Region:Asia

Author(s):Geetanshi

Product Code:KRAD4135

Pages:96

Published On:December 2025

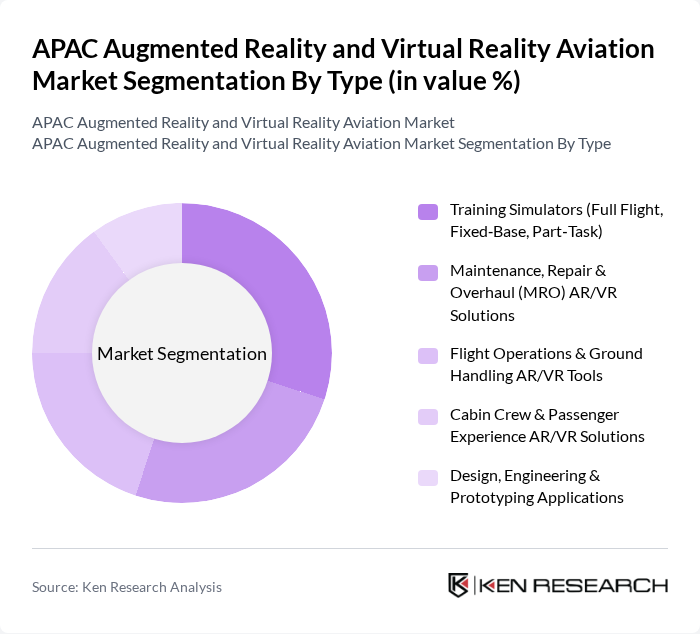

By Type:The market is segmented into various types, including Training Simulators, Maintenance, Repair & Overhaul (MRO) AR/VR Solutions, Flight Operations & Ground Handling AR/VR Tools, Cabin Crew & Passenger Experience AR/VR Solutions, and Design, Engineering & Prototyping Applications. Each of these segments plays a crucial role in enhancing operational efficiency and training effectiveness in the aviation sector.

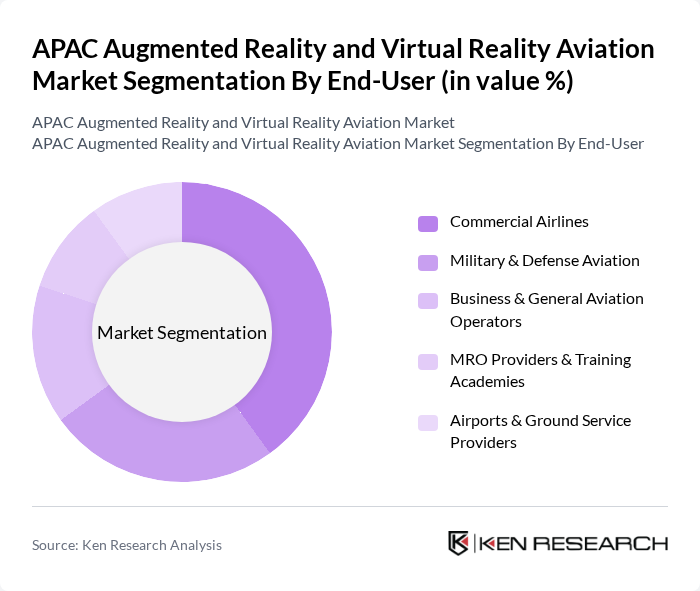

By End-User:The end-user segmentation includes Commercial Airlines, Military & Defense Aviation, Business & General Aviation Operators, MRO Providers & Training Academies, and Airports & Ground Service Providers. Each segment has unique requirements and applications for AR and VR technologies, contributing to the overall market growth.

The APAC Augmented Reality and Virtual Reality Aviation Market is characterized by a dynamic mix of regional and international players. Leading participants such as CAE Inc., Thales Group, Boeing (Jeppesen & Boeing Training Services), Airbus (Airbus Flight Training & Simulation), Honeywell International Inc., L3Harris Technologies, Inc., Elbit Systems Ltd., BAE Systems plc, Rockwell Collins (Collins Aerospace, an RTX business), HTC Corporation (VIVE), Samsung Electronics Co., Ltd., Panasonic Avionics Corporation, Vrgineers Inc., PTC Inc., Unity Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The APAC AR/VR aviation market is poised for significant growth as technological advancements continue to reshape training and operational processes. In future, the integration of AI with AR/VR technologies is expected to enhance user experiences, making training more effective and engaging. Additionally, the rise of cloud-based solutions will facilitate easier access to AR/VR applications, allowing for broader adoption across the aviation industry. As awareness of these technologies grows, more stakeholders are likely to invest in innovative solutions that improve safety and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Training Simulators (Full Flight, Fixed?Base, Part?Task) Maintenance, Repair & Overhaul (MRO) AR/VR Solutions Flight Operations & Ground Handling AR/VR Tools Cabin Crew & Passenger Experience AR/VR Solutions Design, Engineering & Prototyping Applications |

| By End-User | Commercial Airlines Military & Defense Aviation Business & General Aviation Operators MRO Providers & Training Academies Airports & Ground Service Providers |

| By Region | China India Japan South Korea Southeast Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, Others) Australia & New Zealand Rest of APAC |

| By Application | Pilot & Aircrew Training Aircraft & Engine Maintenance / Line & Base MRO Flight Simulation & Mission Rehearsal Cabin Crew Training & Passenger Engagement Airport Operations, Ground Handling & Safety |

| By Investment Source | OEM & Tier?1 Investments Airline & MRO In?house Investments Government & Defense Procurement Venture Capital & Corporate VC Public?Private Partnerships & Innovation Grants |

| By Policy Support | Defense Modernization & Pilot Training Programs Smart Airport & Digitalization Initiatives Innovation, R&D and Industry 4.0 Schemes Skills Development & Workforce Upskilling Programs |

| By Technology | Augmented Reality (AR) Solutions Virtual Reality (VR) Solutions Mixed Reality (MR) & Extended Reality (XR) Solutions Supporting Software Platforms, Content & Analytics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Training Programs | 110 | Training Managers, Chief Pilots |

| Maintenance and Repair Operations | 95 | Maintenance Managers, Technical Directors |

| Passenger Experience Enhancements | 80 | Customer Experience Managers, Innovation Leads |

| AR/VR Technology Providers | 75 | Product Managers, Business Development Executives |

| Regulatory Bodies and Aviation Authorities | 60 | Policy Makers, Regulatory Affairs Specialists |

The APAC Augmented Reality and Virtual Reality Aviation Market is valued at approximately USD 1.5 billion, driven by technological advancements and the increasing demand for immersive training solutions in the aviation sector.