APAC Cashew Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD1837

September 2024

20

About the Report

APAC Cashew Market Overview

-

The Asia Pacific Cashew Market was valued at USD 7.20 billion in 2023, driven by increasing demand for plant-based proteins, a rising focus on healthy snacking, and the expanding middle class in emerging economies. The region's growth in disposable income and urbanization are key contributors to the surge in cashew consumption, especially in countries like India and Vietnam, where cashews are a staple ingredient in traditional and modern cuisines.

- Prominent companies in the APAC cashew market include Olam International, Vietcaj Co., Ltd., Mangaluru Cashew Manufacturers, Charoen Pokphand Foods PCL, and Agrocel Industries Pvt Ltd. These companies are known for their extensive production capabilities, strong supply chain networks, and noteworthy investments in sustainable farming practices.

- Major urban centers driving the market in the Asia Pacific region include Mumbai, Ho Chi Minh City, and Bangkok. Mumbai's leadership is supported by India's status as the world's largest cashew producer and consumer, while Ho Chi Minh City benefits from Vietnam's rapid industrial growth and strong export-oriented cashew processing industry.

- In 2023, Olam International introduced a new range of organic cashews under its "Pure Heart" brand, focusing on premium markets in Japan and South Korea. This move signifies their strategy to capitalize on the growing demand for organic and sustainably sourced cashew products in the region.

APAC Cashew Market Segmentation

The APAC Cashew Market can be segmented based on product type, application, and region:

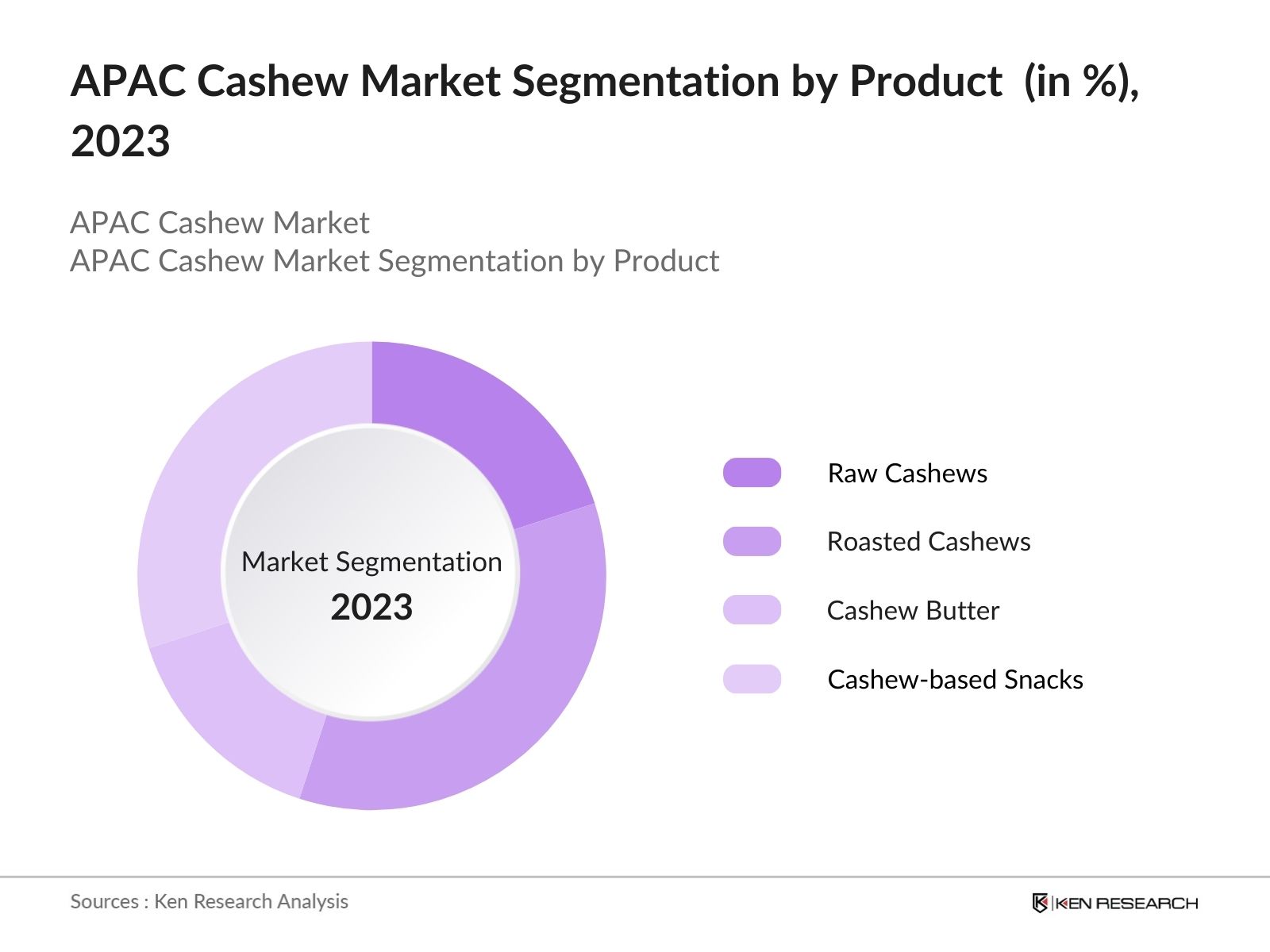

- By Product: The market is segmented into raw cashews, roasted cashews, cashew butter, and cashew-based snacks. In 2023, roasted cashews held the dominant market share due to their popularity as a healthy snack alternative, driven by the growing awareness of the nutritional benefits of cashews, such as being rich in antioxidants and healthy fats.

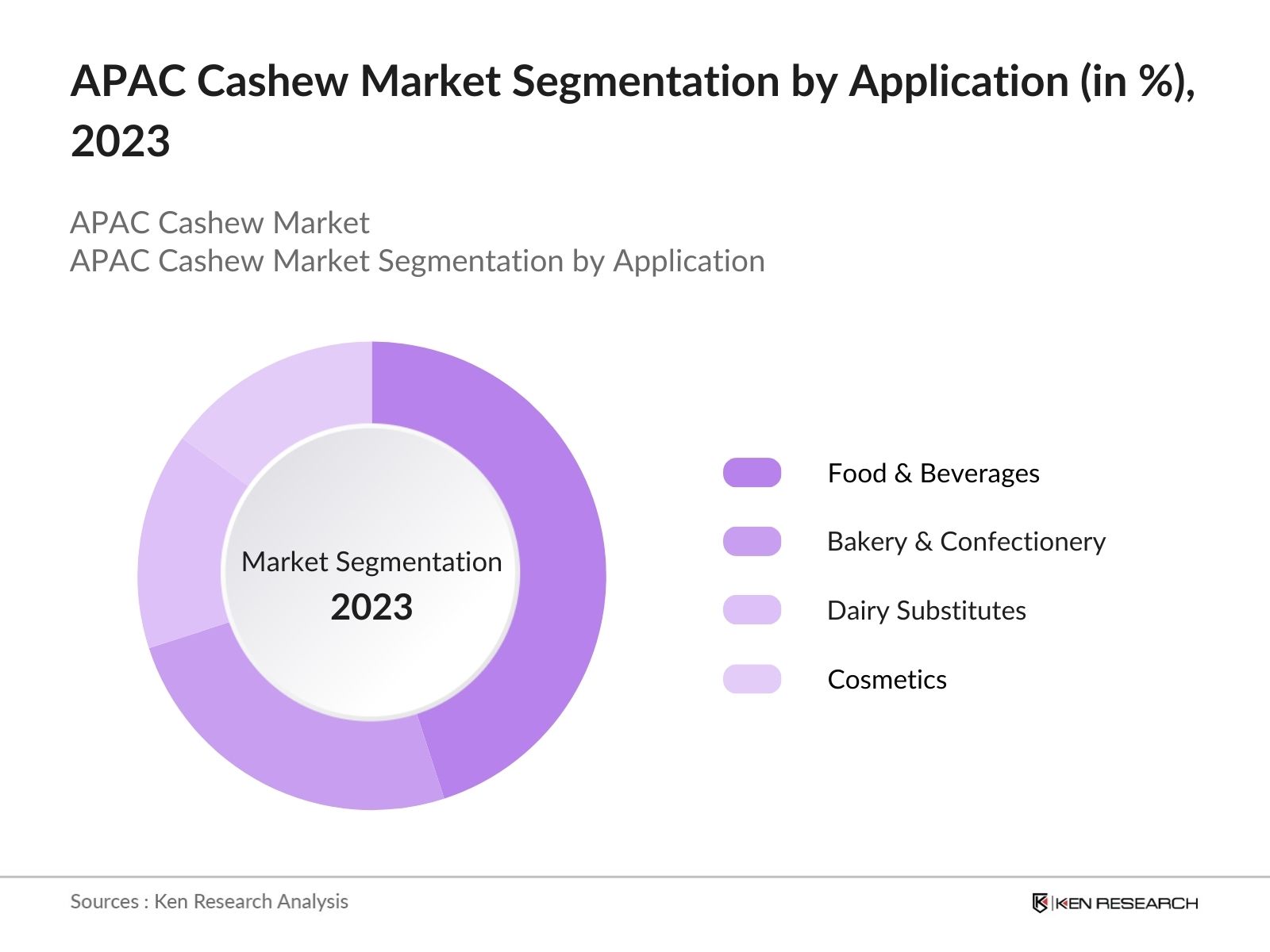

- By Application: The market is segmented by application into food & beverages, bakery & confectionery, dairy substitutes, and cosmetics. In 2023, the food & beverages segment dominated the market share, particularly due to the increasing use of cashews in vegan and plant-based food products, which align with the rising trend of health-conscious and ethical consumerism.

- By Region: The APAC market is segmented by country into India, Vietnam, China, Japan. In 2023, India led the market with the highest market share, driven by its dominant position as a producer and consumer of cashews, coupled with strong domestic demand and export activities. Additionally, India's favorable government policies, including subsidies for cashew farming and incentives for processing industries, have further bolstered its leadership position in the market.

APAC Cashew Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Olam International |

1989 |

Singapore |

|

Vietcaj Co., Ltd. |

2002 |

Ho Chi Minh City, Vietnam |

|

Mangaluru Cashew Manufacturers |

1977 |

Mangalore, India |

|

Charoen Pokphand Foods PCL |

1921 |

Bangkok, Thailand |

|

Agrocel Industries Pvt Ltd |

1980 |

Kutch, India |

- Charoen Pokphand Foods PCL: CPF has made substantial investments in Poland, acquiring a 50% stake in the meat-substitute company Well Well Invest. This acquisition is part of CPF's strategy to diversify its product portfolio and customer base in Europe. Additionally, CPF has acquired two seafood businesses, Fish Food and MaxFish, further expanding its presence in the Polish market.

- Agrocel Industries Pvt Ltd.: In 2023, Olam Agri, a subsidiary of Olam International, completed the acquisition of Avisen SARL for USD 18.5 million. This acquisition allows Olam Agri to expand its animal feed and protein capabilities in Senegal, enhancing its market presence in West Africa.

APAC Cashew Industry Analysis

Growth Drivers:

-

Rising Demand for Plant-Based Proteins: The market is experiencing important growth, primarily driven by a surge in consumer interest in plant-based diets. As more individuals in the region become conscious of their health and environmental impact, the demand for plant-based protein sources, like cashews, has increased. Cashews are particularly valued for their high protein content, making them an ideal ingredient in various plant-based food products, such as dairy alternatives, vegan cheese, and protein bars. This versatile nut also appeals to consumers following specific dietary trends.

- Healthy Snacking Trends: The trend towards healthy snacking is gaining momentum in the Asia-Pacific region, with consumers increasingly opting for snacks that are not only satisfying but also offer health benefits. In 2023, the fruit, nuts, and seeds segment accounted for a substantial 37.8% share of the healthy snacks market. This shift is fueled by a growing awareness of the importance of a balanced diet and the need to incorporate nutrient-dense foods into daily eating habits.

- Expansion of E-commerce Platforms: The rapid expansion of e-commerce platforms in the Asia-Pacific (APAC) region has enhanced the accessibility of cashew products to a broader consumer base. In 2023, e-commerce sales of nuts, including cashews, accounted for one-third of the overall nuts sold in the APAC region. This shift towards digital shopping has allowed consumers to explore a wider variety of cashew products, including organic and specialty items that were previously difficult to find in traditional retail settings. The convenience of online shopping, coupled with targeted marketing and promotions by e-commerce platforms, has further fueled the growth of cashew sales.

Challenges:

-

Supply Chain Disruptions and Price Volatility: The market faces substantial challenges due to supply chain disruptions and price volatility, largely stemming from its reliance on imports from West African and Southeast Asian countries. The U.S. Department of Commerce reported in 2024 that logistical issues, including port congestions and shipping delays, have led to substantial increase in the cost of cashew imports compared to the previous year. These disruptions not only affect pricing but also lead to inconsistencies in product availability.

- Consumer Price Sensitivity: Despite the growing popularity of cashews, the relatively high cost compared to other nuts like peanuts and almonds poses a challenge in penetrating price-sensitive market segments. A 2024 survey by the USDA revealed that majority of consumers consider cashews to be a premium product and are hesitant to purchase them regularly due to their higher price point. This price sensitivity limits the market's growth potential, especially among lower-income households, which make up an important portion of the U.S. population.

Government Initiatives:

-

Rashtriya Krishi Vikas Yojana (RKVY): The Rashtriya Krishi Vikas Yojana (RKVY) is a government initiative aimed at promoting the growth and development of the agricultural sector in India, including the cashew industry. Under this scheme, the government provides financial support and subsidies to cashew farmers for improving cultivation practices, adopting modern agricultural technologies, and enhancing overall productivity. The program also includes funding for infrastructure development, such as irrigation facilities and storage units.

- Cashew Plantation Expansion Program: The Indonesian government has launched a Cashew Plantation Expansion Program aimed at increasing the area under cashew cultivation, particularly in regions with favorable agro-climatic conditions such as Sulawesi and East Nusa Tenggara. This initiative includes providing free seedlings, technical support, and financial assistance to farmers to establish new orchards. The program also focuses on improving the productivity of existing plantations through better pest management practices and soil fertility enhancement.

APAC Cashew Market Future Outlook

The Asia Pacific Cashew Market is expected to witness remarkable growth during the forecast period of 2023-2028, driven by the increasing demand for healthy snacks, rising consumer interest in plant-based diets, and supportive government policies.

Future Market Trends:

-

Growth in Organic Cashew Products: The market is projected to see substantial growth in the demand for organic cashew products over the next five years. This trend is driven by rising consumer awareness of the health and environmental benefits of organic farming. Governments in countries like India and Vietnam are expected to continue promoting organic agriculture as part of their national sustainability goals.

- Expansion of Cashew Applications in Non-Food Sectors: The next five years are anticipated to witness noteworthy expansion of cashew applications in non-food sectors, particularly in the cosmetics industry. Cashew oil and extracts, known for their moisturizing and anti-aging properties, are increasingly being incorporated into skincare and haircare products, supported by ongoing research and product innovation.

Scope of the Report

|

By Product |

Raw Cashews Roasted Cashews Cashew Butter Cashew-based Snacks |

|

By Application |

Food & Beverages Bakery & Confectionery Dairy Substitutes Cosmetics |

|

By Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Direct Sales |

|

By End-User |

Household Foodservice Industrial Institutional |

|

By Region |

India Vietnam China Japan Others |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

-

Cashew Producers and Grower

-

Cashew Processors and Exporters

Food and Beverage Companies

Agricultural Equipment Manufacturers

Trade Associations and Industry Bodies

Health and Wellness Companies

Logistics and Supply Chain Companies

Government and Regulatory Bodies (Ministry of Agriculture and Farmers Welfare and MARD)

Investment Firms and Venture Capitalists

Time Period Captured in the Report:

-

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

-

Olam International Ltd.

Vietnam Cashew Association (VINACAS)

Haprosimex JSC

P.T. Mitra Kerinci

Kalbavi Cashews

Agrocel Industries Pvt. Ltd.

Bismi Cashew Company

M.A. Nut Company

Anacardium Cashew Co., Ltd.

Guangxi Baise Nongken Nuts Development Co., Ltd.

Rajkumar Impex

KC Industry Co., Ltd.

Royal Nuts Pty Ltd.

Pacific Cashew Exporters

N.C. John & Sons Pvt. Ltd.

Table of Contents

01 APAC Cashew Market Overview

1.1. Definition and Scope

1.2. Market Valuation and Historical Performance

1.3. Key Market Trends and Developments

1.4. Market Segmentation Overview

1.5. Key Market Drivers and Challenges

02 APAC Cashew Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03 APAC Cashew Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Plant-Based Proteins

3.1.2. Healthy Snacking Trends

3.1.3. Expansion of E-commerce Platforms

3.2. Challenges

3.2.1. Supply Chain Disruptions and Price Volatility

3.2.2. Consumer Price Sensitivity

3.3. Opportunities

3.3.1. Growth in Organic Cashew Products

3.3.2. Expansion of Cashew Applications in Non-Food Sectors

3.4. Trends

3.4.1. Increasing Popularity of Cashew-based Snacks

3.4.2. Rising Demand for Organic and Sustainable Products

3.5. Government Initiatives

3.5.1. Rashtriya Krishi Vikas Yojana (RKVY)

3.5.2. Cashew Plantation Expansion Program in Indonesia

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

04 APAC Cashew Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Raw Cashews

4.1.2. Roasted Cashews

4.1.3. Cashew Butter

4.1.4. Cashew-based Snacks

4.2. By Application (in Value %)

4.2.1. Food & Beverages

4.2.2. Bakery & Confectionery

4.2.3. Dairy Substitutes

4.2.4. Cosmetics

4.3. By Distribution Channel (in Value %)

4.3.1. Online Retail

4.3.2. Supermarkets/Hypermarkets

4.3.3. Specialty Stores

4.3.4. Direct Sales

4.4. By End-User (in Value %)

4.4.1. Household

4.4.2. Foodservice

4.4.3. Industrial

4.4.4. Institutional

4.5. By Region (in Value %)

4.5.1. India

4.5.2. Vietnam

4.5.3. China

4.5.4. Japan

4.5.5. Others

05 APAC Cashew Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Olam International

5.1.2. Vietcaj Co., Ltd.

5.1.3. Mangaluru Cashew Manufacturers

5.1.4. Charoen Pokphand Foods PCL

5.1.5. Agrocel Industries Pvt Ltd

5.2. Cross Comparison Parameters (Establishment Year, Headquarters, Market Presence, Strategic Initiatives)

06 APAC Cashew Market Competitive Landscape Analysis

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07 APAC Cashew Market Regulatory Framework

7.1. Rashtriya Krishi Vikas Yojana (RKVY)

7.2. Cashew Plantation Expansion Program in Indonesia

7.3. Compliance Requirements and Certification Processes

08 APAC Cashew Market Future Outlook (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

8.3. Future Market Segmentation

8.3.1. By Product Type (in Value %)

8.3.2. By Application (in Value %)

8.3.3. By Distribution Channel (in Value %)

8.3.4. By End-User (in Value %)

8.3.5. By Region (in Value %)

09 APAC Cashew Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on APAC cashew market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for APAC cashew market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple essential cashew companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from cashew companies.

Frequently Asked Questions

01 How big is the APAC cashew market?

The APAC cashew market was valued at USD 7.20 billion in 2023, driven by increasing demand for plant-based proteins, a rising focus on healthy snacking, and the expanding middle class in emerging economies.

02 What are the challenges in the APAC cashew market?

Challenges in the APAC cashew market include supply chain disruptions, price volatility, and consumer price sensitivity. The high cost of cashews compared to other nuts also limits their appeal in price-sensitive market segments.

03 Who are the major players in the APAC cashew market?

Major players in the APAC cashew market include Olam International, Vietcaj Co., Ltd., Mangaluru Cashew Manufacturers, Charoen Pokphand Foods PCL, and Agrocel Industries Pvt Ltd. These companies have extensive production capabilities and strong supply chain networks.

04 What are the growth drivers of the APAC cashew market?

Growth drivers of the APAC cashew market include rising demand for plant-based proteins, the increasing popularity of healthy snacking, and the expansion of e-commerce platforms. Additionally, the trend towards organic and sustainably sourced products is further boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.