Region:Asia

Author(s):Rebecca

Product Code:KRAD1435

Pages:82

Published On:November 2025

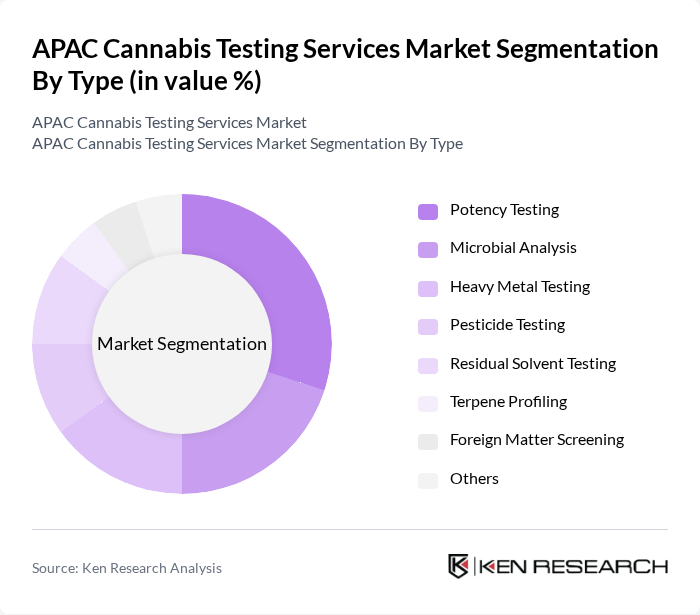

By Type:The market is segmented into various types of testing services, including potency testing, microbial analysis, heavy metal testing, pesticide testing, residual solvent testing, terpene profiling, foreign matter screening, and others. Each of these sub-segments plays a crucial role in ensuring the safety and quality of cannabis products. Potency testing remains the largest segment, reflecting the need for accurate cannabinoid content labeling. Microbial and contaminant analysis is also growing due to regulatory emphasis on product safety .

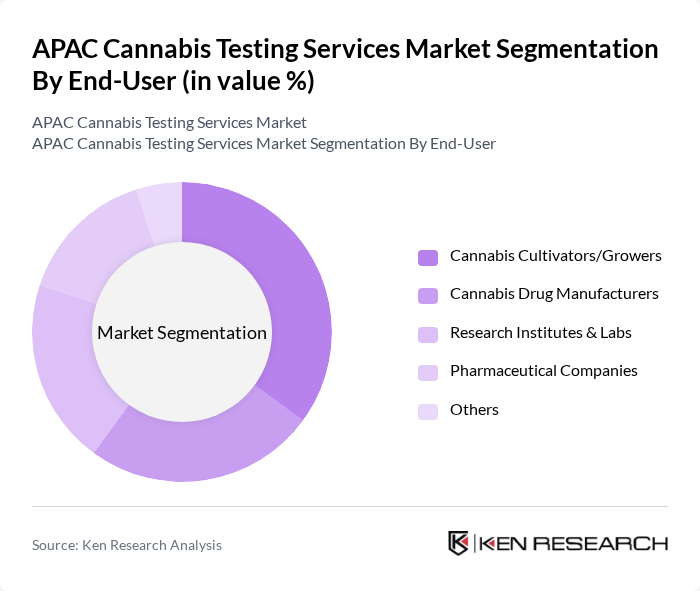

By End-User:The end-user segmentation includes cannabis cultivators/growers, cannabis drug manufacturers, research institutes & labs, pharmaceutical companies, and others. Each segment has unique testing requirements based on their operational needs and regulatory compliance. Cannabis cultivators/growers represent the largest share, driven by the need to comply with evolving safety and quality standards before products enter the supply chain .

The APAC Cannabis Testing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Eurofins Scientific, SGS SA, Intertek Group plc, ALS Limited, Agilent Technologies, LabCorp (Laboratory Corporation of America Holdings), Pace Analytical Services LLC, Steep Hill Labs, CannaSafe Analytics, SC Labs, Cannalysis, Green Leaf Lab, Phytovista Laboratories, ACS Laboratory, and MedLab Pathology contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC cannabis testing services market appears promising, driven by increasing legalization and consumer demand for quality assurance. As regulatory frameworks solidify, testing services will become essential for compliance and consumer safety. Additionally, advancements in testing technologies and methodologies will enhance efficiency and accuracy. The market is likely to witness a surge in partnerships between testing laboratories and cannabis producers, fostering innovation and improving service delivery, ultimately benefiting the entire supply chain.

| Segment | Sub-Segments |

|---|---|

| By Type | Potency Testing Microbial Analysis Heavy Metal Testing Pesticide Testing Residual Solvent Testing Terpene Profiling Foreign Matter Screening Others |

| By End-User | Cannabis Cultivators/Growers Cannabis Drug Manufacturers Research Institutes & Labs Pharmaceutical Companies Others |

| By Region | China India Japan South Korea Australia ASEAN Rest of Asia Pacific |

| By Testing Method | Gas Chromatography Liquid Chromatography Mass Spectrometry Immunoassays Microscopy Testing Others |

| By Sample Type | Flower Oil Edibles Concentrates Others |

| By Certification Type | ISO Certification GMP Certification GLP Certification Others |

| By Policy Support | Subsidies for Testing Facilities Tax Incentives for Cannabis Testing Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cannabis Testing Laboratories | 100 | Laboratory Managers, Quality Assurance Analysts |

| Cannabis Cultivators | 80 | Farm Owners, Head Growers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Cannabis Distributors | 70 | Supply Chain Managers, Sales Directors |

| Industry Experts | 40 | Consultants, Researchers |

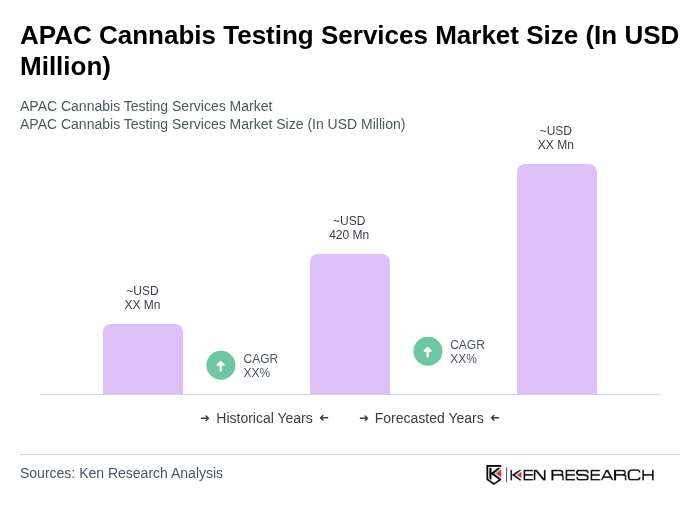

The APAC Cannabis Testing Services Market is valued at approximately USD 420 million, reflecting significant growth driven by increasing legalization of cannabis for medical use and rising consumer awareness regarding product safety and quality across the region.