Region:Middle East

Author(s):Dev

Product Code:KRAC8801

Pages:93

Published On:November 2025

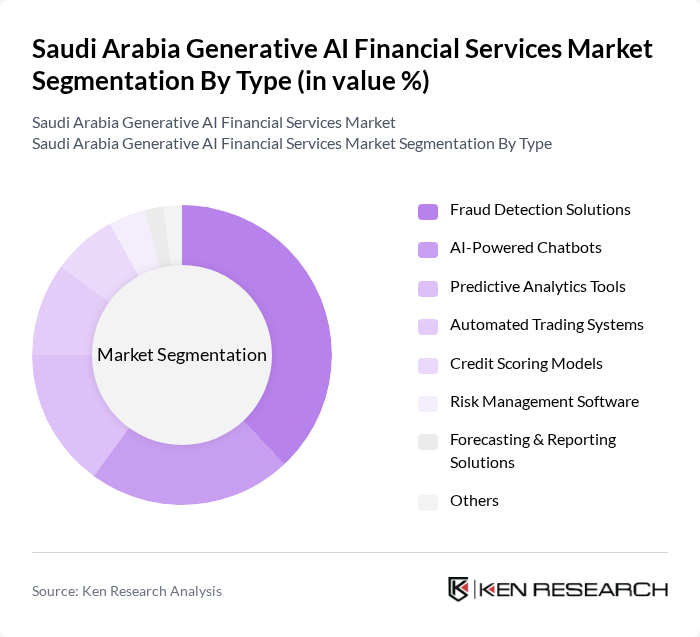

By Type:The market is segmented into various types of generative AI applications, including AI-Powered Chatbots, Predictive Analytics Tools, Automated Trading Systems, Fraud Detection Solutions, Credit Scoring Models, Risk Management Software, Forecasting & Reporting Solutions, and Others. Among these, Fraud Detection Solutions currently lead the market in terms of revenue share, reflecting the sector’s prioritization of security and compliance. However, AI-Powered Chatbots and Predictive Analytics Tools are also experiencing robust adoption due to their ability to enhance customer engagement and operational efficiency. The increasing need for real-time fraud prevention and personalized customer support is driving the adoption of these solutions across financial institutions.

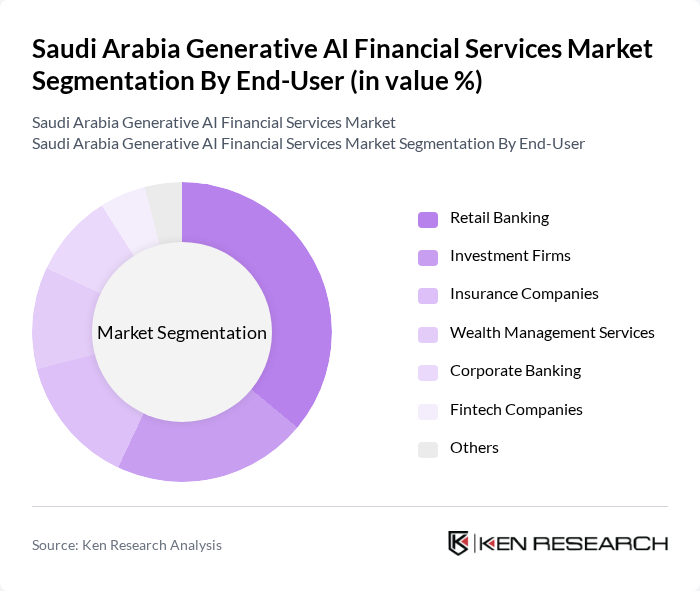

By End-User:The end-user segmentation includes Retail Banking, Investment Firms, Insurance Companies, Wealth Management Services, Corporate Banking, Fintech Companies, and Others. Retail Banking remains the dominant segment, primarily due to the sector’s focus on personalized digital experiences, fraud prevention, and efficient customer service. The increasing adoption of AI-driven chatbots, automated credit scoring, and predictive analytics in retail banking is fueling this dominance. Investment Firms and Insurance Companies are also significant adopters, leveraging generative AI for portfolio optimization, risk assessment, and claims automation.

The Saudi Arabia Generative AI Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as stc pay (Saudi Digital Payments Company), Al Rajhi Bank, Saudi National Bank (SNB), Riyad Bank, Arab National Bank, Banque Saudi Fransi, Alinma Bank, Gulf International Bank, Alawwal Bank, Saudi Investment Bank, Tamam (stc Group), HyperPay, Lean Technologies, Tabby, Amazon Web Services (AWS) Saudi Arabia, Microsoft Arabia, IBM Saudi Arabia, Google Cloud Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the generative AI financial services market in Saudi Arabia appears promising, driven by technological advancements and supportive government policies. As financial institutions increasingly adopt AI solutions, the focus will shift towards enhancing customer experiences and operational efficiencies. The integration of AI with blockchain technology is expected to gain traction, providing secure and transparent financial transactions. Additionally, the collaboration between fintech startups and established banks will foster innovation, creating a dynamic ecosystem that supports sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AI-Powered Chatbots Predictive Analytics Tools Automated Trading Systems Fraud Detection Solutions Credit Scoring Models Risk Management Software Forecasting & Reporting Solutions Others |

| By End-User | Retail Banking Investment Firms Insurance Companies Wealth Management Services Corporate Banking Fintech Companies Others |

| By Application | Customer Service Automation Risk Assessment Compliance Monitoring Financial Forecasting & Reporting Fraud Detection & Prevention Investment Analysis Others |

| By Deployment Model | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| By Technology | Machine Learning Natural Language Processing Deep Learning Generative Adversarial Networks (GANs) Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Others |

| By Geographic Presence | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector AI Implementation | 100 | Chief Technology Officers, AI Project Managers |

| Fintech Innovations in Generative AI | 80 | Product Development Leads, Data Analysts |

| Insurance Sector AI Applications | 60 | Risk Managers, Underwriting Specialists |

| Customer Experience Enhancements | 90 | Customer Experience Managers, Marketing Directors |

| Regulatory Compliance and AI | 50 | Compliance Officers, Legal Advisors |

The Saudi Arabia Generative AI Financial Services Market is valued at approximately USD 38 million, reflecting significant growth driven by the adoption of AI technologies in financial institutions, enhancing operational efficiency and customer experience.