APAC Antifreeze Market Overview

- The APAC Antifreeze Market is valued at USD 2.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for automotive antifreeze due to the rising vehicle production and sales in the region. Additionally, the expansion of industrial activities and the need for effective cooling solutions in various applications have further propelled market growth. The region is experiencing accelerated demand fueled by the production of electric vehicles, particularly in China, which dominates global sales of electric buses and trucks, with over 54,000 electric buses and approximately 52,000 electric medium- and heavy-duty trucks marketed in 2022 alone.

- China and India are the dominant countries in the APAC Antifreeze Market, primarily due to their large automotive manufacturing sectors and growing industrial base. China's extensive automotive production and India's increasing vehicle ownership contribute significantly to the demand for antifreeze products, making these countries key players in the market. The Asia Pacific region is expected to account for the largest revenue share, driven by increasing production of electric vehicles and the region's robust automotive infrastructure.

- The regulatory framework in India mandates the use of environmentally compliant antifreeze formulations in vehicles to reduce environmental impact. This regulatory requirement aims to promote the adoption of biodegradable and less toxic antifreeze solutions, aligning with global sustainability goals and enhancing consumer safety.

APAC Antifreeze Market Segmentation

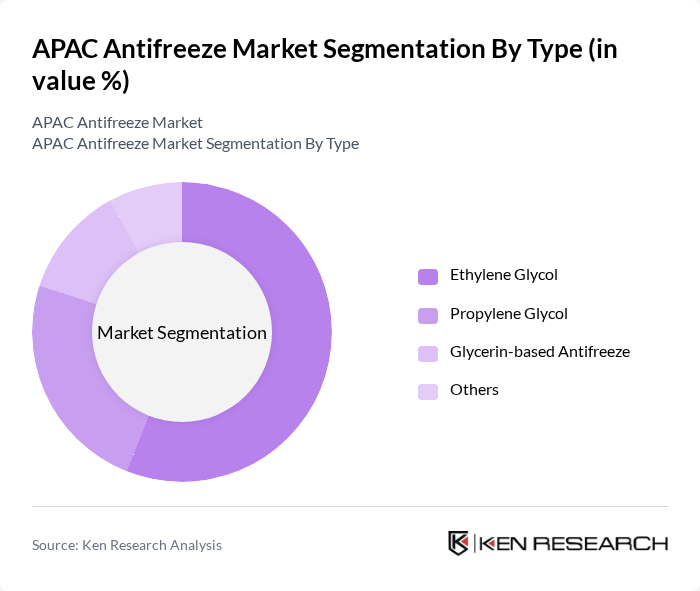

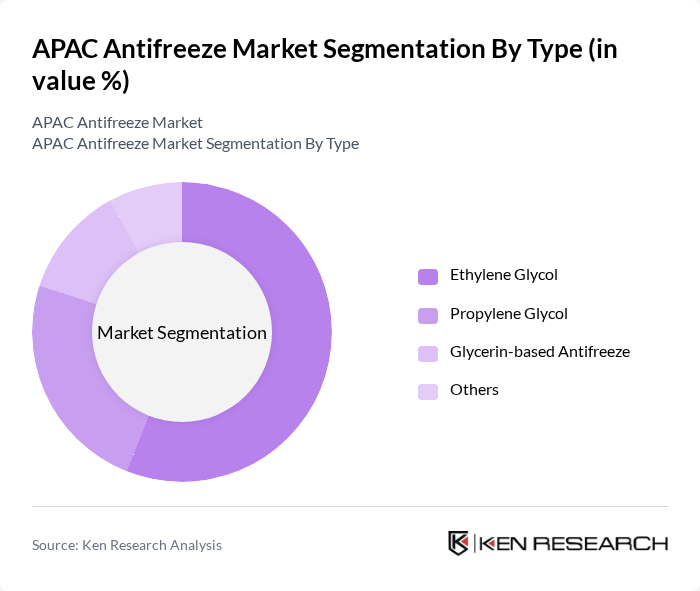

By Type:The market is segmented into Ethylene Glycol, Propylene Glycol, Glycerin-based Antifreeze, and Others. Ethylene Glycol is widely used due to its excellent thermal properties and cost-effectiveness, making it the leading subsegment. The ethylene glycol segment is projected to hold approximately 56% of the market share, driven by its increasing implementation in deicing, radiator protection, and cooling systems. Propylene Glycol is gaining traction due to its non-toxic nature, especially in applications requiring food-grade antifreeze. Glycerin-based Antifreeze is emerging as a sustainable alternative, while the 'Others' category includes various specialized formulations.

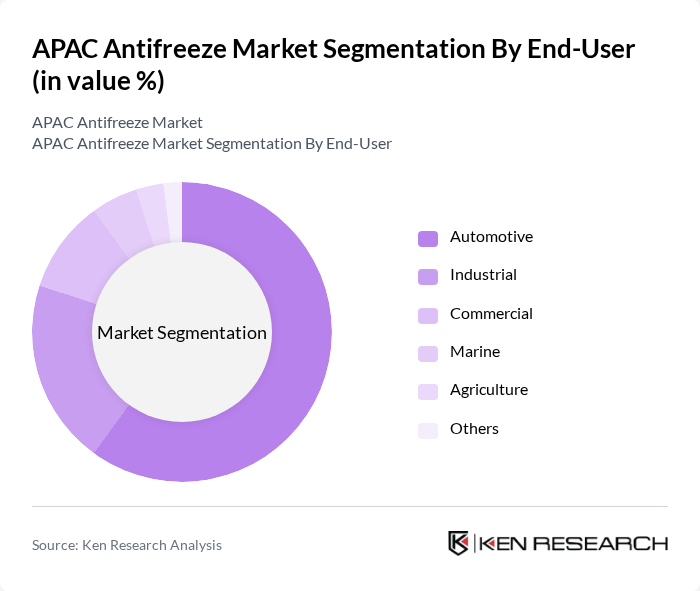

By End-User:The market is segmented into Automotive, Industrial, Commercial, Marine, Agriculture, and Others. The Automotive sector dominates the market due to the high demand for antifreeze in vehicle cooling systems, accounting for approximately 60% of market share. Industrial applications are also significant, driven by the need for effective cooling in machinery and equipment. The Commercial and Marine sectors are growing, while Agriculture and Others contribute to niche applications.

APAC Antifreeze Market Competitive Landscape

The APAC Antifreeze Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, ExxonMobil Corporation, Prestone Products Corporation, Valvoline Inc., Chevron Corporation, Shell plc, TotalEnergies SE, CCI Corporation, Old World Industries, LLC, Fuchs Petrolub SE, Gulf Oil International Ltd., Sonax GmbH, Recochem Inc., Millers Oils Ltd., KOST USA, Inc., Amsoil Inc., PARAS Lubricants Ltd., PENTOSIN (Mitan GmbH), Motul S.A. contribute to innovation, geographic expansion, and service delivery in this space.

APAC Antifreeze Market Industry Analysis

Growth Drivers

- Increasing Automotive Production:The automotive sector in the APAC region is projected to produce approximately 42 million vehicles in future, driven by rising consumer demand and economic recovery. Countries like China and India are leading this growth, with China alone accounting for over 26 million vehicles. This surge in production directly correlates with the increased need for antifreeze products, as every vehicle requires effective cooling solutions to maintain optimal performance and longevity.

- Rising Demand for Electric Vehicles:The electric vehicle (EV) market in APAC is expected to reach 12 million units sold in future, reflecting a significant shift towards sustainable transportation. Governments are investing heavily in EV infrastructure, with China allocating $18 billion for charging stations. This transition necessitates specialized antifreeze formulations to ensure efficient thermal management in EV batteries, thereby creating a robust demand for innovative antifreeze solutions tailored for electric vehicles.

- Stringent Environmental Regulations:In future, APAC countries are expected to implement stricter environmental regulations, with over 35% of nations adopting new emission standards for automotive fluids. This regulatory landscape is pushing manufacturers to develop eco-friendly antifreeze products that comply with these standards. The shift towards biodegradable and less toxic formulations is not only a response to regulations but also aligns with consumer preferences for sustainable products, further driving market growth.

Market Challenges

- Fluctuating Raw Material Prices:The antifreeze market faces significant challenges due to the volatility of raw material prices, particularly ethylene glycol and propylene glycol, which have seen price fluctuations of up to 25% in recent years. This instability can lead to increased production costs, affecting profit margins for manufacturers. As raw material costs rise, companies may struggle to maintain competitive pricing, potentially impacting market share and profitability.

- Competition from Alternative Products:The rise of alternative cooling solutions, such as water-based coolants and advanced thermal management systems, poses a challenge to traditional antifreeze products. In future, it is estimated that alternative products could capture up to 18% of the market share, driven by technological advancements and consumer preferences for innovative solutions. This competition necessitates that antifreeze manufacturers innovate and differentiate their products to retain market relevance.

APAC Antifreeze Market Future Outlook

The APAC antifreeze market is poised for transformative growth, driven by technological advancements and a shift towards sustainability. As manufacturers invest in research and development, innovative antifreeze formulations that enhance performance and reduce environmental impact will emerge. Additionally, the increasing adoption of electric vehicles will necessitate specialized antifreeze solutions, further expanding market opportunities. Strategic partnerships among industry players will also play a crucial role in navigating regulatory challenges and enhancing product offerings, ensuring a competitive edge in this evolving landscape.

Market Opportunities

- Growth in Renewable Energy Sector:The renewable energy sector is projected to grow by 30% in future, creating opportunities for antifreeze products used in solar thermal systems. This growth will drive demand for specialized antifreeze formulations that can withstand high temperatures and improve efficiency, presenting a lucrative market segment for manufacturers to explore.

- Technological Advancements in Antifreeze Formulations:Innovations in antifreeze technology, such as the development of bio-based products, are gaining traction. With an expected market share increase of 12% for bio-based antifreeze in future, manufacturers can capitalize on this trend by investing in R&D to create environmentally friendly products that meet consumer demand for sustainability.