Region:Asia

Author(s):Geetanshi

Product Code:KRAD3941

Pages:100

Published On:November 2025

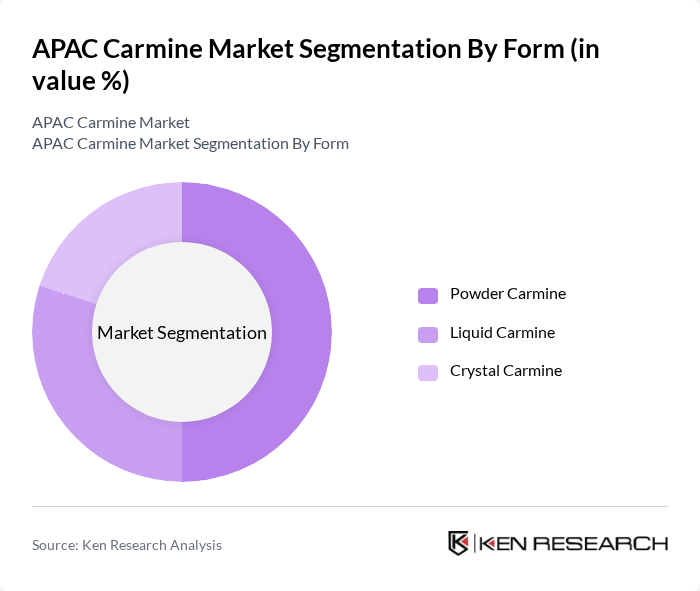

By Form:The market is segmented into three forms:Powder Carmine, Liquid Carmine, and Crystal Carmine. Each form caters to different applications and consumer preferences. Powder carmine is widely used in the food industry due to its versatility, stability, and ease of incorporation into dry mixes and processed foods. Liquid carmine is preferred in beverages and dairy products for its solubility and uniform color dispersion. Crystal carmine is often utilized in specialty and premium products where high color intensity and purity are required .

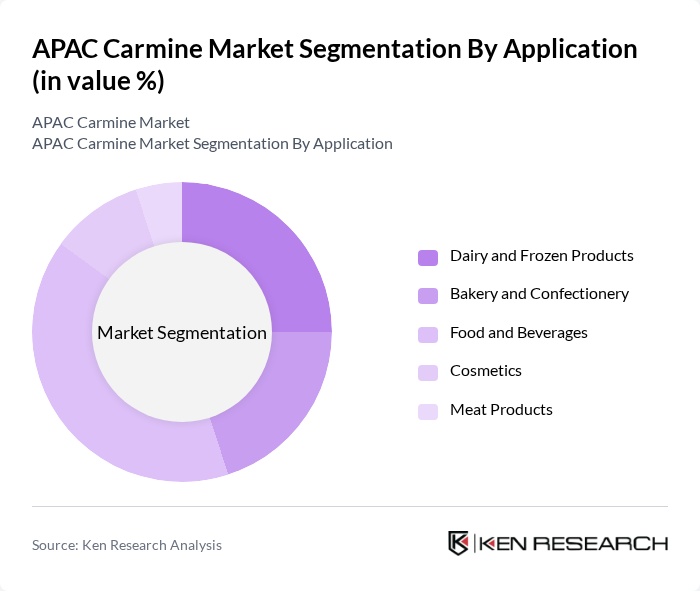

By Application:The applications of carmine are diverse, includingDairy and Frozen Products, Bakery and Confectionery, Food and Beverages, Cosmetics, and Meat Products. The food and beverage sector is the largest consumer of carmine, driven by the increasing demand for natural colorants in processed foods, beverages, and dairy items. Dairy and frozen products represent a significant application area due to the need for visually appealing colors in yogurts, ice creams, and desserts. Bakery and confectionery utilize carmine for vibrant hues in cakes, pastries, and candies. Cosmetics and pharmaceuticals are emerging segments, leveraging carmine for its natural origin and safety profile .

The APAC Carmine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Neelikon Food Dyes and Chemicals Limited, Vinayak Ingredients (India) Pvt. Ltd., Imbarex, GNT Group, Givaudan Sense Colour, BioconColors, Colormaker Inc., Proquimac PFC SA, Amerilure, Chr. Hansen Holding A/S, Sensient Technologies Corporation, D.D. Williamson & Co., Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC carmine market is poised for growth, driven by increasing consumer demand for natural and organic products. As health consciousness continues to rise, manufacturers are likely to innovate and expand their product lines to include carmine-based offerings. Additionally, the trend towards sustainability will encourage companies to adopt eco-friendly practices in sourcing and production, aligning with consumer preferences for environmentally responsible products. This evolving landscape presents a promising future for the carmine market in the region.

| Segment | Sub-Segments |

|---|---|

| By Form | Powder Carmine Liquid Carmine Crystal Carmine |

| By Application | Dairy and Frozen Products Bakery and Confectionery Food and Beverages Cosmetics Meat Products |

| By End-User | Food Processing Companies Beverage Industry Cosmetics and Pharmaceutical Industry Catering Sector |

| By Country/Region | China India Japan South Korea Southeast Asia (Indonesia, Vietnam, Malaysia, Thailand) Rest of APAC |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Industry Applications | 45 | Product Development Managers, Quality Assurance Specialists |

| Cosmetics and Personal Care | 35 | Formulators, Brand Managers |

| Pharmaceuticals and Nutraceuticals | 30 | Regulatory Affairs Managers, R&D Scientists |

| Natural Colorant Suppliers | 25 | Sales Directors, Supply Chain Managers |

| Market Research Analysts | 15 | Market Analysts, Industry Consultants |

The APAC Carmine Market is valued at approximately USD 17 million, driven by the increasing demand for natural food colorants, particularly in the food and beverage sector, as consumers shift towards healthier and organic options.