North America Online Gambling Market Outlook to 2030

Region:North America

Author(s):Vijay Kumar

Product Code:KROD5389

October 2024

94

About the Report

North America Online Gambling Market Overview

- The North America online gambling market is valued at USD 31 billion based on a five-year historical analysis, driven primarily by the increasing penetration of smartphones and internet access across the region. This market is also experiencing growth due to the widespread legalization of online betting and casino platforms in key states across the United States. The ease of access to online gambling platforms and the convenience of playing from home have spurred this rapid growth.

- In terms of regional dominance, the United States holds the leading position in the North American online gambling market, followed by Canada and Mexico. The dominance of the U.S. is attributed to its large population, high disposable incomes, and the progressive legalization of online betting across multiple states. Key cities such as New Jersey and Nevada have become hubs for online gambling due to their favorable regulatory environments and long-standing gambling industries.

- In the U.S., state-level legalization initiatives continue to shape the online gambling landscape. As of 2023, 34 states have legalized some form of online gambling, with several more considering similar measures. This patchwork of regulations allows states to independently set tax rates, licensing requirements, and operational standards for online gambling operators. States like New York and California are currently debating legislation that would further expand the online gambling market, potentially adding millions of new users to the system.

North America Online Gambling Market Segmentation

By Type of Gambling: The market is segmented by type of gambling into sports betting, casino games (slots, poker, etc.), lottery, and esports betting. Recently, sports betting has dominated the market under this segmentation, mainly due to the growing interest in major leagues such as the NFL, NBA, and MLB. The widespread legalization of sports betting across multiple U.S. states has fueled this trend, making it easier for consumers to place bets online.

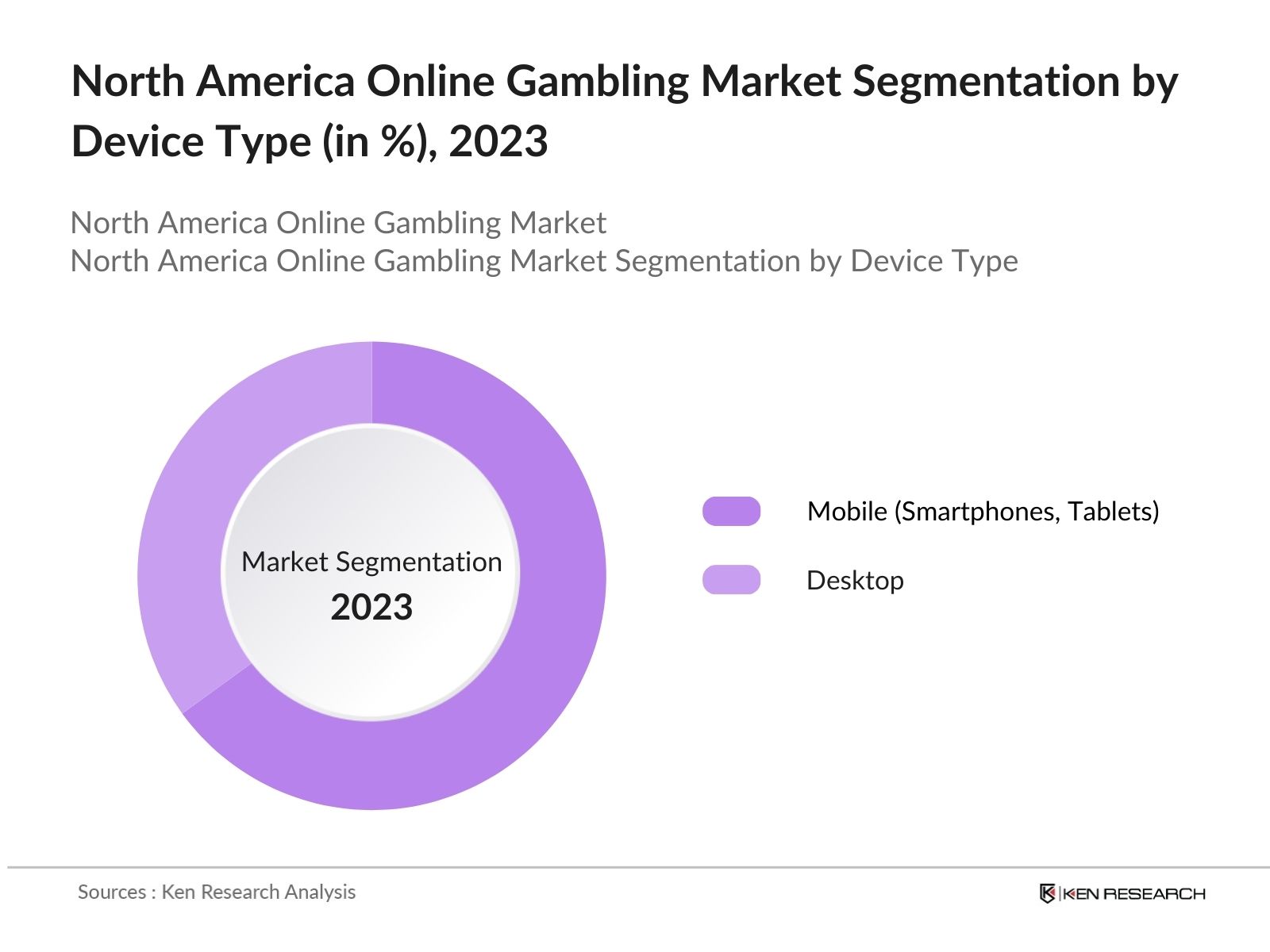

By Device Type: The market is also segmented by device type into desktop and mobile (smartphones, tablets). The mobile segment is leading in market share due to the increasing penetration of smartphones across North America. Mobile devices offer users the convenience of gambling from anywhere at any time, which has been a significant driver of growth. The rise of mobile applications designed for both Android and iOS platforms has also contributed to the dominance of this segment, making it the preferred choice for a majority of players.

North America Online Gambling Market Competitive Landscape

The North America online gambling market is dominated by several key players who maintain a strong foothold in the market. These companies have developed significant brand equity and are continuously expanding their portfolios to offer enhanced experiences to their users. The major players in the market include DraftKings Inc., MGM Resorts International (BetMGM), and Flutter Entertainment (FanDuel).

North America Online Gambling Industry Analysis

Growth Drivers

- Increased Internet Penetration (Market Specific): As of 2024, over 92% of the population in North America has internet access, with the United States and Canada among the global leaders in internet penetration. High-speed broadband has become more accessible, which has been pivotal in boosting online gambling. This infrastructure growth is closely linked to rising demand for online platforms, particularly gambling services. With an estimated 320 million internet users in the U.S. alone, there has been a marked increase in users participating in online betting activities.

- Expansion of Mobile Gambling (Market Specific): The widespread use of smartphones has fueled mobile gambling growth, with over 280 million smartphone users in North America as of 2023. Mobile gambling apps account for a significant portion of online gambling revenue in the region, allowing users to participate from any location. The convenience of mobile platforms has contributed to a spike in real-time betting, particularly for sports and esports. As mobile infrastructure improves with the deployment of 5G networks, the trend is expected to sustain high participation rates.

- Liberalization of Gambling Laws (Market Specific): The regulatory environment for online gambling in North America has seen liberalization, particularly in the United States, where states such as New Jersey, Pennsylvania, and Michigan have legalized various forms of online betting since 2018. Over 30 U.S. states now permit sports betting, contributing to significant revenue growth in the sector. Canadas passing of Bill C-218 in 2021 further opened the market, enabling single-event sports betting, a key driver of the Canadian gambling market.

Market Challenges

- Regulatory Compliance (Market Specific): The fragmented regulatory landscape across North America presents a significant challenge for online gambling operators. Different states in the U.S. enforce their own laws, creating complex compliance requirements for multi-state operators. Regulatory oversight is further complicated by cross-border considerations, with Canadian provinces having distinct regulations for online gambling. Operators are required to navigate an array of licensing rules, taxation policies, and operational restrictions, all of which increase compliance costs.

- Cybersecurity Threats (Market Specific): Cybersecurity remains a significant concern in the North American online gambling market, as digital platforms increasingly become targets for cyberattacks. According to the FBI, financial fraud involving digital transactions in the U.S. surpassed $10 billion in 2023, with online gambling platforms being highly vulnerable due to the volume of money exchanged. Security breaches can erode customer trust, and operators must invest heavily in encryption technologies, identity verification protocols, and fraud detection systems to safeguard transactions.

North America Online Gambling Market Future Outlook

Over the next five years, the North America online gambling market is expected to show significant growth, driven by continuous state-level legalization, advancements in mobile gambling applications, and increasing consumer interest in esports betting. The growing adoption of secure payment methods, such as cryptocurrency and blockchain technology, is also likely to reshape the landscape of online gambling in the region.

Market Opportunities

- Integration of Blockchain Technology (Market Specific): Blockchain technology is gaining traction in the North American online gambling market, offering benefits such as enhanced transparency and security. By utilizing decentralized ledgers, gambling operators can provide players with verifiable transaction records, increasing trust in the fairness of games. In 2023, several U.S. and Canadian operators began implementing blockchain solutions for payment processing and game integrity verification. This technology also allows for the creation of smart contracts, which automatically execute betting outcomes, eliminating the need for third-party verification.

- Expansion of Cryptocurrency Betting (Market Specific): Cryptocurrency betting is an emerging opportunity in North America, driven by the increasing adoption of digital currencies like Bitcoin and Ethereum. In 2023, an estimated 10% of online gambling transactions in the U.S. were conducted using cryptocurrencies, offering users faster and more anonymous transactions. Cryptocurrency betting platforms provide lower transaction fees compared to traditional banking methods, making them attractive to both operators and players.

Scope of the Report

|

Type of Gambling |

Sports Betting Casino Games Lottery Esports Betting |

|

Device Type |

Desktop Mobile |

|

Payment Method |

Credit/Debit Cards E-Wallets Cryptocurrencies |

|

End User |

Casual Gamblers Professional Gamblers High Rollers |

|

Region |

United States Canada Mexico |

Products

Key Target Audience

Government and Regulatory Bodies (e.g., U.S. Gambling Commission, Canadian Gaming Association)

Online Gambling Operators

Technology Providers (e.g., Payment Solutions, AI)

Investment and Venture Capitalist Firms

Mobile Application Developers

Sportsbook Operators

Advertising and Marketing Agencies

Law Firms Specializing in Gaming Regulations

Companies

Players Mentioned in the Report

DraftKings Inc.

MGM Resorts International (BetMGM)

Flutter Entertainment (FanDuel)

Caesars Entertainment Corporation

888 Holdings

Bet365 Group Ltd.

Kindred Group (Unibet)

Penn National Gaming (Barstool Sportsbook)

Entain (formerly GVC Holdings)

PointsBet

Table of Contents

1. North America Online Gambling Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. North America Online Gambling Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. North America Online Gambling Market Analysis

3.1 Growth Drivers

3.1.1 Increased Internet Penetration (Market Specific)

3.1.2 Expansion of Mobile Gambling (Market Specific)

3.1.3 Liberalization of Gambling Laws (Market Specific)

3.1.4 Growth of Esports Betting (Market Specific)

3.2 Market Challenges

3.2.1 Regulatory Compliance (Market Specific)

3.2.2 Cybersecurity Threats (Market Specific)

3.2.3 Gambling Addiction Concerns (Market Specific)

3.3 Opportunities

3.3.1 Integration of Blockchain Technology (Market Specific)

3.3.2 Expansion of Cryptocurrency Betting (Market Specific)

3.3.3 Cross-border Partnerships (Market Specific)

3.4 Trends

3.4.1 Growth of Live Casino Platforms (Market Specific)

3.4.2 AI and Data-Driven Personalization (Market Specific)

3.4.3 Increased Adoption of VR and AR in Online Gambling (Market Specific)

3.5 Government Regulation

3.5.1 State-level Legalization Initiatives (Market Specific)

3.5.2 Taxation Policies (Market Specific)

3.5.3 Responsible Gambling Regulations (Market Specific)

3.5.4 Licensing Requirements (Market Specific)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. North America Online Gambling Market Segmentation

4.1 By Type of Gambling (In Value %)

4.1.1 Sports Betting

4.1.2 Casino Games (Slots, Poker, etc.)

4.1.3 Lottery

4.1.4 Esports Betting

4.2 By Device Type (In Value %)

4.2.1 Desktop

4.2.2 Mobile (Smartphone, Tablet)

4.3 By Payment Method (In Value %)

4.3.1 Credit/Debit Cards

4.3.2 E-Wallets

4.3.3 Cryptocurrencies

4.4 By End User (In Value %)

4.4.1 Casual Gamblers

4.4.2 Professional Gamblers

4.4.3 High Rollers

4.5 By Region (In Value %)

4.5.1 United States

4.5.2 Canada

4.5.3 Mexico

5. North America Online Gambling Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 DraftKings Inc.

5.1.2 Flutter Entertainment (FanDuel)

5.1.3 MGM Resorts International (BetMGM)

5.1.4 Caesars Entertainment Corporation

5.1.5 888 Holdings

5.1.6 Bet365 Group Ltd.

5.1.7 Kindred Group (Unibet)

5.1.8 Penn National Gaming (Barstool Sportsbook)

5.1.9 Entain (formerly GVC Holdings)

5.1.10 PointsBet

5.1.11 William Hill

5.1.12 Betway

5.1.13 Golden Nugget Online Gaming

5.1.14 Bally's Corporation

5.1.15 Rush Street Interactive (BetRivers)

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Market Presence, Customer Base, Number of Platforms, Licensing/Compliance, Technology Integration, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. North America Online Gambling Market Regulatory Framework

6.1 State-wise Regulations

6.2 Compliance Requirements

6.3 Certification and Licensing Processes

7. North America Online Gambling Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. North America Online Gambling Market Segmentation

8.1 By Type of Gambling (In Value %)

8.2 By Device Type (In Value %)

8.3 By Payment Method (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. North America Online Gambling Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the North America Online Gambling Market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the North America Online Gambling Market is compiled and analyzed. This includes assessing market penetration, the ratio of platforms to active users, and the resulting revenue generation. Additionally, we evaluate service quality metrics to ensure the accuracy and reliability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts from a diverse range of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple online gambling operators to gain detailed insights into product segments, user preferences, and other key factors. This interaction verifies and complements statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the North America Online Gambling Market.

Frequently Asked Questions

01. How big is the North America Online Gambling Market?

The North America online gambling market is valued at USD 31 billion based on a five-year historical analysis, driven primarily by the increasing penetration of smartphones and internet access across the region.

02. What are the challenges in the North America Online Gambling Market?

Challenges in this market include regulatory hurdles at state levels, cybersecurity threats, and concerns surrounding gambling addiction. These factors may hinder the market's rapid growth.

03. Who are the major players in the North America Online Gambling Market?

Key players include DraftKings Inc., MGM Resorts International, Flutter Entertainment, Caesars Entertainment, and 888 Holdings. These companies dominate the market due to their strong brand presence and innovative betting platforms.

04. What are the growth drivers of the North America Online Gambling Market?

The market is propelled by the increasing penetration of smartphones, advancements in mobile gambling applications, and the expansion of esports betting. Additionally, the growing acceptance of cryptocurrency and blockchain technology is reshaping payment methods in the sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.