Saudi Arabia Water Well Drilling Market Outlook to 2030

Region:Middle East

Author(s):Sanjeev

Product Code:KROD9427

December 2024

96

About the Report

Saudi Arabia Water Well Drilling Market Overview

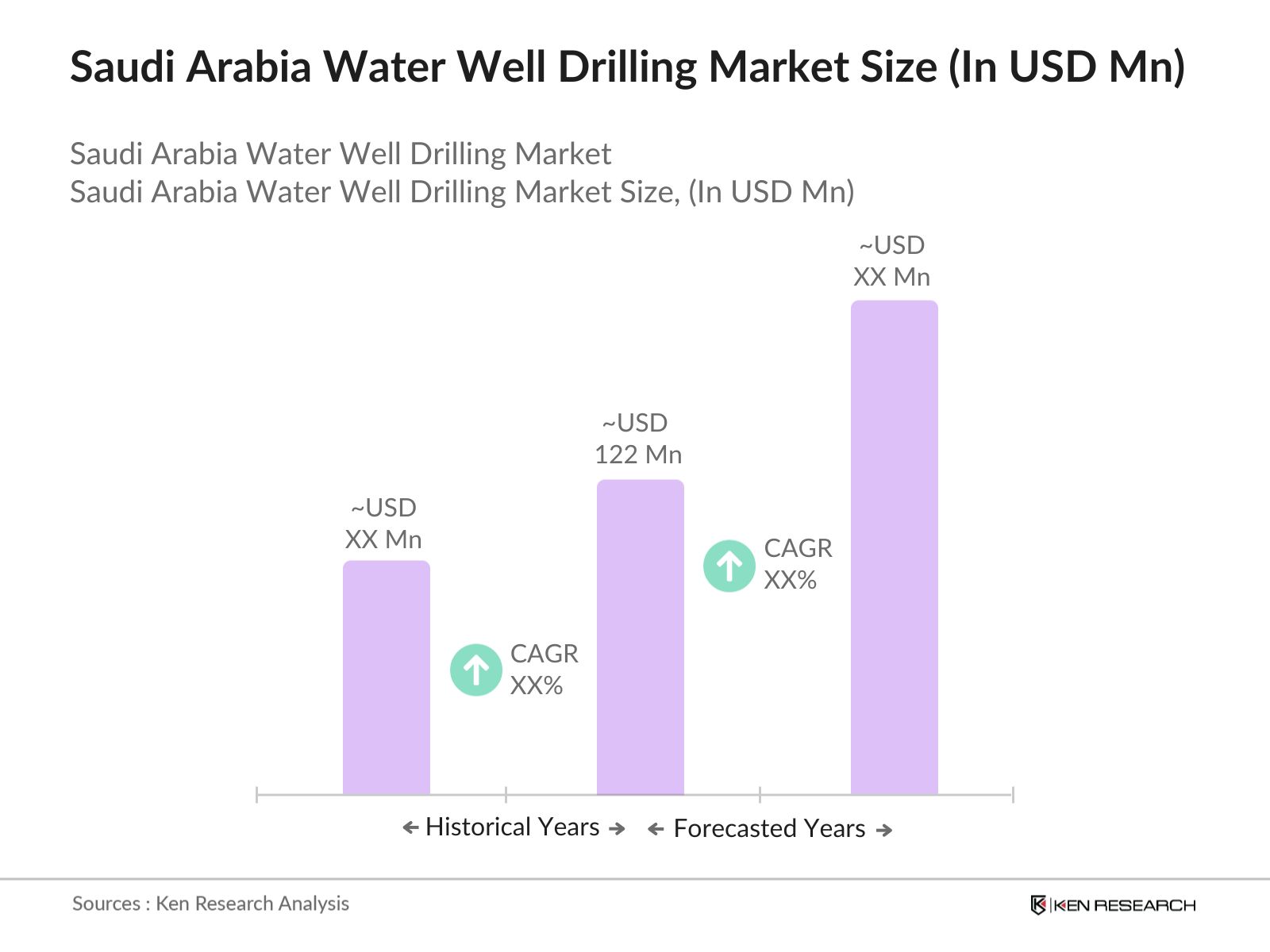

- The Saudi Arabia water well drilling market, based on credible reports, is valued at USD 122 million. This market is primarily driven by the increasing demand for water due to the countrys rapid urbanization and agricultural expansion. The scarcity of natural water resources, coupled with the growing population, has necessitated the development of groundwater resources, which has, in turn, propelled the demand for water well drilling services. Government initiatives, such as Vision 2030 and the National Water Strategy, are also playing a critical role in bolstering the growth of this market.

- Riyadh and the Eastern Province are key regions dominating the water well drilling market in Saudi Arabia. Riyadh, being the capital and the most populous city, has witnessed infrastructural development, which has spurred the need for water wells. Similarly, the Eastern Province, with its arid climate and reliance on agriculture, heavily depends on groundwater for irrigation. This dependency on groundwater in regions with less natural water availability makes these areas central to the growth of the market.

- The National Water Strategy is a cornerstone of Saudi Arabias water resource management efforts. It outlines measures to reduce water consumption, promote groundwater conservation, and enhance the efficiency of water well drilling. The government has committed to reducing groundwater extraction by 30% by 2030, which will influence the way companies approach drilling projects. This strategy mandates that companies implement sustainable practices and adhere to strict guidelines for water well drilling.

Saudi Arabia Water Well Drilling Market Segmentation

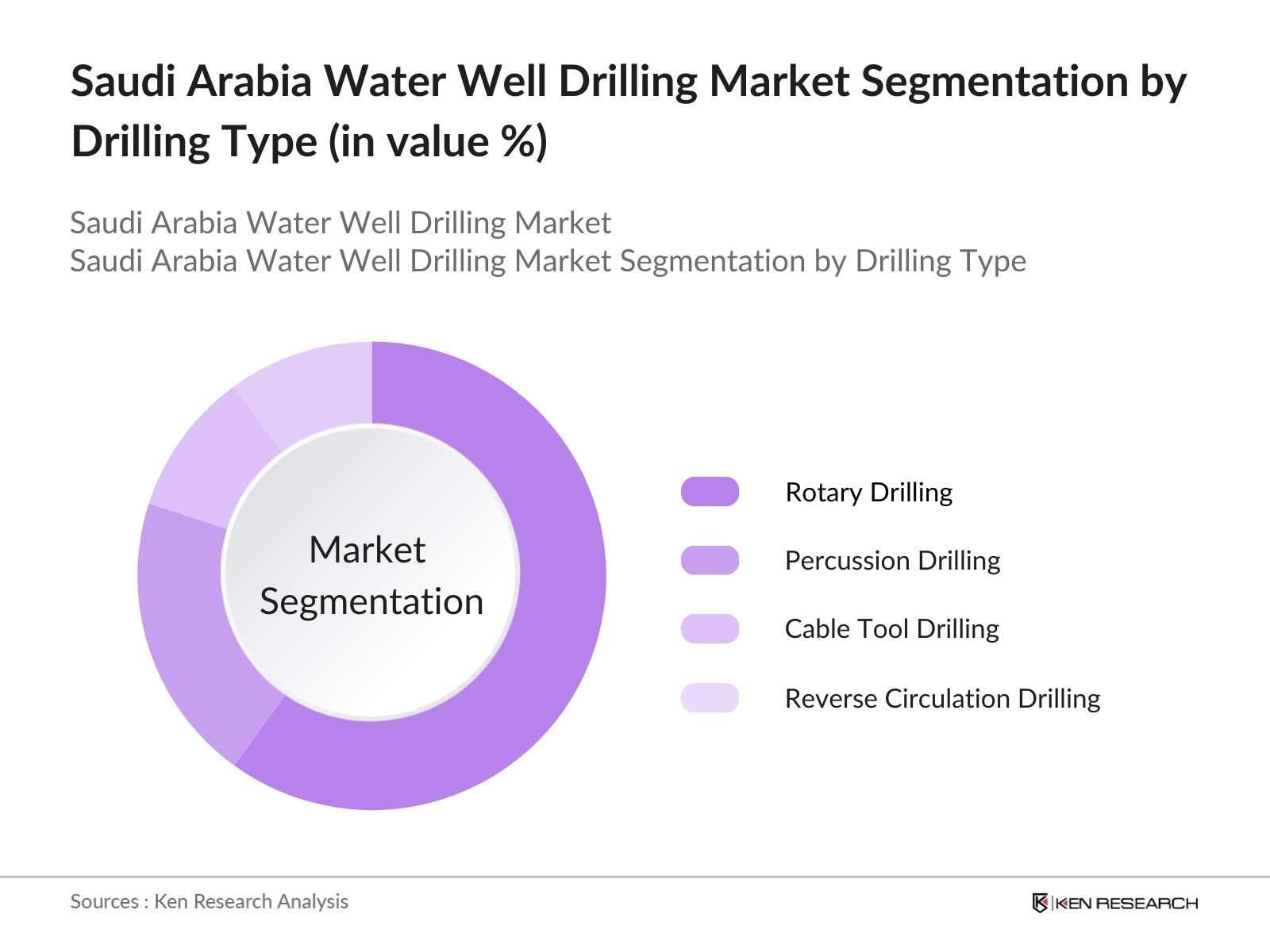

- By Drilling Type: The market is segmented by drilling type into rotary drilling, percussion drilling, cable tool drilling, and reverse circulation drilling. Rotary drilling dominates the market share due to its efficiency in reaching deep aquifers and the ability to operate in challenging geological conditions. The use of advanced rotary rigs in both urban and rural drilling projects has made it the preferred choice, particularly in regions like the Eastern Province, where deep wells are essential to access groundwater.

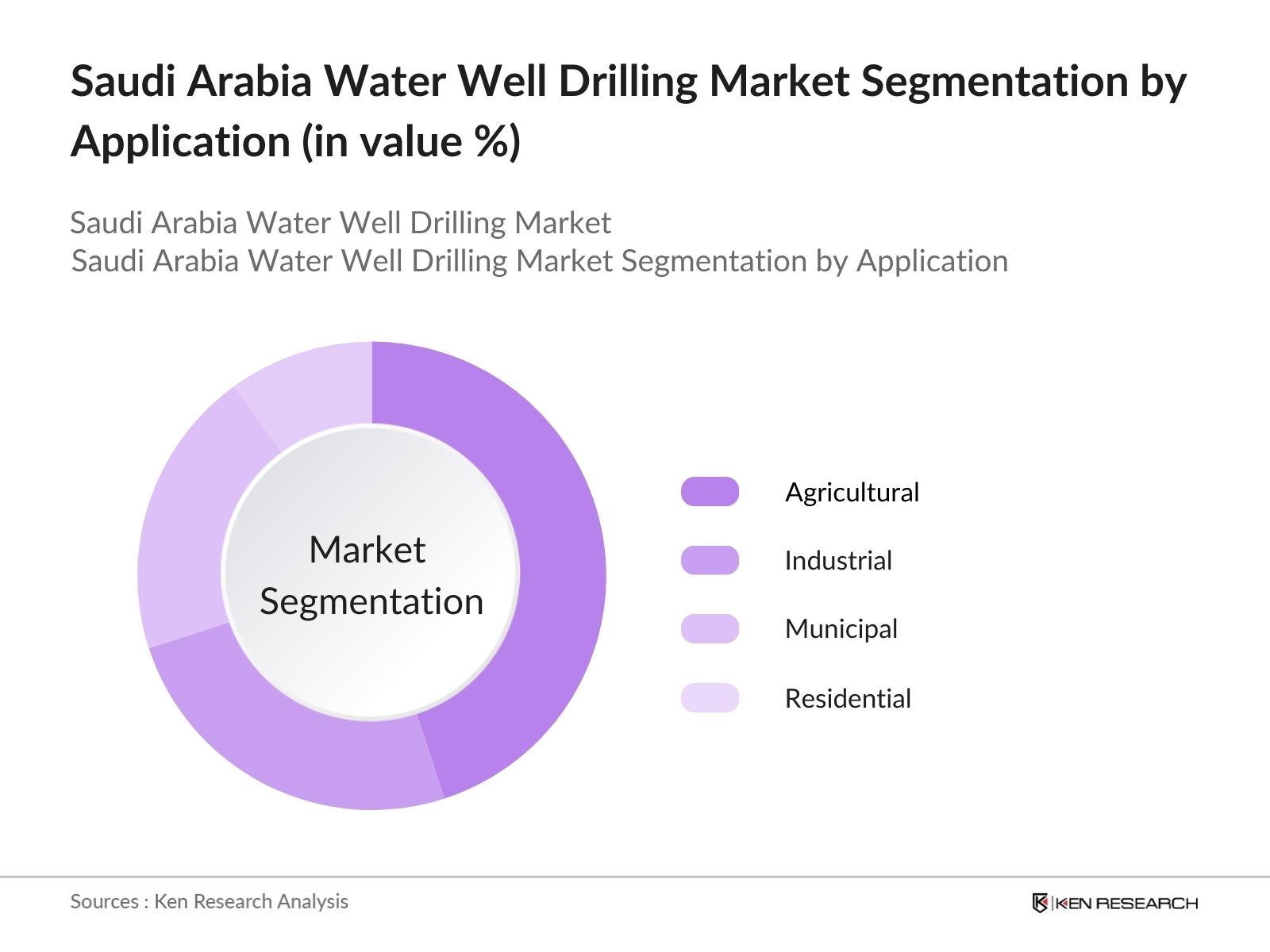

- By Application: The market is further segmented by application into agricultural, industrial, municipal, and residential. The agricultural sector dominates the market, driven by Saudi Arabia's focus on achieving food security through increased irrigation of crops. With limited surface water resources, deep well drilling for irrigation has become vital, especially in the country's rural areas where farming is extensive. Municipal use also holds a share, particularly in urban areas where well drilling is necessary to meet the rising demand for potable water.

Saudi Arabia Water Well Drilling Market Competitive Landscape

The Saudi Arabia water well drilling market is dominated by both local and international companies that specialize in various aspects of well drilling services. Major players include Saudi Aramcos Well Services Division, which has expertise in deep well drilling, and companies like Baker Hughes and Schlumberger, which bring advanced drilling technologies and methodologies to the market. Local companies like Arabian Drilling Company also play a crucial role, leveraging their regional expertise and market presence.

|

Company Name |

Establishment Year |

Headquarters |

Fleet Size |

Well Depth Capacity |

Employees |

|

Saudi Aramco (Well Services) |

1933 |

Dhahran, Saudi Arabia |

|||

|

Baker Hughes |

1907 |

Houston, USA |

|||

|

Schlumberger |

1926 |

Paris, France |

|||

|

Arabian Drilling Company |

1964 |

Al Khobar, Saudi Arabia |

|||

|

Weatherford International |

1941 |

Houston, USA |

Saudi Arabia Water Well Drilling Industry Analysis

Market Growth Drivers

- Water Scarcity (Saudi Arabia's Average Annual Rainfall): Saudi Arabia faces extreme water scarcity, with an average annual rainfall of only 59 mm, making groundwater a crucial resource. The country heavily relies on aquifers, which supply 90% of its water needs. This low rainfall and high dependence on groundwater make water well drilling essential to secure water for domestic, industrial, and agricultural use. This demand is driven by population growth, which reached 35.5 million in 2023, increasing the strain on existing water resources. This ongoing scarcity underpins the need for consistent well drilling to meet water demand.

- Government Initiatives (Vision 2030, National Water Strategy): Saudi Arabias Vision 2030 outlines a comprehensive plan to manage its water resources sustainably. The National Water Strategy 2030 aims to reduce water consumption by improving efficiency in agricultural irrigation and groundwater usage. The Saudi government has allocated $53 billion to enhance water infrastructure, including groundwater management and drilling projects. The development of these water resources is a critical aspect of Vision 2030, ensuring the countrys water security amid the growing demand from various sectors.

- Agricultural Expansion (Increased Irrigation Demand): Agriculture is a major water consumer in Saudi Arabia, with 80% of water usage going to irrigation. In 2022, the country utilized 17.8 billion cubic meters of water for agriculture. The Saudi government has supported the expansion of the agricultural sector, especially in arid regions, requiring enhanced water well drilling efforts to meet irrigation needs. The cultivation of crops in water-intensive farming projects has led to increased pressure on groundwater resources, further driving demand for drilling wells to supply irrigation water.

Market Challenges

- High Drilling Costs (Cost per Meter Drilled): The cost of water well drilling in Saudi Arabia can vary based on geological conditions and depth. On average, the cost per meter drilled ranges between SAR 250-400. The deep aquifers in the country often require drilling to depths of 200 meters or more, resulting in substantial costs. This is a challenge, especially in rural areas, where the financial burden of drilling can limit access to groundwater, making water well drilling a financially intensive task for both government and private investors.

- Environmental Regulations (Water Conservation Laws): Saudi Arabia has implemented strict water conservation laws as part of its National Water Strategy, which regulates the extraction of groundwater. The government enforces caps on groundwater extraction to preserve aquifers, with penalties for excessive drilling. These regulations limit the number of wells that can be drilled annually, affecting companies in the water well drilling market. In 2023, the Saudi government introduced additional policies to curb illegal drilling activities, reinforcing the importance of adhering to environmental standards.

Saudi Arabia Water Well Drilling Market Future Outlook

Over the next five years, the Saudi Arabia water well drilling market is poised for steady growth, driven by continued government investments in water infrastructure, agricultural projects, and urban development. With groundwater being the primary source of water for many regions, the demand for well drilling services is expected to remain robust. Advancements in drilling technologies, such as automated drilling systems, and increased environmental sustainability measures are likely to influence the market's trajectory, offering opportunities for both local and international players.

Future Market Opportunities

- Technological Innovations (Use of Advanced Drilling Technologies): The use of advanced drilling technologies, such as rotary drilling rigs and horizontal drilling techniques, has gained momentum in Saudi Arabia. These innovations allow for deeper and more efficient access to aquifers, reducing the time and cost associated with drilling. In 2024, the Saudi government began promoting the use of AI and IoT in well-drilling operations, aiming to improve the precision and efficiency of water extraction. These technological advancements offer opportunities for growth by enhancing the sustainability of water well operations.

- Public-Private Partnerships (Government Contracts and Private Investment): Saudi Arabia's government has increasingly relied on public-private partnerships (PPPs) to address its water supply challenges. In 2023, the government signed contracts with several private companies to expand well drilling operations in rural areas, offering lucrative investment opportunities. The PPP model, supported by government funding and private expertise, allows for more efficient allocation of resources and rapid infrastructure development. This trend is expected to continue, providing growth potential for companies in the water well drilling market.

Scope of the Report

|

By Drilling Type |

Rotary Drilling Percussion Drilling Cable Tool Drilling Reverse Circulation Drilling |

|

By Well Type |

Deep Wells Shallow Wells |

|

By Application |

Agricultural Industrial Municipal Residential |

|

By Drilling Equipment |

Drill Bits Drilling Rigs Drill Pipes |

|

By Region |

North East West South |

Products

Key Target Audience

Government and Regulatory Bodies (National Water Company, Ministry of Environment, Water and Agriculture)

Water Well Drilling Equipment Manufacturers

Water Resource Management Companies

Agriculture Corporations

Construction and Real Estate Developers

Private Well Drilling Contractors

Investor and Venture Capitalist Firms

Banks and Financial Institutes

Environmental and Sustainability Consultancies

Companies

Major Players in the Saudi Arabia Water Well Drilling Market

Saudi Aramco (Well Services Division)

Baker Hughes

Schlumberger

Weatherford International

Arabian Drilling Company

Nabors Industries

Ensign Energy Services

Halliburton

Saudi Drill

Almar Water Solutions

Petrofac

Oilfields Supply Center Limited

Arabian Rockbits & Drilling Tools (ARDT)

ADNOC Drilling

Taqa Well Services

Table of Contents

1. Saudi Arabia Water Well Drilling Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Saudi Arabia Water Well Drilling Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Saudi Arabia Water Well Drilling Market Analysis

3.1. Growth Drivers

- Water Scarcity (Saudi Arabia's average annual rainfall)

- Government Initiatives (Vision 2030, National Water Strategy)

- Agricultural Expansion (Increased irrigation demand)

3.2. Market Challenges - High Drilling Costs (Cost per meter drilled)

- Environmental Regulations (Water conservation laws)

- Technical Challenges (Complex geological formations)

3.3. Opportunities - Technological Innovations (Use of advanced drilling technologies)

- Public-Private Partnerships (Government contracts and private investment)

- Increased Demand in Rural Areas (Population growth in underserved regions)

3.4. Trends - Adoption of Sustainable Drilling Practices (Reduction in water wastage)

- Increased Automation (Use of AI and IoT in drilling equipment)

- Integration with Smart Water Management Systems

3.5. Government Regulations - National Water Strategy

- Groundwater Management Policies

- Environmental Impact Assessments

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis - Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Industry Rivalry

3.9. Competitive Ecosystem

4. Saudi Arabia Water Well Drilling Market Segmentation

4.1. By Drilling Type (In Value %)

- Rotary Drilling

- Percussion Drilling

- Cable Tool Drilling

- Reverse Circulation Drilling

4.2. By Well Type (In Value %) - Deep Wells

- Shallow Wells

4.3. By Application (In Value %) - Agricultural

- Industrial

- Municipal

- Residential

4.4. By Drilling Equipment (In Value %) - Drill Bits

- Drilling Rigs

- Drill Pipes

4.5. By Region (In Value %) - North

- East

- West

- South

5. Saudi Arabia Water Well Drilling Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

- Halliburton

- Baker Hughes

- Schlumberger

- Weatherford International

- Arabian Drilling Company

- Saudi Drill

- Nabors Industries

- Ensign Energy Services

- Almar Water Solutions

- Saudi Aramco (Well Services Division)

- Kingdom Water Company

- Oilfields Supply Center Limited

- Arabian Rockbits & Drilling Tools (ARDT)

- Petrofac

- ADNOC Drilling

5.2. Cross Comparison Parameters (Revenue, Employee Count, Well Depth Capacity, Operational Footprint, Fleet Size, Technology Utilization, Sustainability Initiatives, Ownership Type)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Contracts and Private Partnerships

5.8. Foreign Direct Investments (FDI)

5.9. Technological Innovations in the Drilling Industry

6. Saudi Arabia Water Well Drilling Market Regulatory Framework

6.1. Water Well Permits and Licensing

6.2. Groundwater Usage Regulations

6.3. Environmental and Sustainability Compliance

6.4. Labor and Safety Regulations

7. Saudi Arabia Water Well Drilling Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Saudi Arabia Water Well Drilling Future Market Segmentation

8.1. By Drilling Type (In Value %)

8.2. By Well Type (In Value %)

8.3. By Application (In Value %)

8.4. By Drilling Equipment (In Value %)

8.5. By Region (In Value %)

9. Saudi Arabia Water Well Drilling Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Market Entry Strategies

9.3. Customer Cohort Analysis

9.4. White Space Opportunity Analysis

9.5. Strategic Investment Areas

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved identifying critical stakeholders within the Saudi Arabia Water Well Drilling Market ecosystem, including government bodies, private drilling contractors, and equipment manufacturers. Comprehensive secondary research was conducted through credible databases, including government sources and industry reports, to map the key drivers and inhibitors of the market.

Step 2: Market Analysis and Construction

This phase included the collection of historical data pertaining to water well drilling activities across Saudi Arabia. Key metrics such as well depth capacities, market penetration rates, and annual growth trends were analyzed using proprietary models. Additionally, an assessment of equipment utilization and the volume of groundwater extracted was conducted to support revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through consultations with industry experts, including drilling equipment suppliers and operators, using structured interviews and CATI methods. These insights were used to cross-verify the data collected during desk research.

Step 4: Research Synthesis and Final Output

In the final phase, the data collected from both primary and secondary research was synthesized to produce a comprehensive report. This included a detailed analysis of market segments, competitive landscape, and future projections, ensuring the reports accuracy and relevance to industry stakeholders.

Frequently Asked Questions

01. How big is the Saudi Arabia Water Well Drilling Market?

The Saudi Arabia water well drilling market is valued at USD 122 million, driven by increasing urbanization, agricultural demand, and government investments in water infrastructure.

02. What are the challenges in the Saudi Arabia Water Well Drilling Market?

Key challenges in Saudi Arabia water well drilling market include high drilling costs, complex geological formations, and stringent environmental regulations aimed at groundwater conservation.

03. Who are the major players in the Saudi Arabia Water Well Drilling Market?

Major players in Saudi Arabia water well drilling market include Saudi Aramco (Well Services Division), Baker Hughes, Schlumberger, Arabian Drilling Company, and Weatherford International.

04. What are the growth drivers of the Saudi Arabia Water Well Drilling Market?

The Saudi Arabia water well drilling market is propelled by government initiatives like Vision 2030, increasing agricultural activities, and the expansion of urban infrastructure.

05. What are the latest trends in the Saudi Arabia Water Well Drilling Market?

Key trends in Saudi Arabia water well drilling market include the adoption of automated drilling technologies, sustainability-driven practices, and the integration of smart water management systems to optimize groundwater usage.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.