Indonesia Medical Device Contract Manufacturing Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD9016

December 2024

95

About the Report

Indonesia Medical Device Contract Manufacturing Market Overview

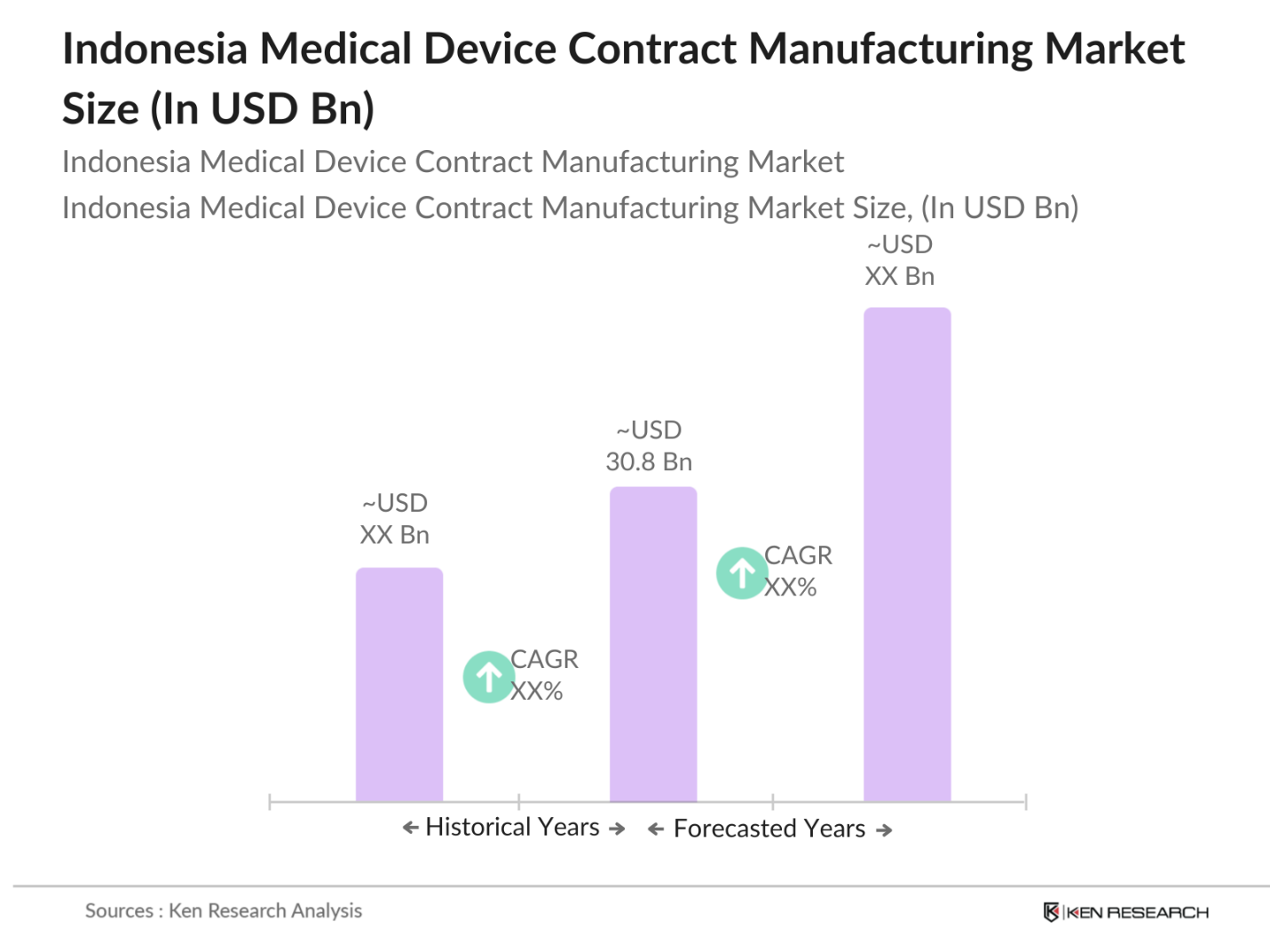

- The Indonesia Medical Device Contract Manufacturing Market is valued at USD 30.8 billion, based on a five-year historical analysis. The market is driven by cost-effective outsourcing solutions that help medical device OEMs (Original Equipment Manufacturers) reduce production costs and expedite time-to-market. The increasing healthcare demand in the country, combined with the growing emphasis on manufacturing quality and regulatory compliance, further bolsters the markets expansion, supported by investments in advanced manufacturing technologies.

- Jakarta and Surabaya dominate the Indonesia Medical Device Contract Manufacturing Market due to their developed infrastructure, skilled labor, and the presence of established manufacturing clusters. These cities are hubs for logistics and distribution, providing manufacturers with strategic access to key medical markets within Indonesia and nearby regions, making them ideal for companies looking to outsource production efficiently.

- The demand for minimally invasive devices has surged in Indonesia as healthcare providers increasingly prefer less invasive treatments. These devices have seen increased application in procedures such as endoscopy and laparoscopic surgeries. The Indonesian Health Ministry reports a notable rise in procedures involving minimally invasive technology, creating demand for devices manufactured locally, reducing the need for costly imports.

Indonesia Medical Device Contract Manufacturing Market Segmentation

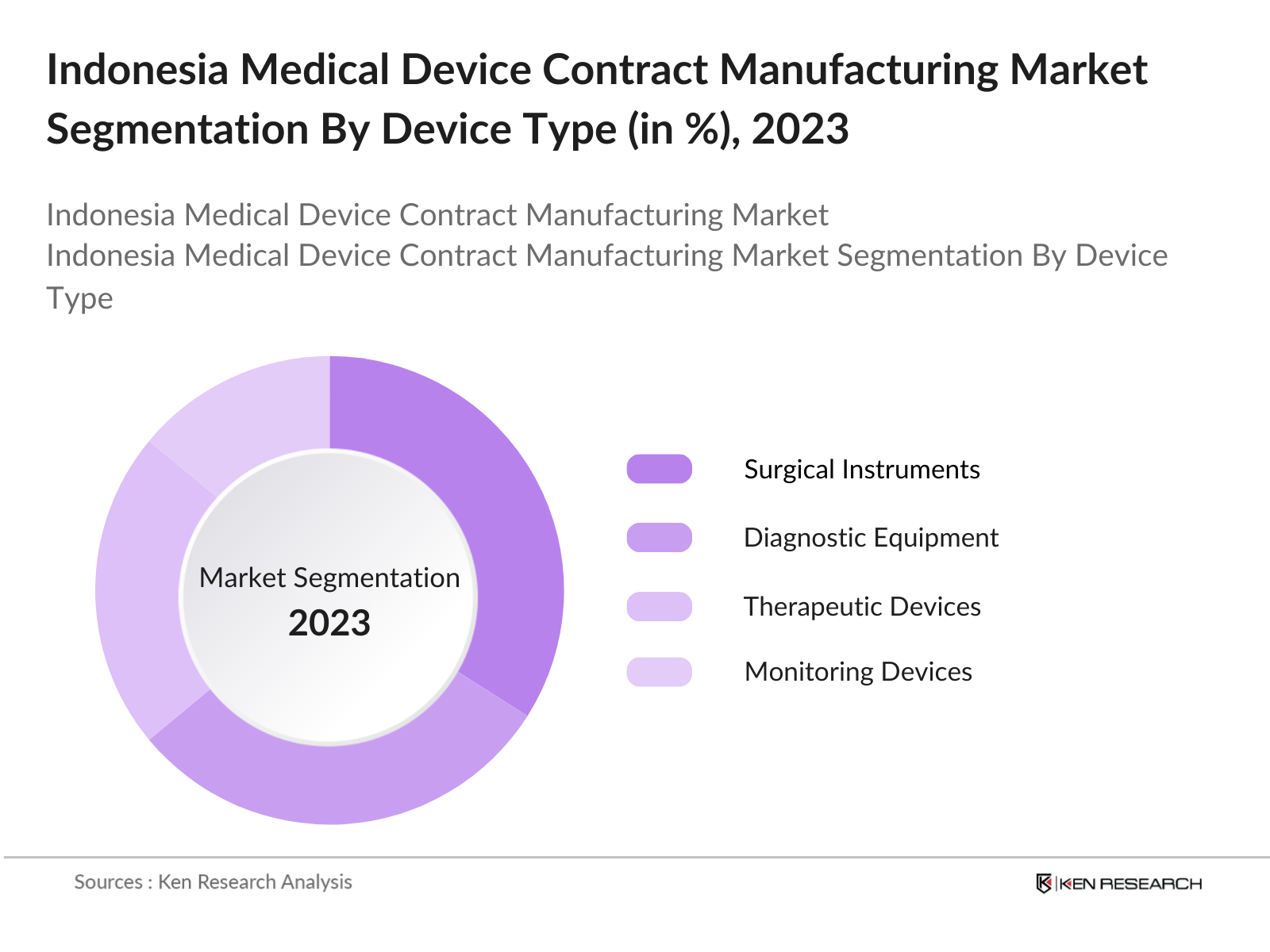

By Device Type: Indonesias medical device contract manufacturing market is segmented by device type into Surgical Instruments, Diagnostic Equipment, Therapeutic Devices, Monitoring Devices, and Others. Recently, Surgical Instruments have captured the dominant share within this segmentation, primarily due to the increasing demand for minimally invasive procedures. Additionally, surgical instruments benefit from high-quality manufacturing standards and steady demand across public and private healthcare providers, cementing their lead in the segment.

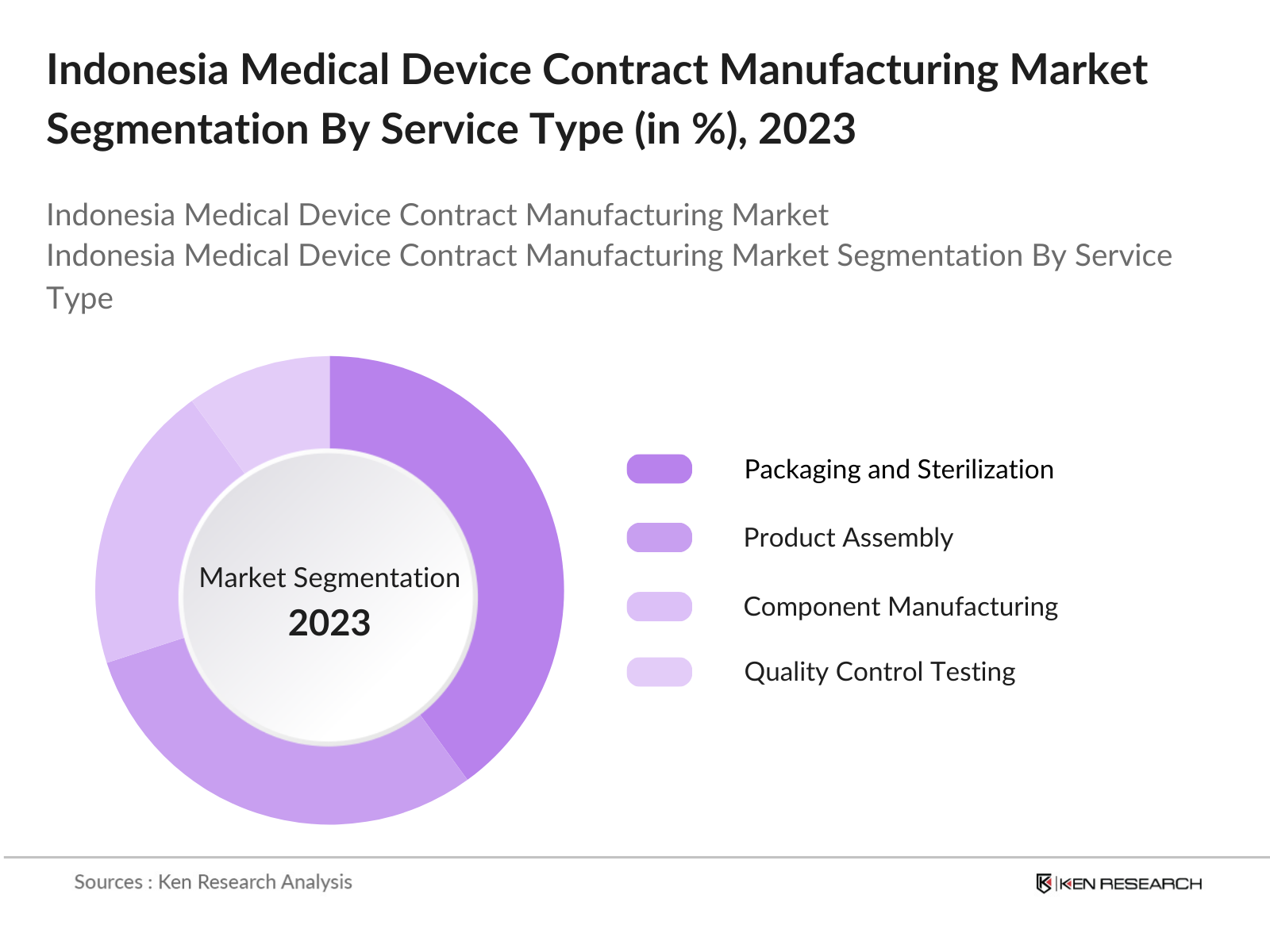

By Service Type: In terms of service type, the market is categorized into Product Assembly, Packaging and Sterilization, Component Manufacturing, Quality Control Testing, and Regulatory Consulting. The Packaging and Sterilization segment dominates due to stringent regulatory requirements ensuring safety and compliance. This segment is crucial, particularly for medical device exports, which require high levels of sterility and secure packaging for international distribution. Consequently, manufacturers invest heavily in packaging and sterilization processes.

Indonesia Medical Device Contract Manufacturing Market Competitive Landscape

The Indonesia Medical Device Contract Manufacturing Market is led by a mix of local and international companies, with significant contributions from both multinational giants and local SMEs. These players maintain competitive positions through strategic alliances, investments in R&D, and regulatory compliance.

Indonesia Medical Device Contract Manufacturing Industry Analysis

Growth Drivers

- Regulatory Support for Outsourcing: Indonesias government has taken steps to bolster medical device manufacturing through policies supporting outsourcing. The Ministry of Health has streamlined licensing and regulation requirements, providing faster approvals for contract manufacturers that meet compliance standards. This regulatory support aligns with Indonesias Health Industry Development agenda, which aims to reduce dependency on imports and promote local manufacturing. As a result, the number of licenses issued for medical device manufacturing has seen significant growth.

- Increasing Demand for Medical Devices: With a growing healthcare sector, Indonesia has witnessed an increased demand for medical devices driven by an expanding aging population. As of 2023, Indonesia had over 27 million individuals aged 60 and above, fueling demand for various healthcare services and medical equipment. Additionally, Indonesias national health insurance program, which covers over 200 million people, has further increased the requirement for domestically manufactured devices.

- Cost-Efficiency Benefits: Indonesias competitive labor market provides a cost advantage for manufacturers. Labor costs in Indonesia remain substantially lower than in other countries, making it a favorable location for medical device manufacturing. The cost savings from local manufacturing compared to importing from higher-cost regions provide substantial savings to healthcare providers and hospitals, enhancing the overall demand for contract manufacturing in Indonesia.

Market Challenges

- Quality Control Issues: Indonesias medical device manufacturers face challenges in adhering to stringent international quality control standards such as ISO 13485 for medical devices. According to the Ministry of Industry, only about 40% of local manufacturers currently meet these high standards, limiting their potential to compete internationally. Ensuring compliance with these standards requires ongoing investment in quality control mechanisms and training, which can be cost-prohibitive for many smaller manufacturers. source

- Limited Access to Skilled Workforce: While Indonesia has a large labor pool, there is a shortage of specialized professionals in medical device manufacturing. As of 2023, the Indonesian government has reported a shortage of trained biomedical engineers, critical for maintaining high standards in the manufacturing process. This skills gap restricts the capacity of local manufacturers to meet international standards, potentially limiting the industry's growth. source

Indonesia Medical Device Contract Manufacturing Market Future Outlook

The Indonesia Medical Device Contract Manufacturing Market is projected to witness sustained growth over the next five years, driven by increasing outsourcing requirements, regulatory alignment with global standards, and government support to develop domestic manufacturing capabilities. Indonesias strategic position in Southeast Asia further supports its attractiveness for contract manufacturing, with manufacturers focusing on cost reduction and operational efficiency in response to rising healthcare demands.

Opportunities

- Expansion into Emerging Medical Segments: medical device manufacturers are exploring new segments such as diagnostics and therapeutic equipment to meet the rising demand. With the diagnostics segment experiencing robust growth, particularly in imaging devices, there is significant potential for local manufacturers to capture a share in this market. According to government reports, diagnostic equipment imports have seen a double-digit increase, indicating a strong market for domestic production. source

- Development of Local Supply Chains: The Indonesian government has prioritized developing local supply chains to reduce dependency on imports. Through initiatives such as the National Industrial Development Plan, the government encourages local sourcing and partnerships, making domestic manufacturing more feasible. With recent investments in material production facilities, local manufacturers are beginning to establish a more sustainable supply chain, reducing costs and enhancing reliability.

Scope of the Report

|

Device Type |

Surgical Instruments Diagnostic Equipment Therapeutic Devices Monitoring Devices Others |

|

Service Type |

Product Assembly Packaging and Sterilization Component Manufacturing Quality Control Testing Regulatory Consulting |

|

Manufacturing Process |

Injection Molding Machining Laser Processing 3D Printing Others |

|

End-User |

OEMs Healthcare Providers CROs |

|

Region |

Java Sumatra Sulawesi Kalimantan Bali & Nusa Tenggara |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Medical Device Manufacturing Industries

Hospital Chains and Healthcare Provider Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health, Indonesian National Agency of Drug and Food Control)

Medical Device Importer and Distributor Companies

Contract Research Organizations (CROs)

Suppliers and Raw Material Manufacturing Companies

Companies

Players Mentioned in the Report

Benchmark Electronics

Jabil Inc.

Flex Ltd.

Kimball Electronics

Nipro Corporation

West Pharmaceutical Services, Inc.

Celestica Inc.

TE Connectivity Ltd.

Plexus Corp.

Elos Medtech AB

Table of Contents

1. Indonesia Medical Device Contract Manufacturing Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Developments

1.4 Industry Value Chain Analysis

2. Indonesia Medical Device Contract Manufacturing Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Developments and Milestones

3. Indonesia Medical Device Contract Manufacturing Market Dynamics

3.1 Growth Drivers

3.1.1 Regulatory Support for Outsourcing (Government Policy)

3.1.2 Increasing Demand for Medical Devices (Healthcare Expansion)

3.1.3 Cost-Efficiency Benefits (Cost Savings)

3.1.4 Technological Advancements (Automation in Manufacturing)

3.2 Market Challenges

3.2.1 Quality Control Issues (Compliance Standards)

3.2.2 Limited Access to Skilled Workforce (Labor Constraints)

3.2.3 High Dependency on Imports (Raw Material Access)

3.3 Opportunities

3.3.1 Expansion into Emerging Medical Segments (Diagnostics & Therapeutics)

3.3.2 Development of Local Supply Chains (Supply Chain Localization)

3.3.3 Investment in Advanced Manufacturing Techniques (3D Printing, Robotics)

3.4 Trends

3.4.1 Rise in Minimally Invasive Device Demand (Product Innovation)

3.4.2 Increase in Private Sector Investments (Investment Surge)

3.4.3 Collaborations with Healthcare Providers (Strategic Alliances)

3.5 Government Regulations

3.5.1 Standards for Medical Device Quality (ISO Compliance)

3.5.2 Manufacturing Certifications (GMP, FDA Certifications)

3.5.3 Import-Export Regulations (Trade Policies)

4. Indonesia Medical Device Contract Manufacturing Market Segmentation

4.1 By Device Type (In Value %)

4.1.1 Surgical Instruments

4.1.2 Diagnostic Equipment

4.1.3 Therapeutic Devices

4.1.4 Monitoring Devices

4.1.5 Others

4.2 By Service Type (In Value %)

4.2.1 Product Assembly

4.2.2 Packaging and Sterilization

4.2.3 Component Manufacturing

4.2.4 Quality Control Testing

4.2.5 Regulatory Consulting

4.3 By Manufacturing Process (In Value %)

4.3.1 Injection Molding

4.3.2 Machining

4.3.3 Laser Processing

4.3.4 3D Printing

4.3.5 Others

4.4 By End-User (In Value %)

4.4.1 OEMs (Original Equipment Manufacturers)

4.4.2 Healthcare Providers

4.4.3 Contract Research Organizations (CROs)

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Sulawesi

4.5.4 Kalimantan

4.5.5 Bali & Nusa Tenggara

5. Indonesia Medical Device Contract Manufacturing Market Competitive Analysis

5.1 Profiles of Major Companies (15 Competitors)

5.1.1 Benchmark Electronics

5.1.2 Jabil Inc.

5.1.3 Flex Ltd.

5.1.4 Sanmina Corporation

5.1.5 Integer Holdings Corporation

5.1.6 West Pharmaceutical Services, Inc.

5.1.7 Celestica Inc.

5.1.8 TE Connectivity Ltd.

5.1.9 Plexus Corp.

5.1.10 Nipro Corporation

5.1.11 Kimball Electronics

5.1.12 Elos Medtech AB

5.1.13 Creganna Medical

5.1.14 Phillips-Medisize Corporation

5.1.15 Providien LLC

5.2 Cross Comparison Parameters (Production Capacity, Market Share, Facility Locations, Core Specialization, Revenue Contribution from Medical Device Sector, Product Diversification, Regulatory Compliance, Certifications)

5.3 Market Share Analysis (Competitive Market Share Distribution)

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions (M&A Activity)

5.6 Investment Analysis

5.7 Joint Ventures & Partnerships

5.8 R&D Expenditure

5.9 Manufacturing Capacity Expansions

6. Indonesia Medical Device Contract Manufacturing Market Regulatory Framework

6.1 Quality Assurance Standards (ISO 13485)

6.2 Compliance with GMP (Good Manufacturing Practices)

6.3 Device Approval Process

6.4 Environmental Regulations

6.5 Export and Import Compliance

7. Indonesia Medical Device Contract Manufacturing Future Market Size (in USD Mn)

7.1 Projected Market Size and Forecasts

7.2 Key Factors Influencing Future Growth

8. Indonesia Medical Device Contract Manufacturing Future Market Segmentation

8.1 By Device Type (In Value %)

8.2 By Service Type (In Value %)

8.3 By Manufacturing Process (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Indonesia Medical Device Contract Manufacturing Market Analysts Recommendations

9.1 Target Addressable Market (TAM)

9.2 Serviceable Available Market (SAM)

9.3 Strategic Recommendations for Market Entry

9.4 Opportunity Mapping & White Space Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial step involves mapping the industrys key stakeholders and identifying critical factors affecting the Indonesia Medical Device Contract Manufacturing Market. The research process utilizes extensive desk research and database analyses to uncover essential market dynamics and build a preliminary industry framework.

Step 2: Market Analysis and Construction

We collect and analyze historical data to gauge market penetration levels, assess the ratio of OEMs to contract manufacturers, and study revenue trends. This analysis includes detailed comparisons across service categories to ensure reliable revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Insights from industry experts are obtained through CATI (computer-assisted telephone interviews) and consultations with senior professionals from prominent contract manufacturing firms. This step aids in validating our market hypotheses, enriching the market insights with operational data.

Step 4: Research Synthesis and Final Output

In the final phase, insights from medical device OEMs are combined with validated data to provide a holistic analysis. This process ensures comprehensive coverage of market dynamics, offering a robust overview of the Indonesia Medical Device Contract Manufacturing Market.

Frequently Asked Questions

1. How big is the Indonesia Medical Device Contract Manufacturing Market?

The Indonesia Medical Device Contract Manufacturing Market is valued at USD 30.8 billion, driven by cost savings, high-quality production standards, and growing healthcare needs.

2. What are the challenges in the Indonesia Medical Device Contract Manufacturing Market?

Challenges include regulatory compliance, quality control issues, and limited access to skilled workforce. The reliance on imported raw materials also poses potential risks.

3. Who are the major players in the Indonesia Medical Device Contract Manufacturing Market?

Key players include Benchmark Electronics, Jabil Inc., Flex Ltd., Kimball Electronics, and Nipro Corporation. These companies dominate the market due to their strong capabilities and adherence to global standards.

4. What are the growth drivers of the Indonesia Medical Device Contract Manufacturing Market?

The market is primarily driven by the need for cost-efficient manufacturing, technological advancements in production processes, and the rising demand for medical devices in healthcare.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.