USA Nutraceutical Products Market Outlook to 2030

Region:North America

Author(s):Sanjna Verma

Product Code:KROD508

July 2024

100

About the Report

USA Nutraceutical Products Market Overview

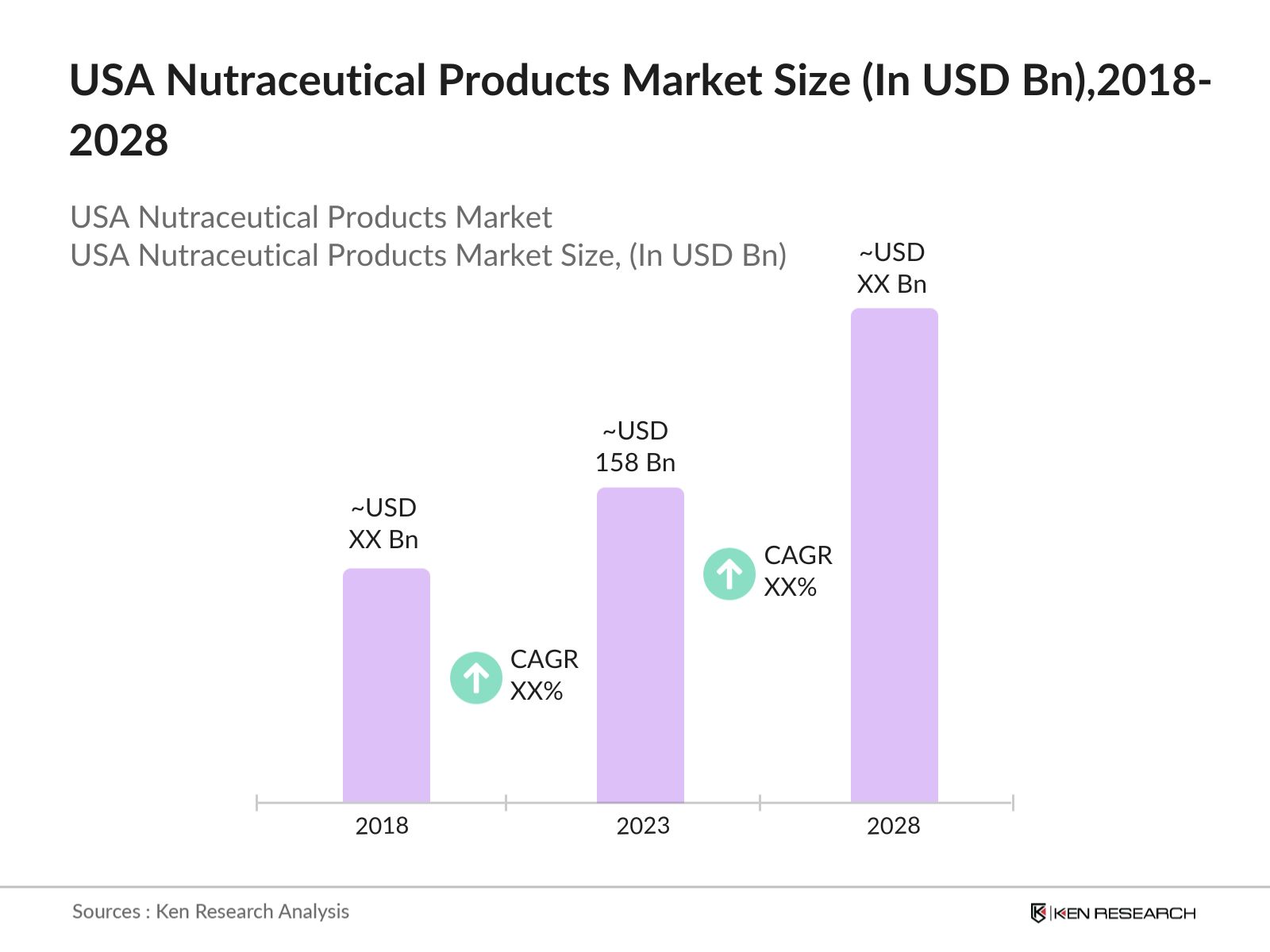

- USA Nutraceutical Products market was valued at USD 158 billion in 2023. The market is primarily driven by an increasing focus on health and wellness, rising consumer awareness regarding the benefits of nutraceuticals, and a growing aging population seeking preventative healthcare solutions.

- Key players in the USA Nutraceutical Products market include Abbott Laboratories, Amway, Herbalife Nutrition Ltd., Pfizer Inc., and General Mills Inc. These companies are leaders due to their extensive product portfolios, strong brand presence, and significant investments in research and development to innovate and improve their nutraceutical offerings.

- New York, Los Angeles, and Chicago are dominant cities in the USA Nutraceutical Products Market. These cities have high concentrations of health-conscious consumers and a robust presence of nutraceutical companies. The urban population in these cities has higher disposable incomes and greater access to health and wellness information, driving demand for premium nutraceutical products.

- The "Herbalife24 Achieve" Protein Bars launched in October 2022, as part of the Herbalife24 performance nutrition line. They are part of Herbalife24's seven-piece product range designed for everyone from gentle joggers to elite athletes This product line includes protein bars and powders designed for athletes and active individuals, providing high-protein options to meet their nutritional needs.

USA Nutraceutical Products Market Segmentation

The USA Nutraceutical Products market can be segmented based on several factors:

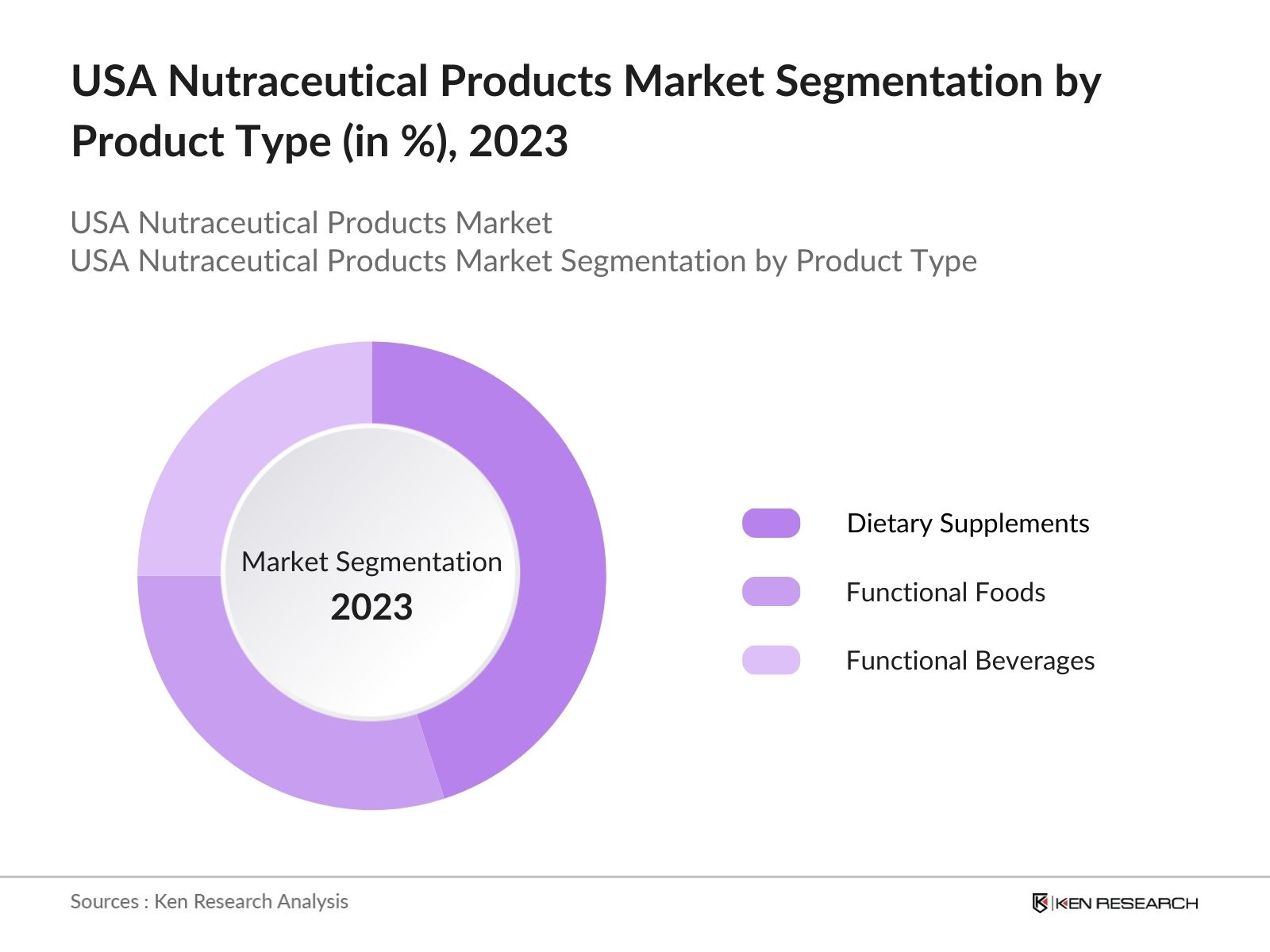

By Product Type: USA Nutraceutical Products Market is segmented by Product Type into Dietary Supplements, Functional Foods & Functional Beverages. In 2023, Dietary Supplements reign as the most dominant sub-segment. This dominance is attributed to the increasing awareness about the benefits of vitamins, minerals, and other dietary supplements in maintaining overall health and managing chronic conditions.

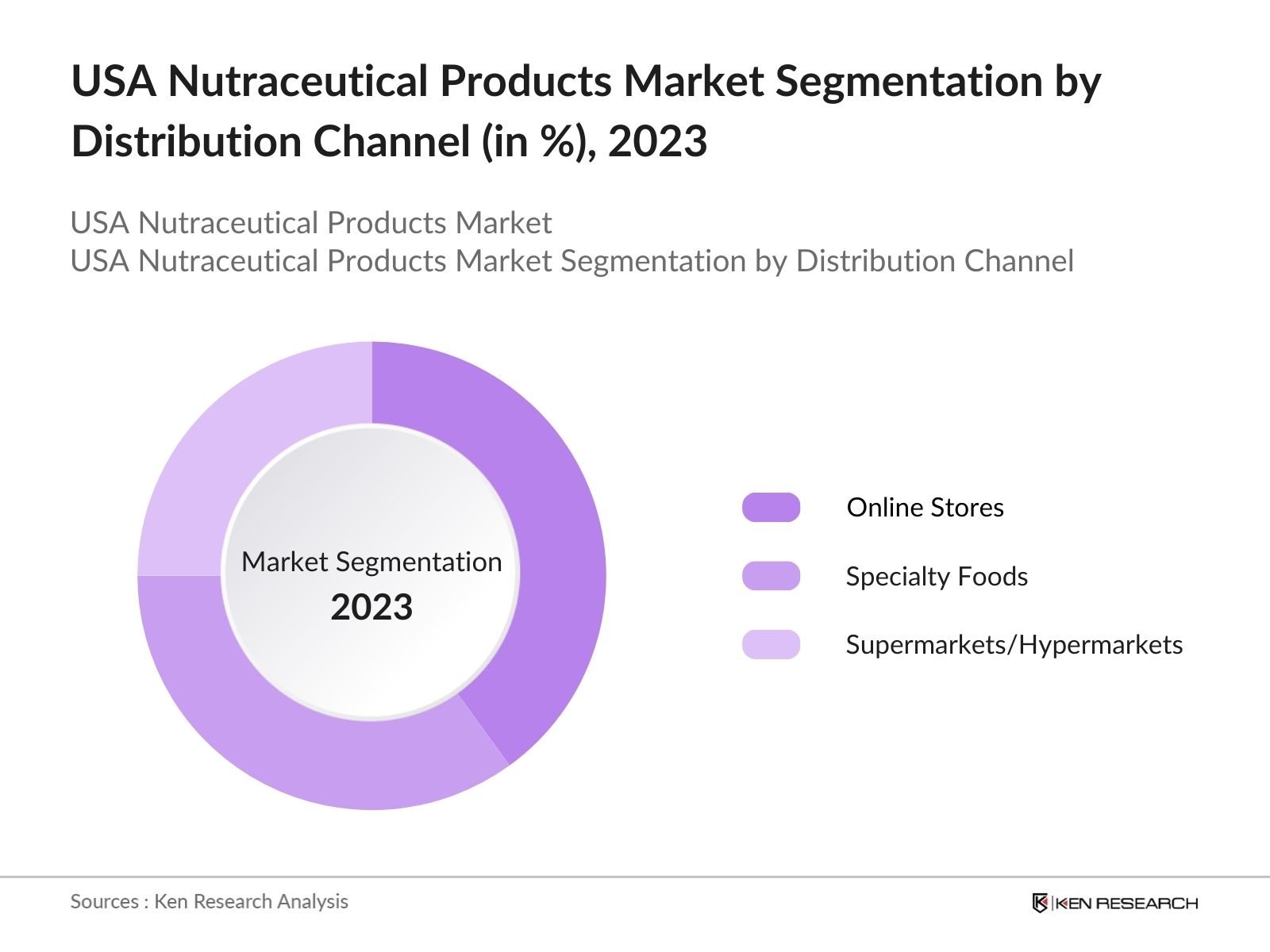

By Distribution Channel: USA Nutraceutical Products Market is segmented by Distribution Channel into Online Stores, Specialty Stores & Supermarkets/Hypermarkets. In 2023, online stores emerge as the most dominant sub-segment. The convenience of purchasing nutraceutical products online, coupled with the availability of a wider range of products and detailed product information, drives this segment's growth.

By Region: USA Nutraceutical Products market is segmented by region into North, South, East & West. In 2023, the west region prevails to its high concentration of health-conscious consumers and a strong presence of nutraceutical manufacturers and distributors. The region's progressive attitude towards health and wellness, coupled with higher disposable incomes, contributes significantly to the market's growth in this area.

USA Nutraceutical Products Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Abbott Laboratories |

1888 |

Chicago, Illinois |

|

Amway |

1959 |

Ada, Michigan |

|

Herbalife Nutrition |

1980 |

Los Angeles, California |

|

Pfizer Inc. |

1849 |

New York, New York |

|

General Mills Inc. |

1866 |

Minneapolis, Minnesota |

- Protality by Abbott Laboratories: In 2024, Abbott Laboratories launched its new PROTALITY brand, introducing a high-protein nutrition shake designed to support adults pursuing weight loss while maintaining muscle mass and good nutrition. The Protality shake contains 30 grams of high-quality protein per 150 calories serving to help preserve muscle.

- Herbalife Nutrition: In 2024, Herbalife and the Herbalife Family Foundation have committed $1 million to the World Food Program USA, specifically aimed at supporting women-led agribusiness in Colombia. This initiative reflects the company's dedication to social responsibility and community support. The funding is intended to enhance food security and empower women in the agricultural sector.

USA Nutraceutical Products Industry Analysis

USA Nutraceutical Products Market Growth Drivers:

- Increasing Health Awareness: The rising awareness about health and wellness among American consumers continues to be a significant growth driver for the nutraceutical products market. Adults in the USA are increasingly concerned about their health, leading to a higher consumption of dietary supplements and functional foods. The shift towards preventive healthcare and the desire to maintain a healthy lifestyle are encouraging consumers to invest more in nutraceutical products.

- Aging Population: In 2022, 58 million adults aged 65 and older were in the U.S., accounting for 17.3% of the nation's population. This demographic is more likely to suffer from chronic diseases and hence, seeks nutraceuticals for their preventive and therapeutic benefits, thereby boosting market demand.

- Rising Prevalence of Chronic Diseases: In USA, about 130 million people have at least 1 major chronic disease including heart disease, cancer, diabetes, obesity, and hypertension. Nutraceutical products, which offer health benefits beyond basic nutrition, are being increasingly adopted as part of disease management and prevention strategies.

USA Nutraceutical Products Market Challenges:

- Regulatory Hurdles: Navigating the complex regulatory landscape poses a significant challenge for nutraceutical companies. The U.S. Food and Drug Administration (FDA) imposes stringent regulations to ensure the safety and efficacy of nutraceutical products. Compliance with these regulations requires substantial investment in testing and documentation, which can be a barrier for small and medium-sized enterprises (SMEs) in the industry.

- High Costs of Raw Materials: The high costs associated with sourcing quality raw materials are another challenge for the nutraceutical market. The prices of essential raw materials like vitamins, minerals, and herbal extracts have seen a steady increase due to supply chain disruptions and increased demand. These rising costs impact the pricing strategies and profit margins of nutraceutical companies.

USA Nutraceutical Products Market Government Initiatives

- FDA's New Regulatory Framework: In 2023, the FDA released a list of priority guidance topics for its Foods Program, focusing on various aspects of food safety and nutrition. The FDA is continuously working on modernizing its regulatory processes, which includes improving transparency and safety across various product categories like nutraceuticals.

- Labeling Requirements: The FDA requires that dietary supplements, which can be considered a category of nutraceuticals, carry specific labeling that includes ingredient lists, nutritional information & health claims. Any health claims made on the label must be substantiated by credible scientific evidence. This is governed under the Dietary Supplement Health and Education Act (DSHEA) of 1994, which specifies that claims must be truthful and not misleading, backed by scientific research.

USA Nutraceutical Products Future Market Outlook

USA Nutraceutical Products market is expected to grow substantially by 2028, driven by personalized nutrition, plant-based nutraceuticals and digital health integration.

Future Trends

- Personalized Nutrition: Personalized nutrition is an emerging trend in the nutraceutical market. In 2024, the concept of customized dietary supplements tailored to individual genetic profiles gained significant traction. Companies like Nestlé Health Science are leveraging advancements in genomics and digital health to offer personalized nutraceutical products, which are expected to revolutionize the market by providing targeted health benefits.

- Plant-Based Nutraceuticals: The demand for plant-based nutraceuticals has surged in recent years. Consumers are increasingly opting for vegan and plant-derived products due to health concerns and ethical considerations, driving the growth of this segment within the nutraceutical market.

Scope of the Report

|

By Product Type |

Dietary Supplements Functional Foods Functional Beverages |

|

By Distribution Channel |

Online Stores Specialty Stores Supermarkets/Hypermarkets |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by Subscribing This Report:

Nutraceutical Manufacturers

Nutraceutical Retailers and Distributors

Pharmaceutical Companies

Dietary Supplement Suppliers

Functional Food and Beverage Manufacturers

Sports Nutrition Companies

Investors & VC Firms

Government & Regulatory Bodies (USDA, CDC etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

Abbott Laboratories

Amway

Herbalife Nutrition Ltd.

Pfizer Inc.

General Mills Inc.

Nestlé Health Science

Bayer AG

Glanbia Plc

Nature's Bounty Co.

NOW Foods

The Nature’s Way Company

Nutraceutical International Corporation

USANA Health Sciences

DSM Nutritional Products

Otsuka Holdings Co., Ltd.

Table of Contents

1. USA Nutraceutical Products Market Overview

1.1 USA Nutraceutical Products Market Taxonomy

2. USA Nutraceutical Products Market Size (in USD Bn), 2018-2023

3. USA Nutraceutical Products Market Analysis

3.1 USA Nutraceutical Products Market Growth Drivers

3.2 USA Nutraceutical Products Market Challenges and Issues

3.3 USA Nutraceutical Products Market Trends and Development

3.4 USA Nutraceutical Products Market Government Regulation

3.5 USA Nutraceutical Products Market SWOT Analysis

3.6 USA Nutraceutical Products Market Stake Ecosystem

3.7 USA Nutraceutical Products Market Competition Ecosystem

4. USA Nutraceutical Products Market Segmentation, 2023

4.1 USA Nutraceutical Products Market Segmentation by Product Type (in value %), 2023

4.2 USA Nutraceutical Products Market Segmentation by Distribution Channel (in value %), 2023

4.3 USA Nutraceutical Products Market Segmentation by Region (in value %), 2023

5. USA Nutraceutical Products Market Competition Benchmarking

5.1 USA Nutraceutical Products Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. USA Nutraceutical Products Future Market Size (in USD Bn), 2023-2028

7. USA Nutraceutical Products Future Market Segmentation, 2028

7.1 USA Nutraceutical Products Market Segmentation by Product Type (in value %), 2028

7.2 USA Nutraceutical Products Market Segmentation by Distribution Channel (in value %), 2028

7.3 USA Nutraceutical Products Market Segmentation by Region (in value %), 2028

8. USA Nutraceutical Products Market Analysts’ Recommendations

8.1 USA Nutraceutical Products Market TAM/SAM/SOM Analysis

8.2 USA Nutraceutical Products Market Customer Cohort Analysis

8.3 USA Nutraceutical Products Market Marketing Initiatives

8.4 USA Nutraceutical Products Market White Space Opportunity Analysis

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on USA Nutraceutical Products Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for USA Nutraceutical Products Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research Output:

Our team will approach multiple nutraceutical products manufacturers, suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from nutraceutical

Frequently Asked Questions

01 How big is USA Nutraceutical Products Market?

USA Nutraceutical Products Market was valued at USD 158 billion in 2023. The market is primarily driven by an increasing focus on health and wellness, rising consumer awareness regarding the benefits of nutraceuticals.

02 What are the growth drivers of the USA Nutraceutical Products Market?

Growth drivers of USA Nutraceutical Products include increasing health awareness among consumers, a growing aging population seeking preventive healthcare solutions, and the rising prevalence of chronic diseases prompting higher demand for nutraceuticals.

03 What are the challenges in the USA Nutraceutical Products Market?

Challenges in the USA Nutraceutical Products market include navigating complex regulatory hurdles, high costs of raw materials, and consumer skepticism regarding the efficacy and safety of nutraceutical products.

04 Who are the major players in the USA Nutraceutical Products Market?

Key players in the USA Nutraceutical Products market include Abbott Laboratories, Amway, Herbalife Nutrition Ltd., Pfizer Inc., and General Mills Inc. These companies are leaders due to their extensive product portfolios, strong brand presence, and significant investments in research and development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.