Vietnam Orthopedic Devices Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD3178

December 2024

96

About the Report

Vietnam Orthopedic Devices Market Overview

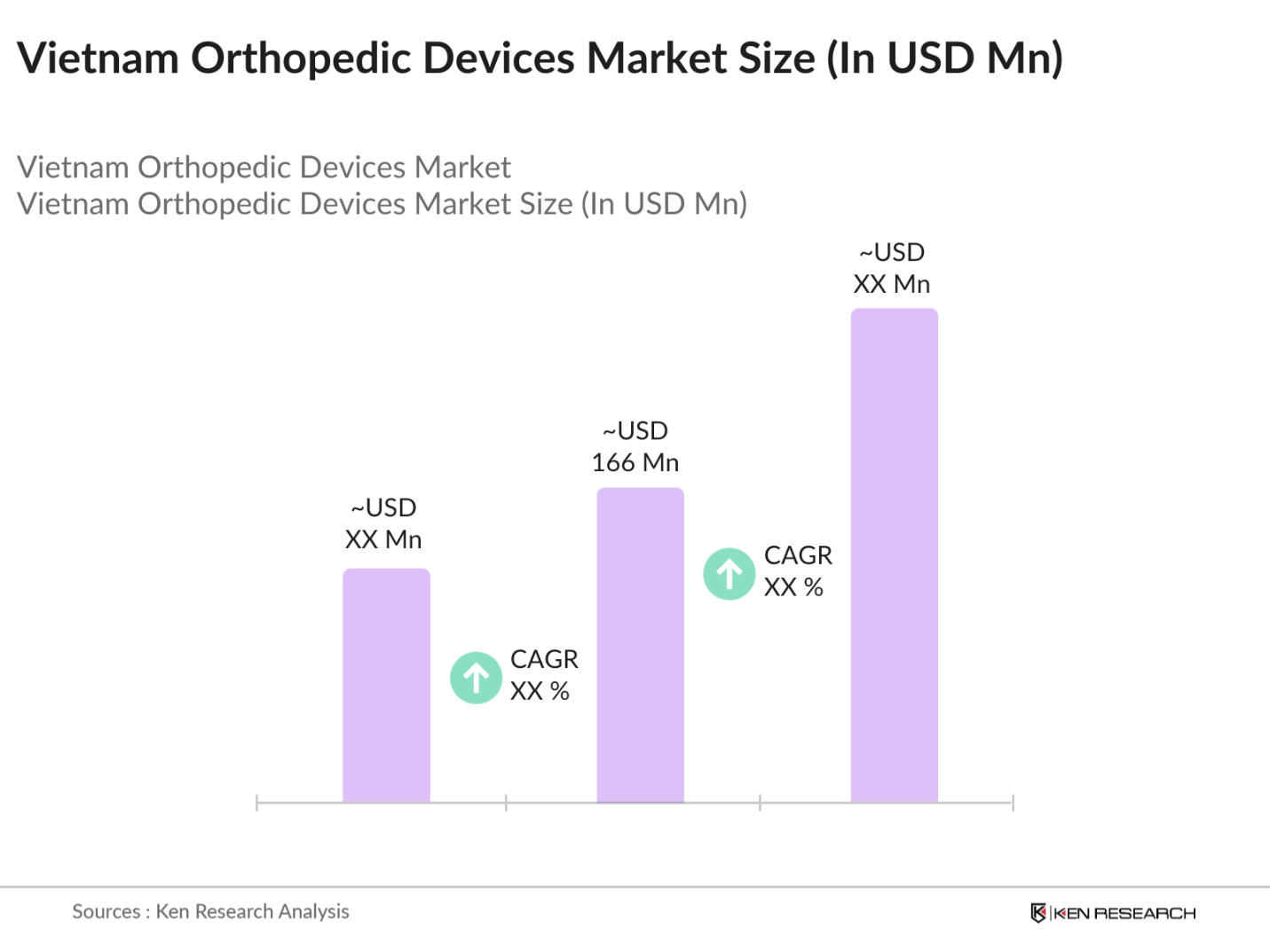

- The Vietnam Orthopedic Devices market is valued at USD 166 million, driven by several factors, including the rising prevalence of musculoskeletal disorders and an aging population. With a significant increase in osteoarthritis and osteoporosis cases, there has been growing demand for joint reconstruction and spine-related surgeries. Additionally, the expansion of healthcare infrastructure in rural areas and greater access to specialized surgeries are propelling the market forward.

- Ho Chi Minh City and Hanoi dominate the orthopedic devices market in Vietnam. These cities are home to major hospitals, advanced healthcare infrastructure, and skilled orthopedic professionals. Their dominance is largely due to the concentration of Vietnams top-tier hospitals and healthcare services, which provide advanced orthopedic surgeries and treatments, making them the primary hubs for orthopedic care in the country.

- Vietnams medical device registration process is governed by the Ministry of Healths regulations, requiring all imported and locally manufactured devices to meet stringent standards. As of 2024, over 5,000 orthopedic devices have been registered under this framework. The process includes a thorough review of the devices safety, quality, and performance, ensuring that only high-quality products enter the market.

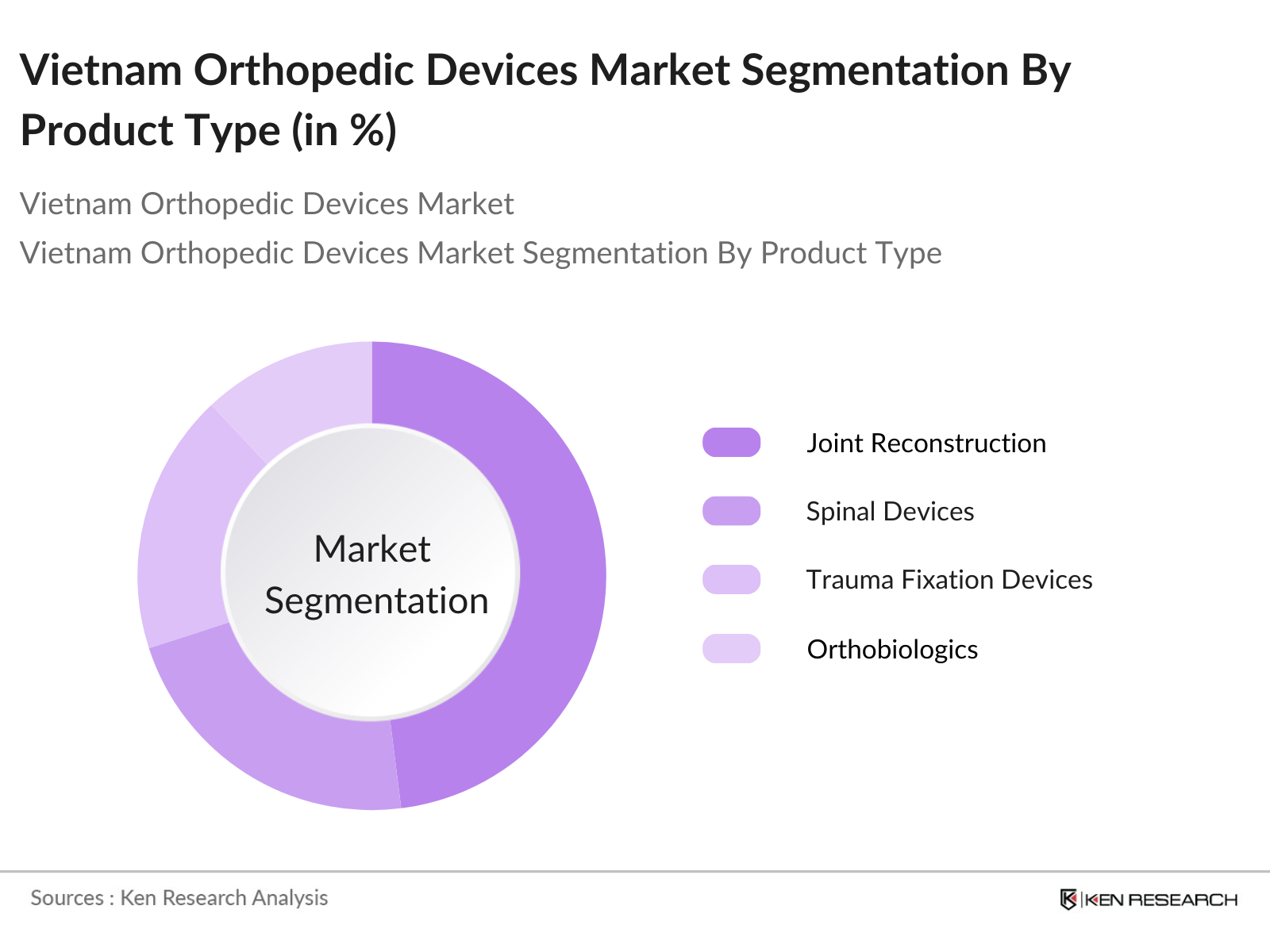

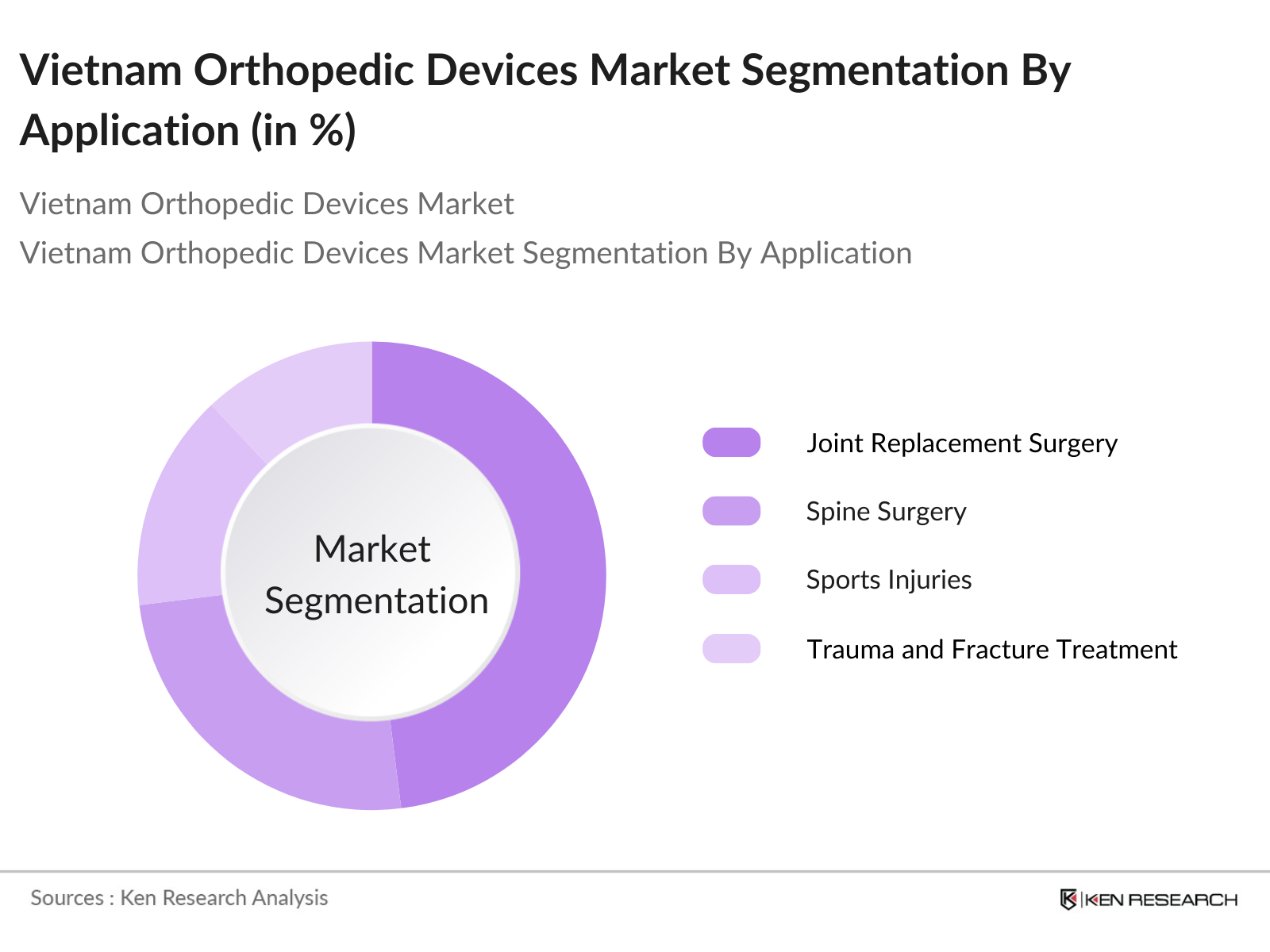

Vietnam Orthopedic Devices Market Segmentation

By Product Type: The Vietnam Orthopedic Devices market is segmented by product type into joint reconstruction, spinal devices, trauma fixation devices, orthobiologics, and arthroscopy devices. Recently, joint reconstruction holds a dominant market share due to the rise in osteoarthritis and the aging population. Vietnam has seen increased adoption of hip and knee replacement surgeries, particularly in Ho Chi Minh City and Hanoi, where advanced medical technologies are available.

By Application: The Vietnam Orthopedic Devices market is segmented by application into joint replacement surgery, spine surgery, sports injuries, trauma and fracture treatment, and bone and soft tissue surgery. Joint replacement surgery leads the market in terms of application, driven by the aging population and the increasing burden of osteoarthritis.

Vietnam Orthopedic Devices Market Competitive Landscape

The Vietnam Orthopedic Devices market is dominated by several key players, with a mix of international and local companies driving competition. Major players like Zimmer Biomet, Stryker, and DePuy Synthes have a significant presence, focusing on joint reconstruction and spinal devices. Local players and distributors also play a crucial role in providing access to medical devices in rural areas.

Vietnam Orthopedic Devices Industry Analysis

Growth Drivers

- Aging Population and Increasing Osteoporosis Cases: Vietnams aging population is rapidly expanding, with approximately 11.9 million people aged 60 and older as of 2023, according to the General Statistics Office of Vietnam. This demographic is particularly susceptible to osteoporosis and fractures, driving demand for orthopedic devices. Osteoporosis cases have been rising significantly, with 30% of women and 20% of men over 50 affected.

- Growing Prevalence of Musculoskeletal Disorders: Musculoskeletal disorders are on the rise in Vietnam, with a reported 9.5 million people affected by conditions such as osteoarthritis, rheumatoid arthritis, and spine-related issues. As a key driver of disability, these conditions require surgical interventions, often relying on orthopedic implants and devices. The Ministry of Health estimates that 80% of people over 65 experience some form of musculoskeletal pain or disorder, further solidifying the need for advanced orthopedic solutions.

- Expansion of Healthcare Facilities in Rural Areas: Vietnam has been expanding its healthcare infrastructure, particularly in rural areas, where healthcare access has historically been limited. As of 2024, the government has constructed over 1,200 new healthcare facilities in underserved regions. This expansion increases the availability of orthopedic surgeries, benefiting rural populations who previously traveled to urban centers for treatment.

Market Challenges

- High Cost of Advanced Orthopedic Devices: Advanced orthopedic devices are often expensive, making them inaccessible to a large portion of the Vietnamese population. The average cost of an advanced implant in Vietnam ranges from VND 30 million to VND 100 million, depending on the type of procedure. This high-cost limits access, especially for rural populations, where income levels are lower.

- Limited Access to Specialist Care in Remote Regions: Despite advancements in healthcare infrastructure, specialist care in orthopedic surgery remains concentrated in urban areas. As of 2023, over 80% of Vietnams orthopedic specialists are based in major cities like Hanoi and Ho Chi Minh City, leaving rural regions underserved. This geographical disparity restricts access to quality orthopedic care for millions, limiting the potential market size for orthopedic devices in remote areas.

Vietnam Orthopedic Devices Market Future Outlook

Over the next five years, the Vietnam Orthopedic Devices market is expected to show steady growth, driven by the expanding healthcare infrastructure, rising demand for orthopedic surgeries, and increasing prevalence of bone-related diseases. With technological advancements like robotic-assisted surgeries and 3D printing for implants, the market is poised for significant innovation. The growing medical tourism sector in Vietnam, particularly for joint replacement surgeries, is also expected to further fuel market expansion.

Market Opportunities

- Collaboration with International Medical Device Manufacturers: Vietnam is becoming a hub for international collaborations in the healthcare sector, particularly with medical device manufacturers from countries like Japan, South Korea, and Germany. As of 2024, the Ministry of Health has signed over 15 agreements with foreign companies to import and co-develop orthopedic devices. This partnership offers local manufacturers access to advanced technologies, improving the availability of high-quality orthopedic implants.

- Public-Private Partnerships for Healthcare Infrastructure Development: Public-private partnerships (PPPs) are on the rise in Vietnam, with several projects dedicated to healthcare infrastructure development. In 2023, the government approved 10 new PPP projects aimed at expanding hospital capacity, many of which focus on orthopedics. These partnerships bring in private investment and expertise, accelerating the development of specialized healthcare facilities equipped with the latest orthopedic devices.

Scope of the Report

|

By Product Type |

Joint Reconstruction Spinal Devices Trauma Fixation Devices Orthobiologics Arthroscopy Devices |

|

By Application |

Joint Replacement Surgery Spine Surgery Sports Injuries Trauma and Fracture Treatment Bone and Soft Tissue Surgery |

|

By Material |

Metal Ceramics Polymers Composites |

|

By End-User |

Hospitals Specialty Clinics Ambulatory Surgical Centers Home Care Settings |

|

By Region |

Ho Chi Minh City Hanoi Da Nang Mekong Delta Central Highlands |

Products

Key Target Audience

Hospitals and Healthcare Providers

Medical Device Distributors

Orthopedic Surgeons and Specialists

Rehabilitation Centers

Public and Private Insurance Providers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (Vietnam Ministry of Health, Medical Device Regulatory Authorities)

Medical Tourism Agencies

Companies

Players Mentioned in the Report

Zimmer Biomet Holdings, Inc.

Stryker Corporation

DePuy Synthes (Johnson & Johnson)

Medtronic PLC

B. Braun Melsungen AG

NuVasive, Inc.

Globus Medical, Inc.

Orthofix Medical Inc.

DJO Global, Inc.

Aesculap Implant Systems

Table of Contents

1. Vietnam Orthopedic Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Vietnam Healthcare Infrastructure Analysis

1.6. Orthopedic Disease Burden and Prevalence in Vietnam

2. Vietnam Orthopedic Devices Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Vietnam Orthopedic Devices Market Analysis

3.1. Growth Drivers

3.1.1. Aging Population and Increasing Osteoporosis Cases

3.1.2. Growing Prevalence of Musculoskeletal Disorders

3.1.3. Expansion of Healthcare Facilities in Rural Areas

3.1.4. Government Initiatives in Public Health (National Healthcare Strategy)

3.1.5. Increased Adoption of Minimally Invasive Surgeries

3.2. Market Challenges

3.2.1. High Cost of Advanced Orthopedic Devices

3.2.2. Limited Access to Specialist Care in Remote Regions

3.2.3. Reimbursement Policy Constraints

3.3. Opportunities

3.3.1. Collaboration with International Medical Device Manufacturers

3.3.2. Public-Private Partnerships for Healthcare Infrastructure Development

3.3.3. Rise in Medical Tourism in Vietnam (Orthopedic Surgery as a Key Segment)

3.4. Trends

3.4.1. Adoption of Robotic-Assisted Surgery

3.4.2. Use of 3D Printing in Implant Manufacturing

3.4.3. Customization of Implants Based on Patient Anatomy

3.4.4. Telemedicine for Post-Surgery Rehabilitation

3.5. Regulatory Framework

3.5.1. Vietnam Medical Device Registration Process

3.5.2. Reimbursement Policies for Orthopedic Surgeries

3.5.3. Import Regulations for Medical Devices

3.5.4. Local Manufacturing Incentives

3.6. SWOT Analysis

3.7. Stake Ecosystem Analysis (Orthopedic Surgeons, Hospitals, Medical Device Distributors, Regulatory Bodies)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Vietnam Orthopedic Devices Market Segmentation

4.1. By Product Type (In Value %) 4.1.1. Joint Reconstruction (Hip, Knee, Shoulder, Elbow)

4.1.2. Spinal Devices (Spinal Fusion, Non-Fusion Devices)

4.1.3. Trauma Fixation Devices (Plates, Screws, Nails)

4.1.4. Orthobiologics (Bone Grafts, Growth Factors)

4.1.5. Arthroscopy Devices

4.2. By Application (In Value %) 4.2.1. Joint Replacement Surgery

4.2.2. Spine Surgery

4.2.3. Sports Injuries

4.2.4. Trauma and Fracture Treatment

4.2.5. Bone and Soft Tissue Surgery

4.3. By Material (In Value %) 4.3.1. Metal

4.3.2. Ceramics

4.3.3. Polymers

4.3.4. Composites

4.4. By End-User (In Value %) 4.4.1. Hospitals

4.4.2. Specialty Clinics

4.4.3. Ambulatory Surgical Centers

4.4.4. Home Care Settings (Post-Surgery Rehabilitation Devices)

4.5. By Region (In Value %) 4.5.1. Ho Chi Minh City

4.5.2. Hanoi

4.5.3. Da Nang

4.5.4. Mekong Delta

4.5.5. Central Highlands

5. Vietnam Orthopedic Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Zimmer Biomet Holdings, Inc.

5.1.2. Stryker Corporation

5.1.3. DePuy Synthes (Johnson & Johnson)

5.1.4. Smith & Nephew plc

5.1.5. Medtronic PLC

5.1.6. NuVasive, Inc.

5.1.7. B. Braun Melsungen AG

5.1.8. Globus Medical, Inc.

5.1.9. Orthofix Medical Inc.

5.1.10. DJO Global, Inc.

5.1.11. Aesculap Implant Systems

5.1.12. MicroPort Scientific Corporation

5.1.13. Wright Medical Group N.V.

5.1.14. Conmed Corporation

5.1.15. Integra LifeSciences Holdings Corporation

5.2. Cross Comparison Parameters

(No. of Employees, Market Share, Product Portfolio, Geographical Presence, R&D Investment, Technological Innovation, Partnerships, Distribution Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Vietnam Orthopedic Devices Market Regulatory Framework

6.1. Compliance Requirements

6.2. Medical Device Approval Process

6.3. National Health Policies Related to Orthopedics

6.4. Import/Export Regulations for Medical Devices

7. Vietnam Orthopedic Devices Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Vietnam Orthopedic Devices Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Material (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Vietnam Orthopedic Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research begins with identifying critical variables, such as product types, application areas, and end-user segments in the Vietnam Orthopedic Devices market. This is done through comprehensive desk research and analysis of existing medical data from credible sources.

Step 2: Market Analysis and Construction

Historical data from the orthopedic devices market in Vietnam is collected and analyzed. This includes the number of orthopedic surgeries, the adoption rate of different medical devices, and the availability of medical services across the country.

Step 3: Hypothesis Validation and Expert Consultation

Key industry experts, including orthopedic surgeons, distributors, and device manufacturers, are consulted through interviews. These experts provide insights on market trends, challenges, and opportunities.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the collected data and generating a detailed report. This includes cross-verifying data with primary research inputs from the industry and using a bottom-up approach for accurate market sizing.

Frequently Asked Questions

1. How big is the Vietnam Orthopedic Devices Market?

The Vietnam Orthopedic Devices Market is valued at USD 166 billion, driven by a growing number of orthopedic surgeries and the expansion of healthcare infrastructure.

2. What are the challenges in the Vietnam Orthopedic Devices Market?

The Vietnam orthopedic devices market challenges include the high cost of advanced orthopedic devices, limited access to specialist care in remote areas, and restrictive reimbursement policies.

3. Who are the major players in the Vietnam Orthopedic Devices Market?

The Vietnam orthopedic devices market key players include Zimmer Biomet, Stryker, DePuy Synthes, Medtronic, and B. Braun. These companies dominate due to their extensive product portfolios, strong distribution networks, and technological advancements.

4. What are the growth drivers of the Vietnam Orthopedic Devices Market?

The Vietnam orthopedic devices market is driven by factors such as an aging population, the rising prevalence of musculoskeletal disorders, and government initiatives to improve healthcare access.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.