North America Marine Engine Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD6699

December 2024

98

About the Report

North America Marine Engine Market Overview

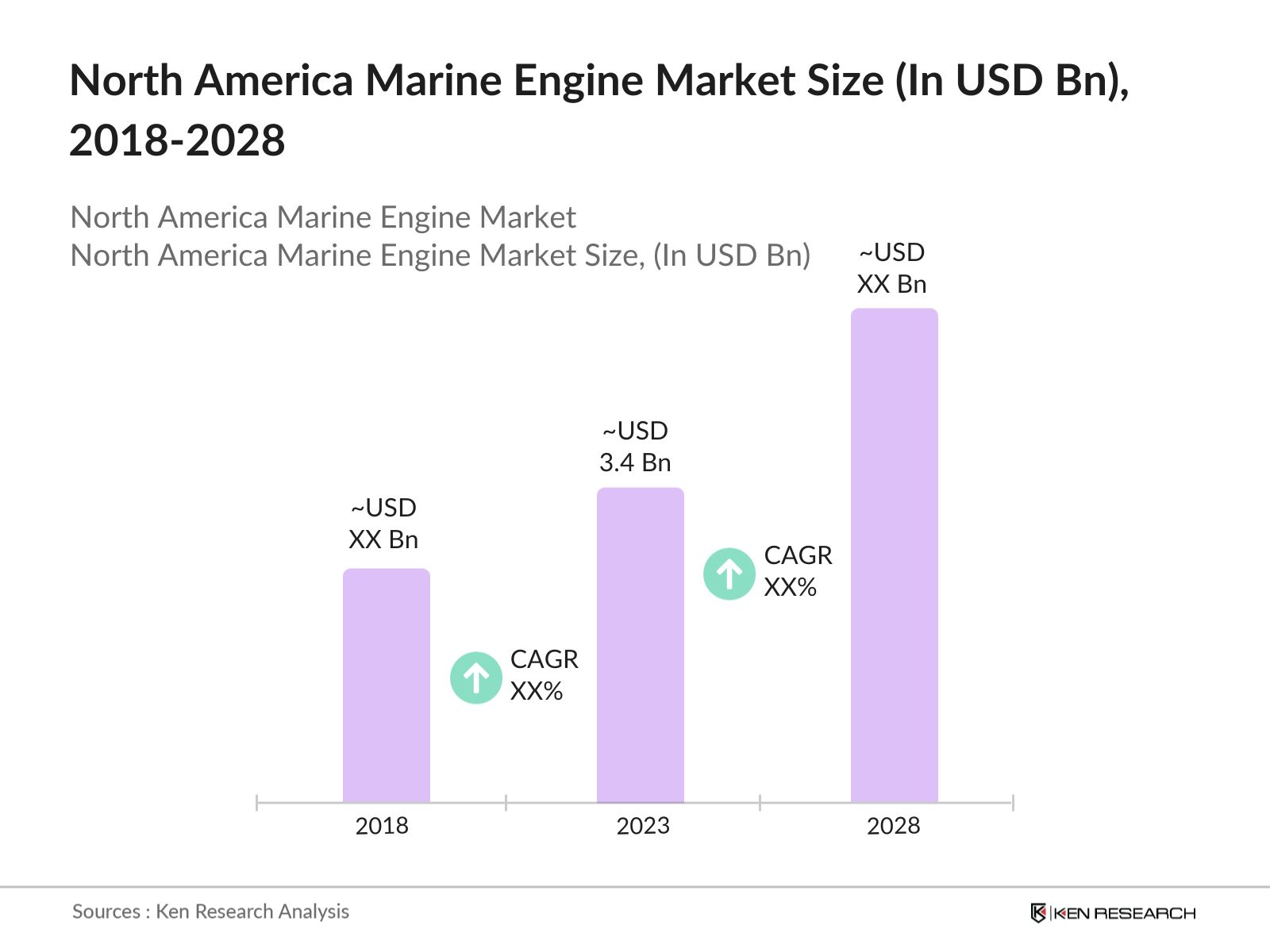

- In 2023, the North America Marine Engine Market was valued at USD 3.4 billion in 2023, driven by the growing demand for efficient and eco-friendly engines. The market's growth is driven by the rising maritime trade, increasing offshore exploration activities, and the need for engines that comply with stringent emission standards. The adoption of LNG and hybrid engines is also contributing to the markets expansion as shipowners seek to reduce their carbon footprint and operational costs.

- Key players in the North America Marine Engine Market include Caterpillar Inc., Cummins Inc., Wrtsil Corporation, Rolls-Royce Holdings, and MAN Energy Solutions. These companies lead the market by offering advanced marine engines that meet the industry's evolving demands. They are heavily investing in research and development to produce engines that are not only powerful and efficient but also compliant with new environmental regulations.

- In 2023, the recent announcements from Wrtsil focus on their first commercially available 4-stroke ammonia dual-fuel engine, which is based on the Wrtsil 25 engine platform. This engine is designed to operate on ammonia and is expected to be ready for contracts by early 2024

- Houston, Miami, and Seattle are the dominant cities in the North America Marine Engine Market. Houston serves as a major hub for offshore exploration and shipping, with a high concentration of companies involved in maritime activities. Miami is a key player in the cruise industry, with significant investments in marine engines tailored for large passenger vessels. Seattle, known for its fishing and shipping industries, also plays a crucial role due to its proximity to the Pacific and its strong emphasis on sustainable marine practices.

North America Marine Engine Market Segmentation

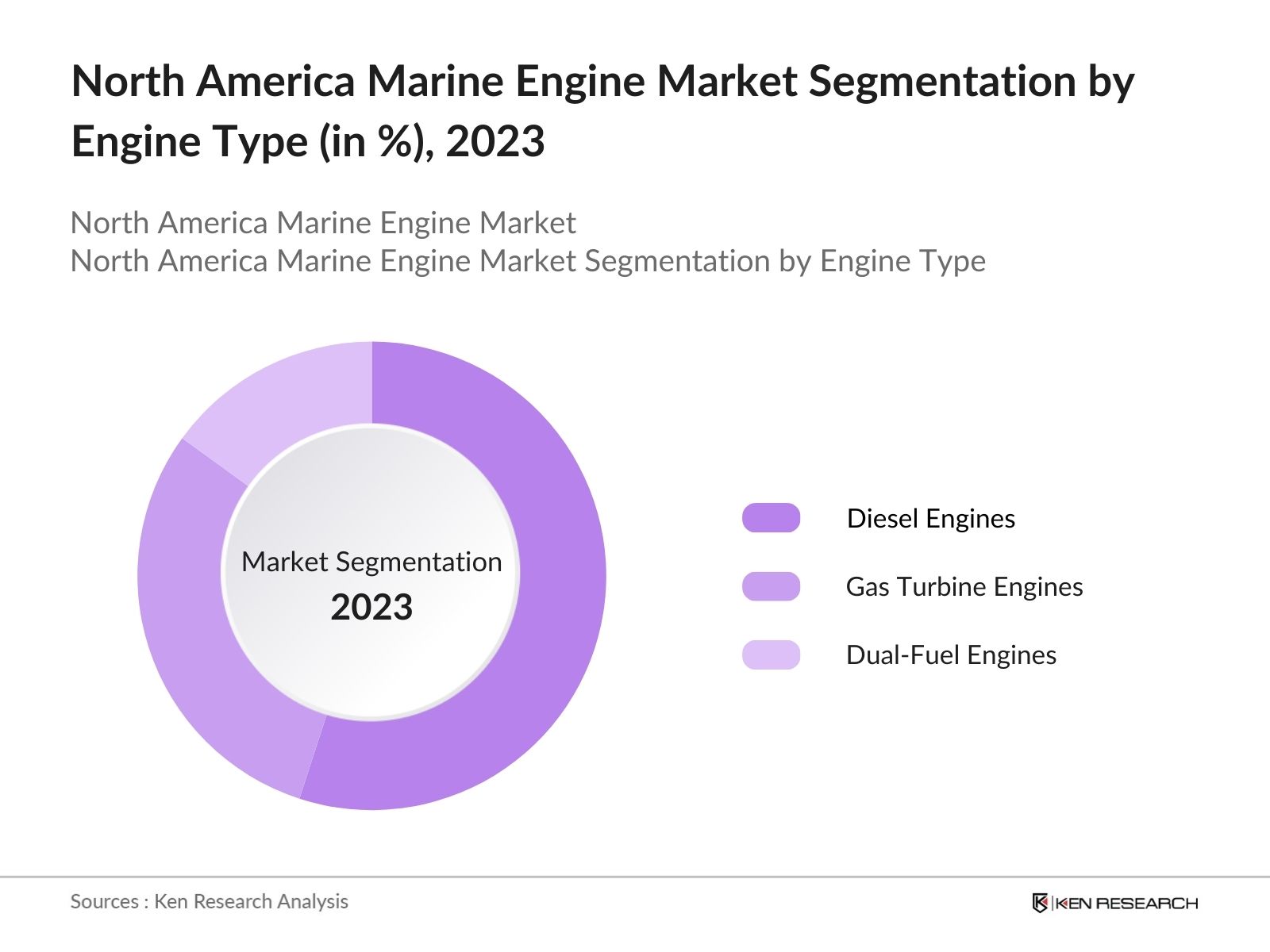

By Engine Type: The North America Marine Engine Market is segmented by engine type into Diesel Engines, Gas Turbine Engines, and Dual-Fuel Engines. In 2023, Diesel Engines held the largest market share due to their widespread use in commercial vessels and naval ships. Despite the growing interest in alternative fuels, diesel engines remain the preferred choice for their reliability, efficiency, and well-established infrastructure. The dominance of this segment is also supported by continuous advancements in diesel engine technology, which have improved fuel efficiency and reduced emissions.

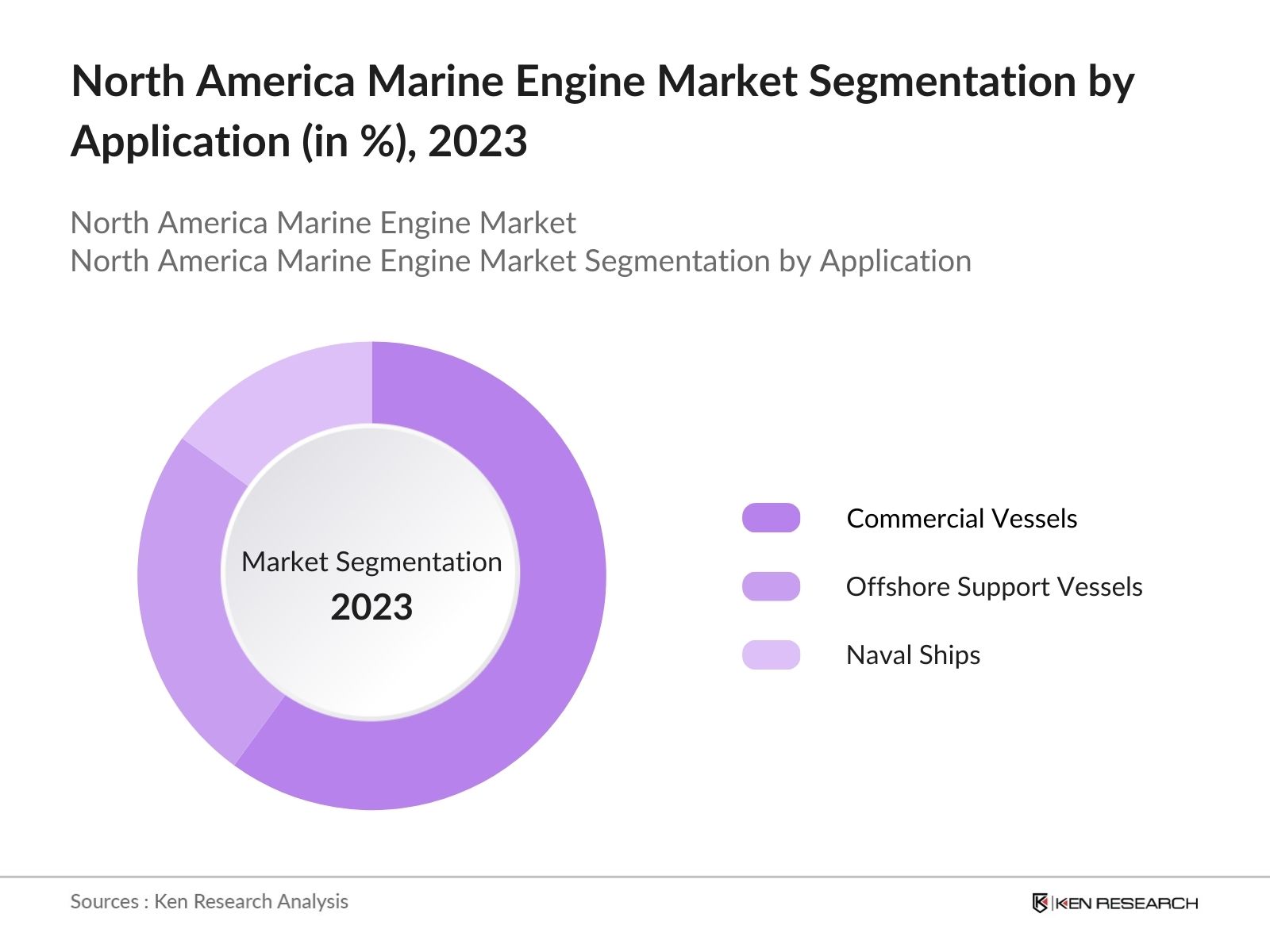

By Application: The market is segmented by application into Commercial Vessels, Offshore Support Vessels, and Naval Ships. Commercial Vessels accounted for the largest share in 2023, driven by the growing maritime trade and the increasing demand for container ships, tankers, and bulk carriers. The dominance of this segment is attributed to the significant investments in fleet modernization, aimed at improving fuel efficiency and compliance with environmental regulations. Additionally, the expanding cruise industry in North America further contributes to the demand for marine engines in this segment.

By Region: The North America Marine Engine Market is regionally segmented into the United States, Canada, and others. The United States dominates the market, accounting for a maximum of the share in 2023, primarily due to its extensive coastline, significant maritime trade activities, and a strong presence of both commercial and naval shipbuilding industries.

North America Marine Engine Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Caterpillar Inc. |

1925 |

Deerfield, Illinois |

|

Cummins Inc. |

1919 |

Columbus, Indiana |

|

Wrtsil Corporation |

1834 |

Helsinki, Finland |

|

Rolls-Royce Holdings |

1904 |

London, United Kingdom |

|

MAN Energy Solutions |

1758 |

Augsburg, Germany |

- Caterpillar Inc. Expansion of LNG Engine Portfolio: In 2024, Caterpillar Inc. expanded its LNG engine portfolio by launching a new series of engines designed for commercial vessels operating in the Gulf of Mexico. The new engines offer enhanced fuel efficiency and reduced emissions, aligning with the latest environmental regulations. Caterpillar's new LNG engine series includes the MaK 16 M 46 DF dual fuel engines, designed for commercial vessels, including cruise ships.

- Cummins Inc. Partnership with U.S. Navy In 2023, Cummins Inc. entered into a partnership with the U.S. Navy to develop hybrid marine engines for the next generation of naval vessels. Cummins partnering with Danfoss' Editron division to bring electrified solutions to the global marine market, with the goal of decreasing CO2 emissions by up to 100% compared to traditional diesel alternatives. Cummins announced its next generation X15 diesel engine, part of the Cummins HELM 15-liter fuel agnostic platform, designed for the heavy-duty on-highway market in North America.

North America Marine Engine Market Analysis

Growth Drivers

- Increasing Demand for Efficient and Eco-Friendly Engines: The growing environmental regulations and the need for cost-effective operations have driven demand for efficient and eco-friendly marine engines in North America. In 2023, the U.S. Environmental Protection Agency (EPA) implemented stricter emission standards for marine vessels, leading to a significant increase in the adoption of LNG and hybrid engines. The adoption of these engines has grown by 18% annually since 2021, reflecting the industry's shift towards sustainability.

- Increasing Maritime Trade and Transport: The expansion of maritime trade in North America is a significant driver for the marine engine market. The U.S. maritime industry handles a substantial amount of cargo, with1,601 million tonsof goods transported by maritime means in 2018, which accounts for approximately70.93%of total U.S. trade tonnage. This includes868 million tonsin exports and733 million tonsin imports.

Challenges

- Fluctuating Fuel Prices and Environmental Regulations: Fluctuating fuel prices pose a significant challenge to the North America Marine Engine Market. In 2023, global fuel prices saw an increase due to geopolitical tensions and supply chain disruptions. This volatility impacts operational costs and profitability for shipping companies, leading to cautious investments in new marine engines. Additionally, the stringent environmental regulations imposed by bodies like the International Maritime Organization (IMO) further complicate the market landscape.

- High Initial Cost of Advanced Marine Engines: The high initial cost of advanced marine engines, particularly those using LNG and hybrid technologies, remains a significant barrier to market growth. In 2023, the average cost of an LNG-powered marine engine was reported to be higher than traditional diesel engines. This substantial price difference makes it challenging for smaller shipping companies and operators to invest in these technologies, despite their long-term operational benefits.

Government Initiatives

- Implementation of Stringent Emission Standards: The International Maritime Organization (IMO) and the U.S. Environmental Protection Agency (EPA) have implemented stringent emission standards for marine vessels, effective from 2023. These regulations require significant reductions in sulfur and nitrogen oxide emissions, compelling shipowners to upgrade their engines or adopt cleaner technologies. The implementation of these standards has led to a surge in demand for compliant marine engines, particularly those using LNG and hybrid technologies.

- Investments in Maritime Infrastructure and R&D: The Canadian government announced in 2023 A CAD 500 million investment by a large Canadian shipyard to upgrade its infrastructure, including a mega block factory, panel line replacement, pipe shop and steel cutting upgrades, and new cranes. A CAD 463 million investment by the Government of Canada to enhance the efficiency of Canadian Surface Combatant ship construction at Irving Shipbuilding Inc. in Halifax.

North America Marine Engine Market Future Outlook

The North America marine engines market is expected to grow during the time period 2023-2028, driven by increasing maritime trade, advancements in engine technology, and a shift towards eco-friendly propulsion systems. The market is expected to benefit from stringent emission regulations and rising demand for reliable, high-performance marine engines across commercial and defence sectors.

Future Trends

- Expansion of Digital Twin and AI-Powered Engine Solutions: By 2028, the North America Marine Engine Market will see a significant expansion in the adoption of Digital Twin and AI-powered engine solutions. These technologies will revolutionize marine engine maintenance and operations, enabling predictive maintenance, real-time performance optimization, and fuel efficiency improvements.

- Growth in LNG and Hybrid Engine Adoption: The adoption of LNG and hybrid engines will continue to grow, this shift will be driven by increasing environmental regulations, rising fuel costs, and the global push towards reducing carbon emissions. Shipowners will continue to invest in LNG and hybrid technologies to comply with the latest emission standards and achieve operational cost savings, solidifying these engines as the preferred choice for new vessels.

Scope of the Report

|

By Engine Type |

Diesel Engines Gas Turbine Engines Dual-Fuel Engines |

|

By Application |

Commercial Vessels Offshore Support Vessels Naval Ships |

|

By Region |

USA Canada |

Products

Key Target Audience:

Shipbuilders and Maritime Equipment Manufacturers

Commercial Shipping Companies

Offshore Oil and Gas Companies

Naval Defense Contractors

Port Authorities and Maritime Infrastructure Developers

Government and Regulatory Bodies (EPA, USCG etc.)

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Caterpillar Inc.

Cummins Inc.

Wrtsil Corporation

Rolls-Royce Holdings

MAN Energy Solutions

General Electric Marine

Volvo Penta

MTU (a Rolls-Royce brand)

Hyundai Heavy Industries

Mitsubishi Heavy Industries Marine Machinery & Equipment

Fairbanks Morse

ABB Marine & Ports

SCANIA

Siemens Energy

Brunswick Corporation

Table of Contents

01. North America Marine Engine Market Overview

1.1. Market Definition and Scope

1.2. Market Size and Growth

1.3. Key Market Drivers

1.4. Overview of Market Segmentation

02. North America Marine Engine Market Size and Analysis, 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. North America Marine Engine Market Dynamics

3.1. Growth Drivers

3.1.1. Increasing Demand for Efficient and Eco-Friendly Engines

3.1.2. Rising Maritime Trade and Offshore Exploration

3.1.3. Technological Advancements in Marine Engine Design

3.2. Market Challenges

3.2.1. Fluctuating Fuel Prices and Environmental Regulations

3.2.2. High Initial Cost of Advanced Marine Engines

3.2.3. Supply Chain Disruptions and Component Shortages

3.3. Government Initiatives

3.3.1. Subsidies and Incentives for Green Marine Technology

3.3.2. Implementation of Stringent Emission Standards

3.3.3. Investments in Maritime Infrastructure and R&D

3.4. Current Market Trends

3.4.1. Shift Towards LNG and Hybrid Marine Engines

3.4.2. Increased Focus on Digitalization and Smart Engine Solutions

3.4.3. Growth in the Retrofit and Maintenance Services Market

04. North America Marine Engine Market Segmentation, 2023

4.1. By Engine Type (Value %)

4.1.1. Diesel Engines

4.1.2. Gas Turbine Engines

4.1.3. Dual-Fuel Engines

4.2. By Application (Value %)

4.2.1. Commercial Vessels

4.2.2. Offshore Support Vessels

4.2.3. Naval Ships

4.3. By Region (Value %)

4.3.1. USA

4.3.2 Canada

05. North America Marine Engine Market Competitive Landscape

5.1. Key Players and Market Share Analysis

5.2. Strategic Initiatives and Developments

5.3. Mergers, Acquisitions, and Investments

5.4. Company Profiles

5.4.1. Caterpillar Inc.

5.4.2. Cummins Inc.

5.4.3. Wrtsil Corporation

5.4.4. Rolls-Royce Holdings

5.4.5. MAN Energy Solutions

06. North America Marine Engine Market Regulatory and Legal Framework

6.1. Environmental Standards and Compliance

6.2. Certification and Regulatory Approvals

07. North America Marine Engine Market Forecast, 2023-2028

7.1. Future Market Size Projections

7.2. Factors Influencing Future Market Growth

08. Future Market Segmentation, 2028

8.1. By Engine Type (Value %)

8.2. By Application (Value %)

8.3. By Technology (Value %)

8.4. By Region (Value %)

09. Analyst Recommendations and Strategic Insights

9.1. Total Addressable Market (TAM) Analysis

9.2. Customer and Market Potential Analysis

9.3. Key Strategic Initiatives for Market Penetration

10. North America Marine Engine Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Research Methodology

Step 1. Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2. Market Building:

Collating statistics on North America Marine Engine Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated in North America Marine Engine Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3. Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4. Research Output:

Our team will approach multiple North America Marine Engine Market companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Marine Engine Market companies.

Frequently Asked Questions

01. How big is the North America Marine Engine Market?

The North America Marine Engine Market was valued at USD 3.4 billion in 2023, driven by rising maritime trade, offshore exploration activities, and increasing demand for eco-friendly and efficient marine engines.

02. What are the challenges in the North America Marine Engine Market?

Challenges in North America Marine Engine Market include fluctuating fuel prices, high initial costs of advanced engines, and ongoing supply chain disruptions. Additionally, compliance with stringent environmental regulations poses financial and operational challenges for shipowners and operators.

03. Who are the major players in the North America Marine Engine Market?

Key players in the North America Marine Engine market include Caterpillar Inc., Cummins Inc., Wrtsil Corporation, Rolls-Royce Holdings, and MAN Energy Solutions. These companies lead the market with their innovative marine engine solutions and strong presence in the maritime industry.

04. What are the growth drivers of the North America Marine Engine Market?

The market in North America Marine Engine Market is driven by increased demand for eco-friendly engines, rising maritime trade, and technological advancements in engine design. Government initiatives promoting green marine technologies also play a significant role in market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.