Region:Africa

Author(s):Shubham

Product Code:KRAA2267

Pages:90

Published On:August 2025

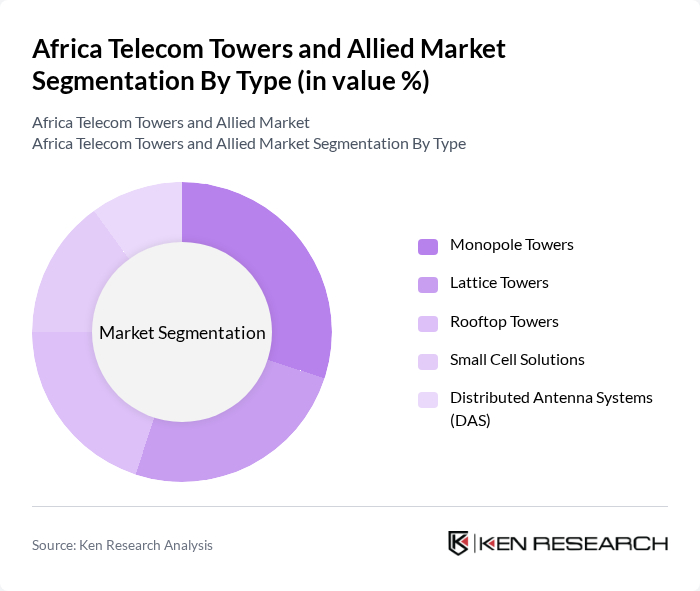

By Type:The market is segmented into various types of telecom towers, including Monopole Towers, Lattice Towers, Rooftop Towers, Small Cell Solutions, and Distributed Antenna Systems (DAS). Each type serves specific needs based on location, capacity, and technological requirements. Monopole Towers are favored for their space efficiency in urban areas, while Lattice Towers are preferred for their robustness in rural settings. Rooftop Towers are increasingly popular in densely populated cities, and Small Cell Solutions are essential for enhancing coverage in high-traffic areas .

By End-User:The end-user segmentation includes Mobile Network Operators (MNOs), Internet Service Providers (ISPs), TowerCo/Independent Tower Companies, Government & Public Sector, and Enterprises. MNOs are the largest segment, driven by the need for extensive network coverage and capacity. ISPs are also significant players, focusing on broadband services. TowerCo companies are emerging as key players, leasing tower space to MNOs and ISPs, while government initiatives are increasingly supporting public sector connectivity .

The Africa Telecom Towers and Allied Market is characterized by a dynamic mix of regional and international players. Leading participants such as IHS Towers (IHS Holding Ltd), Helios Towers plc, American Tower Corporation, Eaton Towers (now part of American Tower), MTN Group, Vodacom Group, Airtel Africa, Orange S.A., Telkom SA SOC Ltd, Liquid Intelligent Technologies (Liquid Telecom), ZESCO Limited, Eskom Holdings SOC Ltd, Comsol Networks, Broadband Infraco, SWIFTNET (Actis/Swiftnet) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Africa Telecom Towers and Allied Market appears promising, driven by technological advancements and increasing connectivity demands. The integration of IoT technologies and the rise of smart city initiatives are expected to further enhance the need for robust telecom infrastructure. Additionally, the shift towards renewable energy solutions will likely reduce operational costs and improve sustainability, making telecom operations more efficient and environmentally friendly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Monopole Towers Lattice Towers Rooftop Towers Small Cell Solutions Distributed Antenna Systems (DAS) |

| By End-User | Mobile Network Operators (MNOs) Internet Service Providers (ISPs) TowerCo/Independent Tower Companies Government & Public Sector Enterprises |

| By Application | Urban Connectivity Rural Connectivity Emergency Services Disaster Recovery IoT & Smart City Deployments |

| By Investment Source | Private Investments Public-Private Partnerships Foreign Direct Investment Government Grants |

| By Policy Support | Subsidies for Infrastructure Development Tax Exemptions for Telecom Projects Regulatory Support for New Entrants Streamlined Permitting Processes |

| By Geography | Nigeria South Africa Egypt Kenya Rest of Africa |

| By Power Source | Grid-Powered Towers Diesel Generator-Powered Towers Renewable Energy-Powered Towers (Solar, Wind, Hybrid) Hybrid Power Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Tower Operators | 100 | Operations Managers, Network Engineers |

| Infrastructure Investment Analysts | 60 | Financial Analysts, Investment Managers |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Telecom Service Providers | 80 | Product Managers, Strategic Planners |

| Local Market Operators | 50 | Site Managers, Regional Directors |

The Africa Telecom Towers and Allied Market is valued at approximately USD 3.5 billion, driven by the increasing demand for mobile connectivity, the expansion of 4G and 5G networks, and rising internet users across the continent.