USA Automotive Aftermarket Industry Outlook to 2030

Region:North America

Author(s):Shubham Kashyap

Product Code:KROD7924

December 2024

81

About the Report

USA Automotive Aftermarket Industry Overview

- The USA Automotive Industry Market, valued at USD 208 billion, is primarily driven by an expanding vehicle fleet and increased average vehicle lifespan, which together contribute to consistent demand for replacement parts, maintenance services, and performance upgrades. Key product categories, such as replacement parts and accessories, dominate due to their essential role in vehicle functionality and customization. Additionally, a shift toward digital retailing channels has enhanced consumer access to aftermarket products, while sustainable practices in manufacturing have started gaining traction as environmentally conscious consumers seek eco-friendly options.

- California, Texas, and Florida are key regions that command a substantial share of the market, supported by their high vehicle populations, urban density, and extensive network of independent repair shops. These states experience heightened demand due to well-developed infrastructure and a thriving culture around vehicle maintenance and customization. Moreover, favorable weather conditions, combined with large commuting populations, bolster the need for regular vehicle upkeep, making these regions central to market growth in the USA Automotive Aftermarket.

- Federal regulations mandate that safety-critical components like brakes and airbags meet strict safety standards. These regulations affect both the quality and manufacturing processes of aftermarket parts, ensuring they provide adequate performance and safety comparable to OEM components, enhancing the reliability of aftermarket options. Additionally, the U.S. requires all aftermarket components impacting emissions to meet strict standards, particularly for exhaust and catalytic systems.

USA Automotive Aftermarket Industry Segmentation

- By Product Type: The market is segmented by product type into replacement parts, accessories, lubricants and fluids, and diagnostic and repair tools. Among these, replacement parts lead the market share, largely due to the need for consistent maintenance of aging vehicles and high-quality replacements. Popular brands such as AutoZone and Advance Auto Parts dominate this segment, maintaining a strong foothold through a broad selection of essential components, from brake pads to batteries, that meet consumer demand for quality and reliability.

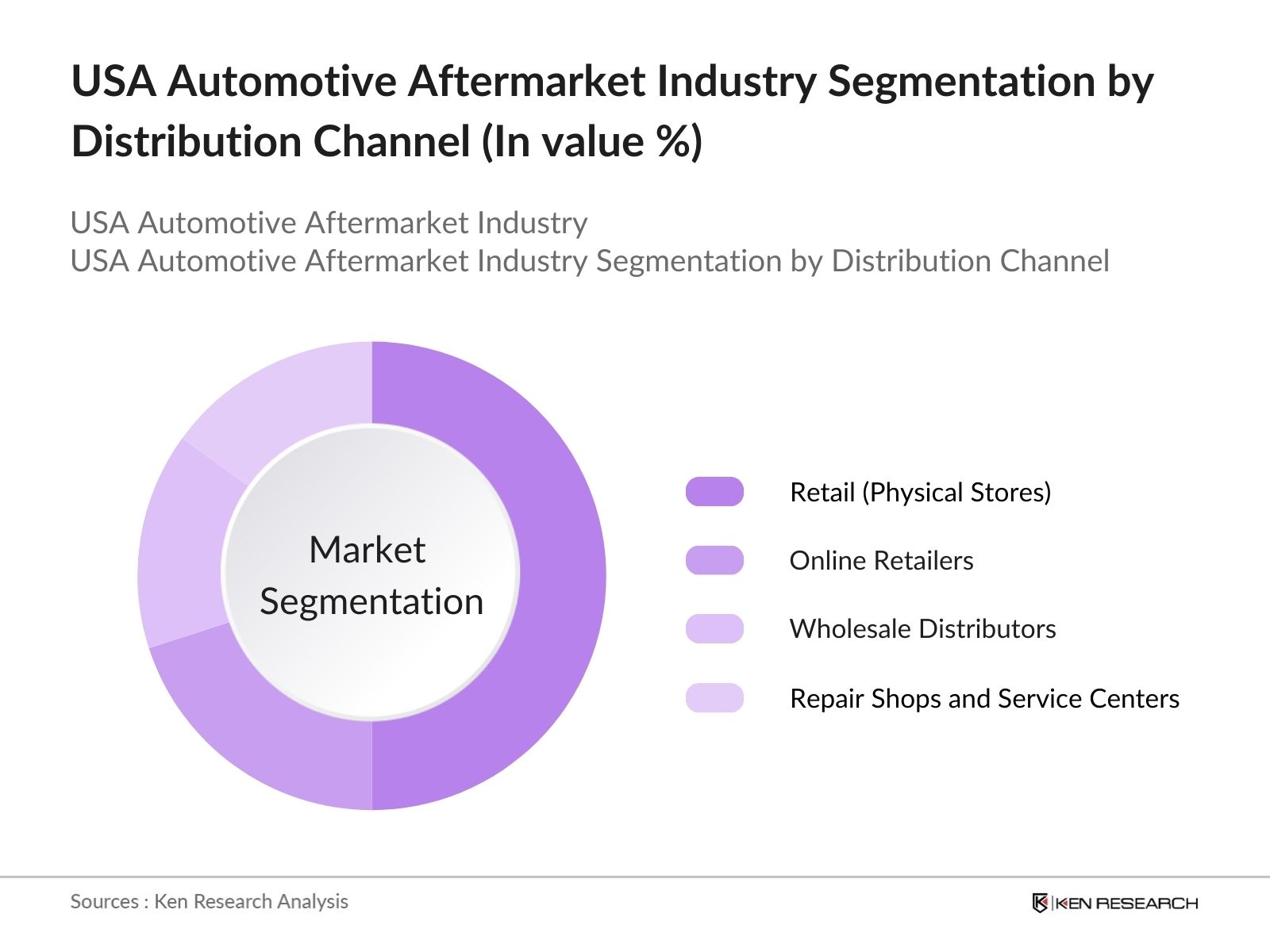

- By Distribution Channel: Distribution is divided among retail (physical stores), online retailers, wholesale distributors, and repair shops and service centers. Retail stores maintain the highest market share as they offer expert guidance, hands-on product testing, and immediate purchase options. However, online retail is rapidly gaining momentum as consumers value the convenience of browsing extensive catalogs and benefiting from competitive pricing, especially among younger, digitally-inclined consumers.

USA Automotive Aftermarket Industry Competitive Landscape

The USA Automotive Aftermarket is dominated by well-established players, including AutoZone, Advance Auto Parts, and O’Reilly Auto Parts, which leverage brand recognition, extensive distribution networks, and digital innovation to secure a competitive edge. These companies invest significantly in R&D, focusing on durable products, e-commerce platforms, and customer loyalty programs to align with evolving consumer expectations.

|

USA Automotive Aftermarket Industry Analysis

Growth Drivers

- Increase in Vehicle Ownership: The U.S. automotive fleet has been steadily growing, with over 280 million registered vehicles as of 2023. This increase, driven by the consistent demand for new and used vehicles, directly impacts aftermarket needs, particularly in maintenance, repairs, and part replacements. The extensive fleet requires regular servicing, supporting aftermarket services like tire replacements and engine part repairs, especially as the average vehicle age now exceeds 12.2 years. The fleet expansion drives higher demand for aftermarket services, helping maintain the market's resilience even as vehicle technology evolves.

- Rising Popularity of E-commerce Platforms: The digital shift in the automotive aftermarket has led to increased online sales, especially for DIY parts. Over majority of DIY consumers now purchase aftermarket parts online, driven by convenience and competitive pricing. Online platforms enable access to various parts, from general maintenance to advanced automotive accessories. This trend is reinforced by the rapid expansion of digital cataloging by manufacturers, facilitating consumer access to necessary parts. The e-commerce boom in aftermarket parts indicates a strong shift towards digital-first consumer behavior in the industry?.

- Consumer Preference Shift to Aftermarket Parts: U.S. consumers are increasingly favoring aftermarket parts for maintenance due to their availability, cost-effectiveness, and compatibility with both new and aging vehicles. OEM alternatives have become more common among the aging vehicle fleet, which has grown noteably since 2020, pushing up the demand for replacement parts and accessories. The trend is further supported by retail outlets and online platforms like Amazon and eBay, which enable consumers to access aftermarket options easily. This shift is solidifying aftermarket parts' role in the U.S. market, helping to diversify choices for vehicle owners.

Challenges

- Quality Control Concerns: The influx of aftermarket parts has highlighted concerns over product quality, with a major portion of U.S. consumers reporting issues with non-certified parts in 2023. Quality control varies across manufacturers, impacting customer trust and potentially reducing the lifespan of critical vehicle components. This inconsistency underscores the need for stringent regulatory oversight, especially in critical parts like brakes and lighting systems, which could directly impact vehicle safety?.

- Price Competition Among Parts Manufacturers: Intense price competition in the U.S. aftermarket sector has pressured suppliers to reduce costs, often compromising quality to maintain margins. Smaller players and international manufacturers have intensified competition by offering lower-cost parts, which, while affordable, may lack durability. This competition reduces profitability across the industry, challenging suppliers to balance cost efficiency with quality assurance to retain consumer trust?

USA Automotive Aftermarket Industry Future Outlook

The USA Automotive Aftermarket Market is set to experience robust growth through 2028, driven by a focus on vehicle maintenance, technological innovations, and a shift toward sustainable products. Companies are expected to expand their digital offerings and introduce eco-friendly products to align with consumer preferences. Additionally, investments in high-tech diagnostic tools and electric vehicle (EV) components will open new avenues for growth, addressing the evolving needs of vehicle owners in a rapidly changing market.

Future Market Opportunities

- Expansion of Digital Platforms: Digital platforms represent a growth opportunity, with aftermarket e-commerce sales seeing a remarkable increase from 2022 to 2023. Online sales enable manufacturers to reach a broader consumer base directly, bypassing traditional retail channels. Innovations in digital cataloguing, which simplifies part selection for consumers, are also expanding the reach of both DIY and DIFM services, catering to growing consumer demand for convenient, accessible parts?.

- Demand for Electric Vehicle (EV) Parts: The rising adoption of electric vehicles (EVs) in the U.S., with nearly 1.4 million EVs on the road as of 2023, opens a new avenue for aftermarket growth. Specific EV replacement parts, including batteries and specialized electronics, are seeing heightened demand. As EVs become more mainstream, aftermarket suppliers have the opportunity to diversify into EV-specific offerings to capture this expanding segment.

Scope of the Report

|

By Product Type |

Replacement Parts Accessories Lubricants and Fluids Diagnostics and Repair Tools |

|

By Distribution Channel |

Retail (Physical Stores) Online Sales Wholesale Distributors Repair Shops and Service Centers |

|

By Vehicle Type |

Passenger Vehicles Light Commercial Vehicles Heavy-Duty Vehicles |

|

By Service Provider Type |

Dealerships Independent Repair Shops Specialty Repair Services |

|

By Region |

Northeast Midwest South West |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Environmental Protection Agency, Department of Transportation)

Automotive Parts Manufacturers

Retail and Wholesale Distributors

E-commerce Platforms

Independent Repair Shops

Automotive Dealerships

Companies

Players Mentioned in the Report

AutoZone Inc.

Advance Auto Parts

OReilly Auto Parts

Genuine Parts Company (NAPA)

LKQ Corporation

Denso Corporation

Continental AG

Tenneco Inc.

Bridgestone Corporation

Michelin North America Inc.

Cooper Tire & Rubber Company

Delphi Automotive

ZF Friedrichshafen AG

Valeo North America, Inc.

Robert Bosch LLC

Table of Contents

01 USA Automotive Aftermarket Industry Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

02 USA Automotive Aftermarket Industry Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Milestones and Developments

03 USA Automotive Aftermarket Industry Analysis

3.1 Growth Drivers

- Vehicle Fleet Expansion

- Consumer Preference Shift to Aftermarket Parts

- Increasing Vehicle Longevity

- Rising e-Commerce Penetration

3.2 Market Challenges

- Quality Control Concerns

- Price Competition Among Parts Manufacturers

- Regulatory Standards

3.3 Opportunities

- Expansion of Digital Platforms

- Demand for Electric Vehicle (EV) Parts

- Increasing DIY Trend Among Consumers

3.4 Trends

- Shift Towards eCommerce Platforms

- Growth in Sustainable and Recyclable Parts

- Rise of Autonomous Vehicle Aftermarket Services

3.5 Regulatory Landscape

- Emission Standards Compliance

- Federal Safety Standards for Parts

- Import Regulations for Foreign Parts

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

04 USA Automotive Aftermarket Industry Segmentation

4.1 By Product Type (In Value %)

- Replacement Parts

- Accessories

- Lubricants and Fluids

- Diagnostics and Repair Tools

4.2 By Distribution Channel (In Value %)

- Retail (Physical Stores)

- Online Sales

- Wholesale Distributors

- Repair Shops and Service Centers

4.3 By Vehicle Type (In Value %)

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy-Duty Vehicles

4.4 By Service Provider Type (In Value %)

- Dealerships

- Independent Repair Shops

- Specialty Repair Services

4.5 By Region (In Value %)

- Northeast

- Midwest

- South

- West

05 USA Automotive Aftermarket Industry Competitive Analysis

5.1 Detailed Profiles of Major Companies

- AutoZone Inc.

- Advance Auto Parts

- OReilly Auto Parts

- Genuine Parts Company (NAPA)

- LKQ Corporation

- Robert Bosch LLC

- Denso Corporation

- Continental AG

- Tenneco Inc.

- Bridgestone Corporation

- Michelin North America Inc.

- Cooper Tire & Rubber Company

- Delphi Automotive

- ZF Friedrichshafen AG

- Valeo North America, Inc.

5.2 Cross Comparison Parameters (Revenue, Headquarters, Number of Stores, Digital Platform Engagement, R&D Investment, Market Reach, Key Product Categories, Customer Loyalty Programs)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Partnerships and Alliances

06 USA Automotive Aftermarket Industry Regulatory Framework

6.1 Environmental Protection Agency (EPA) Standards

6.2 Department of Transportation (DOT) Safety Requirements

6.3 State-Level Emission Standards

6.4 Import and Export Regulations

6.5 Licensing and Certification Standards

07 USA Automotive Aftermarket Industry Future Market Size (In USD Bn)

7.1 Projected Market Size

7.2 Key Drivers for Future Market Expansion

08 USA Automotive Aftermarket Future Industry Segmentation

8.1 By Product Type

8.2 By Distribution Channel

8.3 By Vehicle Type

8.4 By Service Provider Type

8.5 By Region

09 USA Automotive Aftermarket Industry Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segment Analysis

9.3 Strategic Growth Initiatives

9.4 Identification of Untapped Market Opportunities

Research Methodology

Step 1: Identification of Key Variables

A comprehensive ecosystem map was developed to encompass major stakeholders in the USA Automotive Aftermarket. Secondary research from proprietary databases provided an initial understanding of market dynamics and variables impacting the sector.

Step 2: Market Analysis and Construction

This phase involved assessing historical data and market penetration, examining product segments, and evaluating the influence of retail and online channels to form an accurate revenue base. Analysis was refined through data on service quality statistics.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with automotive industry experts provided operational insights, validating primary hypotheses. These consultations ensured the datas relevance and accuracy in reflecting current industry trends.

Step 4: Research Synthesis and Final Output

Primary and secondary data were synthesized to ensure comprehensive insights. Direct engagement with product manufacturers contributed to a robust, verified analysis, addressing consumer preferences and sales performance comprehensively.

Frequently Asked Questions

01 How big is the USA Automotive Aftermarket Industry?

The USA Automotive Aftermarket Industry is valued at USD 208 billion, primarily driven by increased vehicle ownership, longer vehicle lifespans, and the expansion of digital sales channels.

02 What are the main growth drivers for the USA Automotive Aftermarket Industry ?

Growth drivers in the USA Automotive Aftermarket Industry include a large vehicle fleet, rising consumer interest in vehicle longevity, and a shift toward online shopping platforms that offer convenience and competitive pricing.

03 Which companies lead the USA Automotive Aftermarket Industry ?

Leading companies in the USA Automotive Aftermarket Industry include AutoZone, Advance Auto Parts, and OReilly Auto Parts, known for their extensive distribution networks and focus on customer service.

04 What are the challenges in the USA Automotive Aftermarket Industry ?

Challenges in the USA Automotive Aftermarket Industry include fluctuating raw material prices and supply chain disruptions, which impact the availability and pricing of aftermarket products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.