Region:Asia

Author(s):Rebecca

Product Code:KRAC8547

Pages:89

Published On:November 2025

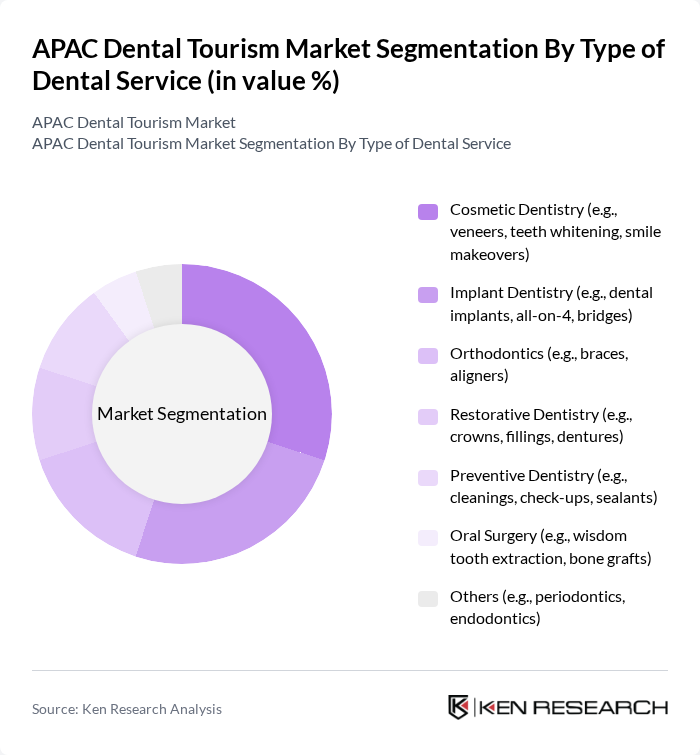

By Type of Dental Service:The dental tourism market is segmented into various types of dental services, including cosmetic dentistry, implant dentistry, orthodontics, restorative dentistry, preventive dentistry, oral surgery, and others. Each of these segments caters to different patient needs and preferences, contributing to the overall growth of the market. Cosmetic and implant dentistry remain the most sought-after services among international dental tourists, driven by demand for aesthetic improvements and advanced restorative procedures .

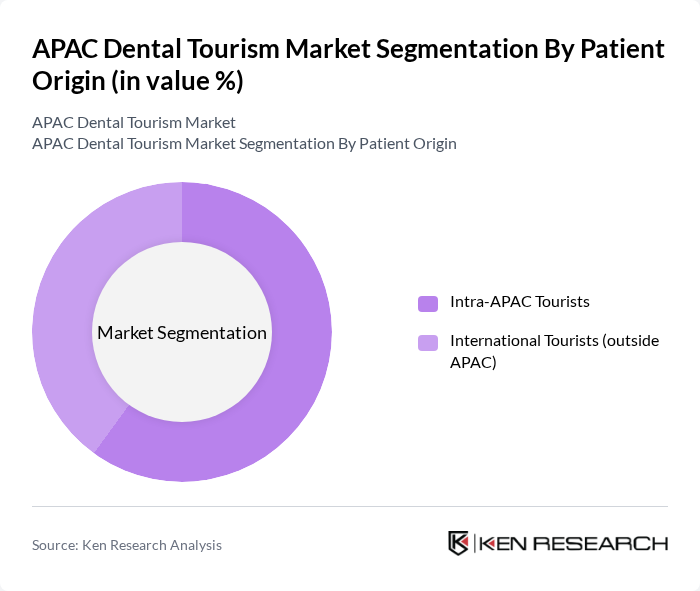

By Patient Origin:The market is also segmented based on the origin of patients, which includes intra-APAC tourists and international tourists from outside the APAC region. This segmentation helps in understanding the flow of patients and their preferences for dental services in different countries. Intra-APAC tourists account for the majority share, reflecting strong regional mobility and demand for affordable dental care .

The APAC Dental Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Smile Dental Clinic (Thailand), Bumrungrad International Hospital Dental Center (Thailand), Apollo Hospitals Dental (India), Clove Dental (India), BIDH Dental Hospital (Bangkok International Dental Hospital, Thailand), Dental Departures (Thailand/Global), Qunomedical (Global, strong APAC presence), Smile Signature Dental Clinics (Thailand), BIDC (Bangkok International Dental Center, Thailand), Healthbase (Medical Tourism Facilitator, APAC), MyMediTravel (Thailand/Global), Dental Solutions Bali (Indonesia), Seoul National University Dental Hospital (South Korea), Mahkota Dental Centre (Malaysia), Dental Focus (Vietnam) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC dental tourism market is poised for significant growth, driven by advancements in technology and increasing patient engagement through digital platforms. The integration of tele-dentistry is expected to enhance patient consultations, making dental care more accessible. Additionally, the rise of personalized dental care solutions will cater to diverse patient needs, fostering a more tailored approach to treatment. These trends indicate a promising future for the dental tourism sector in the APAC region, with potential for innovation and expansion.

| Segment | Sub-Segments |

|---|---|

| By Type of Dental Service | Cosmetic Dentistry (e.g., veneers, teeth whitening, smile makeovers) Implant Dentistry (e.g., dental implants, all-on-4, bridges) Orthodontics (e.g., braces, aligners) Restorative Dentistry (e.g., crowns, fillings, dentures) Preventive Dentistry (e.g., cleanings, check-ups, sealants) Oral Surgery (e.g., wisdom tooth extraction, bone grafts) Others (e.g., periodontics, endodontics) |

| By Patient Origin | Intra-APAC Tourists International Tourists (outside APAC) |

| By Destination Country | Thailand India Malaysia South Korea Vietnam Philippines Singapore Others (e.g., Indonesia, Cambodia, Australia) |

| By End-User | Individual Patients Corporate Clients Insurance Companies Medical Tourism Facilitators Others |

| By Treatment Complexity | Simple Procedures Moderate Procedures Complex Procedures |

| By Payment Method | Out-of-Pocket Payments Insurance Coverage Financing Options Others |

| By Patient Demographics | Age Groups Gender Income Levels Others |

| By Marketing Channel | Online Marketing Offline Marketing Referral Programs Medical Tourism Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics in Thailand | 100 | Clinic Owners, Dental Surgeons |

| Patients Traveling for Dental Implants | 120 | International Patients, Dental Tourists |

| Medical Tourism Agencies | 80 | Travel Agents, Medical Tourism Coordinators |

| Dental Tourism in Malaysia | 90 | Clinic Managers, Marketing Directors |

| Patient Experience Surveys | 120 | Recent Dental Tourists, Patient Advocates |

The APAC Dental Tourism Market is valued at approximately USD 3.2 billion, driven by the affordability of dental procedures in countries like Thailand and India, along with advancements in dental technology and increased consumer awareness of dental health.