Region:Africa

Author(s):Shubham

Product Code:KRAD0685

Pages:96

Published On:August 2025

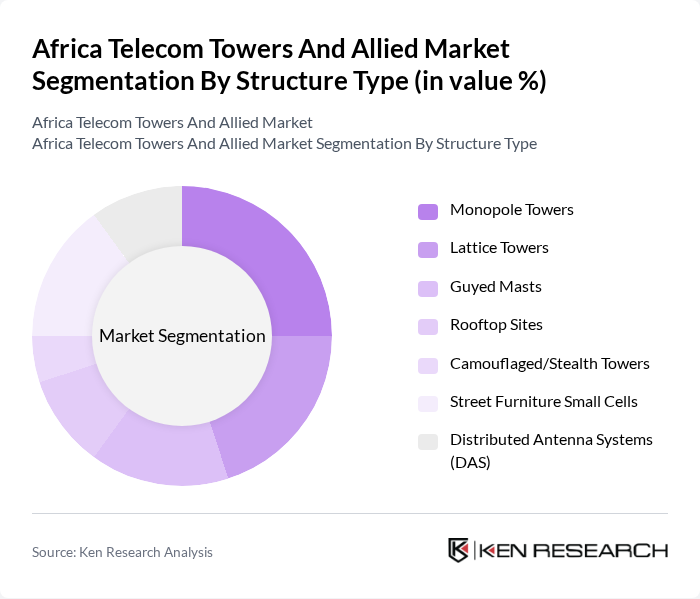

By Structure Type:The structure type segmentation includes various forms of telecom towers that cater to different operational needs and geographical conditions. The subsegments include Monopole Towers, Lattice Towers, Guyed Masts, Rooftop Sites, Camouflaged/Stealth Towers, Street Furniture Small Cells, and Distributed Antenna Systems (DAS). Each type serves specific purposes, with some being more suitable for urban environments while others are designed for rural or remote areas. In Africa, macro sites (lattice and monopoles) remain the backbone due to coverage needs and power-backup requirements, while small cells and DAS are more selectively deployed in dense urban zones and venues .

By Ownership/Business Model:This segmentation focuses on the ownership structure of telecom towers, which can significantly influence operational strategies and market dynamics. The subsegments include Independent TowerCo Owned, MNO Captive (Operator-Owned), Joint Ventures/InfraCo SPVs, and Sale-and-Leaseback Portfolios. Each model presents unique advantages, such as flexibility in operations or capital efficiency. Across Africa, independent towercos continue prioritizing co-locations and selective build-to-suit, while operators pursue sale-and-leaseback or carve-outs to optimize capital and network quality .

The Africa Telecom Towers and Allied Market is characterized by a dynamic mix of regional and international players. Leading participants such as IHS Towers (IHS Holding Limited), Helios Towers plc, American Tower Corporation (ATC Africa), Eaton Towers (now part of American Tower), MTN Group Ltd. (Tower assets and partnerships), Vodacom Group Ltd. (including Vantage Towers Africa partnerships), Airtel Africa plc, Safaricom PLC, Telkom SA SOC Ltd. (including Swiftnet), Liquid Intelligent Technologies, ZESCO Limited (Zambia) — power supply to tower sites, Eskom Holdings SOC Ltd. — power utility interfacing with tower networks, Huawei Technologies Co., Ltd., ZTE Corporation, Ericsson AB contribute to innovation, geographic expansion, and service delivery in this space. Ongoing themes include tenancy ratio improvement, selective build-to-suit, and market-specific initiatives such as Nigeria’s large PPP for new towers and lease reallocations among leading towercos .

The future of the Africa telecom towers market appears promising, driven by technological advancements and increasing connectivity demands. As urbanization accelerates, the need for robust telecom infrastructure will intensify, particularly in underserved areas. Additionally, the integration of renewable energy solutions and smart tower technologies is expected to enhance operational efficiency. These trends will likely attract investments, fostering a more competitive landscape and enabling operators to meet the growing consumer expectations for high-quality services.

| Segment | Sub-Segments |

|---|---|

| By Structure Type | Monopole Towers Lattice Towers Guyed Masts Rooftop Sites Camouflaged/Stealth Towers Street Furniture Small Cells Distributed Antenna Systems (DAS) |

| By Ownership/Business Model | Independent TowerCo Owned MNO Captive (Operator-Owned) Joint Ventures/InfraCo SPVs Sale-and-Leaseback Portfolios |

| By Tenancy & Commercials | Single-Tenant Sites Multi-Tenant Sites (2–3 Tenants) High-Density Sites (4+ Tenants) Colocation and Site Sharing Agreements |

| By Power Solution | Grid-Connected Diesel Generator-Based Hybrid (Solar/DG/Battery) Renewable/Energy-as-a-Service (TowerCos/ESCo) |

| By Application | Mobile Access (2G/3G/4G/5G) Microwave Backhaul Fixed Wireless Access (FWA) Broadcasting and Public Safety |

| By Geography | Nigeria South Africa Egypt Kenya Tanzania Ghana Ethiopia Rest of Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Tower Infrastructure Providers | 90 | CEOs, Operations Managers |

| Mobile Network Operators | 80 | Network Engineers, Strategic Planners |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Managers |

| Investment Firms in Telecom | 60 | Investment Analysts, Portfolio Managers |

| Local Government Officials | 40 | City Planners, Telecommunications Advisors |

The Africa Telecom Towers and Allied Market is valued at approximately USD 3.5 billion, driven by the increasing demand for mobile connectivity, the expansion of 4G and 5G networks, and a growing number of mobile subscribers across the continent.