Region:Middle East

Author(s):Rebecca

Product Code:KRAD4246

Pages:87

Published On:December 2025

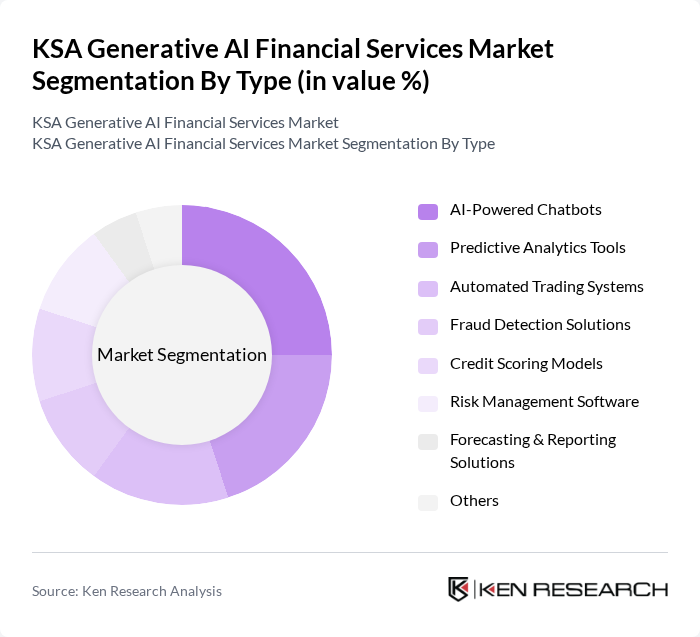

By Type:The market is segmented into various types of generative AI applications, including AI-Powered Chatbots, Predictive Analytics Tools, Automated Trading Systems, Fraud Detection Solutions, Credit Scoring Models, Risk Management Software, Forecasting & Reporting Solutions, and Others. Among these, Fraud Detection Solutions currently lead the market in terms of revenue share, reflecting financial institutions’ strong focus on security, anti?money laundering, and compliance monitoring as AI is embedded into transaction screening and anomaly detection. Each of these sub-segments plays a crucial role in enhancing the efficiency and effectiveness of financial services, with customer service chatbots and forecasting & reporting solutions also emerging as high?growth areas due to their role in digital engagement and management reporting automation.

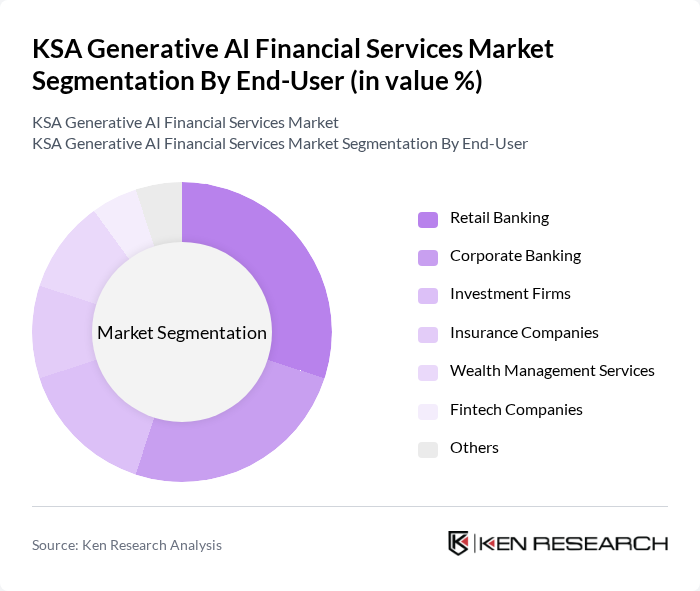

By End-User:The end-user segmentation includes Retail Banking, Corporate Banking, Investment Firms, Insurance Companies, Wealth Management Services, Fintech Companies, and Others. Retail Banking remains the dominant segment, as banks deploy generative AI for personalized digital experiences, conversational banking, automated credit decisioning, and fraud prevention across cards, payments, and consumer lending. Corporate Banking and Investment Firms are increasing their use of generative AI for portfolio analysis, trade and cash?flow forecasting, document automation, and client reporting, while Insurance Companies utilize these capabilities for underwriting support, claims triage, and customer engagement. Fintech Companies act as important adopters and providers of generative AI, embedding these tools into digital wallets, buy?now?pay?later platforms, and payment gateways to differentiate on user experience and risk controls.

The KSA Generative AI Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as stc pay, Al Rajhi Bank, Riyad Bank, Saudi National Bank (SNB), Saudi Awwal Bank (SAB), Arab National Bank, Banque Saudi Fransi, Alinma Bank, Saudi Digital Bank, D360 Bank, Fintech Saudi, Raqamyah Platform, Tamara, HyperPay, PayTabs contribute to innovation, geographic expansion, and service delivery in this space.

The KSA Generative AI Financial Services Market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As institutions increasingly adopt AI-driven solutions, the focus will shift towards enhancing operational efficiency and customer engagement. The integration of AI in risk management and compliance will become paramount, ensuring that financial services remain secure and efficient. Additionally, the rise of digital banking and fintech collaborations will further shape the landscape, fostering innovation and competitive differentiation in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-Powered Chatbots Predictive Analytics Tools Automated Trading Systems Fraud Detection Solutions Credit Scoring Models Risk Management Software Forecasting & Reporting Solutions Others |

| By End-User | Retail Banking Corporate Banking Investment Firms Insurance Companies Wealth Management Services Fintech Companies Others |

| By Application | Customer Service Automation Risk Assessment Fraud Detection & Prevention Compliance Monitoring Financial Forecasting & Reporting Investment Analysis Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Technology | Machine Learning Natural Language Processing Deep Learning Generative Adversarial Networks (GANs) Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Others |

| By Geographic Presence | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Services | 120 | Branch Managers, Customer Experience Officers |

| Fintech Innovations | 100 | Product Managers, Technology Officers |

| Investment Advisory Services | 80 | Financial Advisors, Portfolio Managers |

| Insurance Technology Solutions | 70 | Underwriters, Claims Managers |

| Regulatory Compliance in Financial Services | 60 | Compliance Officers, Risk Management Executives |

The KSA Generative AI Financial Services Market is valued at approximately USD 38 million, reflecting a significant growth trend driven by the adoption of AI technologies in banking and fintech sectors to enhance operational efficiency and customer experience.