USA Crane Market Outlook to 2030

Region:North America

Author(s):Meenakshi Bisht

Product Code:KROD8519

December 2024

94

About the Report

USA Crane Market Overview

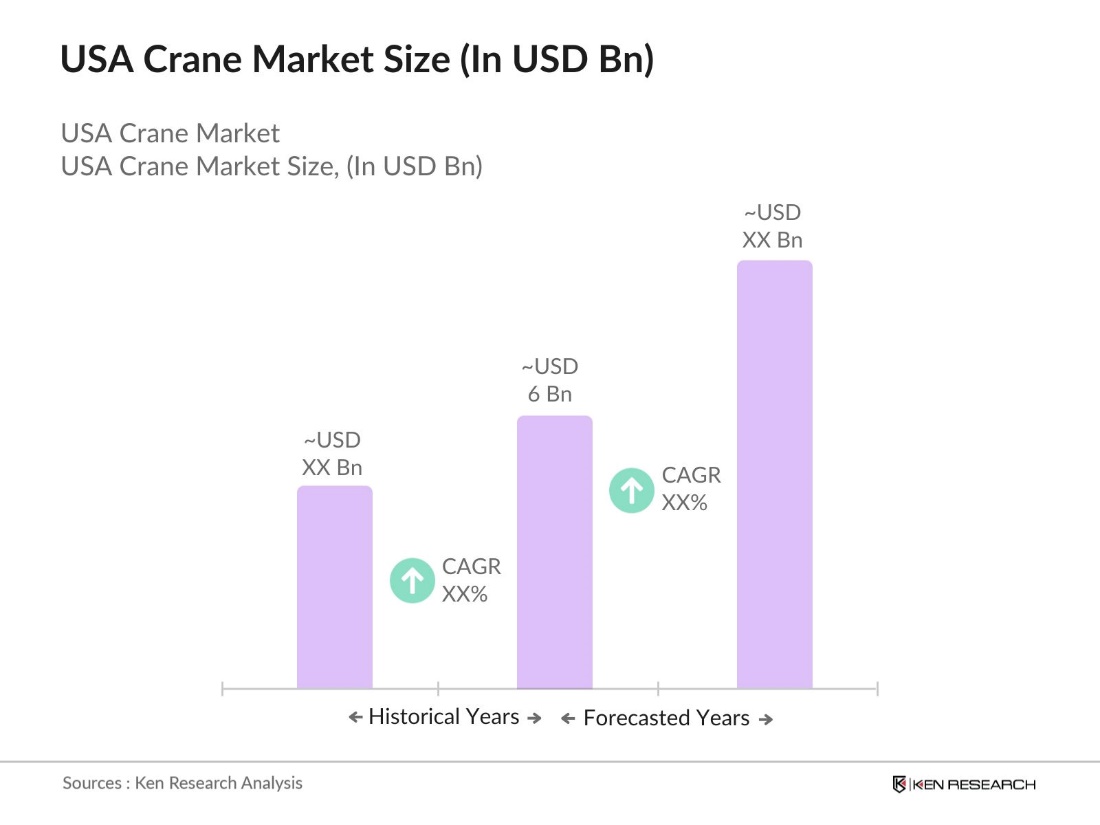

- The USA Crane Market is valued at USD 6 billion, driven by significant investments in construction projects, infrastructure upgrades, and the expansion of industries like renewable energy. The demand for high-capacity cranes is increasing, particularly for projects related to wind energy installations and urban development. The market also benefits from technological innovations, such as automated control systems that enhance operational efficiency and safety.

- The dominant regions in the USA Crane Market include Texas, California, and New York. Texas's leadership is driven by its robust oil and gas industry, which requires specialized heavy-lifting equipment. California, with its ongoing urban construction projects and port operations, necessitates a range of crane types, especially mobile cranes and overhead cranes. New York's dominance stems from its continuous skyscraper and commercial building projects, demanding high-capacity tower cranes for precision and efficiency in congested urban areas.

- OSHA's safety standards for crane operations require compliance with strict guidelines, including annual inspections and operator certifications. In 2024, OSHA has indeed intensified its emphasis on workplace safety, particularly in high-risk sectors like construction. This includes more frequent inspections in states with significant construction activity, such as Texas and Florida. The agency's initiatives aim to reduce workplace hazards and improve overall safety standards across various industries.

USA Crane Market Segmentation

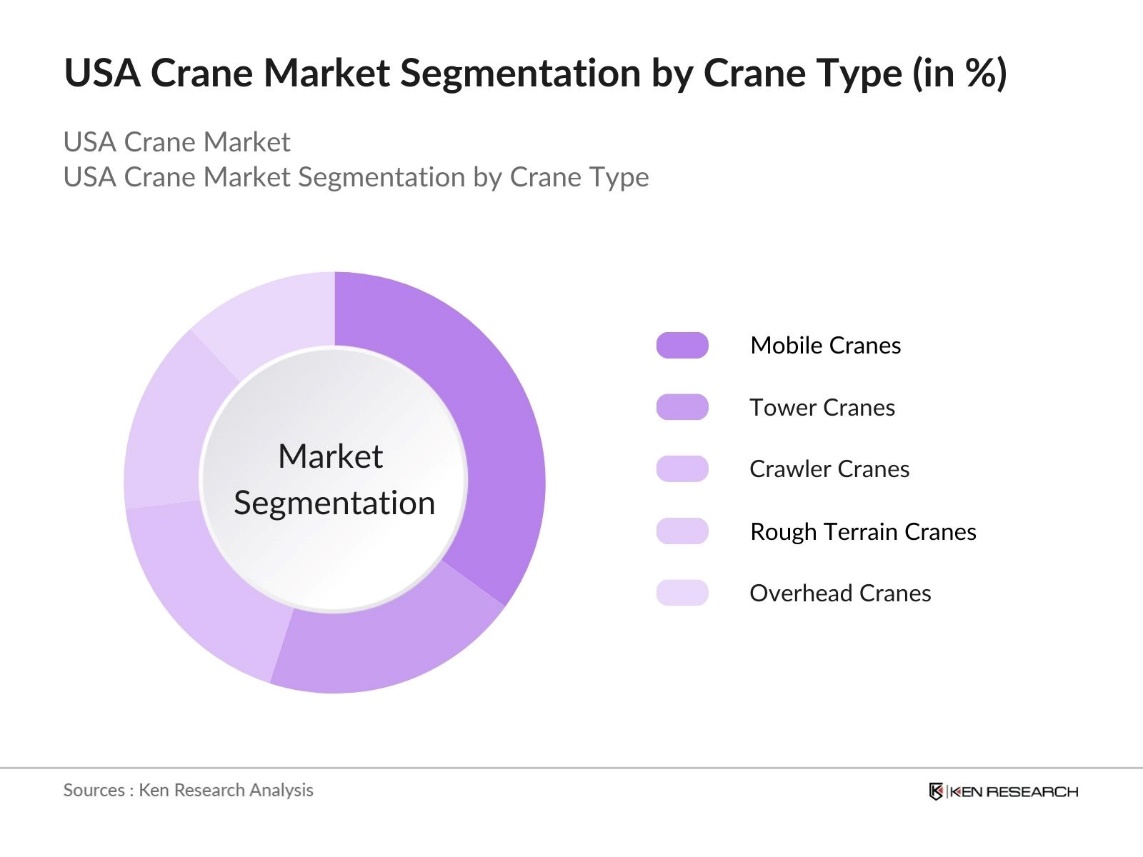

By Crane Type: The USA Crane Market is segmented by crane type into mobile cranes, tower cranes, crawler cranes, rough terrain cranes, and overhead cranes. Mobile cranes hold a dominant market share due to their versatility and mobility, making them ideal for a variety of construction and industrial applications. They are highly preferred for infrastructure projects where flexibility is crucial, such as in urban areas and on temporary project sites. The ease of transportation and setup also adds to the demand for mobile cranes across the country.

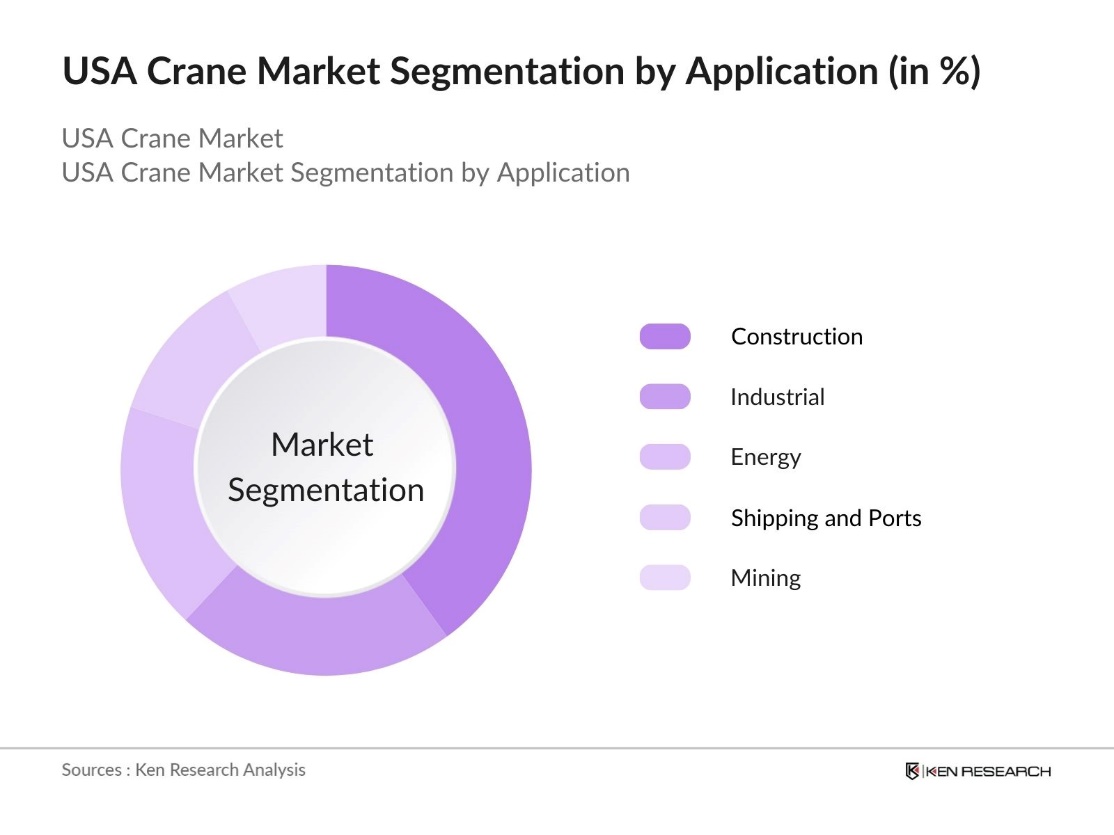

By Application: The USA Crane Market is segmented by application into construction, industrial, energy, shipping and ports, and mining. The construction segment leads the market, driven by the extensive demand for cranes in building skyscrapers, bridges, and commercial structures. The construction boom in urban centers, coupled with the rise of modular construction practices, has made cranes indispensable for lifting heavy materials and ensuring efficient project timelines. The demand is particularly strong for tower cranes in high-rise construction projects across major cities.

USA Crane Market Competitive Landscape

The market is characterized by the presence of both domestic and international manufacturers, with a few key players dominating through their extensive distribution networks, strong after-sales support, and continuous investment in technological advancements. These companies offer a wide range of products, from standard cranes to advanced models equipped with automation features, catering to diverse end-user needs.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

R&D Investment |

Global Reach |

Key Product Line |

Technological Focus |

Sustainability Initiatives |

|

Liebherr Group |

1949 |

Switzerland |

||||||

|

Manitowoc Company, Inc. |

1902 |

Wisconsin, USA |

||||||

|

Terex Corporation |

1933 |

Connecticut, USA |

||||||

|

Tadano Ltd. |

1948 |

Japan |

||||||

|

XCMG Group |

1989 |

China |

USA Crane Industry Analysis

Growth Drivers

- Infrastructure Development (Roadways, Bridges, Ports): The United States is heavily investing in infrastructure through a $1 trillion allocation under the Bipartisan Infrastructure Law (BIL), focusing on modernizing highways, enhancing bridges, and developing ports. This initiative aims to strengthen the nation's transportation and logistics framework. Such extensive projects require heavy lifting equipment like cranes, driving demand in the market and creating new employment opportunities within the construction sector, highlighting the essential role of cranes in supporting infrastructure growth.

- Increase in Urban Construction Projects: Urban construction has surged in major U.S. cities, with New York, Los Angeles, and Chicago witnessing significant development in residential and commercial spaces. As of August 2023, total construction spending in the U.S. was reported at approximately $1.98 trillion, reflecting a 7.4% increase from the previous year. The need for specialized cranes is driven by projects such as skyscraper developments in New York and Chicago.

- Expansion of Renewable Energy Sector (Wind Turbines): The expansion of the renewable energy sector, particularly in wind energy, is driving the demand for cranes capable of installing and maintaining wind turbines. As more wind power projects are developed, the need for large, high-capacity cranes has increased, especially in states that are key contributors to wind energy production. This trend underscores the growing role of specialized cranes in supporting renewable energy infrastructure projects.

Market Challenges

- High Initial Capital Costs (Crane Acquisition): Acquiring cranes involves a substantial upfront investment, presenting challenges for small and mid-sized construction firms. The high initial costs associated with purchasing heavy-duty cranes can limit access to this equipment, especially as financing for such capital expenditures remains restricted due to economic conditions. These financial barriers make it difficult for many businesses to invest in new equipment, impacting their ability to expand operations.

- Maintenance and Operational Costs: Cranes demand substantial ongoing expenditures for maintenance, including regular servicing, spare parts, and skilled labor. These costs can be particularly challenging for companies with large fleets, adding a considerable financial burden to crane ownership. The need for continuous upkeep to ensure operational efficiency further strains budgets, making it a significant factor in overall operational expenses for businesses that rely heavily on crane use.

USA Crane Market Future Outlook

Over the next five years, the USA Crane Market is expected to experience steady growth, driven by continued investments in infrastructure development, modernization of construction practices, and the adoption of advanced crane technologies. As the push for clean energy intensifies, the demand for cranes in the wind energy sector is projected to grow, especially for heavy-lifting applications. Additionally, the market will benefit from the increasing need for urban redevelopment projects, requiring precise and efficient lifting solutions.

Market Opportunities

- Technological Integration (IoT, AI): The integration of Internet of Things (IoT) and Artificial Intelligence (AI) in cranes presents new opportunities for the industry. IoT-enabled cranes can monitor operational status in real-time, aiding in predictive maintenance and reducing unexpected downtimes. AI algorithms enhance the precision of crane movements, improving efficiency in settings like automated warehouses and logistics centers. The growing adoption of these advanced technologies supports a more efficient and adaptable environment for crane operations.

- Rising Demand for Modular Construction Methods: Modular construction is becoming more popular in various regions of the U.S., involving offsite prefabrication of components. This approach requires cranes for assembling and installing these units on-site. The increased use of modular methods, especially in urban areas, is driving demand for cranes that can handle large, prefabricated sections, helping to streamline construction processes and reduce overall build times.

Scope of the Report

|

Crane Type |

Mobile Cranes Tower Cranes Crawler Cranes Rough Terrain Cranes Overhead Cranes |

|

Application |

Construction (Residential, Commercial) Industrial Energy (Wind, Oil & Gas) Shipping and Ports Mining |

|

Capacity |

Up to 20 Tons 20-50 Tons 50-100 Tons Above 100 Tons |

|

Technology |

Automated Control Systems Remote-Controlled Cranes Standard Cranes |

|

Region |

Northeast Midwest South West |

Products

Key Target Audience

Crane Manufacturers

Construction Companies

Renewable Energy Firms

Mining and Resources Companies

Government and Regulatory Bodies (e.g., Occupational Safety and Health Administration)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Liebherr Group

Manitowoc Company, Inc.

Terex Corporation

Tadano Ltd.

XCMG Group

SANY Group

Konecranes

Link-Belt Cranes

Kobelco Construction Machinery Co., Ltd.

Zoomlion Heavy Industry Science & Technology Co., Ltd.

Table of Contents

1. USA Crane Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Crane Types, Applications, Technology)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Crane Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Crane Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development (Roadways, Bridges, Ports)

3.1.2. Increase in Urban Construction Projects

3.1.3. Expansion of Renewable Energy Sector (Wind Turbines)

3.1.4. Advancements in Automation and Remote-Controlled Cranes

3.2. Market Challenges

3.2.1. High Initial Capital Costs (Crane Acquisition)

3.2.2. Maintenance and Operational Costs

3.2.3. Stringent Safety Regulations and Compliance

3.3. Opportunities

3.3.1. Technological Integration (IoT, AI)

3.3.2. Rising Demand for Modular Construction Methods

3.3.3. Growing Investments in Smart City Initiatives

3.4. Trends

3.4.1. Adoption of Electric and Hybrid Cranes

3.4.2. Emergence of Compact Mobile Cranes

3.4.3. Automation in Crane Operations

3.4.4. Expansion of Rental Services for Cranes

3.5. Government Regulations

3.5.1. Occupational Safety and Health Administration (OSHA) Standards

3.5.2. Environmental Protection Agency (EPA) Emission Guidelines

3.5.3. Incentives for Clean Energy Construction Projects

3.5.4. State-Specific Construction and Safety Regulations

3.6. SWOT Analysis

3.7. Value Chain Analysis (Manufacturing, Distribution, End-users)

3.8. Porters Five Forces Analysis

3.9. Market Competition Overview

4. USA Crane Market Segmentation

4.1. By Crane Type (In Value %)

4.1.1. Mobile Cranes (Truck-Mounted, All-Terrain)

4.1.2. Tower Cranes (Flat Top, Luffing Jib)

4.1.3. Crawler Cranes

4.1.4. Rough Terrain Cranes

4.1.5. Overhead Cranes

4.2. By Application (In Value %)

4.2.1. Construction (Residential, Commercial)

4.2.2. Industrial (Manufacturing, Warehousing)

4.2.3. Energy (Wind, Oil & Gas)

4.2.4. Shipping and Ports

4.2.5. Mining

4.3. By Capacity (In Value %)

4.3.1. Up to 20 Tons

4.3.2. 20-50 Tons

4.3.3. 50-100 Tons

4.3.4. Above 100 Tons

4.4. By Technology (In Value %)

4.4.1. Automated Control Systems

4.4.2. Remote-Controlled Cranes

4.4.3. Standard Cranes

4.5. By Region (In Value %)

4.5.1. Northeast

4.5.2. Midwest

4.5.3. South

4.5.4. West

5. USA Crane Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Liebherr Group

5.1.2. Manitowoc Company, Inc.

5.1.3. Terex Corporation

5.1.4. Tadano Ltd.

5.1.5. Link-Belt Cranes

5.1.6. Konecranes

5.1.7. Kobelco Construction Machinery Co., Ltd.

5.1.8. Zoomlion Heavy Industry Science & Technology Co., Ltd.

5.1.9. SANY Group

5.1.10. XCMG Group

5.1.11. Altec Industries, Inc.

5.1.12. Elliott Equipment Company

5.1.13. Palfinger AG

5.1.14. Grove Cranes

5.1.15. Sarens NV

5.2. Cross Comparison Parameters (Market Share, Production Capacity, Regional Presence, Product Range, Revenue, Technological Integration, After-Sales Services, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. Technology Collaborations

5.9. Competitive Landscape Mapping

6. USA Crane Market Regulatory Framework

6.1. Safety Standards and Compliance

6.2. Emission Regulations for Diesel-Powered Cranes

6.3. Licensing and Certification Requirements

6.4. Import and Export Regulations

7. USA Crane Market Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Crane Market Future Segmentation

8.1. By Crane Type (In Value %)

8.2. By Application (In Value %)

8.3. By Capacity (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. USA Crane Market Analysts Recommendations

9.1. Total Addressable Market (TAM) / Serviceable Available Market (SAM) / Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Segmentation and Buying Behavior

9.3. Strategic Positioning for Market Entry

9.4. Opportunity Analysis for Product Differentiation

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the USA Crane Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the USA Crane Market. This includes assessing market penetration, the ratio of end-users to service providers, and the resultant revenue generation. Furthermore, an evaluation of crane quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Sep 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple crane manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the USA Crane Market.

Frequently Asked Questions

01 How big is the USA Crane Market?

The USA Crane Market was valued at USD 6 billion, driven by the growth in the construction, industrial, and energy sectors, alongside advancements in crane technology.

02 What are the challenges in the USA Crane Market?

Challenges in USA Crane Market include high initial investment costs, stringent safety regulations, and the need for regular maintenance, which can increase operational expenses for crane operators.

03 Who are the major players in the USA Crane Market?

Key players in USA Crane Market include Liebherr Group, Manitowoc Company, Inc., Terex Corporation, Tadano Ltd., and XCMG Group, known for their robust product offerings and technological innovations.

04 What are the growth drivers of the USA Crane Market?

The USA Crane Market is propelled by ongoing infrastructure development projects, the rise in renewable energy installations, and technological advancements that enhance crane efficiency and safety.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.