India TMS Market Outlook to 2029

Region:Asia

Author(s):Rebecca Mary Reji

Product Code:KR1507

June 2025

90

About the Report

India TMS Market Overview

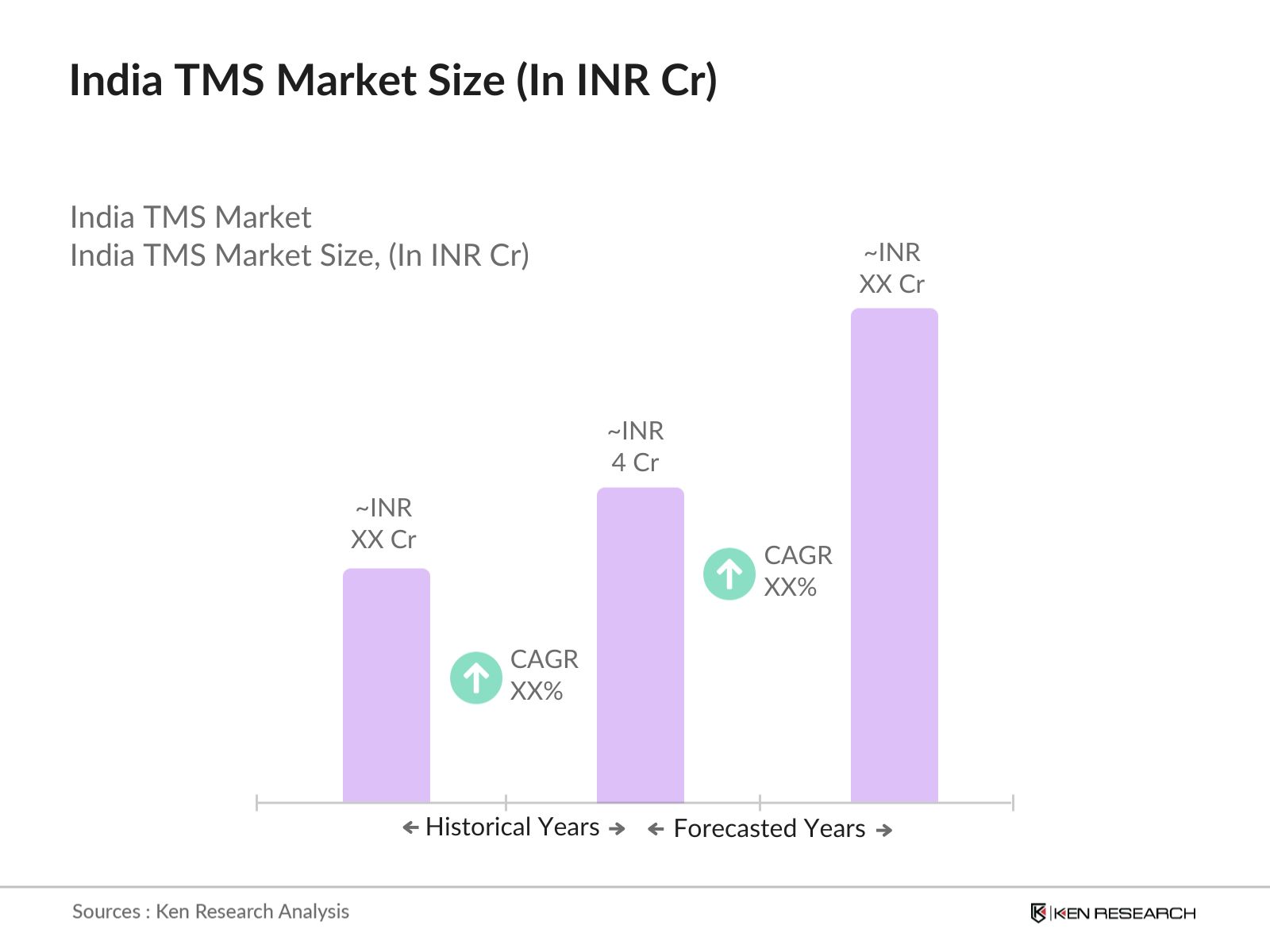

- The India TMS Market is valued at INR 4 Crore. This growth is primarily driven by the increasing demand for efficient transportation management solutions, which are essential for optimizing logistics and supply chain operations. The rise in e-commerce and the need for real-time tracking and analytics have further propelled the market, as businesses seek to enhance operational efficiency and customer satisfaction.

- Key cities dominating the market include Mumbai, Delhi, and Bengaluru. These urban centers are significant due to their robust infrastructure, high concentration of businesses, and technological advancements. The presence of major logistics companies and a growing startup ecosystem in these cities contributes to their dominance in the TMS market.

- In 2024, the Indian government implemented the National Logistics Policy, aimed at promoting seamless movement of goods across the country. This policy focuses on enhancing logistics efficiency, reducing costs, and improving the overall competitiveness of the logistics sector, thereby creating a favorable environment for TMS adoption.

India TMS Market Segmentation

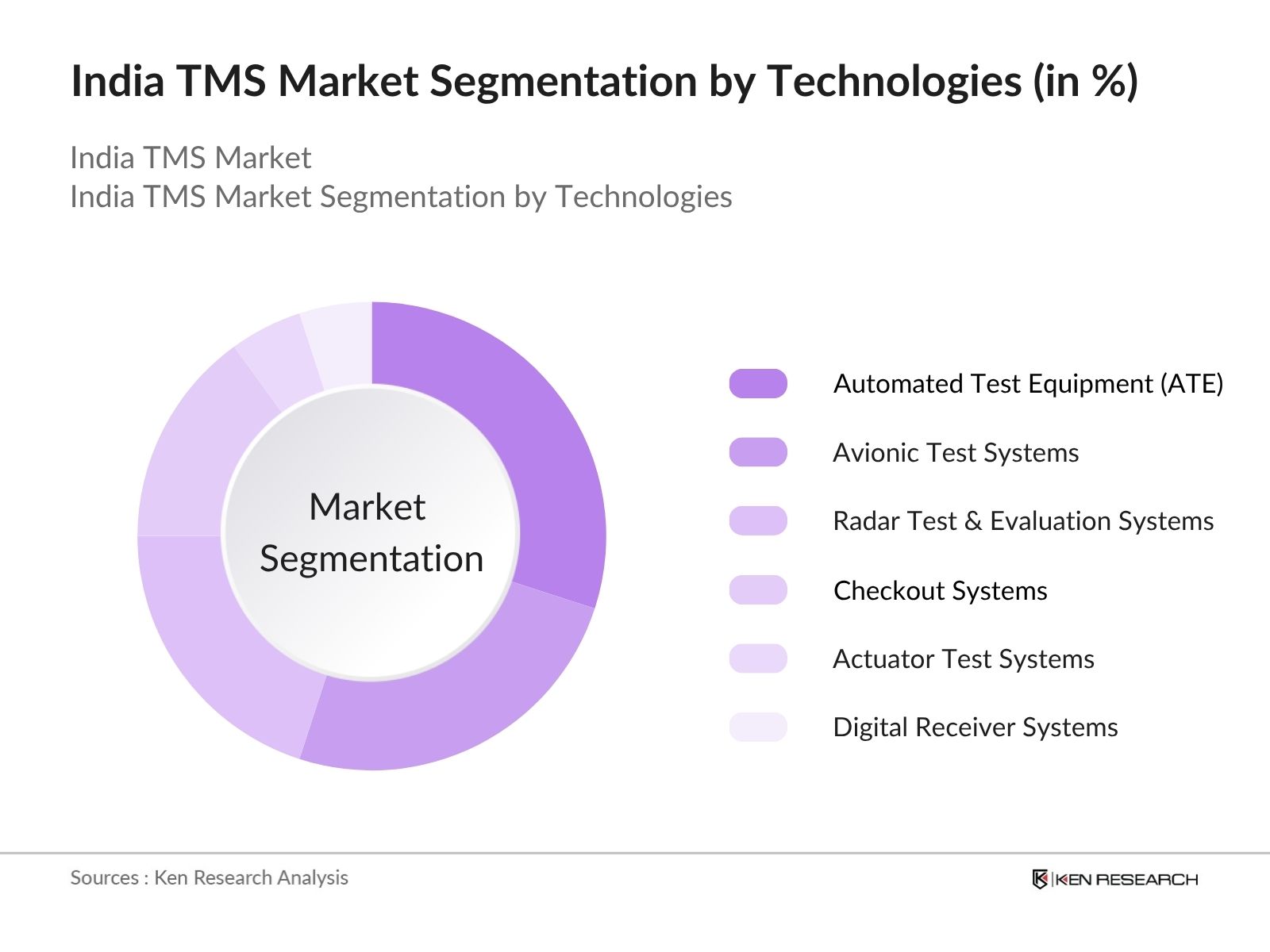

By Technologies: The market is segmented into Automated Test Equipment (ATE), Avionic Test Systems, Radar Test & Evaluation Systems, Checkout Systems, Actuator Test Systems, and Digital Receiver Systems. Automated Test Equipment (ATE) dominates the market due to its versatility, speed, and accuracy in testing complex electronic systems. Avionic and Radar Test Systems are gaining traction with growing aerospace and defense advancements. Checkout and Actuator Test Systems are vital for subsystem validation, while Digital Receiver Systems support precise signal processing, together enabling comprehensive evaluation and reliability in mission-critical applications.

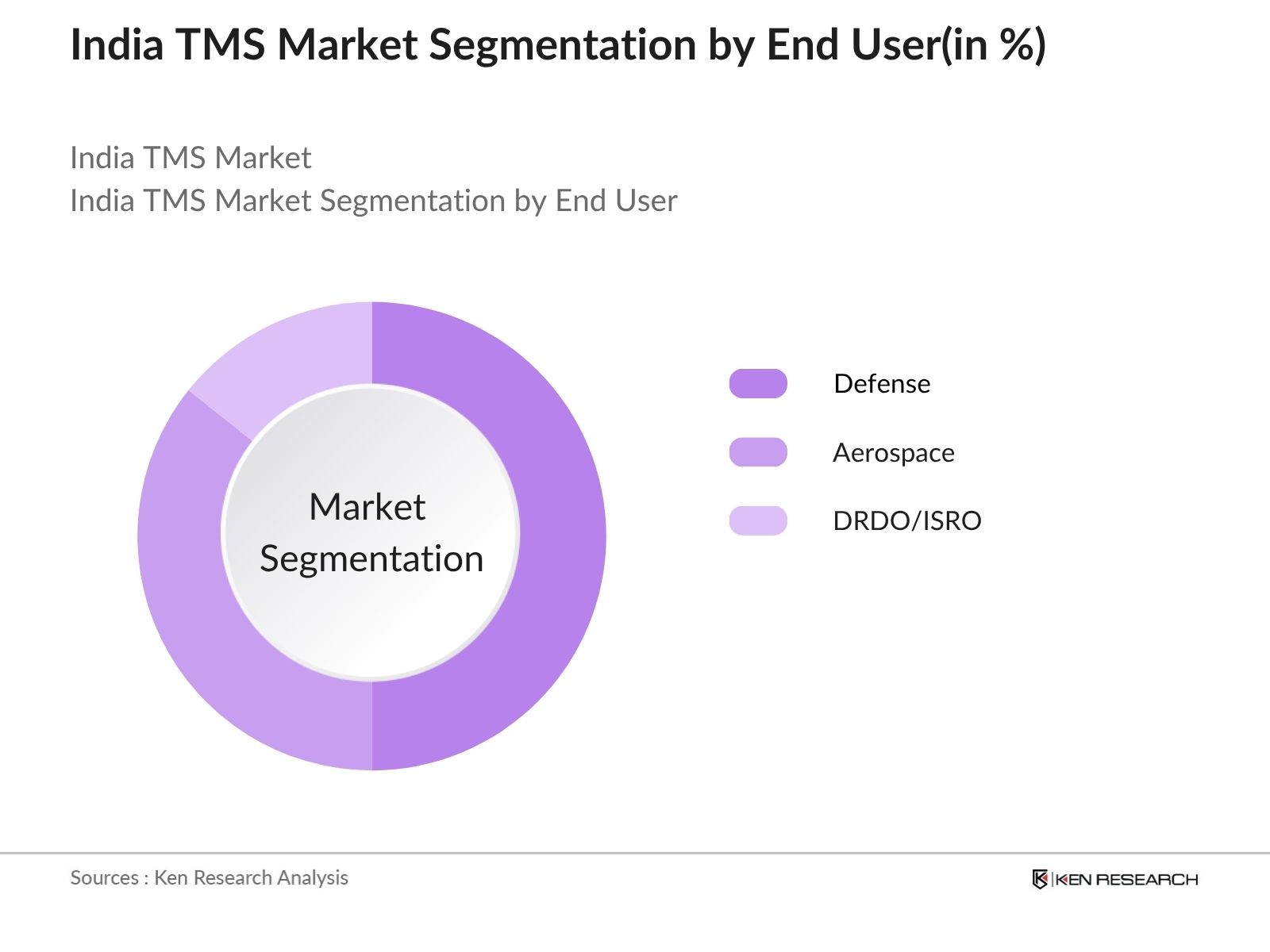

By End User: The market is segmented into Defense, Aerospace, and DRDO/ISRO. The Defense sector leads the market, driven by the need for high-precision testing systems to ensure mission readiness and operational reliability. Aerospace applications are expanding with increased aircraft production and modernization programs, requiring advanced evaluation technologies. DRDO and ISRO represent specialized government end users, focusing on space and defense innovation, where accuracy, durability, and system validation are critical, making them significant contributors to the demand for advanced test and evaluation systems.

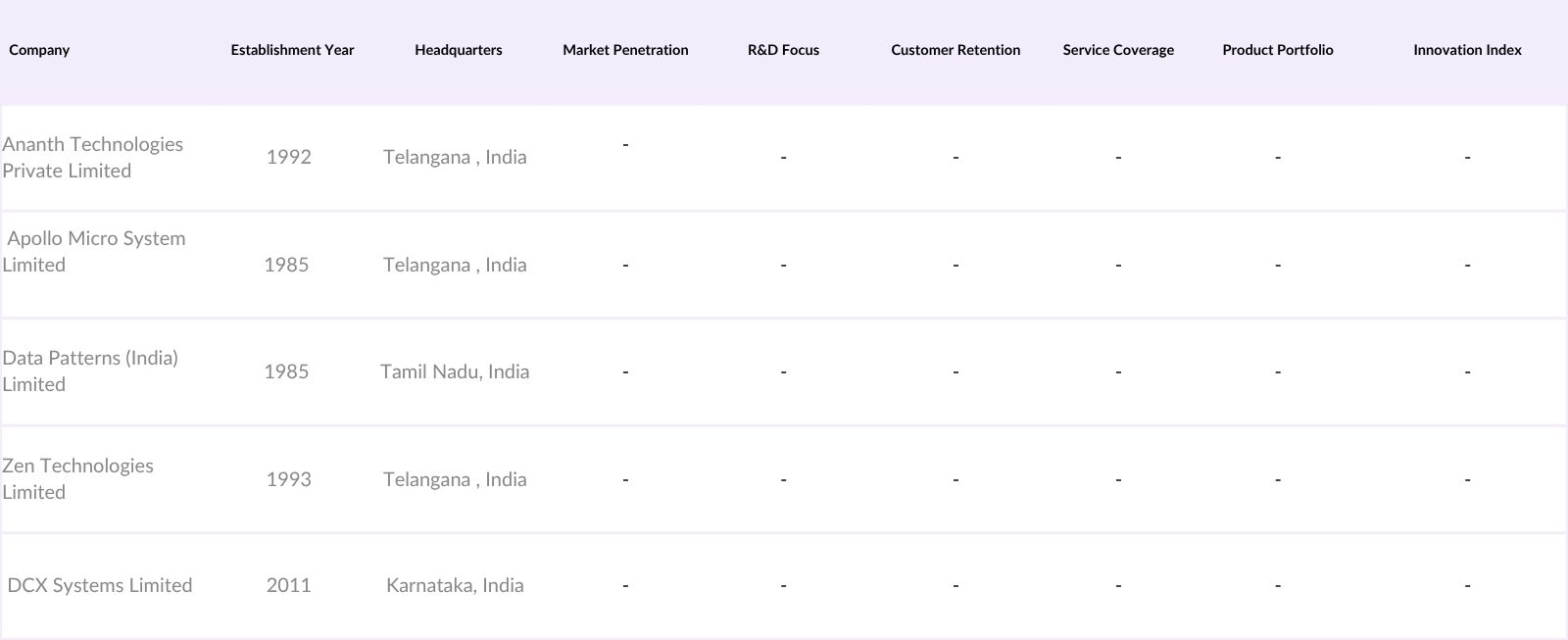

India TMS Market Competitive Landscape

The India TMS Market is characterized by a competitive landscape with several key players, including SAP, Oracle, and JDA Software. These companies are focusing on innovation and technological advancements to enhance their offerings. The market is moderately concentrated, with a mix of established players and emerging startups, all vying for a share in the growing demand for transportation management solutions.

India TMS Market Industry Analysis

Growth Drivers

- Increasing Demand for Supply Chain Optimization: The Indian logistics sector is valued at approximately INR 25 lakh crore (USD 300 billion) in 2024 and is projected to grow at a CAGR of 10-12% over the coming years. Companies are increasingly adopting Transportation Management Systems (TMS) and other technology-driven solutions to enhance supply chain efficiency, reduce costs, and improve delivery times. Government initiatives like "Make in India" and "Digital India" further support this trend by encouraging infrastructure development and digital adoption, helping businesses optimize operations and remain competitive in a rapidly evolving market.

- Rising Adoption of Cloud-based Solutions: The cloud computing market in India is projected to reach around INR 65,000 crore by 2024, with Transportation Management Systems (TMS) playing a key role. Cloud-based TMS solutions offer scalability, flexibility, and cost-efficiency, appealing to businesses across sectors. As more organizations migrate to cloud platforms, demand for integrated TMS that improve operational efficiency and data accessibility is rapidly increasing, driving robust growth in the market.

- Growth in E-commerce and Retail Sectors: India’s e-commerce market is projected to reach approximately INR 12.2 lakh crore in 2024, growing at a rate of about 23.8%. This rapid expansion is significantly impacting logistics and transportation management, increasing the need for efficient Transportation Management Systems (TMS). As e-commerce companies scale operations, consumer demand for faster delivery compels retailers to invest in advanced TMS technologies to optimize complex logistics networks and enhance service levels.

Market Challenges

- High Implementation Costs: The initial investment required for TMS implementation can be a significant barrier for many organizations. Smaller enterprises often struggle to justify these expenses due to the complexity and scale of the systems. This financial hurdle can delay the adoption of TMS solutions, limiting the potential for operational improvements and efficiency gains in the logistics sector.

- Data Security Concerns: As TMS solutions increasingly rely on cloud technology, data security has become a paramount concern for businesses. The logistics sector is particularly vulnerable to cyber threats, with the potential for data breaches leading to significant financial losses. This highlights the critical need for robust security measures in TMS implementations to protect sensitive information and maintain operational resilience.

India TMS Market Future Outlook

The future of the India TMS market appears promising, driven by technological advancements and evolving consumer demands. As businesses increasingly prioritize efficiency and sustainability, the integration of AI and machine learning into TMS solutions is expected to enhance decision-making and operational performance. Additionally, the ongoing expansion of logistics infrastructure, supported by government initiatives, will further facilitate the adoption of advanced TMS technologies, positioning the market for significant growth in the coming years.

Market Opportunities

- Expansion of Logistics Infrastructure: The Indian government is investing heavily in logistics infrastructure, with plans to allocate approximately INR 1,12,00,000 crore by 2024. This massive investment creates opportunities for Transportation Management System (TMS) providers to offer solutions that optimize transportation routes and improve supply chain efficiency, addressing the growing demand for seamless logistics operations across the country.

- Integration of AI and Machine Learning Technologies: India's AI market is presenting a significant opportunity for TMS solutions. By integrating AI and machine learning, TMS can enhance predictive analytics, automate processes, and improve decision-making, enabling businesses to respond more effectively to market changes and customer needs. This growth is supported by government initiatives like the IndiaAI Mission, which allocated over INR 10,300 crore to strengthen AI capabilities over five years.

Scope of the Report

| By Technologies |

Automated Test Equipment (ATE) Avionic Test Systems Radar Test & Evaluation Systems Checkout Systems Actuator Test Systems Digital Receiver Systems |

| By End User |

Defense Aerospace DRDO/ISRO |

| By Defense Sector |

Indian Air Force Indian Navy Indian Army |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Electronics and Information Technology, Telecom Regulatory Authority of India)

Manufacturers and Producers of TMS Solutions

Distributors and Retailers of TMS Products

Telecommunication Service Providers

Technology Providers and Software Developers

Industry Associations and Trade Organizations

Financial Institutions and Banks

Companies

Players Mentioned in the Report:

Ananth Technologies Private Limited

Apollo Micro System Limited

Data Patterns (India) Limited

Zen Technologies Limited

DCX Systems Limited

ComAvia

Centum Electronics

Pinaka

Testamatic Systems

Safran India

Table of Contents

1. Global Macroeconomic Landscape

1.1. Global Economic Landscape

1.2. Overview of Global Defense & Aerospace Sector

2. Indian Economic Outlook Landscape

2.1. Overview of Indian Economic Environment

2.2. Key Economic Indicators & Impact on Defense and Aerospace Industry in India.

2.3. Government, Private Capital Expenditure & Initiatives for Aerospace and Defense Sectoral Growth.

2.4. FDI Flow, Investment Climate and Trends in India.

2.5. Currency Dynamics Linked to Rupee-Dollar Exchange Rate.

3. Regulatory Landscape

3.1. Impact of India’s Growing Focus on ‘Indigenization’ and ‘Make in India’ for Defense and 3.2. Aerospace Production.

3.3. India Aerospace Sector Overview – Focus on ISRO Budgets & Missions.

3.4. Importance of India’s Critical Test, Measurement, and Simulation Technologies Market in 3.5. Defense & Aerospace Industry.

3.6. Business Opportunity for Electronic Components in Defense and Aerospace Sectors via 3.7. Built to specs (BTS) and Built to Print (BTP)

4. Market Analysis

4.1. Global Critical Test, Measurement, and Simulation Technologies Market Size, CY’19 - CY’25P - CY’30F.

4.2. Indian Critical Test, Measurement, and Simulation Technologies Market Size, FY’19-FY’24-FY’30F.

4.3. Market Segmentation of India Critical Test, Measurement, and Simulation Technologies Market, FY’25P & FY’30F.

4.3.1. By Technology Type (FY’25P & FY’30F):

4.3.2. By End-User Industry (FY’25P & FY’30F):

4.3.3. By Defense-Sector (FY’25P & FY’30F):

5. Technological Landscape

5.1. Advancements in Automation and Real-time Testing Solutions.

5.2. Emerging Trends in Radar, Electronic Systems, and Underwater Calibration Technologies.

5.3. Development of Indigenous Tools and Software to Meet Industry-Specific Requirements.

6. Key Growth Drivers

7. Market Challenges and Threats

7.1.Threat & Risks.

8. Competition Landscape - India Critical Test, Measurement and Simulation Technologies Market

8.1. Major Critical Test, Measurement, and Simulation Technologies Suppliers in the Industry.

8.2. Cross-Comparison of Peers in India Critical Test, Measurement, and Simulation Technologies Market

9. Conclusion

10. Research Methodology

10.1. Market Definitions

10.2. Abbreviations.

10.3. Market Sizing and Modeling.

10.4. Consolidated Research Approach.

10.5. Limitations.

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India TMS Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India TMS Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India TMS Market.

Frequently Asked Questions

01. How big is the India TMS Market?

The India TMS Market is valued at INR 4 Crore, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the India TMS Market?

Key challenges in the India TMS Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the India TMS Market?

Major players in the India TMS Market include SAP, Oracle, JDA Software, Manhattan Associates, and Descartes Systems Group, among others.

04. What are the growth drivers for the India TMS Market?

The primary growth drivers for the India TMS Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.