Region:North America

Author(s):Geetanshi

Product Code:KRAD3717

Pages:98

Published On:November 2025

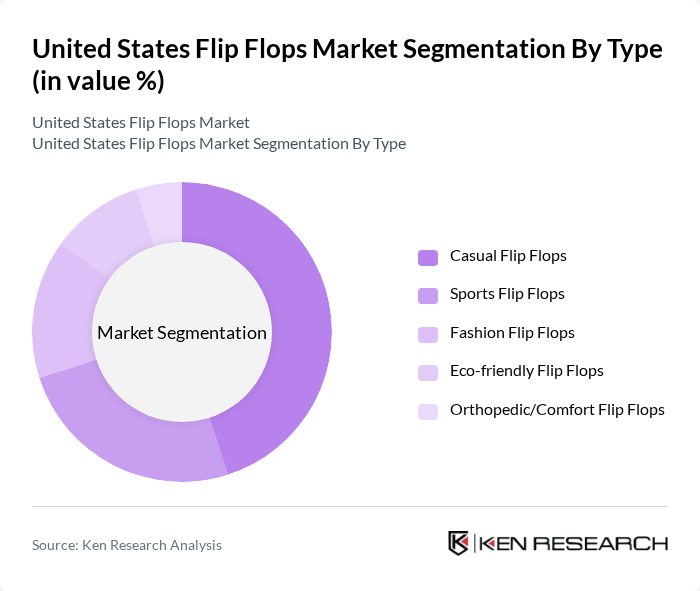

By Type:The market is segmented into various types of flip flops, including Casual Flip Flops, Sports Flip Flops, Fashion Flip Flops, Eco-friendly Flip Flops, and Orthopedic/Comfort Flip Flops. Each type caters to distinct consumer needs and preferences, with Casual Flip Flops being the most popular due to their versatility and comfort. Sports Flip Flops are gaining traction among active consumers, while Eco-friendly options are increasingly favored by environmentally conscious buyers. The market also reflects a rising demand for orthopedic and comfort-focused designs, driven by health and wellness trends.

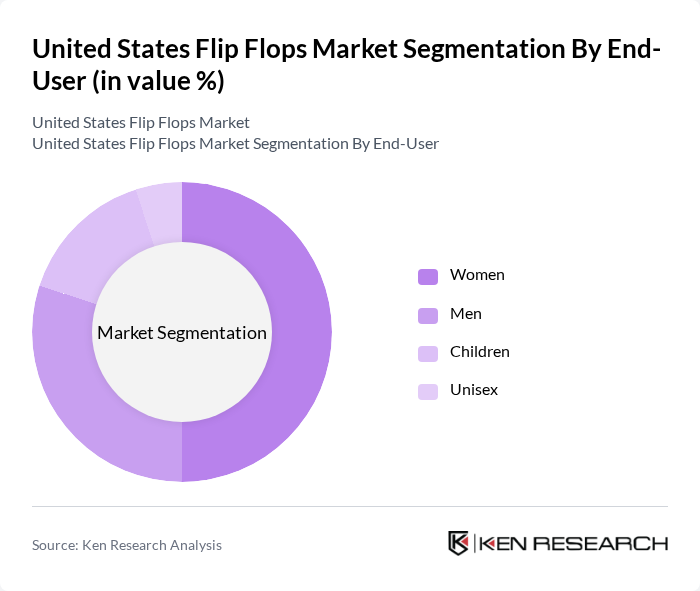

By End-User:The end-user segmentation includes Women, Men, Children, and Unisex categories. Women represent the largest segment, driven by a wide variety of styles and designs available in the market. Men’s flip flops are also popular, particularly in casual and sports categories. The children’s segment is expanding as parents seek comfortable and stylish options for their kids, while unisex designs appeal to a broader audience. The female segment accounts for the highest revenue share, reflecting strong demand for both fashion and comfort-oriented products.

The United States Flip Flops Market is characterized by a dynamic mix of regional and international players. Leading participants such as Havaianas, Reef, Crocs, Adidas, Nike, Teva, Old Navy, OOFOS, Sanuk, Skechers, FitFlop, TKEES, Ipanema, Vionic, Roxy, Tory Burch, Clarks, Deckers Outdoor Corporation, Kappa, Next PLC contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. flip flop market is poised for dynamic growth, driven by evolving consumer preferences towards casual and sustainable footwear. As outdoor activities and beach tourism continue to rise, brands are likely to innovate with eco-friendly materials and customizable options. Additionally, the expansion of e-commerce platforms will facilitate broader market access, allowing smaller brands to compete effectively. The focus on health and wellness trends will further enhance the appeal of comfortable footwear, positioning the market for robust development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Flip Flops Sports Flip Flops Fashion Flip Flops Eco-friendly Flip Flops Orthopedic/Comfort Flip Flops |

| By End-User | Women Men Children Unisex |

| By Distribution Channel | Online Retail Offline Retail Specialty Stores Department Stores Others |

| By Material | Rubber EVA (Ethylene Vinyl Acetate) Leather Recycled/Sustainable Materials Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Occasion | Casual Wear Beach Wear Sports Activities Travel/Resort Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences Survey | 150 | General Consumers, Age 18-45 |

| Retail Insights on Flip Flop Sales | 100 | Store Managers, Sales Associates |

| Manufacturer Feedback on Product Development | 60 | Product Development Managers, Marketing Directors |

| Online Shopping Behavior Analysis | 80 | eCommerce Shoppers, Age 18-35 |

| Environmental Impact Awareness Survey | 40 | Sustainability Advocates, Eco-conscious Consumers |

The United States Flip Flops Market is valued at approximately USD 4.1 billion, reflecting a significant growth trend driven by increasing consumer demand for casual and comfortable footwear, particularly during warmer months and outdoor activities.