Region:Africa

Author(s):Geetanshi

Product Code:KRAA0203

Pages:96

Published On:August 2025

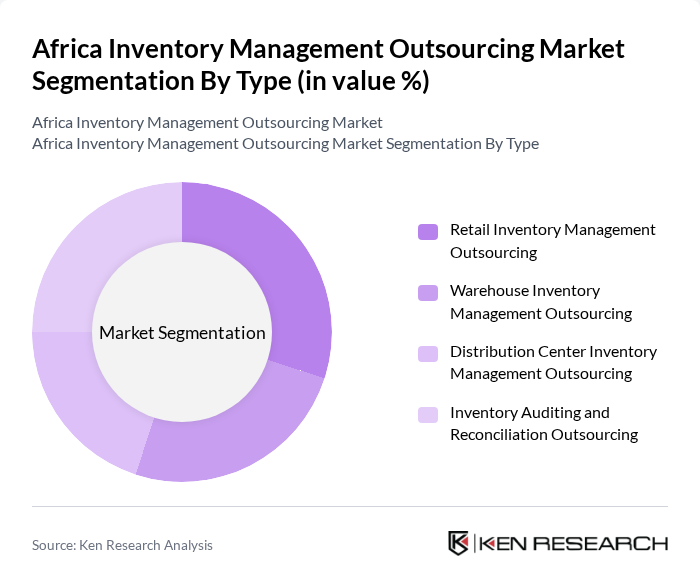

By Type:The market is segmented into various types of inventory management outsourcing services, including Retail Inventory Management Outsourcing, Warehouse Inventory Management Outsourcing, Distribution Center Inventory Management Outsourcing, and Inventory Auditing and Reconciliation Outsourcing. Each of these segments plays a crucial role in enhancing operational efficiency and reducing costs for businesses .

The Retail Inventory Management Outsourcing segment is currently dominating the market due to the rapid growth of the retail sector in Africa, driven by urbanization and evolving consumer preferences. Retailers are increasingly outsourcing inventory management to improve efficiency, reduce operational costs, and enhance customer satisfaction. This trend is particularly evident in countries like South Africa and Nigeria, where e-commerce is expanding rapidly, and retailers are seeking to streamline their operations to meet consumer demands effectively. The focus on customer experience and the need for real-time inventory visibility are key factors contributing to the growth of this segment .

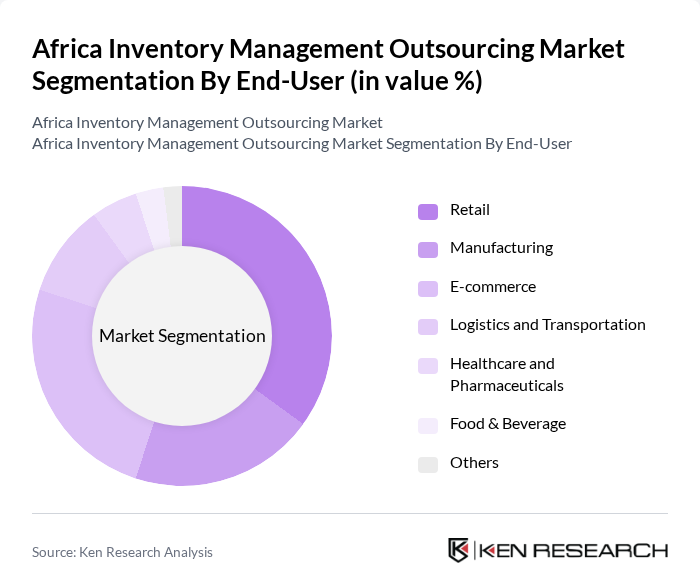

By End-User:The market is segmented based on end-users, including Retail, Manufacturing, E-commerce, Logistics and Transportation, Healthcare and Pharmaceuticals, Food & Beverage, and Others. Each end-user segment has unique requirements and challenges that drive the demand for inventory management outsourcing services .

The E-commerce segment is witnessing significant growth, driven by the increasing number of online shoppers and the need for efficient inventory management solutions. As e-commerce platforms expand, they require robust inventory systems to manage stock levels, fulfill orders promptly, and enhance customer satisfaction. This trend is particularly strong in urban areas where internet penetration is high, and consumers are increasingly turning to online shopping for convenience. The demand for fast and reliable delivery services further propels the growth of this segment .

The Africa Inventory Management Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, Imperial Logistics, CEVA Logistics, DB Schenker, Agility Logistics, UPS Supply Chain Solutions, Bolloré Logistics, DSV Solutions, Bidvest International Logistics, Rhenus Logistics, Maersk Logistics & Services, Value Logistics, Onelogix Group, Super Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Africa inventory management outsourcing market appears promising, driven by technological advancements and increasing e-commerce activities. As businesses seek to enhance supply chain efficiency, the adoption of cloud-based solutions and automation technologies will likely accelerate. Furthermore, strategic partnerships between local firms and global logistics providers are expected to foster innovation and improve service delivery, positioning the market for robust growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Retail Inventory Management Outsourcing Warehouse Inventory Management Outsourcing Distribution Center Inventory Management Outsourcing Inventory Auditing and Reconciliation Outsourcing |

| By End-User | Retail Manufacturing E-commerce Logistics and Transportation Healthcare and Pharmaceuticals Food & Beverage Others |

| By Region | North Africa West Africa East Africa Southern Africa |

| By Application | Inventory Tracking & Visibility Order Fulfillment & Processing Demand Forecasting & Planning Inventory Optimization Returns Management Others |

| By Service Type | Consulting Services Implementation & Integration Services Support and Maintenance Managed Inventory Services Others |

| By Technology | RFID Technology Barcode Technology IoT Solutions Cloud-Based Inventory Management AI & Automation Others |

| By Business Model | B2B Outsourcing B2C Outsourcing Hybrid Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Supply Chain Managers, Inventory Analysts |

| Manufacturing Outsourcing Strategies | 80 | Operations Directors, Procurement Managers |

| E-commerce Fulfillment Processes | 90 | Logistics Coordinators, eCommerce Operations Heads |

| Third-Party Logistics Utilization | 60 | 3PL Executives, Business Development Managers |

| Inventory Technology Adoption | 50 | IT Managers, Supply Chain Technology Specialists |

The Africa Inventory Management Outsourcing Market is valued at approximately USD 1.1 billion, driven by the increasing demand for efficient supply chain management and the rapid growth of e-commerce across the continent.