KSA Automotive Aftermarket Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD3191

December 2024

86

About the Report

KSA Automotive Aftermarket Market Overview

- The KSA Automotive Aftermarket Market is valued at USD 3 billion based on a detailed five-year analysis. This market is primarily driven by the increasing demand for vehicle maintenance services and replacement parts, as the number of vehicles in operation continues to grow. Factors such as rising disposable incomes, increasing vehicle ownership, and the age of the vehicle parc contribute significantly to this growth.

- The KSA Automotive Aftermarket Market sees dominance in regions like Riyadh and Jeddah. These cities are the economic and commercial hubs of Saudi Arabia, where the majority of vehicle owners reside, contributing to the demand for automotive services and parts. Riyadh, being the capital, has a higher concentration of new vehicle sales, which drives the need for OEM (original equipment manufacturer) services, while Jeddah, a major port city, has a flourishing trade in automotive components, both OEM and aftermarket.

- In 2023, the Saudi Standards, Metrology and Quality Organization (SASO) updated safety regulations to ensure that all aftermarket parts comply with strict safety standards. These regulations apply to critical vehicle components such as braking systems, steering parts, and safety devices. The crackdown on non-compliant parts has led to a significant reduction in accidents caused by faulty aftermarket installations, contributing to safer road conditions across the country.

KSA Automotive Aftermarket Market Segmentation

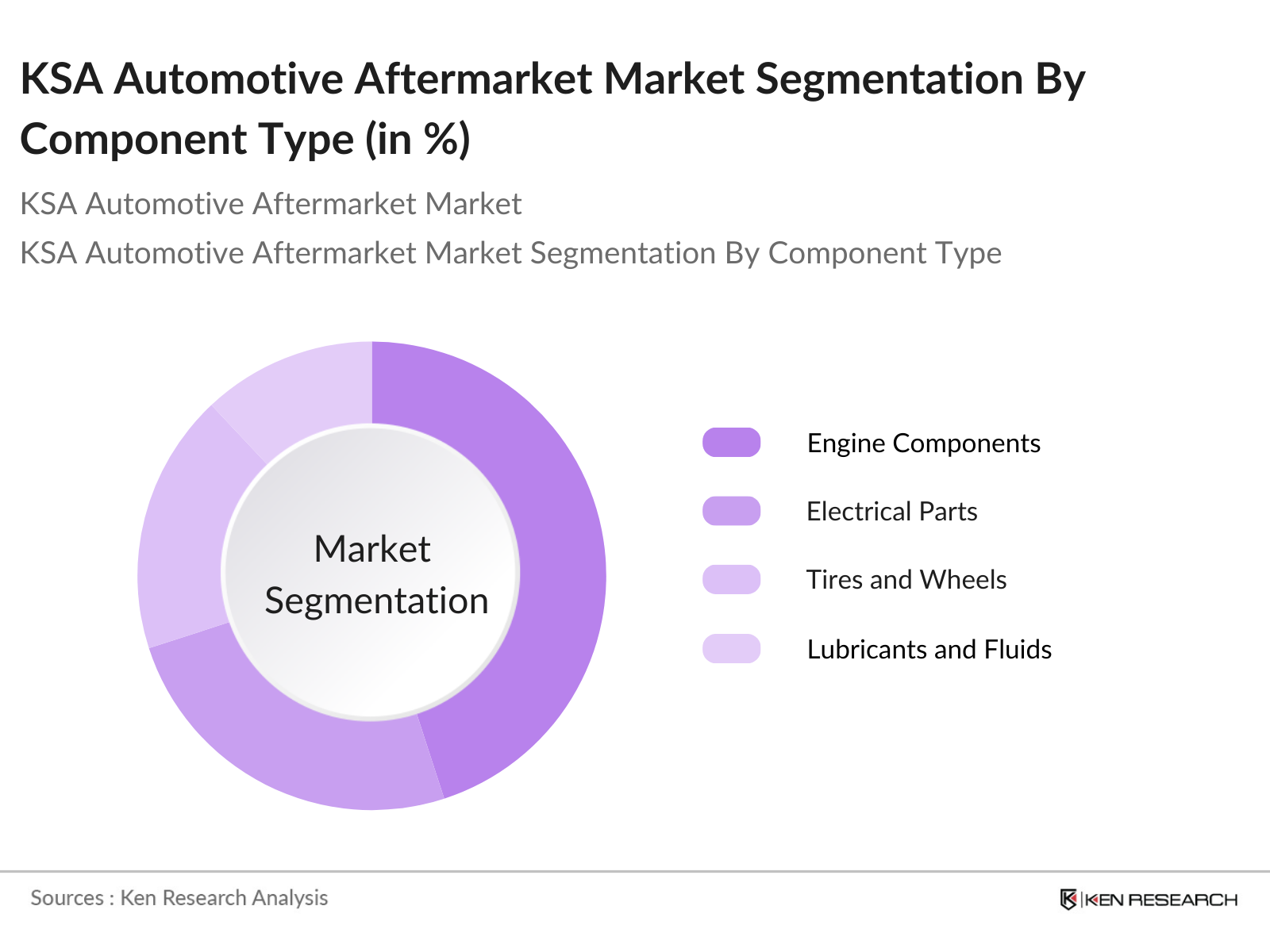

By Component Type: The KSA Automotive Aftermarket Market is segmented by component type into engine components, electrical parts, tires and wheels, lubricants and fluids, and batteries. The engine components segment is currently dominating the market share due to the high demand for replacement parts as vehicles age.

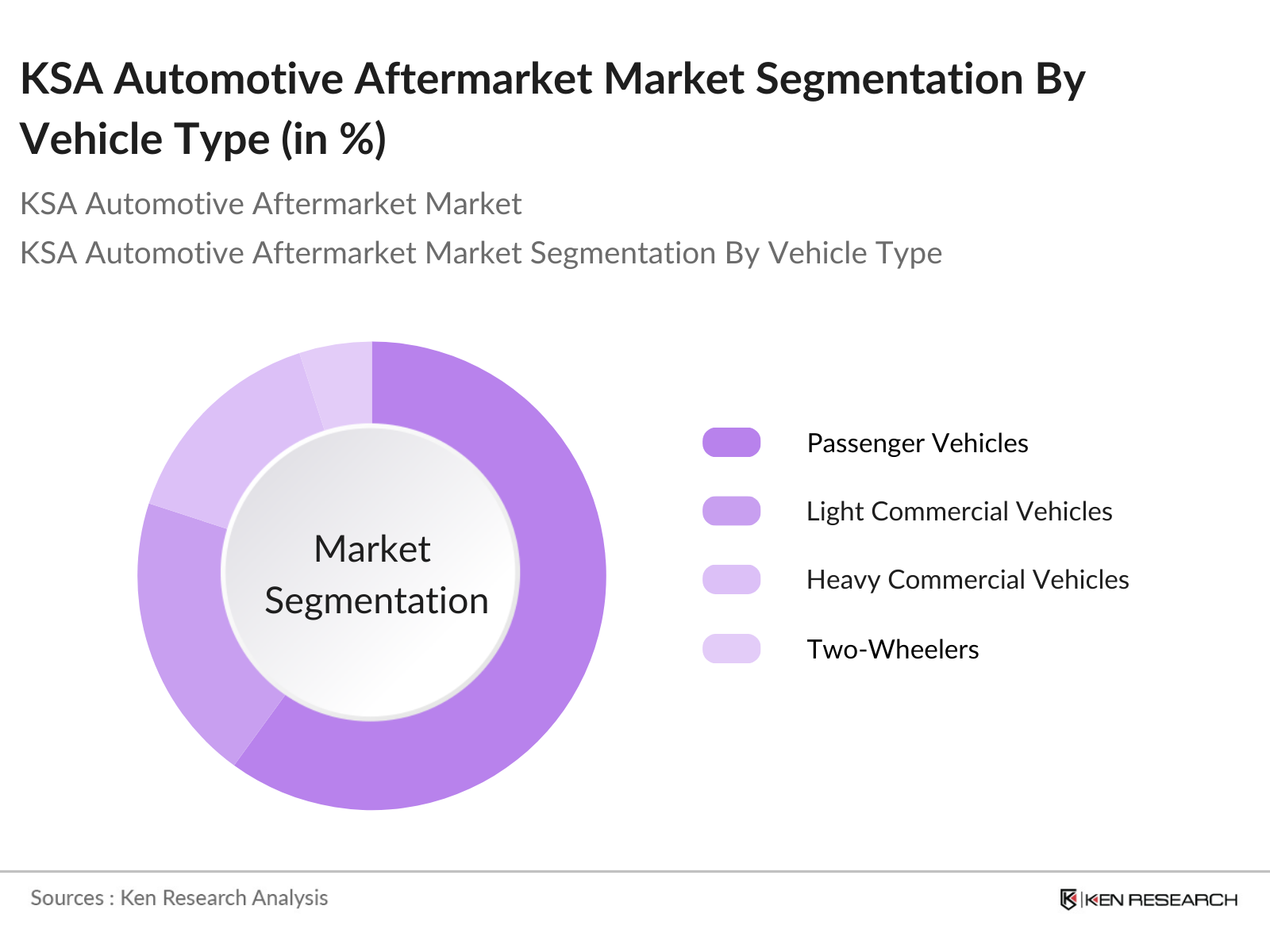

By Vehicle Type: The market is also segmented by vehicle type into passenger vehicles, light commercial vehicles (LCVs), heavy commercial vehicles (HCVs), and two-wheelers. Passenger vehicles dominate the market due to the increasing number of private vehicle owners seeking maintenance and repair services.

KSA Automotive Aftermarket Market Competitive Landscape

The KSA Automotive Aftermarket Market is highly competitive, with a mix of local and international players dominating the scene. Companies like Al Jomaih Automotive, Petromin Corporation, and Bridgestone Middle East are major players. These companies benefit from a wide distribution network and strong partnerships with global OEM brands.

KSA Automotive Aftermarket Industry Analysis

Growth Drivers

- Increasing Vehicle Ownership: The increase in vehicle ownership in the KSA automotive market is directly driving the demand for aftermarket services. As of 2024, Saudi Arabia has seen vehicle registrations exceed 12 million, with the growth in the population and expanding middle class leading to increased car ownership. The IMF reports a GDP per capita of approximately $27,000 in 2023, fueling disposable income growth and higher consumer demand for personal vehicles.

- Rising Demand for Maintenance and Replacement Parts: As vehicles age, maintenance and replacement part demands grow. Saudi Arabias average vehicle age has now surpassed 8 years, increasing the need for repair services. The Saudi Ministry of Transport estimates that older vehicles require more frequent maintenance, and with an average annual vehicle usage of over 20,000 kilometers per vehicle, the frequency of part replacement has seen an uptick.

- Expanding Distribution Networks: Saudi Arabias retail and e-commerce markets are expanding rapidly, with over 85% internet penetration supporting a significant shift towards online retail of automotive parts. The countrys e-commerce market reached $6 billion in 2023, with aftermarket parts playing a crucial role. Additionally, retail expansion has seen companies like Al-Futtaim and Abdullah Abdulghani enhance their presence with over 300 physical retail outlets across major cities.

Market Challenges

- Price Sensitivity Among Consumers: Despite increasing incomes, KSA consumers remain price-sensitive, particularly within the aftermarket industry. The Saudi Ministry of Commerce reported that over 40% of consumers opt for non-branded or cheaper alternatives due to the higher costs associated with original equipment manufacturer (OEM) parts.

- Lack of Skilled Technicians: Saudi Arabias technical workforce in the automotive aftermarket is facing challenges. The National Labor Observatory notes that fewer than 25% of auto technicians have undergone certified technical training. The scarcity of skilled professionals hampers the ability of workshops to handle advanced diagnostic and repair work, particularly for newer vehicle models and electric vehicles.

KSA Automotive Aftermarket Market Future Outlook

Over the next five years, the KSA Automotive Aftermarket Market is expected to exhibit steady growth, driven by a growing vehicle parc, advancements in repair and diagnostic technologies, and the increasing digitalization of services. The market will see more adoption of e-commerce platforms for purchasing automotive parts and a rising trend toward the use of connected technologies in vehicles, which will enhance the need for advanced diagnostics and repair services.

Market Opportunities

- Growth in Electric Vehicles: The adoption of electric vehicles (EVs) is slowly accelerating in Saudi Arabia, with over 10,000 EVs on the roads as of 2023. With the Public Investment Funds plan to invest $6 billion into EV infrastructure, the demand for EV-specific aftermarket products is expected to grow. Charging infrastructure is also expanding, with over 1,000 charging stations across major cities, further incentivizing EV adoption.

- Technological Advancements in Diagnostics and Repairs: Saudi Arabia's automotive workshops are increasingly adopting advanced diagnostic tools and technologies. The Ministry of Industry and Mineral Resources reports that over 2,000 service centers have adopted state-of-the-art diagnostic tools in 2023. This has improved efficiency in identifying vehicle issues, reducing downtime, and enhancing customer satisfaction.

Scope of the Report

|

By Component Type |

Engine Components Electrical Parts Tires and Wheels Lubricants and Fluids Batteries |

|

By Vehicle Type |

Passenger Vehicles LCVs HCVs Two-Wheelers |

|

By Distribution Channel |

Online Channels Offline Retailers Distributors and Wholesalers |

|

By Service Provider |

Independent Repair Shops OEM Service Centers Mobile Mechanics |

|

By Region |

Riyadh Jeddah Dammam Mecca Medina |

Products

Key Target Audience

Automotive Parts Manufacturers

Vehicle Fleet Operators

Independent Repair Shops

OEM Service Providers

Automotive Parts Distributors

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Transport and Logistic Services)

Insurance Companies

Companies

Players Mentioned in the Report

Al Jomaih Automotive

Zahid Tractor & Heavy Machinery Co.

Abdul Latif Jameel

Al-Futtaim Auto & Machinery Company (FAMCO)

United Motors Company

Petromin Corporation

Bridgestone Middle East & Africa

Yokohama Rubber Co., Ltd.

Gulf Oil Middle East Ltd.

TotalEnergies

Table of Contents

1. KSA Automotive Aftermarket Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Automotive Aftermarket Market Size (In SAR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Increased vehicle parc, Fleet Expansion)

2.3. Key Market Developments and Milestones

3. KSA Automotive Aftermarket Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Ownership

3.1.2. Rising Demand for Maintenance and Replacement Parts (Vehicle age, usage trends)

3.1.3. Expanding Distribution Networks (E-commerce penetration, retail expansion)

3.1.4. Government Incentives for Local Manufacturing

3.2. Market Challenges

3.2.1. Price Sensitivity Among Consumers

3.2.2. Lack of Skilled Technicians (Technician training, certification)

3.2.3. Counterfeit Products Proliferation

3.3. Opportunities

3.3.1. Growth in Electric Vehicles (EV-specific aftermarket parts)

3.3.2. Technological Advancements in Diagnostics and Repairs

3.3.3. Demand for Premium Aftermarket Products

3.4. Trends

3.4.1. Integration of Connected Car Technologies (Telematics)

3.4.2. Growing Popularity of E-Commerce Platforms (Online retail of parts)

3.4.3. Shifts Toward Sustainable and Green Automotive Solutions

3.5. Government Regulation

3.5.1. Regulations on Emissions Standards (Pollution control)

3.5.2. Localization Policies (Incentives for local manufacturing)

3.5.3. Safety Standards for Aftermarket Parts

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Distributors, Suppliers, Retailers)

3.8. Porters Five Forces (Bargaining power of suppliers, Competitive intensity)

3.9. Competitive Ecosystem (Dominance of international vs local players)

4. KSA Automotive Aftermarket Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Engine Components

4.1.2. Electrical Parts

4.1.3. Tires and Wheels

4.1.4. Lubricants and Fluids

4.1.5. Batteries

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Light Commercial Vehicles (LCVs)

4.2.3. Heavy Commercial Vehicles (HCVs)

4.2.4. Two-Wheelers

4.3. By Distribution Channel (In Value %)

4.3.1. Online Channels

4.3.2. Offline Retailers (Independent Garages, OEM Dealerships)

4.3.3. Distributors and Wholesalers

4.4. By Service Provider (In Value %)

4.4.1. Independent Repair Shops

4.4.2. OEM Service Centers

4.4.3. Mobile Mechanics

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Mecca

4.5.5. Medina

5. KSA Automotive Aftermarket Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Al Jomaih Automotive

5.1.2. Zahid Tractor & Heavy Machinery Co.

5.1.3. Abdul Latif Jameel

5.1.4. Al-Futtaim Auto & Machinery Company (FAMCO)

5.1.5. United Motors Company

5.1.6. Petromin Corporation

5.1.7. Bridgestone Middle East & Africa

5.1.8. Yokohama Rubber Co., Ltd.

5.1.9. Gulf Oil Middle East Ltd.

5.1.10. TotalEnergies

5.1.11. Al-Hajiry Trading LLC

5.1.12. Bosch Middle East

5.1.13. Denso Corporation

5.1.14. ACDelco

5.1.15. Goodyear Middle East

5.2. Cross Comparison Parameters (Revenue, Market Presence, Aftermarket Service Offerings, Product Portfolio, Partnerships, Innovation Initiatives, Customer Base, Competitive Pricing Strategies)

5.3. Market Share Analysis (Local vs Global players)

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Support

5.8. Venture Capital Funding

5.9. Private Equity Investments

6. KSA Automotive Aftermarket Market Regulatory Framework

6.1. Emission and Safety Regulations

6.2. Compliance Requirements for Importers and Manufacturers

6.3. Certification and Licensing Procedures

7. KSA Automotive Aftermarket Future Market Size (In SAR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Automotive Aftermarket Future Market Segmentation

8.1. By Component Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Service Provider (In Value %)

8.5. By Region (In Value %)

9. KSA Automotive Aftermarket Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Go-to-Market Strategy

9.5. Market Positioning and Branding

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying key players, including distributors, OEMs, and independent repair shops, through extensive desk research. Proprietary databases and secondary research were utilized to map out the main stakeholders influencing the market's dynamics. The goal was to define the most critical variables driving market growth.

Step 2: Market Analysis and Construction

In this phase, historical data on market performance and penetration was compiled, focusing on revenue streams, service provider ratios, and the demand for automotive parts. A comprehensive assessment of key service statistics provided a reliable baseline for the markets performance.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses based on the data collected and validated them through consultations with industry experts using computer-assisted telephone interviews (CATIs). These insights helped refine the data further and ensure accurate market representations.

Step 4: Research Synthesis and Final Output

In the final phase, detailed insights were gathered through direct engagements with automotive parts manufacturers, allowing for cross-validation of market data and a more refined understanding of consumer preferences and market behavior.

Frequently Asked Questions

1. How big is the KSA Automotive Aftermarket Market?

The KSA automotive aftermarket market is valued at USD 3 billion in 2023, driven by an expanding vehicle parc, the age of existing vehicles, and the rising need for replacement parts.

2. What are the challenges in the KSA Automotive Aftermarket Market?

The KSA automotive aftermarket market challenges include the proliferation of counterfeit products, a shortage of skilled technicians, and price sensitivity among consumers, which puts pressure on the profitability of parts and services providers.

3. Who are the major players in the KSA Automotive Aftermarket Market?

The KSA automotive aftermarket market key players in the market include Al Jomaih Automotive, Petromin Corporation, Bridgestone Middle East, and Zahid Tractor. These companies dominate due to their strong distribution networks and extensive partnerships with international OEMs.

4. What are the growth drivers of the KSA Automotive Aftermarket Market?

The KSA automotive aftermarket market growth is driven by increasing vehicle ownership, demand for quality aftermarket parts, and a rising focus on vehicle maintenance, particularly as more vehicles exceed their warranty periods.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.