Region:Asia

Author(s):Geetanshi

Product Code:KRAD7236

Pages:94

Published On:December 2025

By Type:The market is segmented into various types of gases, including Compressed Air, Nitrogen, Oxygen, Argon, Carbon Dioxide, Hydrogen, and Specialty Gases. Each type serves distinct applications across industries, influencing their market dynamics and growth potential, with nitrogen and oxygen widely used in manufacturing and healthcare, carbon dioxide and argon in metal fabrication and food processing, hydrogen in emerging clean energy applications, and specialty gases in electronics, semiconductors, and research.

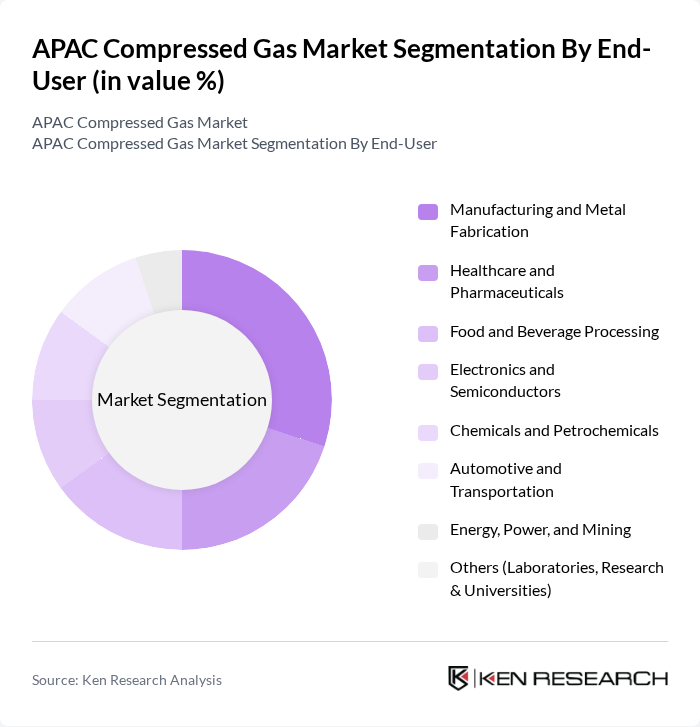

By End-User:The end-user segmentation includes Manufacturing and Metal Fabrication, Healthcare and Pharmaceuticals, Food and Beverage Processing, Electronics and Semiconductors, Chemicals and Petrochemicals, Automotive and Transportation, Energy, Power, and Mining, and Others (Laboratories, Research & Universities). Each sector has unique requirements for compressed gases, driving their respective market shares, with manufacturing, metal fabrication, and chemicals using large volumes of nitrogen, oxygen, argon, and carbon dioxide; healthcare and pharmaceuticals relying heavily on medical oxygen and specialty gases; electronics and semiconductors demanding ultra-high-purity specialty gases; and automotive and transportation increasingly consuming compressed natural gas and hydrogen as cleaner fuels.

The APAC Compressed Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Liquide S.A., Linde plc, Air Products and Chemicals, Inc., Taiyo Nippon Sanso Corporation, Messer SE & Co. KGaA, Iwatani Corporation, Nippon Gases Holdings, Inc. (Mitsubishi Chemical Group), Air Water Inc., Southern Industrial Gas Sdn Bhd, India Glycols Limited (Industrial Gases Division), TAIYO GASES Co., Ltd. (Regional Subsidiary / JV Entities), Gulf Cryo Holding K.S.C. (APAC Operations), Buzwair Industrial Gases Factory (APAC & Export Presence), Universal Industrial Gases, Inc. (APAC Supply Agreements), Airgas, Inc. (A Subsidiary of Air Liquide – APAC Sourcing & Projects) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC compressed gas market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt digital technologies, the integration of smart gas management systems is expected to enhance operational efficiency. Furthermore, the growing emphasis on safety and compliance will likely lead to innovations in gas handling and storage solutions. These trends indicate a robust future for the market, with opportunities for growth in emerging applications and sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Compressed Air Nitrogen Oxygen Argon Carbon Dioxide Hydrogen Specialty Gases |

| By End-User | Manufacturing and Metal Fabrication Healthcare and Pharmaceuticals Food and Beverage Processing Electronics and Semiconductors Chemicals and Petrochemicals Automotive and Transportation Energy, Power, and Mining Others (Laboratories, Research & Universities) |

| By Region | China India Japan South Korea Southeast Asia (Indonesia, Malaysia, Thailand, Vietnam, Philippines, Others) Rest of APAC (Australia, New Zealand, Pakistan, Bangladesh, Others) |

| By Application | Industrial Processes (Cutting, Welding, Inerting, Blanketing) Medical and Life-support Applications Food & Beverage Preservation and Packaging Electronics Manufacturing and Testing Energy & Power Applications Laboratory and Analytical Use Others |

| By Distribution Mode | On-site Generation Bulk (Tanker) Supply Cylinder and Packaged Gas Supply Pipeline Supply |

| By Storage Type | Cylinders Bulk Storage (Tanks) On-Site Storage and Generation Systems Others |

| By Policy & Regulatory Environment | Safety and Handling Regulations Environmental and Emission Norms Incentives for Clean Energy and Low-Carbon Gases Import, Export, and Trade Regulations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Gas Supply | 100 | Hospital Procurement Managers, Medical Gas Coordinators |

| Manufacturing Sector Usage | 80 | Production Managers, Quality Control Supervisors |

| Food Processing Applications | 70 | Food Safety Officers, Operations Managers |

| Energy Sector Compressed Gas | 60 | Energy Analysts, Plant Managers |

| Research and Development in Gas Applications | 50 | R&D Directors, Innovation Managers |

The APAC Compressed Gas Market is valued at approximately USD 1.6 billion, driven by increasing demand for industrial gases across sectors such as manufacturing, healthcare, and food processing, particularly in emerging economies like China and India.