Region:Asia

Author(s):Geetanshi

Product Code:KRAD7259

Pages:96

Published On:December 2025

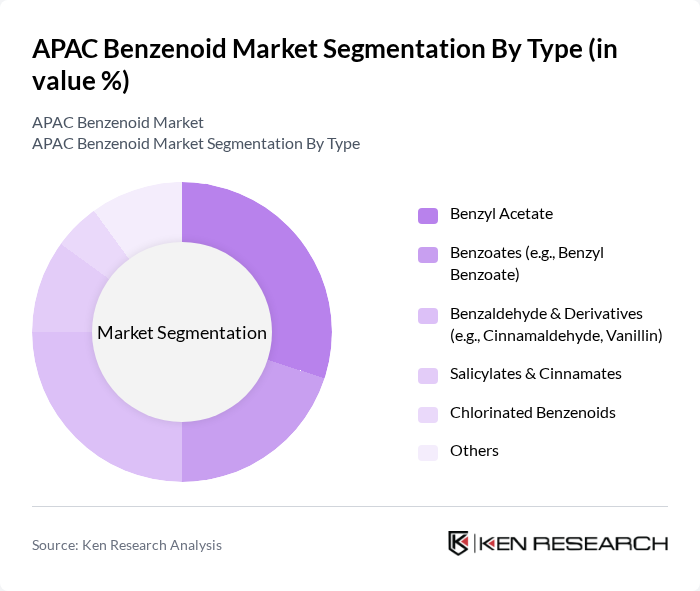

By Type:The benzenoid market can be segmented into various types, including Benzyl Acetate, Benzoates (e.g., Benzyl Benzoate), Benzaldehyde & Derivatives (e.g., Cinnamaldehyde, Vanillin), Salicylates & Cinnamates, Chlorinated Benzenoids, and Others. Among these, Benzyl Acetate is one of the leading subsegments in fragrance and personal care formulations due to its sweet, floral aroma and extensive use in fine fragrances, soaps, detergents, and air care products. Rising consumption of personal care products, home and fabric care, and air fresheners in Asia Pacific supports continued strong demand for benzyl acetate and other key benzenoid notes.

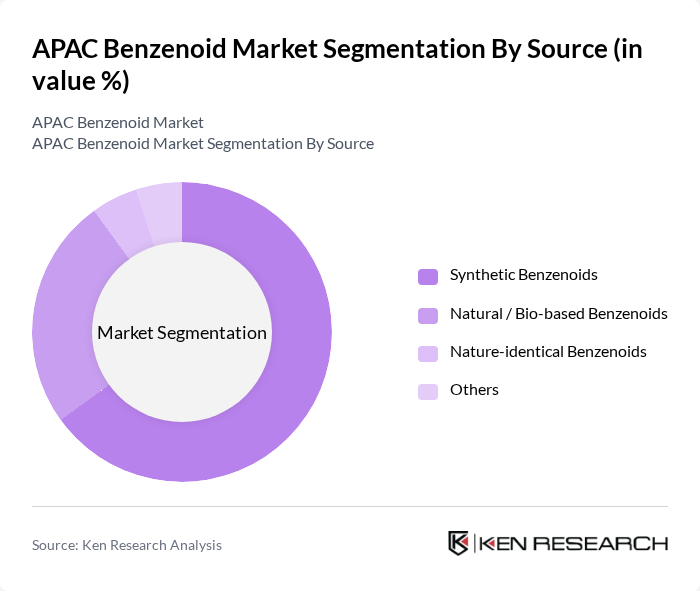

By Source:The benzenoid market is also categorized by source, including Synthetic Benzenoids, Natural / Bio-based Benzenoids, Nature-identical Benzenoids, and Others. The Synthetic Benzenoids subsegment continues to dominate in volume terms due to their broad availability, consistent quality, and cost-effective production, particularly for detergents, household products, and mass-market fragrances. However, the Natural / Bio-based and nature-identical benzenoids segments are gaining traction as brands and consumers increasingly prioritize sustainable sourcing, IFRA- and REACH-compliant aroma ingredients, and bio-based or biotech-derived aroma chemicals in premium personal care and fine fragrance lines.

The APAC Benzenoid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Firmenich SA, Givaudan SA, Symrise AG, IFF (International Flavors & Fragrances Inc.), Takasago International Corporation, Eternis Fine Chemicals Ltd., Jayshree Aromatics Pvt. Ltd., Sensient Technologies Corporation, Mane SA, Robertet SA, Valtris Specialty Chemicals, Emerald Kalama Chemical (a business of LANXESS), Zhejiang NHU Co., Ltd., Guangzhou Jiangwan Flavor & Fragrance Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC benzenoid market is poised for transformative growth, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and eco-friendly products is expected to shape product development strategies, with manufacturers investing in innovative formulations. Additionally, the rise of e-commerce platforms is likely to enhance market accessibility, allowing consumers to explore a wider range of benzenoid products. As the market adapts to these trends, strategic collaborations will play a crucial role in driving competitive advantage and expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | Benzyl Acetate Benzoates (e.g., Benzyl Benzoate) Benzaldehyde & Derivatives (e.g., Cinnamaldehyde, Vanillin) Salicylates & Cinnamates Chlorinated Benzenoids Others |

| By Source | Synthetic Benzenoids Natural / Bio-based Benzenoids Nature-identical Benzenoids Others |

| By Application | Fragrances (Fine Fragrances, Soaps & Detergents, Air Care) Flavors (Food & Beverage) Cosmetics & Personal Care Pharmaceuticals Agrochemicals Household & Industrial Products Others |

| By End-User | Flavor & Fragrance Houses Consumer Goods Manufacturers (FMCG) Pharmaceutical Manufacturers Agrochemical Companies Distributors & Traders Others |

| By Geography | China India Japan South Korea Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam, Others) Rest of APAC (Australia, New Zealand, Others) |

| By Product Form | Liquid Solid Powder Encapsulated / Granulated Others |

| By Packaging Type | Bulk Industrial Packaging (Drums, IBCs, Tankers) Intermediate Packaging (Carboys, Jerry Cans) Small / Retail Packs Eco-Friendly / Sustainable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fragrance Industry Applications | 100 | Product Development Managers, Sourcing Specialists |

| Pharmaceutical Sector Utilization | 90 | Regulatory Affairs Managers, Quality Control Analysts |

| Industrial Chemical Manufacturing | 80 | Operations Managers, Production Supervisors |

| Research & Development Insights | 70 | R&D Scientists, Innovation Managers |

| Environmental Compliance and Safety | 60 | Environmental Managers, Safety Officers |

The APAC Benzenoid Market is valued at approximately USD 380 million, based on a five-year historical analysis. This valuation reflects the increasing demand for benzenoid compounds in various sectors, including fragrances, flavors, and pharmaceuticals.