Region:Asia

Author(s):Dev

Product Code:KRAC4813

Pages:86

Published On:October 2025

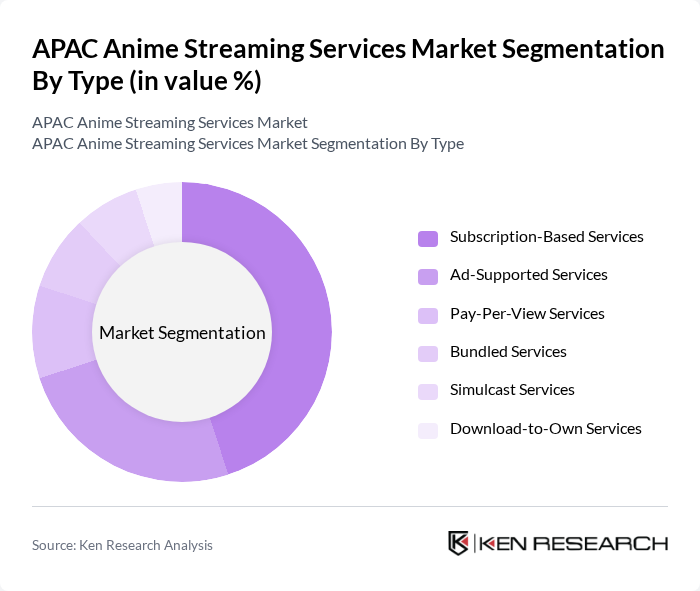

By Type:The market is segmented into various types of services that cater to different consumer preferences. Subscription-based services are leading the market due to their convenience, extensive content libraries, and exclusive simulcast offerings. Ad-supported services are gaining traction as they provide free access to content, appealing to budget-conscious viewers and expanding reach in mobile-first markets. Pay-per-view services offer flexibility for occasional viewers who prefer to pay only for specific titles. Bundled services attract consumers looking for value by combining anime with other entertainment content such as movies, games, or music. Simulcast services allow fans to watch new episodes shortly after their release in Japan, enhancing engagement and reducing piracy. Download-to-own services cater to collectors and dedicated fans who seek permanent access to their favorite titles and bonus content.

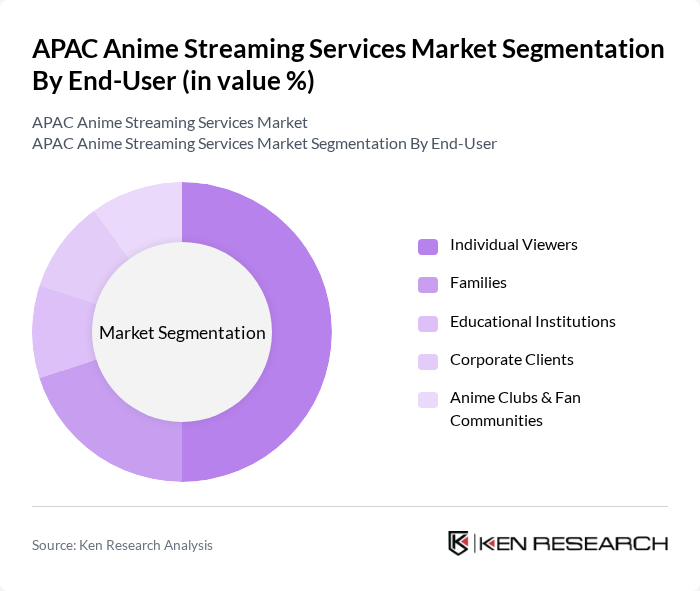

By End-User:The end-user segmentation highlights the diverse audience engaging with anime streaming services. Individual viewers represent the largest segment, driven by the growing popularity of anime among young adults and teenagers, as well as the convenience of mobile streaming. Families are increasingly subscribing to services that offer curated content suitable for all ages and parental controls. Educational institutions are utilizing anime for language learning, cultural studies, and creative arts programs. Corporate clients are exploring anime for marketing, branding, and employee engagement initiatives. Anime clubs and fan communities play a significant role in promoting content, organizing events, and driving subscriptions through word-of-mouth and social media engagement.

The APAC Anime Streaming Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Crunchyroll, Funimation (now part of Crunchyroll/Sony Group), Netflix, Amazon Prime Video, Bilibili, iQIYI, Hulu Japan, Viu, Disney+, Aniplus Asia, HIDIVE, Youku, Muse Asia, Rakuten Viki, Niconico contribute to innovation, geographic expansion, and service delivery in this space.

The APAC anime streaming market is poised for continued growth, driven by technological advancements and evolving consumer preferences. As internet accessibility improves, platforms are likely to invest in localized content to cater to diverse audiences. The integration of interactive features and social media elements will enhance user engagement. Furthermore, the rise of subscription-based models will likely dominate the market, providing a steady revenue stream while fostering a loyal customer base. Overall, the future appears promising for anime streaming services in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription-Based Services Ad-Supported Services Pay-Per-View Services Bundled Services Simulcast Services Download-to-Own Services |

| By End-User | Individual Viewers Families Educational Institutions Corporate Clients Anime Clubs & Fan Communities |

| By Region | Japan China South Korea Southeast Asia India Oceania |

| By Genre | Action & Adventure Romance Fantasy & Sci-Fi Comedy Slice of Life Horror & Thriller Sports Others |

| By Subscription Model | Monthly Subscription Annual Subscription Free Trials Freemium Model |

| By Device Type | Mobile Devices Smart TVs Laptops and Desktops Gaming Consoles Tablets |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Carrier Billing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Anime Streaming User Preferences | 100 | Anime Viewers, Streaming Subscribers |

| Content Acquisition Insights | 60 | Content Managers, Licensing Managers |

| Market Trends in APAC | 50 | Industry Analysts, Market Researchers |

| Consumer Behavior Analysis | 80 | Demographic Segments, Focus Group Participants |

| Competitive Landscape Assessment | 60 | Business Development Managers, Marketing Managers |

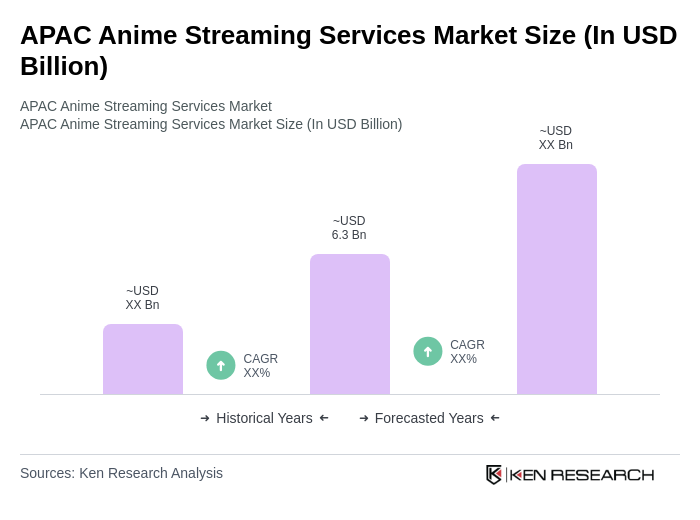

The APAC Anime Streaming Services Market is valued at approximately USD 6.3 billion, reflecting significant growth driven by the increasing popularity of anime content and the rise of digital streaming platforms in the region.