Region:Africa

Author(s):Shubham

Product Code:KRAA1822

Pages:86

Published On:August 2025

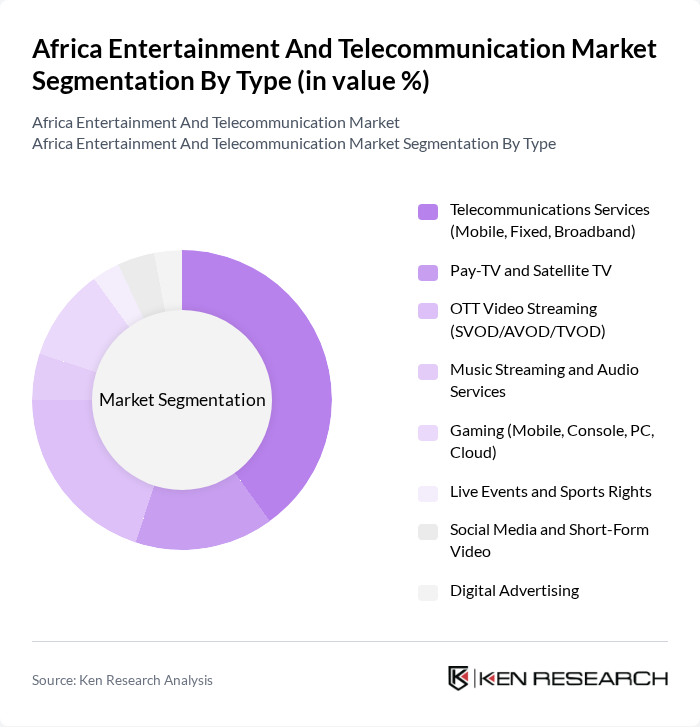

By Type:The market is segmented into various types, including Telecommunications Services, Pay-TV and Satellite TV, OTT Video Streaming, Music Streaming, Gaming, Live Events, Social Media, and Digital Advertising. Each of these segments caters to different consumer preferences and technological advancements, reflecting the diverse entertainment landscape in Africa. Telecom services account for the largest revenue share given the scale of mobile subscriptions and data monetization, while OTT video and mobile-first entertainment are expanding on the back of smartphone penetration, improved broadband, and localized content strategies.

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Enterprises, and the Public Sector and Education. Each segment has unique needs and consumption patterns, influencing the types of services and content offered. Individual consumers dominate usage and spending across mobile data, OTT, music, and social platforms, while SMEs and enterprises drive demand for connectivity, cloud collaboration, and digital communication services.

The Africa Entertainment And Telecommunication Market is characterized by a dynamic mix of regional and international players. Leading participants such as MTN Group, Vodacom Group, Airtel Africa, Safaricom, Telkom SA, Orange Middle East & Africa, Ethio telecom, Maroc Telecom (Itissalat Al-Maghrib), MultiChoice Group (DStv, GOtv), CANAL+ Afrique, StarTimes Group, Showmax, Netflix, Amazon Prime Video, iROKOtv, Spotify, Boomplay, Audiomack, YouTube, Starlink (SpaceX) — Africa, Liquid Intelligent Technologies (Liquid Telecom), Zamtel (Zambia Telecommunications Company Limited), Econet Wireless, Cell C, Telkom Kenya (Zuku parent: Wananchi Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Africa entertainment and telecommunication market appears promising, driven by technological advancements and increasing consumer demand. The adoption of 5G technology is expected to enhance streaming quality and reduce latency, fostering a more immersive user experience. Additionally, the growth of e-sports and localized content production will attract younger audiences, further diversifying the market. As infrastructure improves, more consumers will gain access to digital platforms, creating new opportunities for content creators and service providers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Telecommunications Services (Mobile, Fixed, Broadband) Pay-TV and Satellite TV OTT Video Streaming (SVOD/AVOD/TVOD) Music Streaming and Audio Services Gaming (Mobile, Console, PC, Cloud) Live Events and Sports Rights Social Media and Short-Form Video Digital Advertising |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Enterprises Public Sector and Education |

| By Distribution Channel | Direct-to-Consumer Apps and Websites Telecom Bundles and Carrier Billing Retail and Dealer Networks Third-Party Aggregators and Super-Apps |

| By Content Genre | Sports Drama and Nollywood/Afrobeats Visuals Comedy and Variety News and Current Affairs Music and Podcasts Kids and Education Documentary and Factual |

| By Pricing Model | Subscription (Monthly/Annual, Micro-subscriptions) Prepaid and Pay-Per-Use/TVOD Freemium Ad-Supported (AVOD/Free-to-Air with Ads) |

| By Audience Demographics | Age Groups Gender Income Levels Urban vs Rural |

| By Device Type | Smartphones and Feature Phones Tablets Smart TVs and Set-Top Boxes PCs and Laptops Gaming Consoles Connected TV Sticks and Dongles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Service Users | 150 | Mobile Users, Broadband Subscribers |

| Streaming Service Subscribers | 100 | Content Consumers, Digital Media Users |

| Industry Experts and Analysts | 40 | Market Analysts, Telecom Consultants |

| Content Creators and Producers | 75 | Film Producers, Music Executives |

| Regulatory Bodies and Policy Makers | 40 | Government Officials, Regulatory Analysts |

The Africa Entertainment and Telecommunication Market is valued at approximately USD 7174 billion, with estimates suggesting it could reach around USD 80 billion in the near future, driven by mobile technology adoption and increased demand for digital content.