Indonesia Car Rental and Leasing Market

Region:Asia

Author(s):Harsh Saxena

Product Code:KR1504

June 2025

90

About the Report

Indonesia Car Rental and Leasing Market Overview

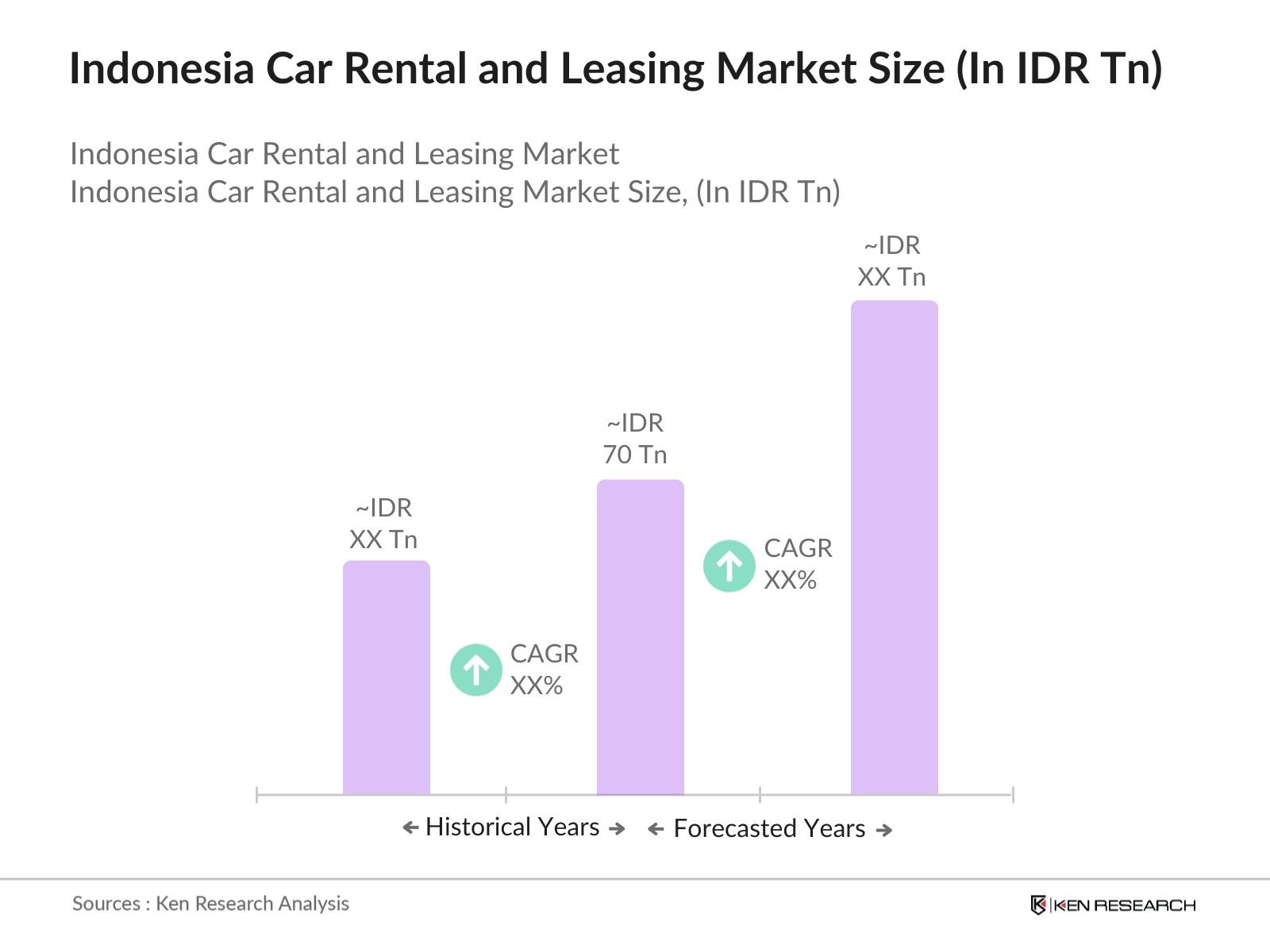

- The Indonesia Car Rental and Leasing Market is valued at IDR 70 TN, reflecting robust growth driven by rising demand for flexible mobility, rapid urbanization, and an expanding middle class seeking convenient transportation. Tourism, especially in Bali, and increased business travel further fuel market expansion. Consumers increasingly prefer renting vehicles for flexibility and cost-effectiveness over ownership, supported by digital booking platforms and improved infrastructure. The market is projected to grow, reshaping mobility options across Indonesia.

- Key cities like Jakarta, Bali, and Surabaya dominate Indonesia’s car rental market due to high population density, strong economic activity, and tourism. Jakarta, the capital and business hub, attracts many travelers and professionals. Bali, a top international tourist destination with over 6.3 million foreign visitors in 2024, drives significant rental demand. Surabaya, a major trade center, supports strong demand from local and visiting business communities, making this city central to the market.

- In recent years, the Indonesian government has required car rental companies to register with the Ministry of Transportation. These regulations aim to improve service standards, ensure safety compliance, and promote transparent pricing, boosting consumer trust and market growth. Regulations like the Ministry of Transportation Regulation No. 108/2017 also govern vehicle operations and cooperation with ride-hailing services, reflecting efforts to formalize and regulate the sector amid ongoing enforcement challenges.

Indonesia Car Rental and Leasing Market Segmentation

By Consumer Type: The market is segmented into B2B Consumers, B2C Industry clients, and B2C Personal Users. B2B Consumers, including corporate clients and logistics firms, account for a significant share due to long-term leasing and fleet management needs. B2C Industry clients, such as travel agencies and event organizers, drive demand for short-term rentals during peak seasons. Meanwhile, B2C Personal Users are increasingly adopting rental services for leisure, daily commuting, and special occasions, supported by rising disposable incomes and improved digital booking platforms.

By Time-Based Product Type: The market is segmented into monthly and yearly rental contracts for B2B consumers. Yearly rentals contribute the highest revenue share, driven by corporate clients seeking long-term fleet solutions for employee mobility and logistics. These contracts offer cost stability and operational continuity for businesses. Monthly rentals are gaining traction among SMEs and project-based industries due to their flexibility, allowing companies to scale fleets based on short-term operational needs without long-term commitments.

Indonesia Car Rental and Leasing Market Competitive Landscape

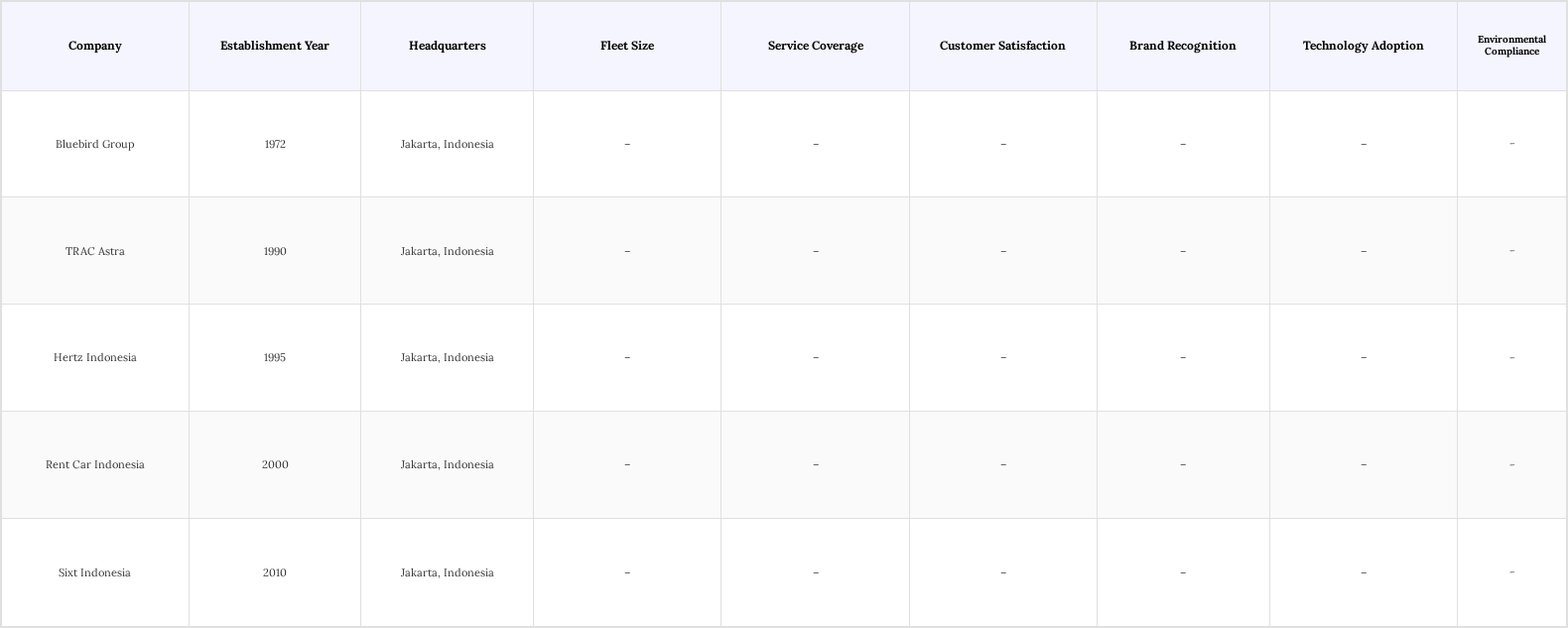

The Indonesia Car Rental and Leasing Market features a competitive landscape with prominent players such as Bluebird Group, TRAC Astra, and Hertz Indonesia. These companies are recognized for their extensive fleets, strong brand presence, and commitment to customer service. The market remains moderately concentrated, with both local and international firms competing on pricing and service innovation.

Indonesia Car Rental and Leasing Market Industry Analysis

Growth Drivers

- Pro-Tourism Initiatives and National Events Driving Rental Demand: Indonesia’s tourism recovery is accelerating, with over 0.7 trillion domestic trips recorded in 2023, supported by government campaigns such as “Wonderful Indonesia.” National events and festivals boost short-term vehicle rental demand in key regions like Bali, Jakarta, and Yogyakarta, causing booking spikes during peak travel periods and driving seasonal revenue for rental companies.

- Infrastructure Growth & Rising Disposable Incomes Fueling Mobility: Major infrastructure projects like the Trans-Java Toll Road and new airports are improving connectivity in Indonesia. In 2024, Indonesia’s GDP per capita reached approximately IDR 0.0786 trillion (78.6 million rupiah). The country’s total GDP at current prices was around IDR 22,139 trillion in 2024. This rising purchasing power, combined with better infrastructure, is driving increased demand for flexible mobility options such as car rentals, especially among the expanding middle class.

- Corporate Leasing & E-Commerce Logistics Accelerating Market Growth: The rise in corporate fleet leasing is being driven by businesses optimizing travel costs and operational efficiency. Simultaneously, the booming e-commerce sector, with players like Tokopedia and Shopee, is driving last-mile delivery needs. This dual demand is encouraging rental providers to expand B2B offerings, diversify vehicle types, and invest in fleet scalability to serve both enterprise clients and logistics operators.

Market Challenges

- Rising Operational Costs & Elevated Vehicle Logistics: Rental companies are facing increasing operational expenses driven by higher fuel prices, maintenance costs, and elevated vehicle shipping charges, especially for fleet distribution across islands, impacting overall profitability and service scalability.

- Market Disruptions from Unorganized Players & Resale Value Decline: Intense price competition from unorganized local operators is eroding margins for established firms, while shifting consumer demand and EV adoption trends are reducing the resale value of conventional vehicles, posing financial challenges for fleet renewal strategies.

Indonesia Car Rental and Leasing Market Future Outlook

The future of the Indonesia car rental and leasing market appears promising, driven by evolving mobility preferences and innovative ownership models. As MPVs gain traction for family and group travel, and more users turn to digital platforms for bookings, tech-enabled services will define competitive advantage. Additionally, the introduction of co-ownership models and a growing focus on sustainability are prompting rental companies to diversify fleets and adopt greener alternatives. Overall, the market is set for robust growth, with flexibility, convenience, and eco-consciousness shaping the next wave of service innovation.

Market Opportunities

- Introduction of Co-Ownership Models & Growing Focus on Sustainability: With rising vehicle costs and environmental concerns, car rental firms in Indonesia are exploring co-ownership and car-sharing models to reduce capital burden and increase fleet utilization. Simultaneously, the government’s push for low-emission mobility, including incentives for electric vehicles, is encouraging companies to adopt greener fleets, aligning business models with sustainability goals, and shifting consumer expectations.

- MPVs Gaining Traction & Growing Popularity of Digital Platforms: Multi-purpose vehicles (MPVs) are witnessing increased demand in Indonesia due to their versatility and suitability for family and group travel, especially across tourism hubs. Simultaneously, with over 212 million internet users and growing smartphone adoption, car rental firms are leveraging digital platforms to enhance booking efficiency and customer engagement, aligning with the shift toward online mobility solutions.

Scope of the Report

| By Consumer Type |

B2B Consumer B2C Industry B2C Personal |

| By Time-based Product Type |

Monthly Yearly |

| By Time-Based Driver Model |

With Driver Self-Drive |

| By On-Demand Service Type |

Conventional Ride-Hailing |

| By Distance-Based Product Type |

In-Town Out-Town |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Transportation, Ministry of Tourism)

Automobile Manufacturers

Fleet Management Companies

Insurance Providers

Tourism and Travel Agencies

Logistics and Supply Chain Companies

Local and Regional Government Authorities

Companies

Players Mentioned in the Report:

Bluebird Group

TRAC Astra

Hertz Indonesia

Rent Car Indonesia

Sixt Indonesia

IndoDrive Rentals

Nusantara Car Lease

Bali Auto Rentals

Jakarta Wheels

Archipelago Car Hire

Table of Contents

1. Executive

1.1. Summary

1.2. Executive Summary: Indonesia Car Rental & Leasing Market

2. Market Attractiveness of Indonesia Car Rental and Leasing Market

2.1. Ecosystem: Indonesia Car Rental and Leasing

2.2. Rental and Leasing Fleet Including On-Demand Services Market Fleet Handled and Revenue Generated 2019-2024-2029F

2.3. Rental and Leasing Market Excluding On-Demand Services Fleet Handled and Revenue Generated 2019-2024-2029F

2.4. On-Demand Fleets and Revenue Generated 2019-2024-2029F

3. Indonesia Car Rental and Leasing

3.1. Market Segmentation Including On-Demand Services Market

3.2. Indonesia Car Rental and Leasing Market Including On Demand Services, By Consumer Type, 2019-2024-2029F

3.3. Indonesia Car Rental and Leasing Market Including On Demand Services, By Time-based Product Type for B2B Consumer, 2019- 2024- 2029F

3.4. Indonesia Car Rental and Leasing Market Including On-Demand Services, By Time-Based Driver Model for B2B Consumer, 2019- 2024- 2029F

3.5. Indonesia Car Rental and Leasing Market Including On Demand Services, By Charging Based Model for B2C Industry Consumer, 2019-2024-2029F

3.6. Indonesia Car Rental and Leasing Market Including On-Demand Services, By Time-Based Product Type for B2C Industry, 2019- 2024- 2029F

3.7. Indonesia Car Rental and Leasing Market Including On-Demand Services, By Time-Based Driver Model for B2C Industry, 2019- 2024- 2029F

3.8. Indonesia Car Rental and Leasing Market Including On-Demand Services, By Distance-Based Product Type for B2C Industry, 2019- 2024- 2029F

3.9. Indonesia Car Rental and Leasing Market Including On-Demand Services, By On-Demand Service Type for B2C Industry, 2019- 2024- 2029F

3.10. Indonesia Car Rental and Leasing Market Including On Demand Services, By Charging Based Model for B2C Personal Consumer, 2019-2024-2029F

3.11. Indonesia Car Rental and Leasing Market Including On Demand Services, By Time-based Product Type for B2C Personal, 2019-2024-2029F

3.12. Indonesia Car Rental and Leasing Market Including On-Demand Services, By Time-Based Driver Model for B2C Personal Consumer, 2019- 2024- 2029F

3.13. Indonesia Car Rental and Leasing Market Including On-Demand Services, By Distance-Based Product Type for B2C Personal Consumer, 2019- 2024- 2029F

3.14. Indonesia Car Rental and Leasing Market Including On-Demand Services, By On-Demand Service Type for B2C Personal Consumer, 2019- 2024- 2029F

4. Indonesia Car Rental and Leasing

4.1. Market Segmentation Excluding On-Demand Services

4.2. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By Consumer Type, 2019- 2024- 2029F

4.3. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By Channel Type, 2019- 2024- 2029F

4.4. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Industry Offline Channel Type, 2019- 2024- 2029F

4.5. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Industry Online Channel Type, 2019- 2024- 2029F

4.6. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By Channel Type, 2019- 2024- 2029F

4.7. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Personal Offline Channel Type, 2019- 2024- 2029F

4.8. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Personal Online Channel Type, 2019- 2024- 2029F

4.9. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2B Consumer Vehicle Type, 2019- 2024- 2029F

4.10. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Industry Vehicle Type, 2019- 2024- 2029F

4.11. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Personal Vehicle Type, 2019- 2024- 2029F

4.12. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2B Consumer Region, 2019- 2024- 2029F

4.13. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Industry Region, 2019- 2024- 2029F

4.14. Indonesia Car Rental and Leasing Market Excluding On-Demand Services, By B2C Personal Region, 2019- 2024- 2029F

5. Indonesia Rental & Leasing Market Electric Vehicle Fleet Analysis

5.1. EV Fleet Analysis

5.2. EV Depreciation Trends & Resale Value Analysis

6. Industry Analysis of the Indonesia Car Rental and Leasing Market

6.1. Key Market Growth Drivers

6.2. Major Challenges in the Market

6.3. Key Market Trends and Developments

7. Rental and Leasing Vehicle Analysis of Indonesia

7.1. Major Vehicle Brand and Pricing for Short-Term Rental

8. Customer Reservation Channel Analysis for Car Rental and Leasing

8.1. Profiling of Key Aggregate Players and Platforms

8.2. Partnership model with Hotel Chains, Airport, and others in the Market

9. Competitive Landscape for Car Rental and Leasing Players

9.1. Market Share of Major Players in the Market, 2024

9.2. Business Strategies of Major Players in the Market

9.3. New Entrants and Emerging Players in the Market

9.4. Pricing Strategy for Major Rental and Leasing Players In The Market

10. Customer Insights & Behavior Analysis of Retail Consumers

10.1. Vehicle Preference for B2C Industry and B2C Personal Consumers

10.2. Preferred Booking Mode for B2C Industry and B2C Personal Consumers

10.3. Retail Consumer Preference for Self-Driven and Chauffeur Hire

10.4. Service Preference for B2C Personal & B2C Industry Consumers

10.5. Booking Pattern and Peak Season for Retail Consumer Demand

10.6. International Tourist Demand and Local Demand Analysis

11. Technological Disruptions & Innovation

11.1. Technological Disruptions and Innovation in the Car Rental and ? Leasing Market of Indonesia

12. Regulatory Environment in the Car Rental & Leasing Market

12.1. Government Regulations- Licensing and Compliance

12.2. Fare Regulations

13. Analyst Recommendations

13.1. Global Success Case Study with Key Differentiators and Impact

13.2. Marketing Initiative Strategy for Indonesia Car Rental and Leasing Companies

13.3. White Space Opportunity Analysis for the Indonesia Car Rental and Leasing Market

13.4. Promising Region Identification for Car Rental Operations based on Population Density, Tourism Traffic

13.5. Promising Region Identification for Car Leasing operations based on Corporate Presence

14. Research Methodology

14.1. Market Definitions

14.2. Abbreviations

14.3. Market Sizing Approach

14.4. Consolidated Research Approach

14.5. Sample Size Inclusion

14.6. Limitations and Future Conclusions

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders in the Indonesia Car Rental and Leasing Market. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry information. The primary goal is to pinpoint and define the essential variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will gather and analyze historical data related to the Indonesia Car Rental and Leasing Market. This includes evaluating market penetration rates, the ratio of rental services to demand, and revenue generation patterns. Additionally, we will assess service quality metrics to ensure the reliability of our revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors. These consultations will provide critical operational and financial insights, helping to refine and substantiate the market data collected. This step is crucial for ensuring the accuracy of our findings.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple stakeholders to gather in-depth insights into product segments, sales performance, and consumer preferences. This direct interaction will help verify and enhance the data obtained through previous research methods, ensuring a thorough and validated analysis of the Indonesia Car Rental and Leasing Market.

Frequently Asked Questions

01. How big is the Indonesia Car Rental and Leasing Market?

The Indonesia Car Rental and Leasing Market is valued at IDR 70 Trillion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Indonesia Car Rental and Leasing Market?

Key challenges in the Indonesia Car Rental and Leasing Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Indonesia Car Rental and Leasing Market?

Major players in the Indonesia Car Rental and Leasing Market include Bluebird Group, TRAC Astra, Hertz Indonesia, Rent Car Indonesia, Sixt Indonesia, among others.

04. What are the growth drivers for the Indonesia Car Rental and Leasing Market?

The primary growth drivers for the Indonesia Car Rental and Leasing Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.