Indonesia Clinical Research Organization Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD6093

December 2024

81

About the Report

Indonesia Clinical Research Organization Market Overview

- The Indonesia Clinical Research Organization (CRO) market is valued at USD 1.2 billion, driven by increased investments in pharmaceutical and biotechnology research and development. The expansion of the healthcare infrastructure, coupled with the increasing number of clinical trials, has propelled this market. The growing prevalence of diseases like cancer and cardiovascular conditions has necessitated more clinical research, further fueling market growth. Additionally, Indonesias strategic location as a clinical trial hub in Southeast Asia is bolstering the CRO market.

- Indonesias dominant cities in the CRO market include Jakarta, Surabaya, and Bandung. Jakarta leads due to its advanced healthcare infrastructure and concentration of pharmaceutical companies, while Surabaya and Bandung contribute through their growing medical institutions and research capabilities. These cities have strong regulatory support and established clinical trial centers, which make them favorable for conducting clinical trials. Their dominance also comes from the availability of a large patient pool, which is critical for clinical research.

- The Indonesian government has streamlined the approval process for international clinical research organizations (CROs) to attract foreign investment. In 2023, the approval time for international CROs was reduced to six months, down from an average of 12 months in 2021. This improvement is part of the governments broader strategy to make Indonesia a regional hub for clinical trials. With clear regulatory pathways and simplified procedures, international CROs are increasingly choosing Indonesia as a destination for conducting clinical trials.

Indonesia Clinical Research Organization Market Segmentation

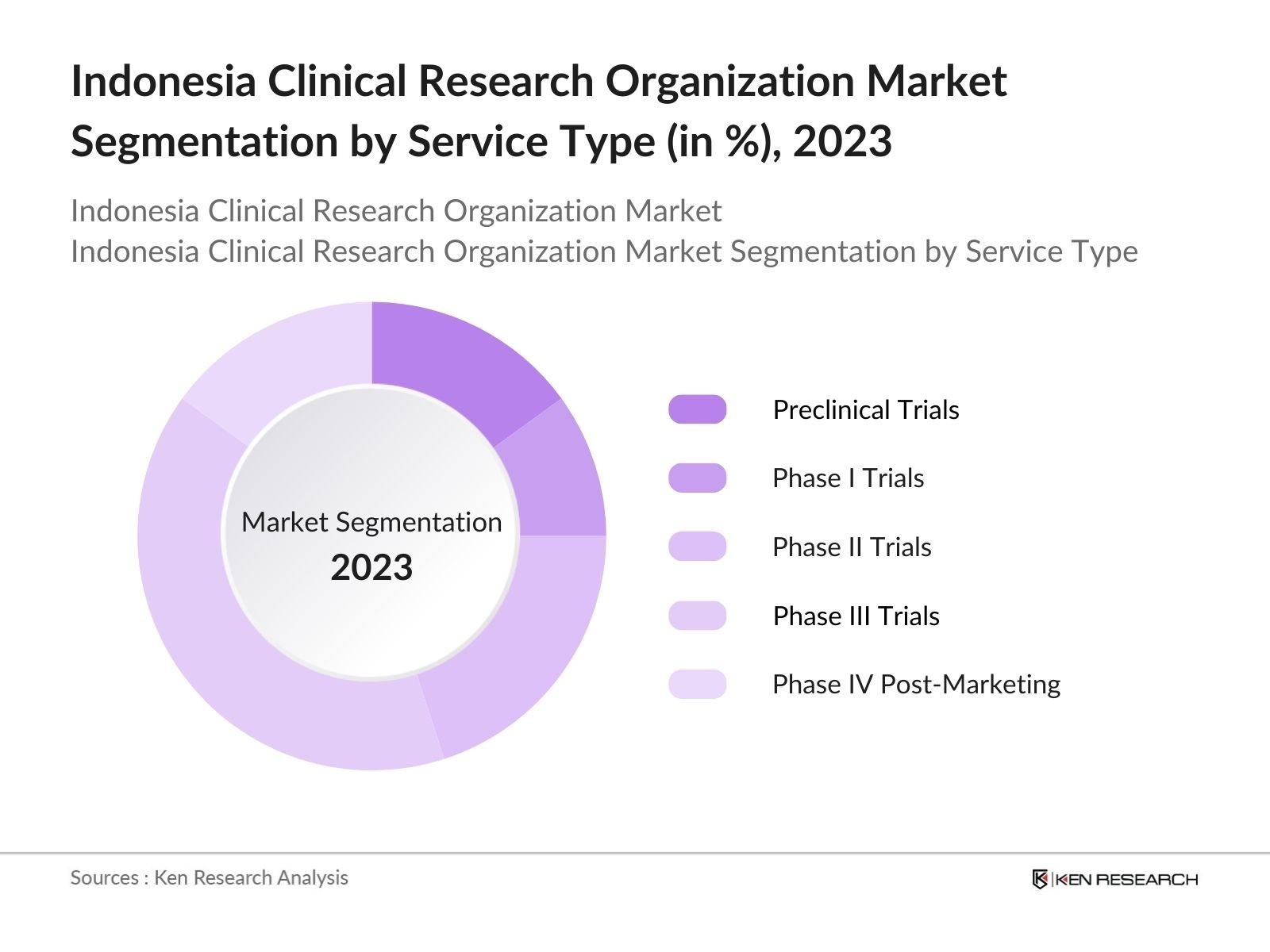

By Service Type: The market is segmented by service type into Preclinical Trials, Phase I Trials, Phase II Trials, Phase III Trials, and Phase IV Post-Marketing Trials. Among these, Phase III Trials hold the largest market share. This segment is dominant because Phase III trials involve a larger patient population and longer study durations, which require more resources and expertise, making it a crucial phase in drug approval. The high cost associated with these trials also increases revenue for CROs in this category, driving its dominance.

By Therapeutic Area: The market in Indonesia is further segmented by therapeutic area into Oncology, Cardiovascular Diseases, Infectious Diseases, Neurology, and Immunology. Oncology dominates this segment due to the high incidence of cancer in Indonesia, which increases the demand for cancer-related clinical trials. Oncology trials are complex, long, and involve a large number of patients, making them highly profitable for CROs. Additionally, the global interest in cancer drug development has made oncology one of the most active therapeutic areas for clinical research.

Indonesia Clinical Research Organization Market Competitive Landscape

The Indonesia Clinical Research Organization market is dominated by several key players, including local and global CROs. These companies have a presence due to their long-standing relationships with pharmaceutical companies, operational excellence, and deep regulatory knowledge. The Indonesia CRO market is primarily dominated by global players such as ICON Plc, IQVIA, and Parexel International, alongside prominent local players like Prodia Clinical Laboratory. These companies lead the market through their vast clinical trial networks, comprehensive service offerings, and high expertise in navigating Indonesias regulatory framework.

|

Company Name |

Establishment Year |

Headquarters |

Global Reach |

Therapeutic Specialties |

Number of Trials Conducted |

Local Partnerships |

Regulatory Expertise |

Technology Integration |

Revenue |

|

ICON Plc |

1990 |

Ireland |

|||||||

|

IQVIA |

1982 |

USA |

|||||||

|

Parexel International |

1982 |

USA |

|||||||

|

Prodia Clinical Laboratory |

1973 |

Indonesia |

|||||||

|

Medpace Holdings Inc. |

1992 |

USA |

Indonesia Clinical Research Organization Industry Analysis

Growth Drivers

- Expansion of Healthcare Infrastructure: Indonesia has made strides in improving its healthcare infrastructure, key to fostering clinical trials. The country had 2,877 hospitals by 2023, a marked increase from previous years, reflecting the government's commitment to expanding healthcare access. As part of the 2022 state budget, the government earmarked an additional IDR 40 trillion to accelerate healthcare infrastructure growth, focusing on building hospitals and research centers in underserved regions. This expansion offers better facilities for clinical research and provides a robust foundation for further trials across the country.

- Growing Pharmaceutical R&D Investment: Investment in pharmaceutical research and development (R&D) has surged in Indonesia, driven by increasing demand for innovative treatments. In 2023, pharmaceutical R&D expenditure reached IDR 5 trillion, boosted by both public and private sectors. Indonesian pharmaceutical firms have increasingly collaborated with international players to conduct clinical trials for vaccines and innovative therapies. This investment growth aligns with government initiatives, such as the 2022 national R&D strategy, which aimed to attract more foreign companies by simplifying regulatory processes. This ensures Indonesia remains competitive in the global clinical research market.

- Availability of Skilled Workforce: Indonesia boasts a growing pool of skilled professionals in clinical research, supported by government initiatives to enhance education and training in medical and pharmaceutical fields. By 2023, Indonesia had 12,000 clinical researchers, a increase from previous years. The governments focus on healthcare education has led to an influx of new graduates in medicine and biopharmaceuticals, further bolstered by initiatives like the 2022 Healthcare Workforce Development Program. This skilled workforce allows for efficient trial management and quality data, which are critical to clinical research success.

Market Challenges

- Stringent Regulatory Framework: Indonesias regulatory environment for clinical trials is complex, with lengthy approval times that slow research processes. In 2022, clinical trial approval times averaged 9 to 12 months, creating delaysfor pharmaceutical companies and CROs. Licensing delays, coupled with regulatory bottlenecks, further compound these challenges. Despite ongoing efforts to streamline these processes, the regulatory framework remains one of the largest hurdles for foreign and domestic clinical research organizations, making it difficult to execute trials efficiently.

- Limited Patient Recruitment Pools: Indonesias vast geographical expanse and varied population distribution pose challenges to patient recruitment for clinical trials. By 2023, patient recruitment rates in rural areas were estimated to be 30% lower than in urban centers. This gap is attributed to the limited availability of healthcare facilities and awareness about clinical trials in remote regions. While initiatives are underway to improve healthcare access, the disparity in recruitment pools continues to be a major challenge for CROs operating in the country.

Indonesia Clinical Research Organization Market Future Outlook

Over the next five years, the Indonesia Clinical Research Organization market is expected to see substantial growth driven by increasing investments in drug discovery, continuous expansion of healthcare infrastructure, and the availability of a large patient pool for clinical trials. The rise of precision medicine and the integration of advanced clinical trial technologies, such as AI and machine learning, will further enhance the market's capabilities. The governments efforts to streamline regulatory processes and encourage foreign investment in the healthcare sector will attract global pharmaceutical and biotechnology companies to Indonesia.

Future Market Opportunities

- Increased Demand for Decentralized Trials: The global trend towards decentralized clinical trials presents an opportunity for CROs in Indonesia to adopt more flexible trial methodologies. In 2023, decentralized trials accounted for 15% of all clinical trials conducted in Indonesia, a growing trend driven by improved digital health infrastructure and increasing internet penetration. The country's rising mobile internet user base, which reached 180 million in 2022, facilitates easier remote patient monitoring, making decentralized trials an attractive model for future research.

- Investment in Clinical Trial Technology Solutions: Investment in clinical trial technology is increasing in Indonesia, with a focus on streamlining trial processes. By 2023, investment in clinical trial technologies, including eClinical solutions and electronic data capture (EDC) systems, reached IDR 1 trillion. This investment is key to reducing trial timelines and improving data accuracy, making Indonesia a more attractive destination for clinical research. With the support of government-backed initiatives, such as the 2022 Digital Health Transformation Roadmap, Indonesia is positioned to become a leader in clinical trial technology adoption in Southeast Asia.

Scope of the Report

|

Service Type |

Preclinical Trials Phase I Phase II Phase III Phase IV |

|

Therapeutic Area |

Oncology Cardiovascular Infectious Diseases Neurology Immunology |

|

End User |

Pharma & Biotech Medical Devices Academic Institutions Government Organizations |

|

Clinical Trial Type |

Observational Studies Interventional Studies Expanded Access Trials |

|

Region |

Java Bali Sumatra Sulawesi Kalimantan |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Indonesia FDA)

Pharmaceutical and Biotechnology Companies

Medical Device Manufacturers

Clinical Trial Service Providers

Hospital and Healthcare Providers

CRO Executives and Operations Managers

Bioethics and Institutional Review Boards

Banks and Financial Institutions

Companies

Major Players

Prodia Clinical Laboratory

ICON Plc

PPD (Thermo Fisher Scientific)

Medpace Holdings Inc.

IQVIA

Labcorp Drug Development

PRA Health Sciences

Syneos Health

KCR CRO

Pharm-Olam

Novotech

Parexel International

Covance Inc.

Charles River Laboratories

Worldwide Clinical Trials

Table of Contents

1. Indonesia Clinical Research Organization Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Clinical Research Organization Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Clinical Research Organization Market Analysis

3.1. Growth Drivers

3.1.1. Rising Government Support for Clinical Trials

3.1.2. Expansion of Healthcare Infrastructure

3.1.3. Growing Pharmaceutical R&D Investment

3.1.4. Availability of Skilled Workforce

3.2. Market Challenges

3.2.1. Stringent Regulatory Framework (Regulatory Bottlenecks, Licensing Delays)

3.2.2. Competition with Regional CROs

3.2.3. Limited Patient Recruitment Pools

3.3. Opportunities

3.3.1. Collaboration with Global Pharmaceutical Firms

3.3.2. Increased Demand for Decentralized Trials

3.3.3. Investment in Clinical Trial Technology Solutions

3.4. Trends

3.4.1. Integration of AI in Clinical Trial Processes

3.4.2. Use of Electronic Data Capture (EDC) Systems

3.4.3. Increasing Prevalence of Adaptive Trials

3.5. Government Regulations

3.5.1. Ministry of Health Clinical Trial Guidelines

3.5.2. Bioethics and Data Protection Policies

3.5.3. Approval Process for International CROs

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stakeholder Ecosystem (CROs, Pharma Companies, Regulatory Agencies, Hospitals)

3.8. Porters Five Forces (Threat of New Entrants, Buyer Power, Supplier Power, etc.)

3.9. Competition Ecosystem

4. Indonesia Clinical Research Organization Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Preclinical Trials

4.1.2. Phase I Trials

4.1.3. Phase II Trials

4.1.4. Phase III Trials

4.1.5. Phase IV Post-Marketing Trials

4.2. By Therapeutic Area (In Value %)

4.2.1. Oncology

4.2.2. Cardiovascular Diseases

4.2.3. Infectious Diseases

4.2.4. Neurology

4.2.5. Immunology

4.3. By End User (In Value %)

4.3.1. Pharmaceutical & Biotechnology Companies

4.3.2. Medical Device Companies

4.3.3. Academic & Research Institutions

4.3.4. Government Organizations

4.4. By Clinical Trial Type (In Value %)

4.4.1. Observational Studies

4.4.2. Interventional Studies

4.4.3. Expanded Access Trials

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Bali

4.5.3. Sumatra

4.5.4. Sulawesi

4.5.5. Kalimantan

5. Indonesia Clinical Research Organization Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Prodia Clinical Laboratory

5.1.2. PPD (Thermo Fisher Scientific)

5.1.3. ICON Plc

5.1.4. Medpace Holdings Inc.

5.1.5. IQVIA

5.1.6. Labcorp Drug Development

5.1.7. PRA Health Sciences

5.1.8. Syneos Health

5.1.9. KCR CRO

5.1.10. Pharm-Olam

5.1.11. Novotech

5.1.12. Parexel International

5.1.13. Covance Inc.

5.1.14. Charles River Laboratories

5.1.15. Worldwide Clinical Trials

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Global Reach, Revenue, Therapeutic Specialties, Clinical Trial Success Rate, Regulatory Expertise, Operational Efficiency)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Clinical Research Organization Market Regulatory Framework

6.1. Clinical Trial Standards and Guidelines (Ethical Standards, GCP, ICH Guidelines)

6.2. Compliance Requirements (Data Privacy, Patient Consent)

6.3. Certification Processes

7. Indonesia Clinical Research Organization Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Clinical Research Organization Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Therapeutic Area (In Value %)

8.3. By End User (In Value %)

8.4. By Clinical Trial Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia Clinical Research Organization Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we create an ecosystem map of the major stakeholders in the Indonesia CRO market. This is supported by desk research and proprietary databases that provide in-depth market insights. The goal is to identify the variables influencing the market, such as regulatory policies and clinical trial trends.

Step 2: Market Analysis and Construction

Historical market data is collected and analyzed, including CRO penetration rates, services offered, and revenue figures. This analysis helps construct a reliable foundation to estimate the market size and performance.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through interviews with industry experts and stakeholders, providing us with critical financial and operational insights. These consultations are instrumental in refining our data and analysis.

Step 4: Research Synthesis and Final Output

The final phase involves compiling insights from both the top-down and bottom-up approaches to deliver a comprehensive report on the Indonesia CRO market, ensuring accuracy and thoroughness in the data presented.

Frequently Asked Questions

01. How big is the Indonesia Clinical Research Organization Market?

The Indonesia CRO market is valued at USD 1.2 billion, driven by an expanding pharmaceutical sector and increasing clinical trial activities in the country.

02. What are the challenges in the Indonesia Clinical Research Organization Market?

Challenges in the Indonesia CRO market include navigating Indonesias complex regulatory landscape, limited patient recruitment pools, and competition from regional CROs.

03. Who are the major players in the Indonesia Clinical Research Organization Market?

Key players in the Indonesia CRO market include ICON Plc, IQVIA, Parexel International, Prodia Clinical Laboratory, and Medpace Holdings Inc.

04. What are the growth drivers of the Indonesia Clinical Research Organization Market?

The Indonesia CRO market is propelled by increasing R&D investments from pharmaceutical companies, government support for clinical trials, and the expansion of Indonesias healthcare infrastructure.

05. What role does technology play in the Indonesia Clinical Research Organization Market?

Technological advancements such as AI in clinical trial processes and electronic data capture (EDC) systems are driving efficiency and accuracy, making Indonesia a favorable market for clinical trials in the Indonesia CRO market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.