Region:Asia

Author(s):Shubham

Product Code:KRAD6620

Pages:91

Published On:December 2025

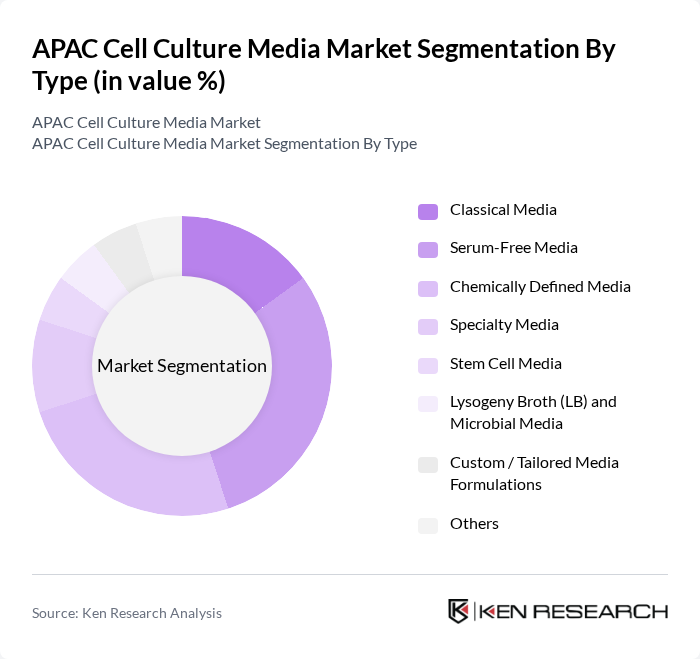

By Type:The cell culture media market can be segmented into various types, including Classical Media, Serum-Free Media, Chemically Defined Media, Specialty Media, Stem Cell Media, Lysogeny Broth (LB) and Microbial Media, Custom / Tailored Media Formulations, and Others. Serum-Free Media is increasingly gaining traction in Asia-Pacific as biopharmaceutical manufacturers and research organizations move toward animal-origin-free and defined formulations to improve safety, reduce contamination risks, and meet stringent quality and regulatory expectations. The demand for Chemically Defined Media is also on the rise as it provides higher reproducibility, batch-to-batch consistency, and scalability in cell culture processes, which is critical for large-scale production of monoclonal antibodies, vaccines, and advanced therapies in the region.

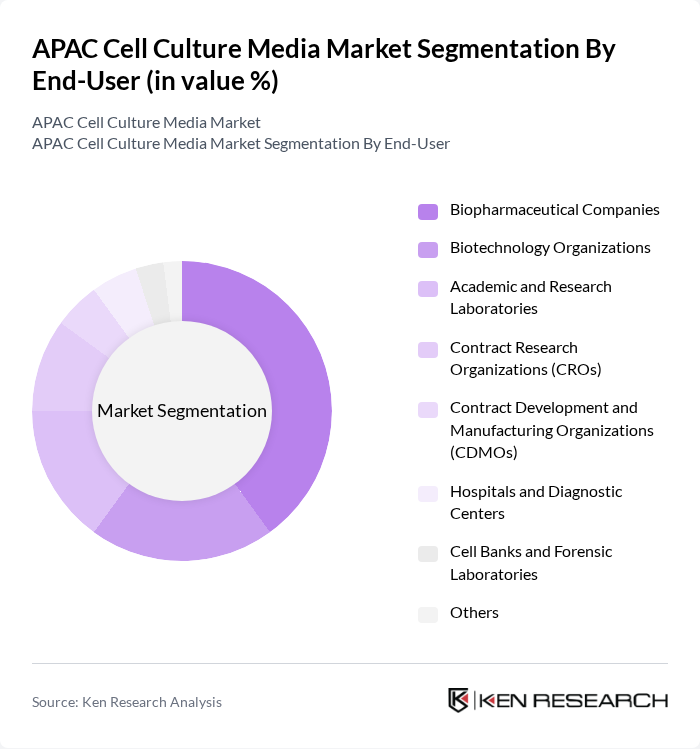

By End-User:The end-user segmentation includes Biopharmaceutical Companies, Biotechnology Organizations, Academic and Research Laboratories, Contract Research Organizations (CROs), Contract Development and Manufacturing Organizations (CDMOs), Hospitals and Diagnostic Centers, Cell Banks and Forensic Laboratories, and Others. Biopharmaceutical Companies are the leading end-users, driven by the increasing demand for biologics, biosimilars, and vaccines, which require specialized, high-performance cell culture media for process development and commercial manufacturing. Rising in-house media optimization, expansion of monoclonal antibody and vaccine production, and greater adoption of continuous and single-use bioprocessing are further strengthening the dominance of biopharmaceutical companies in media consumption across the region.

The APAC Cell Culture Media Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Cytiva (formerly GE Healthcare Life Sciences), Lonza Group Ltd., Corning Incorporated, Sartorius AG, FUJIFILM Irvine Scientific, Inc., HiMedia Laboratories Pvt. Ltd., Takara Bio Inc., STEMCELL Technologies Inc., Nissui Pharmaceutical Co., Ltd., JSR Life Sciences (including KBI Biopharma / Serum-free Media Assets), PAN-Biotech GmbH, PeproTech, Inc. (a Bio-Techne brand), Local and Regional APAC Players (e.g., Shanghai BasalMedia Technologies Co., Ltd.; Biological Industries Israel Beit Haemek Ltd. – APAC operations) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC cell culture media market is poised for significant transformation, driven by ongoing advancements in biotechnology and increasing demand for personalized medicine. As research institutions and biopharmaceutical companies continue to invest in innovative cell culture techniques, the market is expected to evolve rapidly. Furthermore, the integration of automation and artificial intelligence in laboratory processes will enhance efficiency, while a growing focus on sustainability will shape production practices, ensuring a more environmentally friendly approach to cell culture media development.

| Segment | Sub-Segments |

|---|---|

| By Type | Classical Media Serum-Free Media Chemically Defined Media Specialty Media Stem Cell Media Lysogeny Broth (LB) and Microbial Media Custom / Tailored Media Formulations Others |

| By End-User | Biopharmaceutical Companies Biotechnology Organizations Academic and Research Laboratories Contract Research Organizations (CROs) Contract Development and Manufacturing Organizations (CDMOs) Hospitals and Diagnostic Centers Cell Banks and Forensic Laboratories Others |

| By Application | Biopharmaceutical Production (Biologics and Biosimilars) Drug Screening & Development Vaccine Production Diagnostics Regenerative Medicine & Tissue Engineering Gene Therapy & Cell Therapy Others |

| By Source | Animal Component–Containing Media Animal Component–Free / Chemically Defined Media Plant-Based Media Microbial-Based Media Synthetic and Recombinant Media Others |

| By Region | China Japan South Korea India Southeast Asia Australia & New Zealand Rest of Asia-Pacific |

| By Distribution Channel | Direct Tenders Third-Party / Local Distributors E-commerce and Online Sales Retail Sales Others |

| By Packaging Type | Bottles Bags (Single-Use Bioprocess Bags) Vials and Ampoules Bulk Containers and Drums Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical R&D Departments | 120 | R&D Managers, Lab Technicians |

| Academic Research Institutions | 100 | Principal Investigators, Research Scientists |

| Cell Culture Media Suppliers | 80 | Sales Managers, Product Development Leads |

| Clinical Research Organizations | 70 | Project Managers, Quality Assurance Officers |

| Regulatory Bodies and Associations | 50 | Regulatory Affairs Specialists, Policy Makers |

The APAC Cell Culture Media Market is valued at approximately USD 1.5 billion, driven by the increasing demand for biopharmaceuticals and advancements in cell-based therapies across major markets like China, India, Japan, and South Korea.