnerships with Travel Agencies (Strategic Alliances): Forming partnerships with travel agencies presents a significant opportunity for the RV market in India. Collaborations with leading agencies can facilitate RV rental services, providing customers with access to guided RV tours and managed travel experiences. Travel agency partnerships contributed over INR 5,000 crore to Indias tourism sector in 2023, underscoring their potential to drive RV adoption. By working with agencies, RV providers can expand their services to a broader customer base, making RV travel accessible to those hesitant about ownership.

- Integration of Advanced Technology in RVs (Tech Advancements): With increasing demand for tech-savvy vehicles, integrating advanced technologies in RVs creates a notable market opportunity. The inclusion of features like GPS navigation, IoT-based smart systems, and solar panels aligns with consumer preferences for high-tech convenience and sustainability. Indias automotive sector has experienced a 15% rise in the adoption of smart systems in vehicles in 2023. Enhanced technology within RVs improves user experiences and aligns with the younger demographics preferences for connectivity and eco-friendly travel.

Scope of the Report

|

Motorhomes, Campervans, Travel Trailers, Pop-Up Campers, Fifth-Wheel Trailers |

|

|

By End User |

Leisure Travel, Business Travel Family Camping Festival & Event Attendees Off-Grid Travel Enthusiasts |

|

By Fuel Type |

Diesel, Petrol Electric Hybrid Solar-Powered |

|

By Ownership Model |

Ownership Rental Subscription-Based Leasing Timeshare |

|

By Region |

North East West South |

Products

Key Target Audience

Automobile Manufacturers

Government and Regulatory Bodies (Ministry of Road Transport & Highways, Ministry of Tourism)

Investors and Venture Capital Firms

Travel and Tourism Agencies

Environmental Advocacy Organizations

Campground and RV Park Operators

Electric Vehicle Component Suppliers

Consumer Electronics Manufacturers

Companies

Players Mention in the Report:

Mahindra & Mahindra

Force Motors

Tata Motors

Caravan Outfitters

Pinnacle Industries

BharatBenz

JCBL Group

Winnebago India

Trippers Vans

Campertrail

Airstream India

RV-On-Call

Travellers Inn

Eicher Motors

Jayco India

Table of Contents

1. India Recreational Vehicle Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Recreational Vehicle Market Size (In INR Cr)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Recreational Vehicle Market Analysis

3.1 Growth Drivers

3.1.1 Rising Disposable Income (Economic Indicator)

3.1.2 Growth in Domestic Tourism (Tourism Data)

3.1.3 Increased Awareness of RV Benefits (Consumer Insights)

3.1.4 Shift Towards Sustainable Travel (Environmental Awareness)

3.2 Market Challenges

3.2.1 High Initial Investment Costs (Financial Metrics)

3.2.2 Lack of Dedicated RV Infrastructure (Infrastructure Analysis)

3.2.3 Limited Awareness in Rural Regions (Market Penetration)

3.3 Opportunities

3.3.1 Partnerships with Travel Agencies (Strategic Alliances)

3.3.2 Integration of Advanced Technology in RVs (Tech Advancements)

3.3.3 Market Expansion in Untapped Regions (Geographical Expansion)

3.4 Trends

3.4.1 Rising Popularity of Van Life (Lifestyle Shifts)

3.4.2 Preference for Eco-Friendly RVs (Green Technology)

3.4.3 Customized RV Interiors (Customization Trends)

3.5 Government Regulation

3.5.1 Regulations on Vehicle Dimensions (Government Compliance)

3.5.2 Emission Standards (Environmental Regulations)

3.5.3 Road Safety Standards (Transportation Safety)

3.5.4 Licensing Requirements for RV Owners (Legal Compliance)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. India Recreational Vehicle Market Segmentation

4.1 By Type (In Value %)

4.1.1 Motorhomes

4.1.2 Campervans

4.1.3 Travel Trailers

4.1.4 Pop-Up Campers

4.1.5 Fifth-Wheel Trailers

4.2 By End User (In Value %)

4.2.1 Leisure Travel

4.2.2 Business Travel

4.2.3 Family Camping

4.2.4 Festival & Event Attendees

4.2.5 Off-Grid Travel Enthusiasts

4.3 By Fuel Type (In Value %)

4.3.1 Diesel

4.3.2 Petrol

4.3.3 Electric

4.3.4 Hybrid

4.3.5 Solar-Powered

4.4 By Ownership Model (In Value %)

4.4.1 Ownership

4.4.2 Rental

4.4.3 Subscription-Based

4.4.4 Leasing

4.4.5 Timeshare

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Recreational Vehicle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mahindra & Mahindra

5.1.2 Force Motors

5.1.3 Tata Motors

5.1.4 Caravan Outfitters

5.1.5 Pinnacle Industries

5.1.6 BharatBenz

5.1.7 JCBL Group

5.1.8 Winnebago India

5.1.9 Trippers Vans

5.1.10 Campertrail

5.1.11 Airstream India

5.1.12 RV-On-Call

5.1.13 Travellers Inn

5.1.14 Eicher Motors

5.1.15 Jayco India

5.2 Cross Comparison Parameters

5.2.1 Revenue

5.2.2 Market Share

5.2.3 Number of Dealerships

5.2.4 Fleet Size

5.2.5 Technology Integration (Fuel Type, IoT, Navigation)

5.2.6 Manufacturing Capacity

5.2.7 Customer Base

5.2.8 Regional Presence

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. India Recreational Vehicle Market Regulatory Framework

6.1 Road Safety Regulations

6.2 Vehicle Size Compliance

6.3 Emission Standards

6.4 RV Parking and Campground Regulations

6.5 Licensing and Registration Requirements

7. India Recreational Vehicle Future Market Size (In INR Cr)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Recreational Vehicle Future Market Segmentation

8.1 By Type (In Value %)

8.2 By End User (In Value %)

8.3 By Fuel Type (In Value %)

8.4 By Ownership Model (In Value %)

8.5 By Region (In Value %)

9. India Recreational Vehicle Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the entire ecosystem of stakeholders within the India Recreational Vehicle Market. This phase includes extensive desk research and consultation with industry reports to identify critical market influencers, consumer demographics, and policy impacts on RV adoption.

Step 2: Market Analysis and Construction

This phase focuses on gathering and analyzing historical data relevant to the India Recreational Vehicle Market. It includes evaluating the growth in vehicle ownership, the rise in domestic tourism, and identifying key growth drivers such as fuel preference and technology integration.

Step 3: Hypothesis Validation and Expert Consultation

Using a combination of CATIs and face-to-face interviews, insights are gathered from industry experts, RV manufacturers, and campground operators. This validation process ensures that the report is grounded in real-world perspectives and current industry practices.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing data from primary and secondary sources, verified through cross-referencing with stakeholders in the RV market. This ensures that the analysis is comprehensive, accurate, and reflective of current trends and future projections.

Frequently Asked Questions

01. How big is the India Recreational Vehicle Market?

The India Recreational Vehicle Market is valued at USD 147 million, largely driven by the rise in domestic tourism and increasing consumer interest in affordable travel options.

02. What are the major challenges in the India Recreational Vehicle Market?

Challenges in India Recreational Vehicle Market include high initial costs, limited RV infrastructure, and regulatory constraints related to vehicle dimensions and emission standards.

03. Who are the major players in the India Recreational Vehicle Market?

Key players in India Recreational Vehicle Market include Mahindra & Mahindra, Force Motors, Tata Motors, Pinnacle Industries, and BharatBenz, with each bringing unique offerings and advantages in terms of regional presence, customer base, and innovation.

04. What are the growth drivers for the India Recreational Vehicle Market?

The India Recreational Vehicle Market growth is propelled by increasing consumer demand for flexible travel options, government support for eco-tourism, and advancements in RV technology.

05. Why are motorhomes the most popular vehicle type in the India RV market?

Motorhomes dominate due to their integrated amenities and convenience, appealing to families and long-distance travelers who prefer self-sufficient travel solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.