USA Personal Finance Software Market Outlook to 2030

Region:North America

Author(s):Yogita Sahu

Product Code:KROD6395

November 2024

98

About the Report

USA Personal Finance Software Market Overview

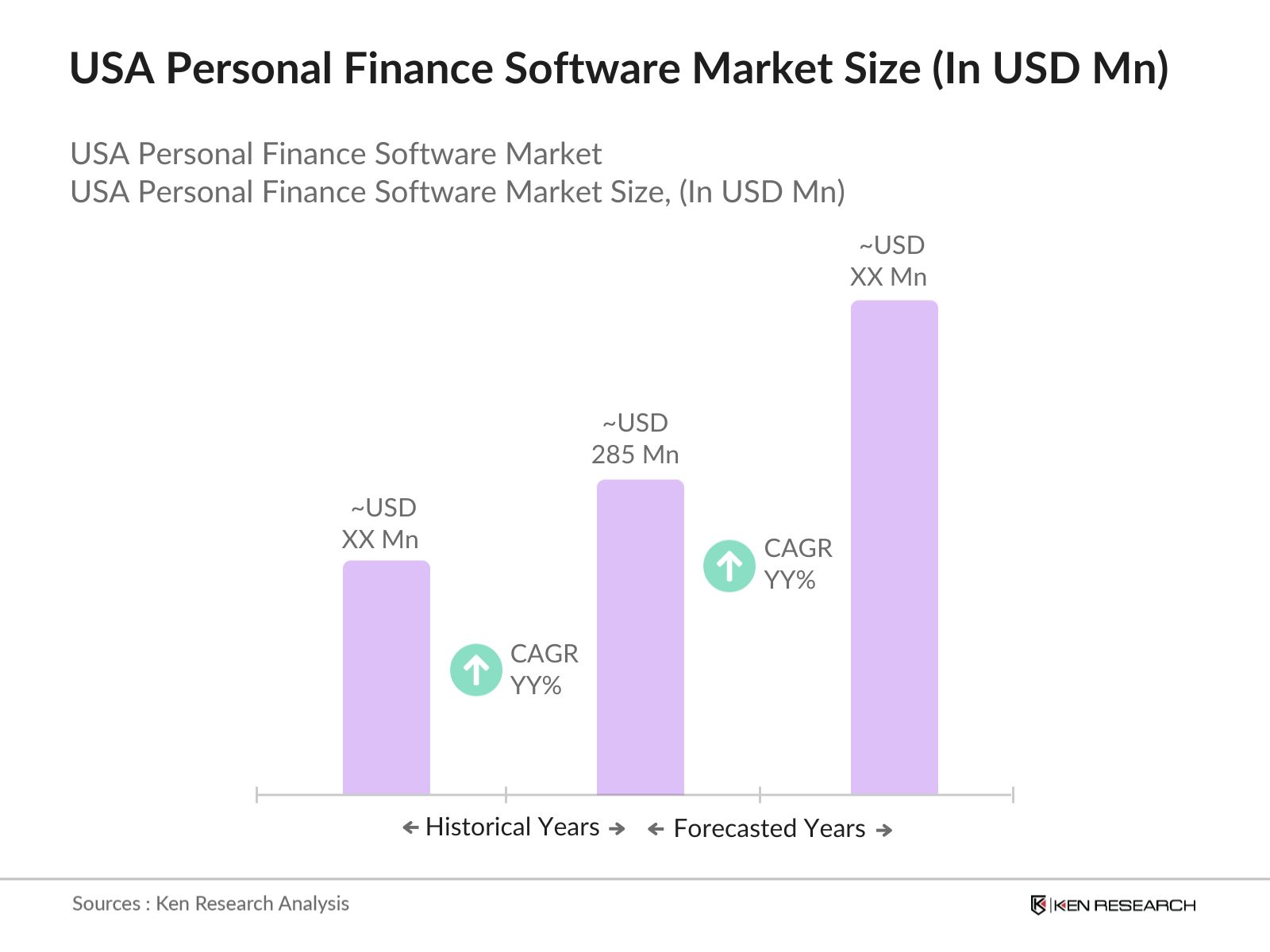

- The USA personal finance software market is valued at USD 285 million, based on a five-year historical analysis. This market size is driven by the increasing digitization of personal financial management tools, where consumers are adopting solutions for budgeting, expense tracking, and investment planning. The rise in demand for mobile-based applications has contributed to the market's growth, with financial technology innovations enhancing the user experience by simplifying complex financial management tasks.

- The USA personal finance software market is largely dominated by key metropolitan areas such as New York, San Francisco, and Chicago. These cities are financial hubs with a high concentration of tech-savvy individuals, financial institutions, and fintech startups. The dominance of these areas stems from their advanced financial ecosystems, widespread internet and mobile penetration, and high-income user bases that demand sophisticated financial management solutions.

- The U.S. government has ramped up efforts to promote financial literacy through initiatives like the Financial Literacy and Education Commission (FLEC). In 2024, Congress allocated $120 million for state-level financial literacy programs aimed at improving personal financial management skills among the general population. These initiatives are expected to increase the adoption of personal finance software as more individuals become aware of the benefits of budgeting, saving, and investment tracking tools.

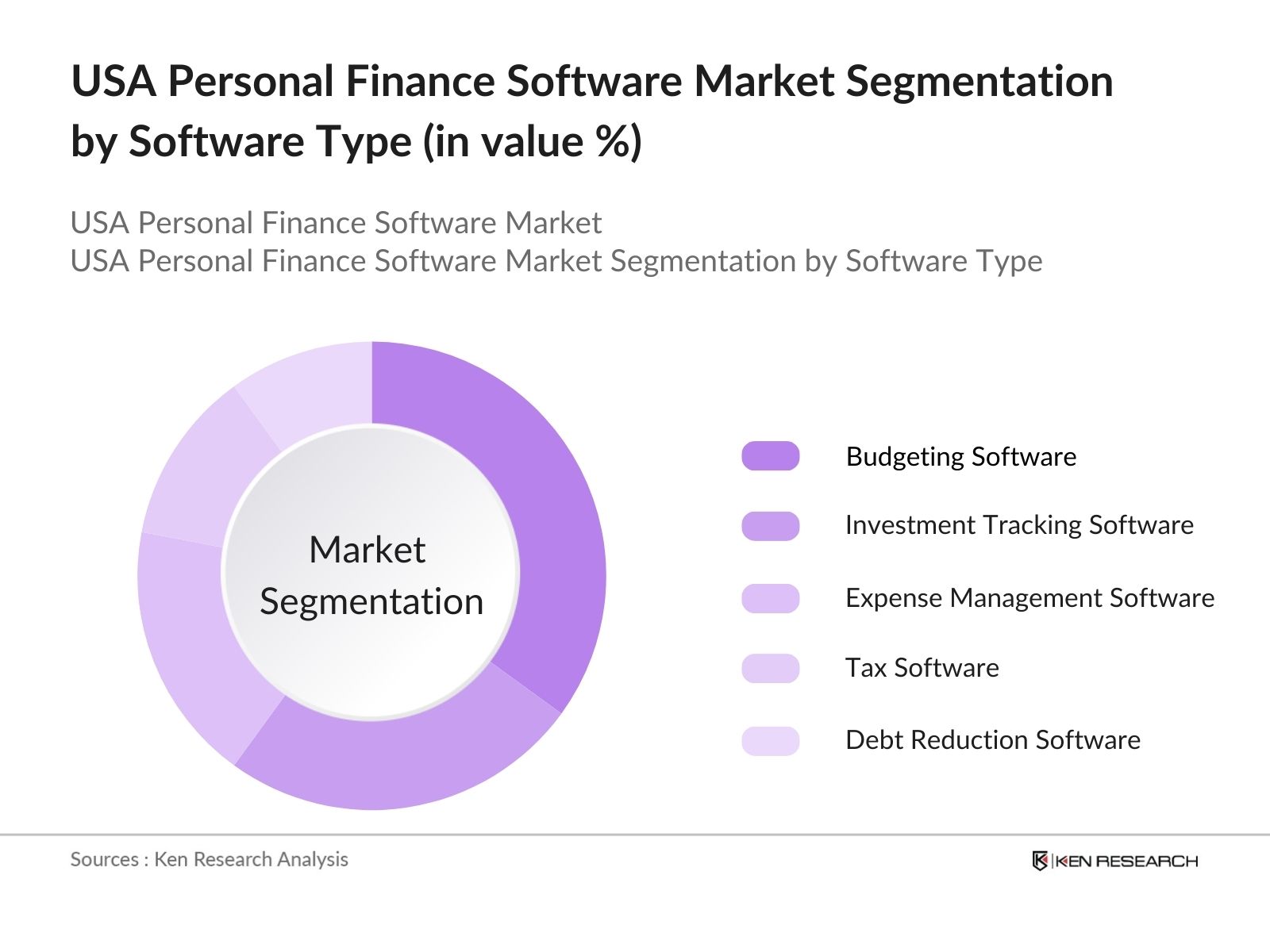

USA Personal Finance Software Market Segmentation

By Software Type: The market is segmented by software type into Budgeting Software, Investment Tracking Software, Expense Management Software, Tax Software, and Debt Reduction Software. Budgeting Software has the dominant market share under the segmentation by software type. This dominance can be attributed to the growing emphasis on financial literacy and the increasing need for individuals to plan their finances effectively. With more people focusing on managing their daily expenses and saving for long-term goals, budgeting tools that allow customization and real-time expense tracking have gained traction.

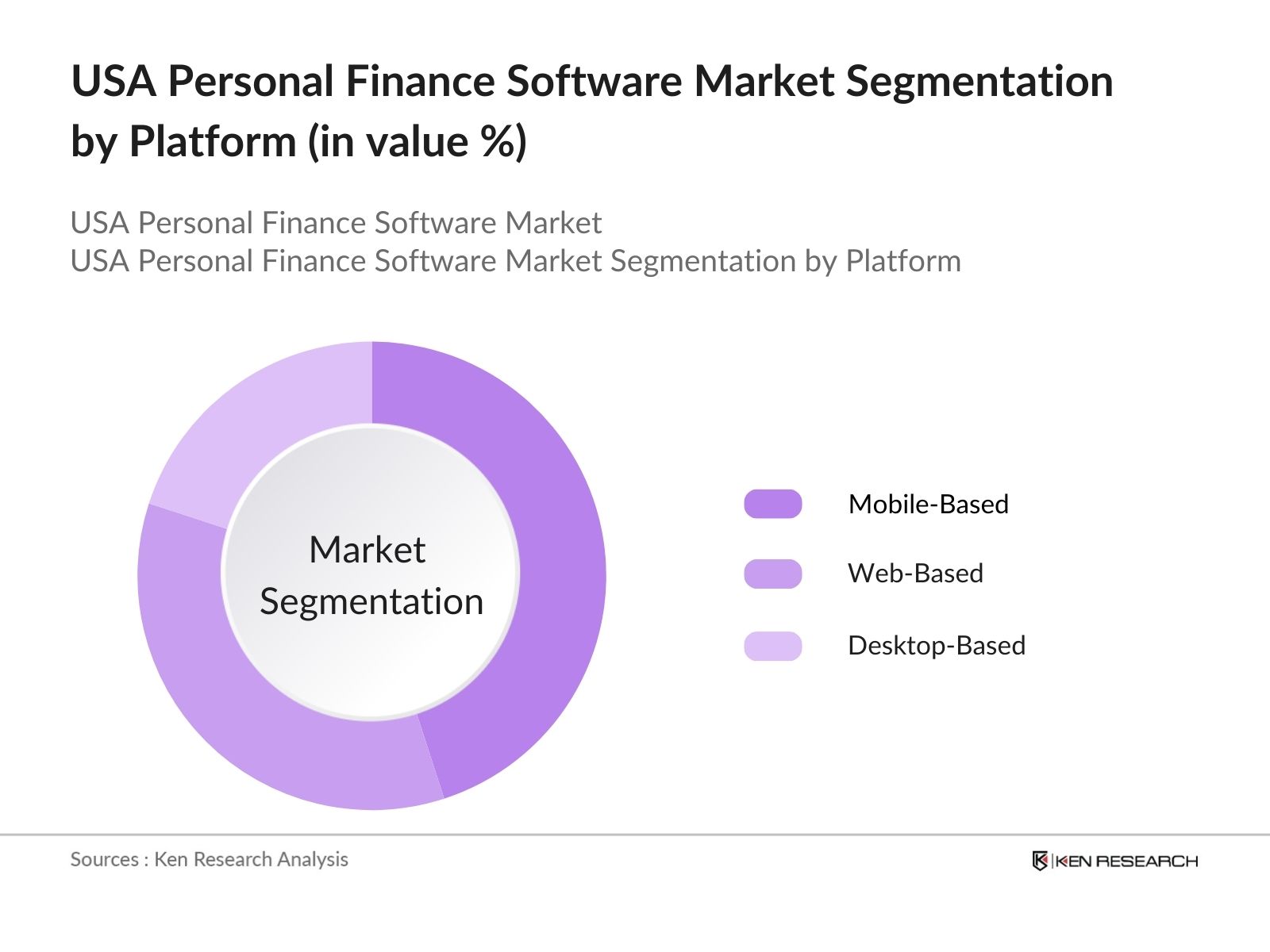

By Platform: The market is also segmented by platform into Web-Based, Mobile-Based, and Desktop-Based solutions. Mobile-Based Platforms hold the largest market share under this segmentation. The rapid adoption of smartphones and the increasing reliance on mobile applications for day-to-day tasks have led to the growth of mobile-based personal finance solutions. These platforms are highly popular among millennials and Gen Z users who prefer the convenience of managing their finances on-the-go.

USA Personal Finance Software Market Competitive Landscape

The market is characterized by the presence of several key players, many of which are established software providers or fintech firms. These companies dominate due to their extensive user bases, robust financial backing, and continuous innovation in personal finance solutions.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

No. of Employees |

Market Penetration |

Major Product |

Customer Support Rating |

Security Features |

Partnerships with Financial Institutions |

|

Intuit Inc. |

1983 |

California, USA |

|||||||

|

Quicken Inc. |

1983 |

California, USA |

|||||||

|

Personal Capital |

2009 |

California, USA |

|||||||

|

You Need A Budget (YNAB) |

2004 |

Utah, USA |

|||||||

|

EveryDollar |

2015 |

Tennessee, USA |

USA Personal Finance Software Market Analysis

Market Growth Drivers

- Increased Adoption of Digital Banking: The growing preference for digital banking solutions is driving the adoption of personal finance software. In 2024, there were around 230 million active digital banking users in the United States, creating a fertile ground for personal finance software to thrive. These users seek seamless integration between their financial accounts and personal finance tools, which has led to a rise in demand for platforms that offer real-time financial insights.

- Shift Towards Subscription-Based Financial Services: Subscription-based financial tools are gaining traction as more users prefer a low-commitment, customizable approach to managing personal finances. With nearly 150 million people subscribed to various online services in 2024, personal finance software providers are capitalizing on this trend by offering tiered subscription models. These models allow users to select packages that suit their specific financial needs, whether its investment tracking, tax preparation, or real-time financial updates, enhancing the market's growth.

- Expansion of Retirement Savings Incentives: The U.S. government has introduced tax incentives to encourage more citizens to save for retirement, which indirectly boosts the demand for personal finance software. In 2024, the Secure Act 2.0 expanded automatic enrollment in retirement plans and increased catch-up contributions for individuals over 50. These legislative changes are expected to create more demand for personal finance software with integrated retirement planning tools, as users seek better ways to manage and optimize their savings.

Market Challenges

- Complex Regulatory Environment: The U.S. financial sector is heavily regulated, with over 200 federal and state regulations governing various aspects of financial services. The evolving landscape of regulatory frameworks, particularly regarding consumer data protection and financial reporting standards, poses a challenge for personal finance software providers.

- Integration Challenges with Traditional Banking Systems: Many personal finance software platforms face challenges in integrating with legacy banking systems that are still prevalent across the U.S. financial sector. In 2024, more than 4,000 banks and credit unions operated on outdated core banking systems, creating technical barriers for seamless integration with modern personal finance platforms.

USA Personal Finance Software Market Future Outlook

Over the next five years, the USA personal finance software industry is expected to experience growth, driven by the increasing awareness of personal financial management, the rapid adoption of digital solutions, and advancements in artificial intelligence and machine learning.

Future Market Opportunities

- Integration of Blockchain for Enhanced Security: Over the next five years, personal finance software will likely incorporate blockchain technology to improve the security and transparency of financial transactions. Blockchains decentralized nature will reduce instances of data breaches and fraud, addressing growing concerns around financial data privacy. By 2029, it is expected that a portion of personal finance platforms will offer blockchain-powered solutions to track and verify financial transactions, especially as blockchain adoption increases across the financial services sector.

- Adoption of Advanced Predictive Analytics: In the near future, personal finance software will increasingly rely on advanced predictive analytics to offer highly personalized financial advice. By 2029, predictive models will be able to provide users with more accurate financial forecasts based on historical spending patterns, income fluctuations, and external market conditions. This will allow consumers to make proactive adjustments to their financial strategies, such as identifying optimal savings rates or investment opportunities.

Scope of the Report

|

By Software Type |

Budgeting Software |

|

By Platform |

Web-Based |

|

By End User |

Individuals |

|

By Subscription Model |

Free |

|

By Distribution Channel |

Direct-to-Consumer |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Financial Institutions (e.g., JP Morgan, Citibank)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Treasury)

Private Equity Firms

Cloud Service Providers

Companies

Players Mentioned in the Report:

Intuit Inc.

Quicken Inc.

You Need A Budget (YNAB)

Personal Capital

EveryDollar

Mint

Tiller Money

Moneydance

Banktivity

TurboTax

Simplifi by Quicken

CountAbout

PocketGuard

Zeta

Microsoft Money Plus

Table of Contents

1. USA Personal Finance Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. USA Personal Finance Software Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. USA Personal Finance Software Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Financial Literacy (Financial Education)

3.1.2. Growing Adoption of Digital Banking (Financial Technology)

3.1.3. Increasing Demand for Personalized Financial Tools (Consumer Customization)

3.1.4. High Mobile and Internet Penetration (Tech Integration)

3.2. Market Challenges

3.2.1. Privacy and Security Concerns (Data Security)

3.2.2. Lack of Integration with Financial Institutions (Software Compatibility)

3.2.3. High Subscription Costs (Affordability)

3.3. Opportunities

3.3.1. Emergence of AI and ML in Financial Tools (AI Integration)

3.3.2. Partnerships with Financial Institutions (B2B Opportunities)

3.3.3. Expansion of Cloud-Based Solutions (Cloud Adoption)

3.4. Trends

3.4.1. Growth of Subscription-Based Models (Revenue Models)

3.4.2. Integration of Cryptocurrency Management (Cryptocurrency Support)

3.4.3. Rise of Micro-Investment and Budgeting Tools (Investment Simplification)

3.5. Government Regulations

3.5.1. Data Protection Acts (Data Security Compliance)

3.5.2. Financial Reporting Standards (Regulatory Compliance)

3.5.3. Fintech Regulatory Sandbox (Regulatory Sandbox)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Developers, Consumers, Financial Institutions, Fintech Partners)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. USA Personal Finance Software Market Segmentation

4.1. By Software Type (In Value %)

4.1.1. Budgeting Software

4.1.2. Investment Tracking Software

4.1.3. Expense Management Software

4.1.4. Tax Software

4.1.5. Debt Reduction Software

4.2. By Platform (In Value %)

4.2.1. Web-Based

4.2.2. Mobile-Based

4.2.3. Desktop-Based

4.3. By End User (In Value %)

4.3.1. Individuals

4.3.2. Small Businesses

4.3.3. Financial Advisors

4.4. By Subscription Model (In Value %)

4.4.1. Free

4.4.2. Freemium

4.4.3. Subscription-Based

4.5. By Distribution Channel (In Value %)

4.5.1. Direct-to-Consumer

4.5.2. Third-Party App Stores

4.5.3. Financial Institution Partnerships

4.6. By Region (In Value %)

4.6.1. North

4.6.2. East

4.6.3. West

4.6.4. South

5. USA Personal Finance Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Intuit Inc.

5.1.2. The Quicken Company

5.1.3. You Need A Budget (YNAB)

5.1.4. Personal Capital

5.1.5. Mint

5.1.6. Tiller Money

5.1.7. EveryDollar

5.1.8. Moneydance

5.1.9. TurboTax

5.1.10. Banktivity

5.1.11. CountAbout

5.1.12. PocketGuard

5.1.13. Zeta

5.1.14. Simplifi by Quicken

5.1.15. Microsoft Money Plus

5.2. Cross Comparison Parameters (Revenue, Market Share, User Base, Subscription Pricing, Integration with Banks, Mobile App Ratings, Customer Support, Security Features)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.4.1. New Product Launches

5.4.2. Mergers and Acquisitions

5.4.3. Partnerships with Financial Institutions

5.5. Investment Analysis

5.6. Government Grants and Funding

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. USA Personal Finance Software Market Regulatory Framework

6.1. Data Privacy Regulations

6.2. Financial Transactions Compliance

6.3. Software Security Certifications

6.4. Compliance Requirements for Financial Institutions

7. USA Personal Finance Software Future Market Size (in USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. USA Personal Finance Software Future Market Segmentation

8.1. By Software Type (In Value %)

8.2. By Platform (In Value %)

8.3. By End User (In Value %)

8.4. By Subscription Model (In Value %)

8.5. By Distribution Channel (In Value %)

8.6. By Region (In Value %)

9. USA Personal Finance Software Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive stakeholder map of the USA personal finance software market. This involves gathering information on consumers, software developers, financial institutions, and other key players to identify variables influencing market dynamics.

Step 2: Market Analysis and Construction

This step involves an in-depth analysis of historical data to assess market penetration and the distribution of revenue across various product segments. Factors such as user demographics and product usage trends are examined to ensure accuracy in market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are developed based on historical data and then validated through consultations with market experts and stakeholders. This step includes interviews with software developers and financial institutions.

Step 4: Research Synthesis and Final Output

In the final step, all insights gathered from desk research, expert consultation, and data analysis are synthesized into a coherent report. This ensures a comprehensive understanding of the market landscape and future trends.

Frequently Asked Questions

How big is the USA Personal Finance Software Market?

The USA personal finance software market is valued at USD 285 million, driven by the rising adoption of digital financial tools and increased demand for customized financial management solutions.

What are the challenges in the USA Personal Finance Software Market?

Challenges in the USA personal finance software market include data privacy concerns, high subscription costs for premium software, and the lack of integration with all financial institutions. These factors limit the accessibility of personal finance solutions to a broader audience.

Who are the major players in the USA Personal Finance Software Market?

Key players in the USA personal finance software market include Intuit Inc., Quicken Inc., You Need A Budget (YNAB), Personal Capital, and EveryDollar. These companies dominate the market due to their strong product offerings, user base, and continuous innovation.

What are the growth drivers of the USA Personal Finance Software Market?

The USA personal finance software market is driven by the rise of fintech innovations, increasing awareness of personal financial management, and the integration of artificial intelligence to provide more personalized user experiences.

What trends are shaping the USA Personal Finance Software Market?

Key trends in the USA personal finance software market include the growth of mobile-based financial management apps, the integration of cryptocurrency tracking tools, and the rise of micro-investment platforms designed to cater to younger users.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.