APAC Dental Prosthetics Market Overview

- The APAC Dental Prosthetics Market is valued at USD 3.9 billion, based on a five-year historical analysis. This growth is primarily driven by an increasing aging population, rising dental health awareness, and advancements in dental technology. The demand for dental prosthetics, including crowns, bridges, and implants, has surged as more individuals seek restorative and cosmetic dental solutions. Additional drivers include the expansion of dental tourism, particularly in India, Thailand, and South Korea, and the adoption of digital dentistry technologies such as CAD/CAM and 3D printing, which enhance precision and efficiency in prosthetic fabrication .

- Countries such as China, Japan, and India dominate the APAC Dental Prosthetics Market due to their large populations and growing healthcare infrastructure. China leads with its rapid urbanization and increasing disposable income, while Japan benefits from its advanced healthcare system and high demand for quality dental care. India is witnessing a rise in dental tourism and awareness about oral health, contributing to its market prominence. The region’s growth is further supported by government initiatives to improve oral health, increasing penetration of dental insurance, and a burgeoning middle class seeking advanced dental solutions .

- In 2023, the Indian government implemented the National Oral Health Program, which aims to improve dental health services across the country. This initiative, under the Ministry of Health & Family Welfare, includes funding for dental education, awareness campaigns, and the establishment of dental clinics in rural areas, thereby enhancing access to dental prosthetics and promoting overall oral health. The program mandates integration of oral health into primary healthcare, periodic screening, and training of healthcare workers to deliver preventive and curative dental services .

APAC Dental Prosthetics Market Segmentation

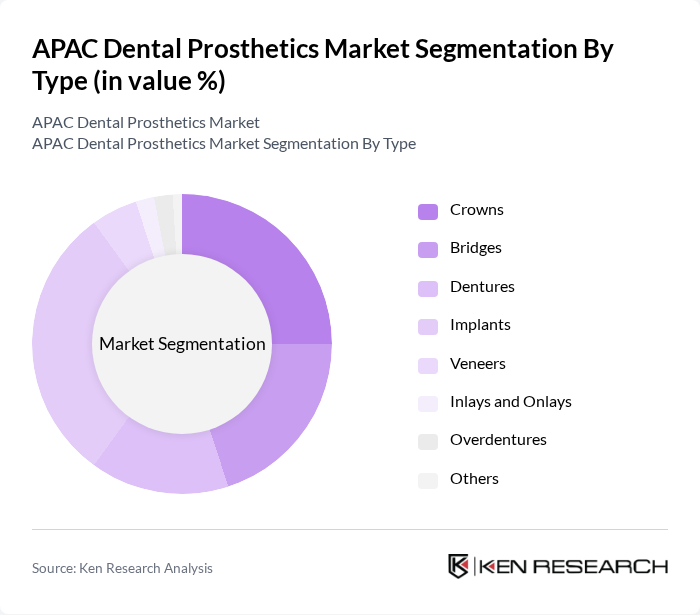

By Type:The market is segmented into various types of dental prosthetics, including crowns, bridges, dentures, implants, veneers, inlays and onlays, overdentures, and others. Each type serves specific dental needs, with varying levels of demand based on consumer preferences and clinical requirements. Crowns and implants are the most in-demand due to their effectiveness in restoring function and aesthetics, while digital workflows are increasing the adoption of custom prosthetics .

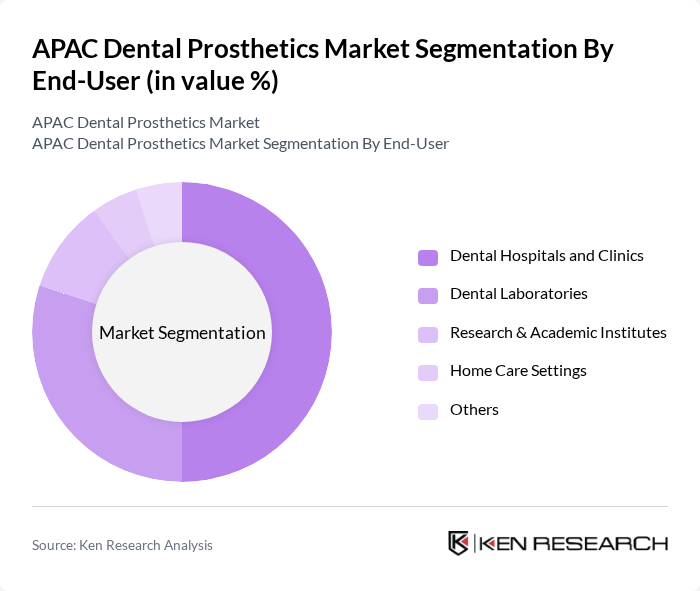

By End-User:The end-user segmentation includes dental hospitals and clinics, dental laboratories, research and academic institutes, home care settings, and others. Each segment plays a crucial role in the distribution and application of dental prosthetics, catering to different consumer needs and preferences. Dental hospitals and clinics remain the primary channel due to the complexity of prosthetic procedures, while dental laboratories are essential for custom device manufacturing .

APAC Dental Prosthetics Market Competitive Landscape

The APAC Dental Prosthetics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Straumann Holding AG, Dentsply Sirona Inc., Nobel Biocare Services AG, Zimmer Biomet Holdings, Inc., 3M Company, Henry Schein, Inc., Patterson Companies, Inc., Ivoclar Vivadent AG, GC Corporation, Kuraray Noritake Dental Inc., Bicon, LLC, Align Technology, Inc., VITA Zahnfabrik H. Rauter GmbH & Co. KG, Dental Wings Inc., Shofu Inc., Envista Holdings Corporation, Planmeca Oy, OSSTEM IMPLANT Co., Ltd., Kulzer GmbH, BEGO GmbH & Co. KG, Candulor AG, Modern Dental Group Limited, Argen Corporation contribute to innovation, geographic expansion, and service delivery in this space.

APAC Dental Prosthetics Market Industry Analysis

Growth Drivers

- Increasing Aging Population:The APAC region is witnessing a significant demographic shift, with the elderly population projected to reach 1.4 billion in future, according to the United Nations. This demographic is more susceptible to dental issues, leading to a higher demand for dental prosthetics. Additionally, the World Health Organization estimates that 60-90% of school children and nearly 100% of adults have dental cavities, further driving the need for restorative dental solutions among older adults.

- Rising Dental Aesthetic Awareness:The growing emphasis on dental aesthetics is evident, with the global dental cosmetic market expected to reach $34 billion in future. Increased awareness of oral health and aesthetics, particularly among younger populations, is driving demand for dental prosthetics. Reports indicate that 75% of individuals aged 18-34 are considering cosmetic dental procedures, which is expected to boost the adoption of advanced prosthetic solutions in the APAC region significantly.

- Technological Advancements in Dental Prosthetics:The integration of advanced technologies such as CAD/CAM and 3D printing is revolutionizing the dental prosthetics market. In future, the 3D printing market in dentistry is projected to reach $7 billion, enhancing the production of customized prosthetics. These technologies not only improve the precision and quality of dental products but also reduce production time, making dental prosthetics more accessible to a broader population in the APAC region.

Market Challenges

- High Cost of Dental Prosthetics:The cost of dental prosthetics remains a significant barrier to access, with average prices ranging from $1,200 to $3,500 per unit. This high cost limits affordability for many patients, particularly in developing countries within the APAC region. According to the World Bank, approximately 24% of the population in East Asia and Pacific lower-middle-income countries lives below the international poverty line, making it challenging for them to invest in necessary dental care.

- Lack of Skilled Professionals:The dental industry in the APAC region faces a shortage of skilled professionals, with an estimated deficit of 250,000 dentists in future, as reported by the Asia Pacific Dental Federation. This shortage hampers the ability to provide adequate dental care and prosthetic services, leading to longer wait times and reduced patient satisfaction. The lack of training programs further exacerbates this issue, limiting the workforce's capacity to meet growing demand.

APAC Dental Prosthetics Market Future Outlook

The APAC dental prosthetics market is poised for transformative growth driven by technological innovations and changing consumer preferences. As the region embraces digital dentistry and minimally invasive procedures, the demand for high-quality, customized solutions will increase. Furthermore, the expansion of dental clinics and e-commerce platforms will enhance accessibility, allowing more patients to benefit from advanced dental care. The focus on sustainable materials will also shape future product offerings, aligning with global trends towards eco-friendly practices in healthcare.

Market Opportunities

- Expansion of Dental Clinics:The rapid growth of dental clinics in urban and rural areas presents a significant opportunity for the dental prosthetics market. With over 60,000 dental clinics projected to open in future, increased access to dental care will drive demand for prosthetic solutions, particularly in underserved regions, enhancing overall oral health outcomes.

- Increasing Investment in Dental Research:Investment in dental research is expected to exceed $1.2 billion in future, focusing on innovative materials and techniques. This influx of funding will facilitate the development of advanced dental prosthetics, improving patient outcomes and satisfaction. Enhanced research capabilities will also foster collaboration between academia and industry, driving further advancements in the field.