India Two-Wheeler Market Outlook to 2029

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1525

August 2025

90

About the Report

India Two-Wheeler Market Overview

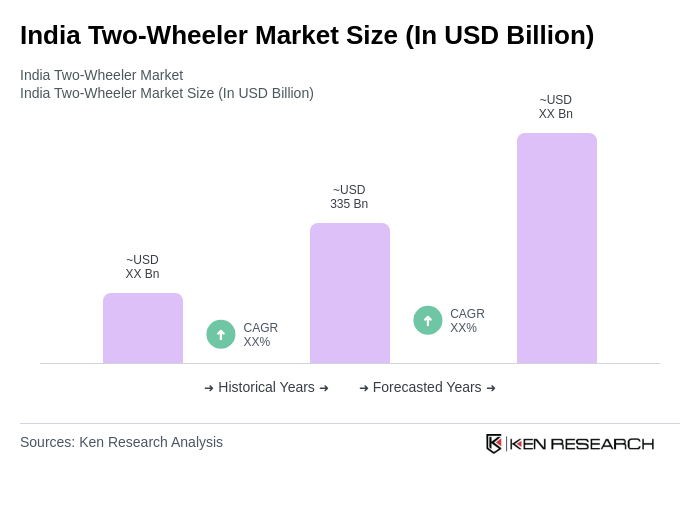

- The India Two-Wheeler Market is valued at around USD 335 billion, based on recent historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing preference for two-wheelers as an affordable mode of transportation. The market has experienced a significant increase in demand for electric two-wheelers, reflecting a shift towards sustainable mobility solutions.

- Key cities such as Delhi, Mumbai, and Bangalore dominate the market due to their high population density, extensive road networks, and a burgeoning middle class. These urban centers are characterized by heavy traffic congestion, making two-wheelers an attractive option for daily commuting. Additionally, the presence of major manufacturers and a robust dealership network further solidifies their market dominance.

- The Indian government has continued to implement and update policies promoting electric two-wheelers through schemes like FAME II, which ran until March 2024, providing substantial subsidies and incentives. In 2024, the EMPS plan was launched with significant funding to further support electric two-wheeler adoption, reinforcing efforts to reduce pollution and fossil fuel dependence, while encouraging manufacturers and consumers to embrace electric mobility solutions.

India Two-Wheeler Market Segmentation

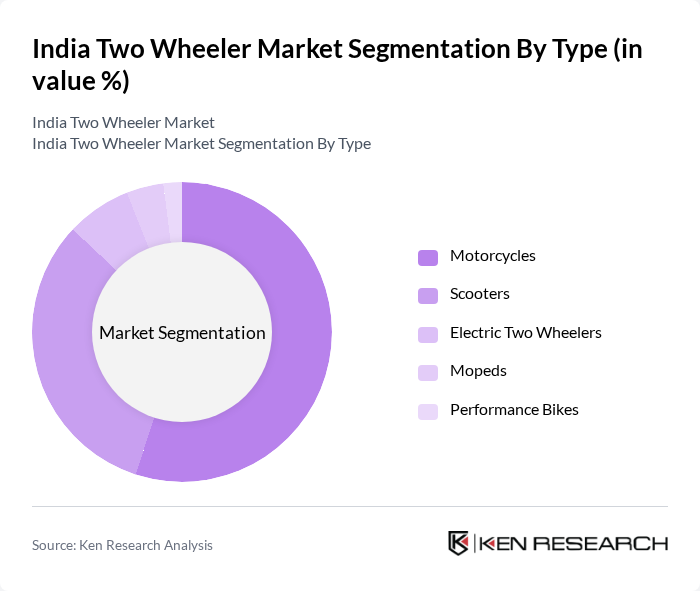

By Type: The two-wheeler market can be segmented into motorcycles, scooters, electric two-wheelers, mopeds, and performance bikes. Scooters have gained immense popularity due to their ease of use and fuel efficiency, particularly among urban commuters. Motorcycles maintain a significant share, appealing to a younger demographic seeking performance and style. Electric two-wheelers are rapidly emerging as a key segment, driven by government incentives, increasing environmental awareness, and the introduction of new models from leading manufacturers.

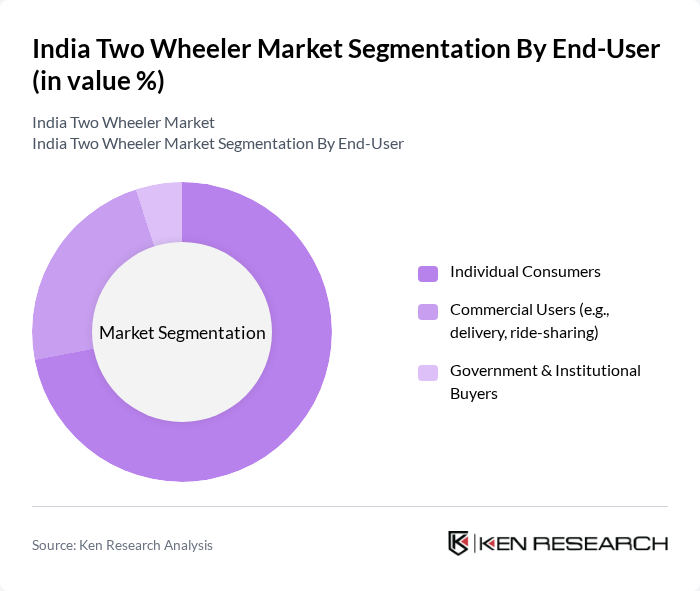

By End-User: The end-user segmentation includes individual consumers, commercial users, and government & institutional buyers. Individual consumers dominate the market, driven by the need for personal mobility solutions. Commercial users, including delivery services and ride-sharing platforms, are increasingly adopting two-wheelers for their operational efficiency. Government and institutional buyers are also contributing to the market, particularly in urban transport initiatives.

India Two-Wheeler Market Competitive Landscape

The India Two-Wheeler Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hero MotoCorp, Honda Motorcycle & Scooter India, TVS Motor Company, Bajaj Auto, Royal Enfield (Eicher Motors), Suzuki Motorcycle India, Yamaha Motor India, Piaggio Vehicles, Ather Energy, Ola Electric Mobility, Mahindra Two Wheelers, Kinetic Green Energy & Power Solutions, Ultraviolette Automotive, LML Electric, and Revolt Motors contribute to innovation, geographic expansion, and service delivery in this space.

| Hero MotoCorp | 1984 | New Delhi, India | – | – | – | – | – | – |

| Honda Motorcycle & Scooter India | 2001 | Gurugram, India | – | – | – | – | – | – |

| TVS Motor Company | 1978 | Chennai, India | – | – | – | – | – | – |

| Bajaj Auto | 1945 | Pune, India | – | – | – | – | – | – |

| Royal Enfield (Eicher Motors) | 1901 | Chennai, India | – | – | – | – | – | – |

| Company | Establishment Year | Headquarters | Group Size (Large, Medium, or Small as per industry convention) | Annual Sales Volume (Units) | Market Share (%) | Revenue (INR Crore/USD Million) | EBITDA Margin (%) | Product Portfolio Breadth |

|---|

India Two-Wheeler Market Industry Analysis

Growth Drivers

- Increasing Urbanization: Urbanization in India is projected to surpass 530 million people soon, with urban areas accounting for about 40% of the population. This rapid urban growth drives demand for two-wheelers as a convenient and cost-effective transport mode. The urban population’s reliance on two-wheelers is evident, with over 17 million units sold recently, reflecting a strong preference for personal mobility solutions in congested cities.

- Rising Disposable Incomes: India's per capita income is estimated at approximately $2,400 in the most recent period, leading to increased purchasing power among consumers. This economic growth is fostering a greater demand for two-wheelers, as more individuals can afford personal vehicles. The two-wheeler segment has seen a sales increase of approximately 13% year-on-year, indicating that rising disposable incomes are directly correlating with higher vehicle ownership rates across various demographics.

- Demand for Fuel-Efficient Vehicles: With fuel prices averaging around ?100 per liter recently, consumers are increasingly seeking fuel-efficient two-wheelers. Sales of models achieving over 30 km/liter have risen by approximately 20% in the past year. This growth is driven by the need to reduce transportation costs, making two-wheelers an appealing choice for budget-conscious consumers looking for economical commuting solutions.

Market Challenges

- Regulatory Compliance Issues: The Indian two-wheeler market faces challenges from strict regulations. BS-VI emission norms have increased production costs and affected pricing. From January 2026, safety rules mandating Anti-lock Braking Systems (ABS) on all two-wheelers will add costs, especially for entry-level models. Manufacturers must invest in technology upgrades to comply, which can strain resources and impact competitiveness, particularly for smaller players.

- Intense Competition: The Indian two-wheeler market is highly competitive, with over 10 major players aggressively vying for market share. This competitive environment has led to pricing pressures and fierce rivalry, compelling companies to continuously innovate and enhance customer service to sustain their positions. Such demands can divert resources from other critical areas like research and development. Leading manufacturers include Hero MotoCorp, Honda, TVS, Bajaj, Suzuki, Royal Enfield, and several emerging electric vehicle brands, all contributing to a dynamic and challenging market landscape.

India Two-Wheeler Market Future Outlook

The future of the India two-wheeler market appears promising, driven by the ongoing shift towards electric mobility and the integration of smart technologies. As the government continues to promote electric vehicle adoption through incentives and infrastructure development, the market is likely to witness a significant transformation. Additionally, advancements in vehicle features, such as connectivity and safety, will enhance consumer appeal, fostering a more competitive environment that encourages innovation and sustainability in the industry.

Market Opportunities

- Growth of E-commerce Delivery Services: India’s e-commerce market is projected to present a significant opportunity for two-wheeler manufacturers. Delivery services increasingly rely on two-wheelers for last-mile logistics, driving demand for efficient and reliable vehicles. This trend is expected to boost two-wheeler sales, especially in urban areas, where quick and cost-effective delivery is essential.

- Expansion of Electric Two Wheelers: The electric two-wheeler segment is growing rapidly, with sales recently crossing around 1.05 lakh (105,000) units in June 2025, showing strong year-on-year growth. Government initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme and the newer Electric Mobility Promotion Scheme (EMPS) are key drivers of this growth. Improvements in battery technology and expanding charging infrastructure are further encouraging consumer adoption, presenting a lucrative market opportunity for manufacturers.

Scope of the Report

| By Type |

Motorcycles Scooters Electric Two Wheelers Mopeds Performance Bikes |

| By End-User |

Individual Consumers Commercial Users (e.g., delivery, ride-sharing) Government & Institutional Buyers |

| By Region |

North India South India East India West India |

| By Price Range |

Entry-Level/Budget Segment Mid-Range Segment Premium/Luxury Segment |

| By Sales Channel |

Online Sales Authorized Dealerships Direct Company Outlets |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Road Transport and Highways, Automotive Research Association of India)

Manufacturers and Producers

Distributors and Retailers

Automobile Component Suppliers

Industry Associations (e.g., Society of Indian Automobile Manufacturers)

Financial Institutions

Logistics and Supply Chain Companies

Companies

Players Mentioned in the Report:

Hero MotoCorp

Honda Motorcycle & Scooter India

TVS Motor Company

Bajaj Auto

Royal Enfield (Eicher Motors)

Suzuki Motorcycle India

Yamaha Motor India

Piaggio Vehicles

Ather Energy

Ola Electric Mobility

Table of Contents

Market Assessment Phase

1. Executive Summary and Approach

2. India Two-Wheeler Market Overview

2.1 Key Insights and Strategic Recommendations

2.2 India Two-Wheeler Market Overview

2.3 Definition and Scope

2.4 Evolution of Market Ecosystem

2.5 Timeline of Key Regulatory Milestones

2.6 Value Chain & Stakeholder Mapping

2.7 Business Cycle Analysis

2.8 Policy & Incentive Landscape

3. India Two-Wheeler Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Urbanization

3.1.2 Rising Disposable Incomes

3.1.3 Demand for Fuel-Efficient Vehicles

3.1.4 Government Initiatives for Electric Vehicles

3.2 Market Challenges

3.2.1 Regulatory Compliance Issues

3.2.2 Intense Competition

3.2.3 Fluctuating Raw Material Prices

3.2.4 Infrastructure Limitations

3.3 Market Opportunities

3.3.1 Growth of E-commerce Delivery Services

3.3.2 Expansion of Electric Two-Wheelers

3.3.3 Increasing Demand in Rural Areas

3.3.4 Technological Advancements in Vehicle Features

3.4 Market Trends

3.4.1 Shift Towards Electric Mobility

3.4.2 Integration of Smart Technology

3.4.3 Customization and Personalization of Vehicles

3.4.4 Growth of Subscription Models

3.5 Government Regulation

3.5.1 Emission Norms Compliance

3.5.2 Safety Regulations for Two-Wheelers

3.5.3 Incentives for Electric Vehicle Adoption

3.5.4 Licensing and Registration Policies

4. SWOT Analysis

5. Stakeholder Analysis

6. Porter's Five Forces Analysis

7. India Two Wheeler Market Market Size, 2019-2024

7.1 By Value

7.2 By Volume

7.3 By Average Selling Price

8. India Two-Wheeler Market Segmentation

8.1 By Type

8.1.1 Motorcycles

8.1.2 Scooters

8.1.3 Electric Two-Wheelers

8.1.4 Mopeds

8.1.5 Performance Bikes

8.2 By End-User

8.2.1 Individual Consumers

8.2.2 Commercial Users (e.g., delivery, ride-sharing)

8.2.3 Government & Institutional Buyers

8.3 By Region

8.3.1 North India

8.3.2 South India

8.3.3 East India

8.3.4 West India

8.4 By Price Range

8.4.1 Entry-Level/Budget Segment

8.4.2 Mid-Range Segment

8.4.3 Premium/Luxury Segment

8.5 By Sales Channel

8.5.1 Online Sales

8.5.2 Authorized Dealerships

8.5.3 Direct Company Outlets

9. India Two-Wheeler Market Competitive Analysis

9.1 Market Share of Key Players

9.2 Cross-Comparison of Key Players

9.2.1 Company Name

9.2.2 Group Size (Large, Medium, or Small as per industry convention)

9.2.3 Annual Sales Volume (Units)

9.2.4 Market Share (%)

9.2.5 Revenue (INR Crore/USD Million)

9.2.6 EBITDA Margin (%)

9.2.7 Product Portfolio Breadth

9.2.8 Distribution Network Reach

9.2.9 R&D/Innovation Spend (% of Revenue)

9.2.10 Brand Equity Index

9.2.11 After-Sales Service Coverage

9.2.12 Electric Vehicle (EV) Penetration (%)

9.3 SWOT Analysis of Top Players

9.4 Pricing Analysis

9.5 Detailed Profile of Major Companies

9.5.1 Hero MotoCorp

9.5.2 Honda Motorcycle & Scooter India

9.5.3 TVS Motor Company

9.5.4 Bajaj Auto

9.5.5 Royal Enfield (Eicher Motors)

9.5.6 Suzuki Motorcycle India

9.5.7 Yamaha Motor India

9.5.8 Piaggio Vehicles

9.5.9 Ather Energy

9.5.10 Ola Electric Mobility

10. India Two-Wheeler Market End-User Analysis

10.1 Procurement Behavior of Key Ministries

10.1.1 Government Fleet Purchases

10.1.2 Tendering Processes

10.1.3 Budget Allocations

10.2 Corporate Spend on Infrastructure & Energy

10.2.1 Investment in Electric Two-Wheelers

10.2.2 Partnerships with Delivery Services

10.3 Pain Point Analysis by End-User Category

10.3.1 Maintenance Costs

10.3.2 Fuel Efficiency Concerns

10.3.3 Safety Features

10.4 User Readiness for Adoption

10.4.1 Awareness of Electric Options

10.4.2 Financial Incentives

10.5 Post-Deployment ROI and Use Case Expansion

10.5.1 Performance Metrics

10.5.2 User Feedback Mechanisms

11. India Two-Wheeler Market Future Size, 2025-2030

11.1 By Value

11.2 By Volume

11.3 By Average Selling Price

Go-To-Market Strategy Phase

1. Whitespace Analysis + Business Model Canvas

1.1 Market Gaps Identification

1.2 Value Proposition Development

1.3 Revenue Streams

1.4 Cost Structure Analysis

1.5 Key Partnerships

1.6 Customer Segments

1.7 Channels

2. Marketing and Positioning Recommendations

2.1 Branding Strategies

2.2 Product USPs

2.3 Target Audience Identification

2.4 Communication Strategy

3. Distribution Plan

3.1 Urban Retail Strategies

3.2 Rural NGO Tie-ups

3.3 Online Distribution Channels

4. Channel & Pricing Gaps

4.1 Underserved Routes

4.2 Pricing Bands Analysis

4.3 Competitor Pricing Comparison

5. Unmet Demand & Latent Needs

5.1 Category Gaps

5.2 Consumer Segments Analysis

5.3 Emerging Trends

6. Customer Relationship

6.1 Loyalty Programs

6.2 After-sales Service

6.3 Customer Feedback Mechanisms

7. Value Proposition

7.1 Sustainability Initiatives

7.2 Integrated Supply Chains

7.3 Customer-Centric Innovations

8. Key Activities

8.1 Regulatory Compliance

8.2 Branding Initiatives

8.3 Distribution Setup

9. Entry Strategy Evaluation

9.1 Domestic Market Entry Strategy

9.1.1 Product Mix

9.1.2 Pricing Band

9.1.3 Packaging

9.2 Export Entry Strategy

9.2.1 Target Countries

9.2.2 Compliance Roadmap

10. Entry Mode Assessment

10.1 Joint Ventures

10.2 Greenfield Investments

10.3 Mergers & Acquisitions

10.4 Distributor Model

11. Capital and Timeline Estimation

11.1 Capital Requirements

11.2 Timelines

12. Control vs Risk Trade-Off

12.1 Ownership vs Partnerships

13. Profitability Outlook

13.1 Breakeven Analysis

13.2 Long-term Sustainability

14. Potential Partner List

14.1 Distributors

14.2 Joint Ventures

14.3 Acquisition Targets

15. Execution Roadmap

15.1 Phased Plan for Market Entry

15.1.1 Market Setup

15.1.2 Market Entry

15.1.3 Growth Acceleration

15.1.4 Scale & Stabilize

15.2 Key Activities and Milestones

15.2.1 Milestone Planning

15.2.2 Activity Tracking

Disclaimer Contact UsResearch Methodology

Phase 1: Approach

Desk Research

- Analysis of industry reports from the Society of Indian Automobile Manufacturers (SIAM)

- Review of government publications and policy documents related to two-wheeler manufacturing and sales

- Examination of market trends and consumer behavior studies published by automotive research firms

Primary Research

- Interviews with key stakeholders in the two-wheeler industry, including manufacturers and dealers

- Surveys conducted with end-users to understand preferences and purchasing behavior

- Focus group discussions with target demographics to gather qualitative insights on brand perception

Validation & Triangulation

- Cross-validation of findings through comparison with historical sales data and market forecasts

- Triangulation of insights from primary interviews with secondary data sources

- Sanity checks through expert reviews from industry veterans and market analysts

Phase 2: Market Size Estimation

Top-down Assessment

- Estimation of total market size based on national vehicle registration statistics and growth rates

- Segmentation of the market by vehicle type, including scooters, motorcycles, and electric two-wheelers

- Incorporation of macroeconomic indicators such as GDP growth and urbanization rates

Bottom-up Modeling

- Collection of sales data from leading two-wheeler manufacturers to establish baseline figures

- Analysis of dealership performance metrics to gauge regional market dynamics

- Estimation of market penetration rates for electric two-wheelers based on current adoption trends

Forecasting & Scenario Analysis

- Development of predictive models using historical sales data and economic indicators

- Scenario analysis based on potential regulatory changes and shifts in consumer preferences

- Creation of multiple forecasts (baseline, optimistic, and pessimistic) through 2030

Phase 3: CATI Sample Composition

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Two-Wheelers | 120 | Urban Commuters, First-time Buyers |

| Dealer Insights on Sales Trends | 60 | Dealership Owners, Sales Managers |

| Electric Two-Wheeler Adoption | 50 | Current Electric Vehicle Owners, Eco-conscious Consumers |

| Market Sentiment Analysis | 90 | General Public, Two-Wheeler Enthusiasts |

| Impact of Government Policies | 40 | Policy Makers, Industry Analysts |

Frequently Asked Questions

What is the current value of the India Two Wheeler Market?

The India Two Wheeler Market is valued at approximately USD 335 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a shift towards electric two-wheelers as a sustainable transportation option.

What factors are driving the growth of the India Two Wheeler Market?

Key growth drivers include increasing urbanization, rising disposable incomes, and a growing demand for fuel-efficient vehicles. These factors contribute to the rising preference for two-wheelers as a cost-effective mode of transportation in congested urban areas.

Which cities dominate the India Two Wheeler Market?

Major cities such as Delhi, Mumbai, and Bangalore dominate the India Two Wheeler Market due to their high population density, extensive road networks, and a burgeoning middle class, making two-wheelers an attractive commuting option.

What is the significance of electric two-wheelers in the Indian market?

Electric two-wheelers are rapidly gaining traction in India, driven by government incentives and increasing environmental awareness. This segment is expected to grow significantly, reflecting a shift towards sustainable mobility solutions in the two-wheeler market.

How does the Indian government support electric two-wheeler adoption?

The Indian government promotes electric two-wheelers through initiatives like the FAME II scheme, which offers subsidies and incentives. This support aims to reduce pollution and dependence on fossil fuels while encouraging manufacturers and consumers to adopt electric mobility solutions.

What are the main segments of the India Two Wheeler Market?

The India Two Wheeler Market is segmented by type into motorcycles, scooters, electric two-wheelers, mopeds, and performance bikes. Each segment caters to different consumer preferences and usage patterns, with scooters being particularly popular among urban commuters.

Who are the key players in the India Two Wheeler Market?

Key players in the India Two Wheeler Market include Hero MotoCorp, Honda Motorcycle & Scooter India, TVS Motor Company, Bajaj Auto, and Royal Enfield, among others. These companies contribute to innovation and competition within the market.

What challenges does the India Two Wheeler Market face?

The market faces challenges such as regulatory compliance issues, particularly with BS-VI emission norms, and intense competition among major players. These factors can impact production costs and profit margins, affecting overall market dynamics.

What opportunities exist in the India Two Wheeler Market?

Opportunities in the India Two Wheeler Market include the growth of e-commerce delivery services and the expansion of electric two-wheelers. As urban logistics demand increases, two-wheeler manufacturers can capitalize on this trend for last-mile delivery solutions.

How is urbanization affecting the demand for two-wheelers in India?

Urbanization is projected to increase significantly, with urban areas expected to house around 600 million people. This growth drives demand for two-wheelers, as they provide a convenient and cost-effective transportation solution in densely populated cities.

What is the expected future outlook for the India Two Wheeler Market?

The future outlook for the India Two Wheeler Market is promising, with anticipated growth in electric mobility and smart technologies. Government support and advancements in vehicle features are expected to enhance consumer appeal and foster market transformation.

What are the different end-user segments in the India Two Wheeler Market?

The end-user segments in the India Two Wheeler Market include individual consumers, commercial users, and government & institutional buyers. Individual consumers dominate the market, driven by the need for personal mobility solutions.

What role do fuel-efficient vehicles play in the India Two Wheeler Market?

Fuel-efficient vehicles are increasingly sought after in the India Two Wheeler Market due to rising fuel prices. Consumers are looking for economical commuting solutions, leading to a growing demand for two-wheelers that offer high fuel efficiency.

How does competition impact the pricing strategies in the India Two Wheeler Market?

Intense competition in the India Two Wheeler Market has led to price wars among major players, reducing profit margins. Companies must continuously innovate and enhance customer service to maintain market positions, impacting their pricing strategies.

What are the primary sales channels for two-wheelers in India?

Primary sales channels for two-wheelers in India include online sales, authorized dealerships, and direct company outlets. These channels facilitate consumer access to a wide range of products and enhance the purchasing experience.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.