KSA Electrical Steel Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev Kumar

Product Code:KROD709

July 2024

85

About the Report

KSA Electrical Steel Market Overview

- KSA Electrical Steel Market is growing rapidly. The Global Electrical Steel Market reached a valuation of USD 40.5 Billion in 2023, driven by the increasing demand in applications such as power transformers, motors, and generators.

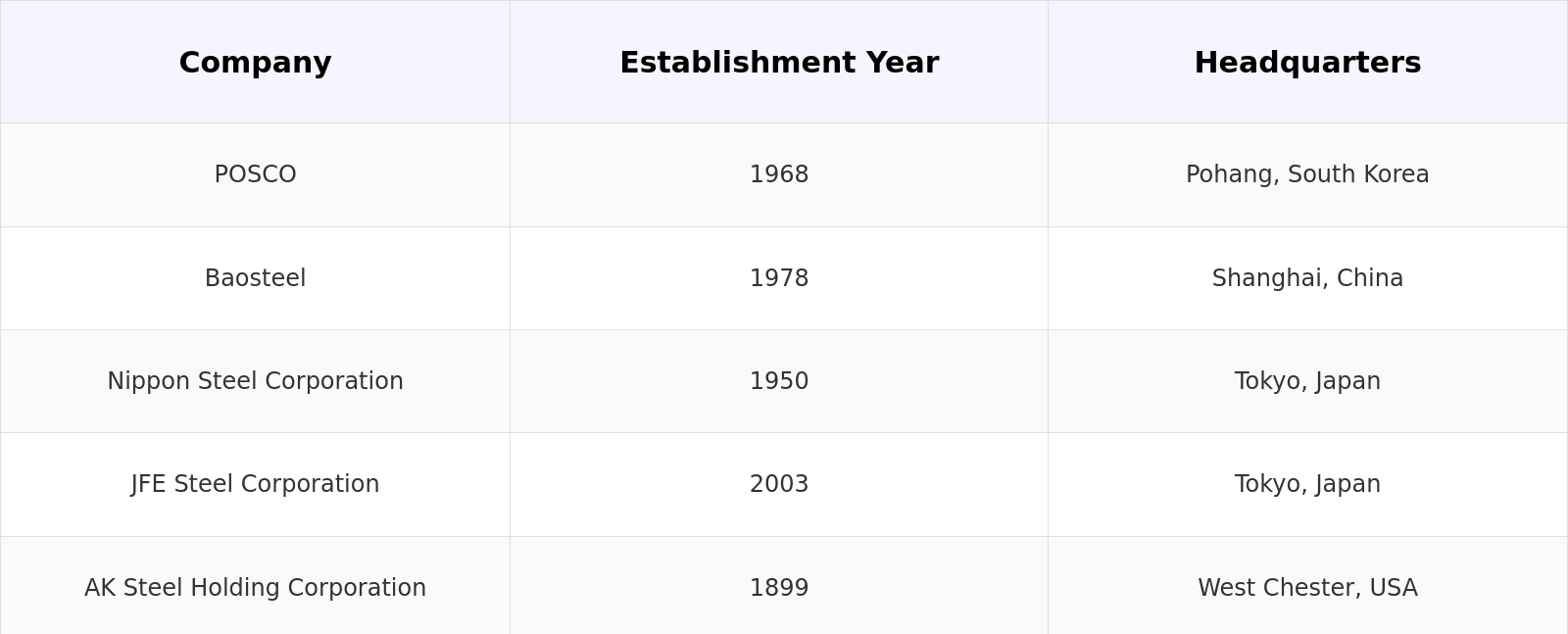

- The market is characterized by key players including POSCO, Baosteel, Nippon Steel Corporation, and JFE Steel Corporation. These companies are noted for their technological advancements, diverse product portfolios, and extensive distribution networks.

- In 2023, POSCO announced the launch of a new range of high-performance electrical steel products designed for the Middle Eastern market. This development is part of POSCO’s strategy to enhance its market presence in the region by offering advanced solutions for the growing demand for energy-efficient electrical applications.

KSA Electrical Steel Current Market Analysis

- The increasing urbanization and industrialization in KSA have led to higher demand for electrical steel in power distribution and industrial machinery. The Kingdom's GDP per capita increased from $22,000 in 2018 to $24,500 in 2023, indicating enhanced economic activity and demand for electrical steel.

- The rapid development of the renewable energy sector is a key driver for the electrical steel market. KSA's energy sector investments reached USD 80 billion annually, reflecting the growth of sectors utilizing electrical steel in renewable energy projects.

- The eastern region of KSA, particularly cities like Dammam and Jubail, dominates the electrical steel market. This dominance is attributed to higher industrial activity, significant investments in power infrastructure, and the presence of major industrial zones in these areas.

KSA Electrical Steel Market Segmentation

The KSA electrical steel market can be segmented by various factors like product type, application, and end-user industry.

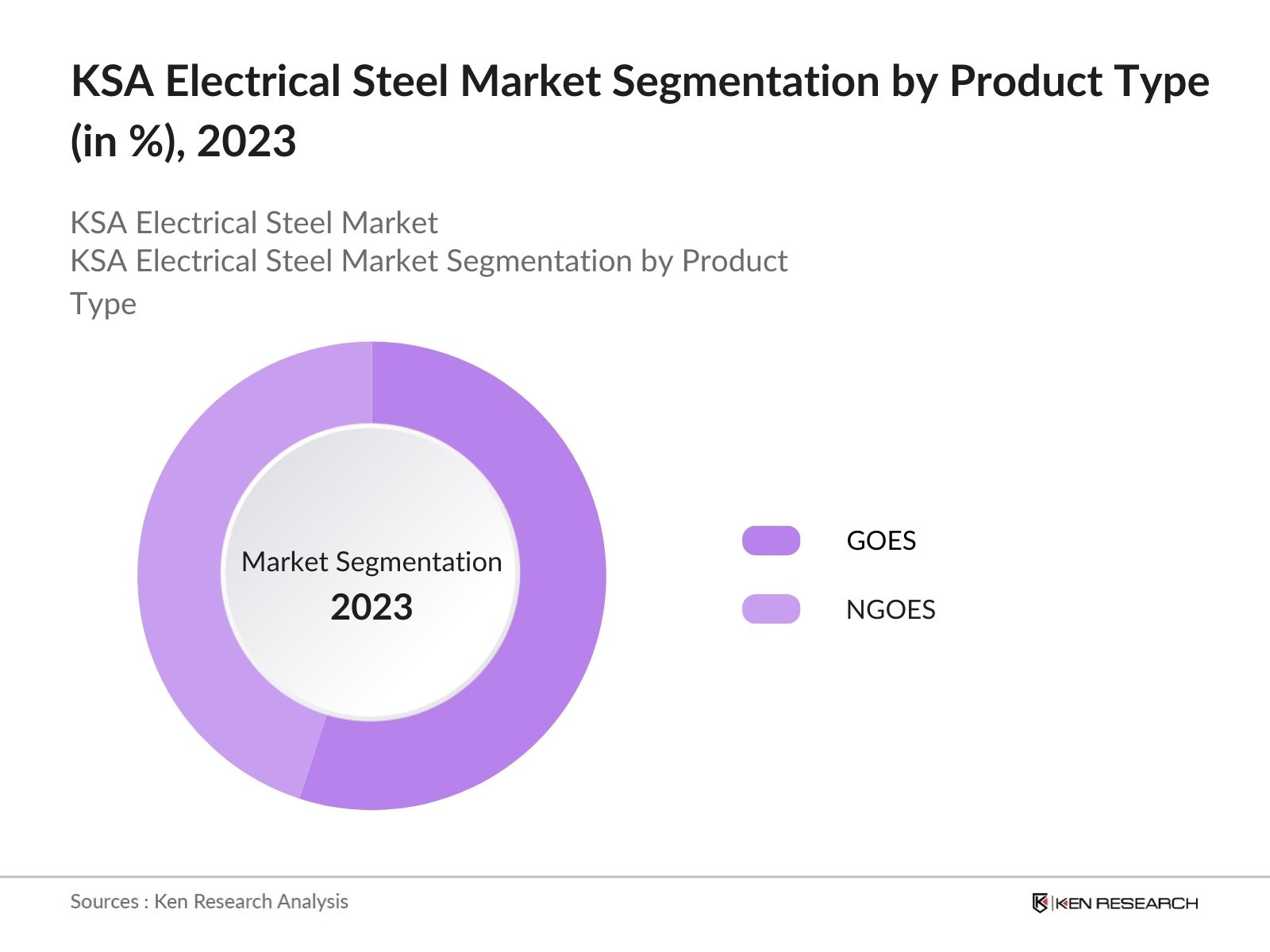

- By Product Type: KSA electrical steel market can be segmented by product type into Grain-Oriented Electrical Steel (GOES) and Non-Grain-Oriented Electrical Steel (NGOES). In 2023, NGOES dominated the market due to their wide range of applications in consumer electronics and automotive sectors. GOES is primarily used in high-end applications requiring greater efficiency and reduced energy loss, such as transformers.

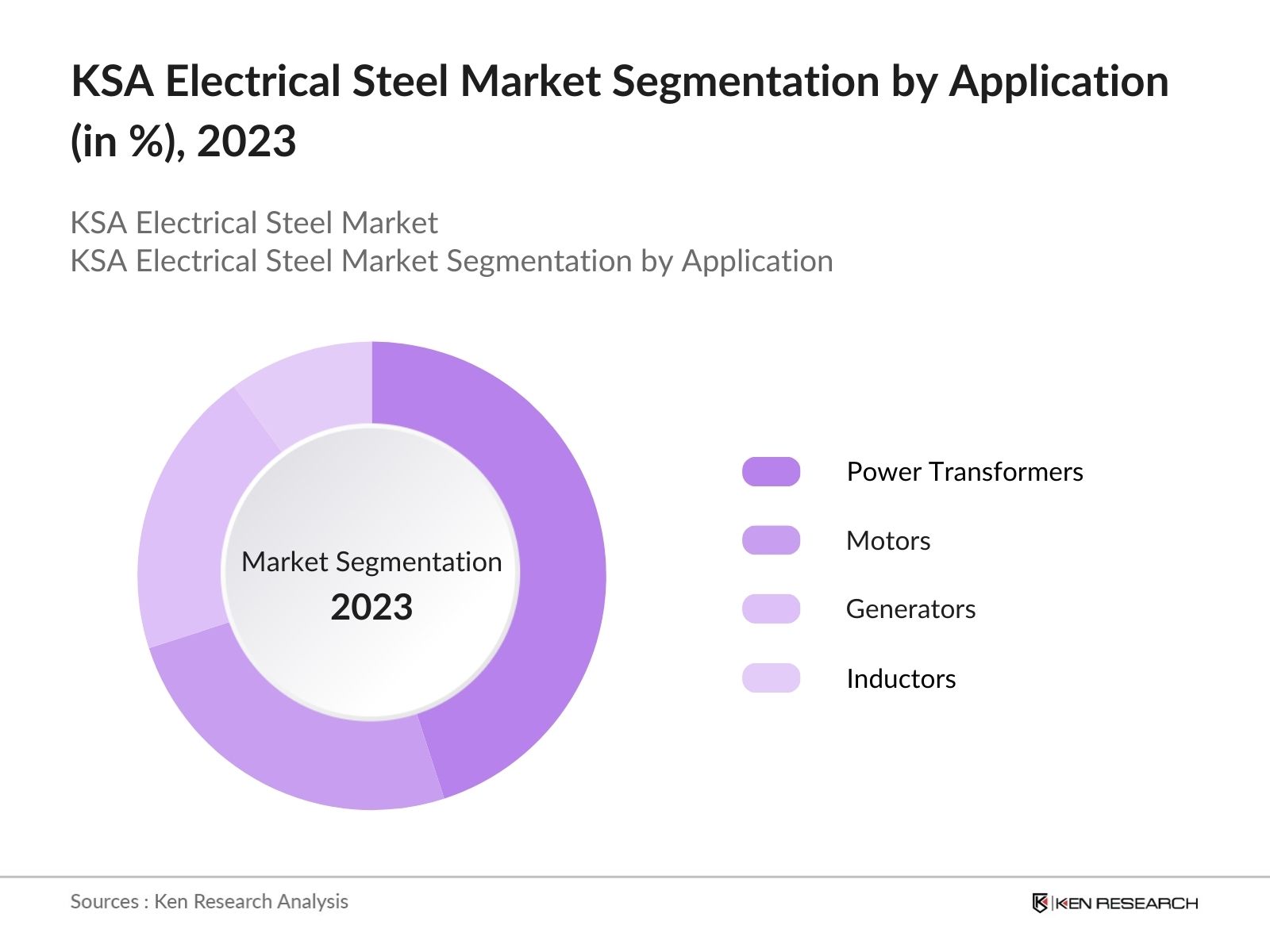

- By Application: KSA electrical steel market can be segmented by application into Power Transformers, Motors, Generators and Inductors. In 2023, power transformers held the largest market share, driven by increasing investments in power infrastructure and energy-efficient solutions across the Kingdom.

- By End-User Industry: - KSA electrical steel market can be segmented by End-User Industry into Energy Sector, Automotive Sector, Consumer Electronics Sector and Industrial Machinery Sector. The energy sector is the largest end-user, utilizing electrical steel for various applications including power transformers, generators, and motors.

KSA Electrical Steel Market Competitive Landscape Overview

- POSCO: Expanding in KSA with New Product Launches: POSCO has gained a market share in KSA due to its extensive product portfolio and robust distribution network. In 2023, the company introduced a new series of electrical steel products tailored for the Middle Eastern market, enhancing its presence. POSCO's focus on innovative electrical steel technology continues to drive its growth, with the company recording sales of 40,000 tons in KSA in 2023.

- Nippon Steel Corporation: Strengthening Market Position Through R&D: Nippon Steel Corporation, a key player in the electrical steel market, is known for its high-quality products used in various industrial applications. The company's commitment to research and development has bolstered its market position, with sales reaching 25,000 tons of electrical steel in KSA in 2023.

- JFE Steel Corporation: Expansion and Performance in Middle East: In 2023, JFE Steel Corporation sold 60,000 tons of electrical steel in KSA, driven by strategic initiatives including local partnerships and tailored solutions for the Middle Eastern market.

KSA Electrical Steel Industry Analysis

Market Growth Drivers

- Industrialization and Urbanization: The rapid industrialization and urbanization in KSA has significantly boosted the demand for electrical steel. Government spending on infrastructure projects reached USD 266 billion in 2023, enhancing the deployment of such materials.

- Renewable Energy Projects: The growth of renewable energy projects in KSA, such as solar and wind farms, has increased the demand for electrical steel. In 2023, government investments in renewable energy projects reached USD 53 billion, promoting the use of energy-efficient materials.

- Advancements in Production of Electrical Steel: Ongoing advancements in the production of electrical steel, such as high-temperature resistant electrical steel, amorphous steel technology, domain refinement, and laser scribing, have led to more efficient and high-performance materials. These technologies improve magnetic properties and reduce energy losses, essential for transformers and electric motors. This has increased the adoption of advanced electrical steel across various industries in KSA.

Market Challenges

- Raw Material Price Fluctuations: The electrical steel market in KSA has been impacted by fluctuations in the prices of raw materials, such as iron ore and coal. These components have experienced price volatility due to global supply chain disruptions and inflationary pressures, affecting profit margins for manufacturers.

- Competition from Imported Products: The market faces stiff competition from imported electrical steel products. Local manufacturers struggle to match the competitive pricing of these imports, which affects market share and profitability.

- Regulatory and Environmental Compliance: Adhering to strict regulatory standards and environmental compliance requirements poses a challenge for manufacturers in the electrical steel market. These regulations often necessitate significant investments in technology and processes to reduce emissions and improve energy efficiency, which can increase operational costs and impact profitability.

Market Government Initiatives

- National Industrial Development and Logistics Program (NIDLP): Initiated to boost the industrial sector, this program aims to enhance the local manufacturing capabilities of high-value products including electrical steel. In 2023, the government allocated over USD 13.3 billion towards industrial initiatives, significantly supporting the electrical steel market.

- Vision 2030: KSA’s Vision 2030 initiative focuses on diversifying the economy and developing infrastructure. By 2023, the government invested USD 133 billion in various infrastructure projects, promoting the use of advanced materials like electrical steel in construction and industrial applications.

KSA Electrical Steel Future Market Outlook

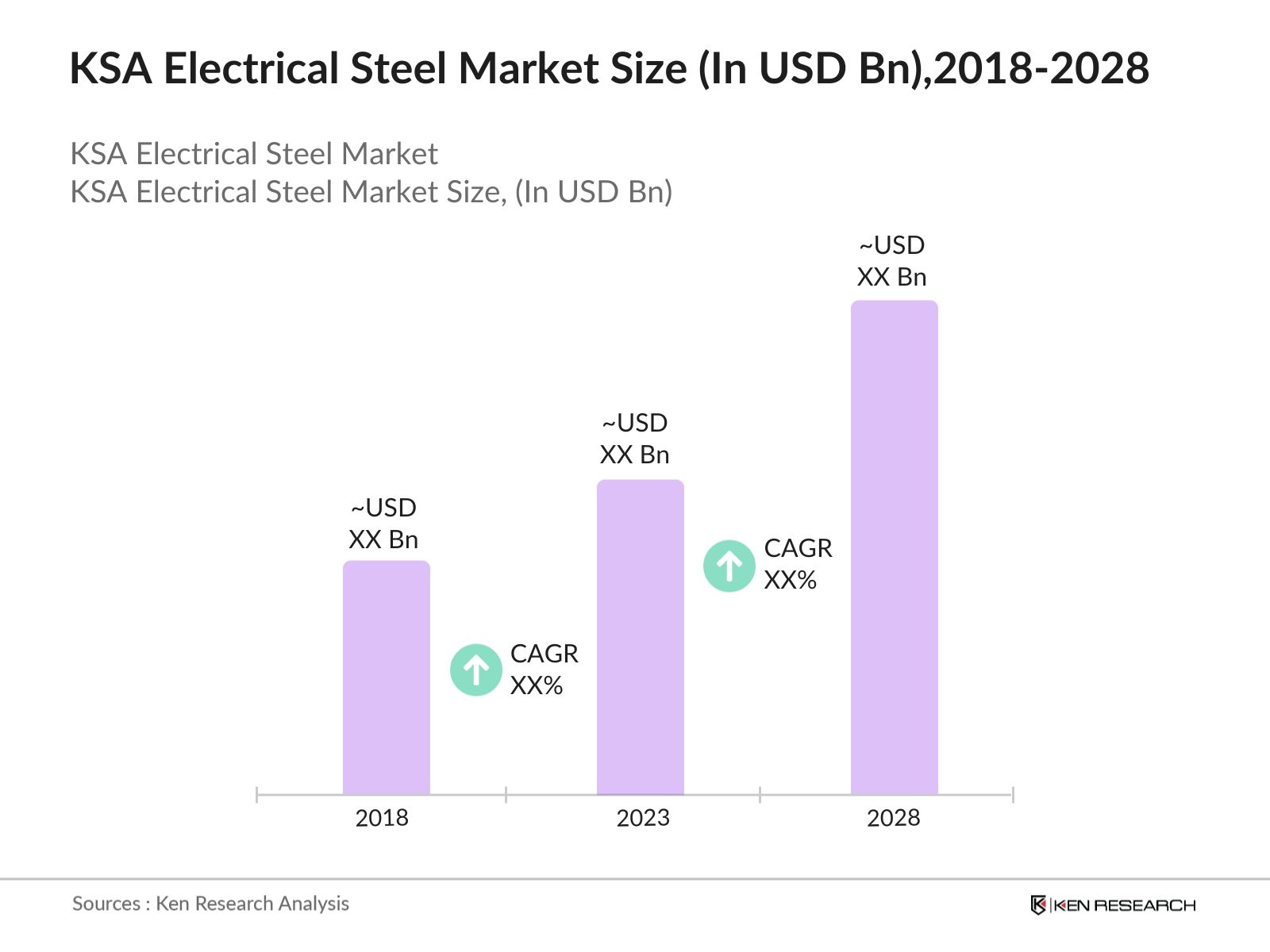

KSA Electrical Steel Market is expected to grow significantly by 2028 along with a respectable CAGR from 2023-2028. The market is anticipated to see increased adoption in various sectors, including energy, automotive, and industrial machinery, driven by technological advancements and rising demand for energy-efficient solutions.

Future Market Trends

- Increase in Smart Grid Deployments: The expansion of smart grid projects in KSA is expected to significantly drive down the demand for electrical steel. Smart grids require advanced transformers and electrical components that utilize high-quality electrical steel to improve energy efficiency and grid reliability. By 2028, investments in smart grid infrastructure in KSA are projected to reach USD 40 billion, aligning with KSA's Vision 2030 goals.

- Expansion of Renewable Energy Capacity: KSA's commitment to expanding its renewable energy capacity, including solar and wind energy projects, will boost the demand for electrical steel. Electrical steel is a critical component in the manufacturing of wind turbine generators and solar panel transformers. The planned addition of gigawatts of renewable energy capacity by 2028 will significantly increase the market demand.

- Advancements in Electric Vehicle (EV) Technology: The growing adoption of electric vehicles (EVs) in KSA will drive the demand for electrical steel, particularly for use in EV motors and charging infrastructure. With government initiatives promoting the transition to electric mobility and the establishment of EV manufacturing plants, the electrical steel market is poised for substantial growth. The anticipated increase in EV production and sales by 2028 will further stimulate demand for high-performance electrical steel.

Scope of the Report

|

By Product Type |

Grain-Oriented Electrical Steel (GOES) Non-Grain-Oriented Electrical Steel (NGOES) |

|

By Application |

Power Transformers Motors Generators Inductors |

|

By End-Use Industry |

Energy Sector Automotive Sector Consumer Electronics Sector Industrial Machinery Sector |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Electrical Steel Manufacturers

Power Transformer Manufacturers

Automotive Manufacturers

Consumer Electronics Companies

Industrial Equipment Manufacturers

Renewable Energy Companies

Government and Regulatory Bodies

Banks and Financial Institutions

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

POSCO

Baosteel

Nippon Steel Corporation

JFE Steel Corporation

AK Steel Holding Corporation

Tata Steel

Thyssenkrupp AG

ArcelorMittal

Voestalpine AG

United States Steel Corporation

Shougang Group

Hebei Iron and Steel Group

NLMK Group

China Steel Corporation

Hyundai Steel

Table of Contents

1. KSA Electrical Steel Market Overview

1.1 KSA Electrical Steel Market Taxonomy

2. KSA Electrical Steel Market Size (in USD Bn), 2018-2023

3. KSA Electrical Steel Market Analysis

3.1 KSA Electrical Steel Market Growth Drivers

3.2 KSA Electrical Steel Market Challenges and Issues

3.3 KSA Electrical Steel Market Trends and Development

3.4 KSA Electrical Steel Market Government Regulation

3.5 KSA Electrical Steel Market SWOT Analysis

3.6 KSA Electrical Steel Market Stake Ecosystem

3.7 KSA Electrical Steel Market Competition Ecosystem

4. KSA Electrical Steel Market Segmentation, 2023

4.1 KSA Electrical Steel Market Segmentation by Product Type (in %), 2023

4.2 KSA Electrical Steel Market Segmentation by Application (in %), 2023

4.3 KSA Electrical Steel Market Segmentation by End-Use Industry (in %), 2023

5. KSA Electrical Steel Market Competition Benchmarking

5.1 KSA Electrical Steel Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters, and advanced analytics)

6. KSA Electrical Steel Future Market Size (in USD Bn), 2023-2028

7. KSA Electrical Steel Future Market Segmentation, 2028

7.1 KSA Electrical Steel Market Segmentation by Product Type (in %), 2028

7.2 KSA Electrical Steel Market Segmentation by Application (in %), 2028

7.3 KSA Electrical Steel Market Segmentation by End-Use Industry (in %), 2028

8. KSA Electrical Steel Market Analysts’ Recommendations

8.1 KSA Electrical Steel Market TAM/SAM/SOM Analysis

8.2 KSA Electrical Steel Market Customer Cohort Analysis

8.3 KSA Electrical Steel Marketing Initiatives

8.4 KSA Electrical Steel Market White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on KSA Electrical Steel Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Electrical Steel Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 :Validating and Finalizing:

Building market hypothesis and conducting CATIs with Industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple Electrical Steel companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from KSA Electrical Steel companies.

Frequently Asked Questions

01. How big is the KSA Electrical Steel Market?

KSA Electrical Steel Market is growing rapidly. The Global Infrared detector market reached a valuation of USD 40.5 Billion in 2023, driven by the increasing demand in applications such as power transformers, motors, and generators.

02. Who are the major players in the KSA Electrical Steel Market?

Some of the major players in the market include POSCO, Baosteel, Nippon Steel Corporation, JFE Steel Corporation, and AK Steel Holding Corporation, which dominate the market owing to their extensive distribution networks, strong brand presence, and diverse product portfolios.

03. What are the growth drivers for the KSA Electrical Steel Market?

The rapid industrialization and urbanization in KSA have significantly boosted the demand for electrical steel. In 2023, government spending on infrastructure projects reached USD 266 billion, enhancing the deployment of such materials. Additionally, the growth of renewable energy projects, such as solar and wind farms, has increased the demand for electrical steel. Government investments in renewable energy projects reached USD 53 billion in 2023.

04. What are the challenges in the KSA Electrical Steel Market?

The electrical steel market in KSA has been significantly impacted by fluctuations in the prices of raw materials, such as iron ore and coal. This environment calls for strategic adjustments by organized players to navigate these challenges effectively. Furthermore, the market faces stiff competition from imported electrical steel products, affecting local manufacturers' market share and profitability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.