Region:Asia

Author(s):Dev

Product Code:KRAC2782

Pages:87

Published On:October 2025

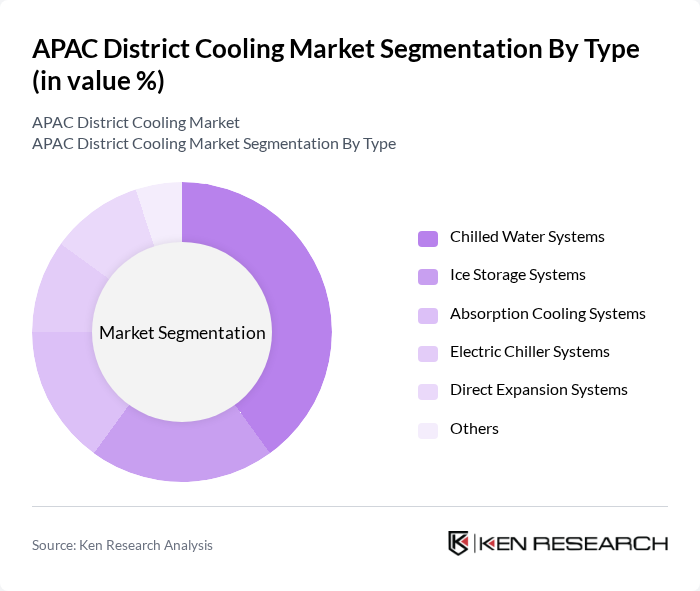

By Type:The market is segmented into various types of cooling systems, including Chilled Water Systems, Ice Storage Systems, Absorption Cooling Systems, Electric Chiller Systems, Direct Expansion Systems, and Others. Each type serves different applications and has unique advantages, catering to diverse consumer needs.

TheChilled Water Systemssegment is currently the dominant type in the market, accounting for a significant share due to their efficiency and scalability. These systems are widely used in commercial buildings and large infrastructures, where the demand for cooling is high. The trend toward energy efficiency and sustainability has further propelled the adoption of chilled water systems, as they can significantly reduce energy consumption compared to traditional cooling methods. Additionally, advancements in technology have improved the performance and reliability of these systems, making them a preferred choice for many developers and facility managers.

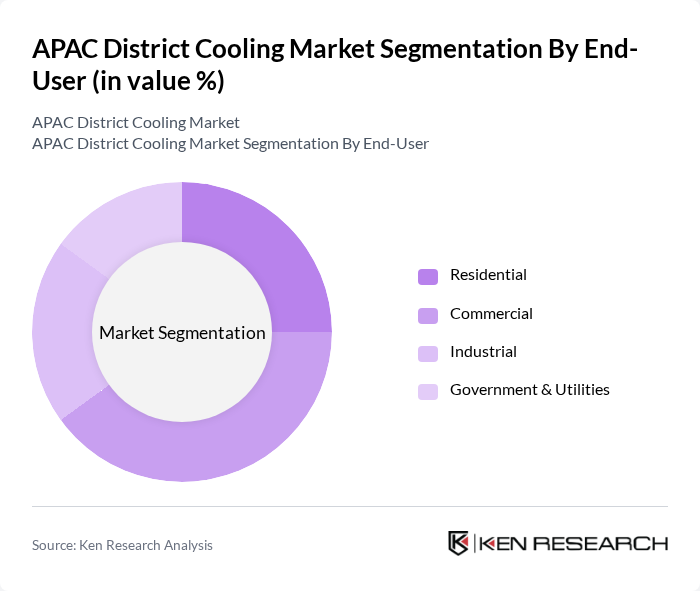

By End-User:The market is segmented by end-user into Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct requirements and preferences, influencing the choice of cooling systems.

TheCommercialsegment leads the market, driven by the increasing number of commercial buildings and the need for efficient cooling solutions in urban areas. Businesses are increasingly adopting district cooling systems to reduce operational costs and enhance energy efficiency. The growing trend of green buildings and sustainability initiatives further supports the demand for district cooling in commercial applications. Additionally, the Industrial segment is also significant, as industries seek to optimize their cooling processes and reduce energy consumption.

The APAC District Cooling Market is characterized by a dynamic mix of regional and international players. Leading participants such as ENGIE, Veolia Environnement S.A., Keppel DHCS Pte Ltd, Singapore District Cooling Pte Ltd, Tabreed (National Central Cooling Company PJSC), Dalkia, SUEZ, AHI Carrier (Carrier Global Corporation), Johnson Controls International plc, Trane Technologies plc, Daikin Industries, Ltd., Mitsubishi Electric Corporation, Hitachi, Ltd., Shinryo Corporation, Toshiba Carrier Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC district cooling market appears promising, driven by increasing urbanization and a shift towards sustainable energy solutions. As cities expand, the demand for efficient cooling systems will rise, particularly in densely populated areas. Technological advancements, such as IoT integration, will enhance system efficiency and management. Furthermore, government initiatives aimed at reducing carbon footprints will likely accelerate the adoption of district cooling, positioning it as a key player in the region's energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Chilled Water Systems Ice Storage Systems Absorption Cooling Systems Electric Chiller Systems Direct Expansion Systems Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | China India Japan South Korea ASEAN Oceania Rest of APAC |

| By Technology | Centralized Cooling Systems Decentralized Cooling Systems Hybrid Systems Others |

| By Application | Commercial Buildings Industrial Facilities Public Infrastructure Residential Complexes Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial District Cooling Systems | 100 | Facility Managers, Energy Efficiency Consultants |

| Residential Cooling Solutions | 80 | Real Estate Developers, Urban Planners |

| Industrial Cooling Applications | 60 | Operations Managers, Plant Engineers |

| Government Policy Impact | 40 | Policy Makers, Regulatory Affairs Specialists |

| Technological Innovations in Cooling | 50 | R&D Managers, Technology Officers |

The APAC District Cooling Market is valued at approximately USD 10 billion, driven by the increasing demand for energy-efficient cooling solutions, rising temperatures, and rapid urbanization in the region.