APAC Fast Food Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD4079

November 2024

82

About the Report

APAC Fast Food Market Overview

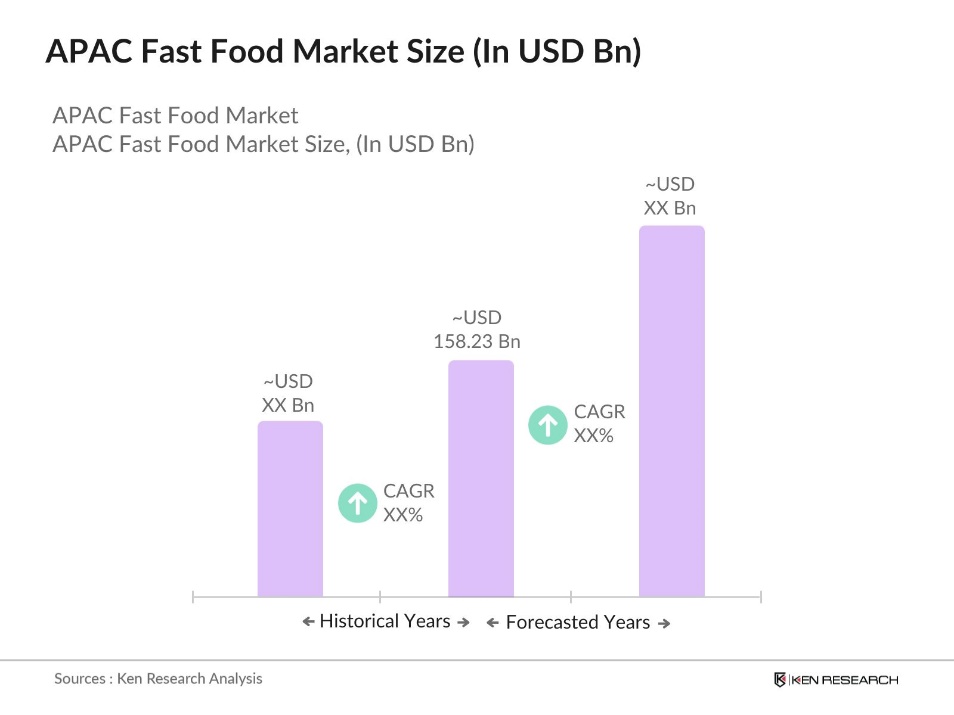

- The Asia-Pacific (APAC) Fast Food Market is valued at USD 158.23 billion, driven by rapid urbanization, increasing disposable income, and a fast-paced lifestyle among consumers across the region. The rise of online food delivery platforms, combined with the growing presence of international fast-food chains, has fueled demand. Major cities such as Tokyo, Shanghai, and Mumbai have witnessed significant growth in the fast-food sector due to their large, affluent populations and increasing preference for convenience foods. Data from credible sources such as the World Bank confirm this consistent market expansion.

- Countries like China, Japan, and India dominate the APAC fast food market primarily due to their large population bases, a growing middle class, and rapid urbanization. China leads the market as its younger generation embraces Western food culture, and international chains such as McDonald's and KFC expand their reach. India, despite its cultural diversity, shows a rising trend in fast-food consumption due to an expanding millennial population, increasing internet penetration, and the success of quick-service restaurants (QSRs).

- The Malaysian Ministry of Health has introduced a draft regulation (Regulation No. 38B) to limit the content of trans fatty acids in food products sold within the country. The regulation proposes a maximum of 2g of trans fatty acids per 100g of fat, excluding those of animal origin. This initiative aligns with global recommendations by the World Health Organization and regulations from regions like the European Union and India. The draft regulation is currently open for public comments until January 16, 2024.

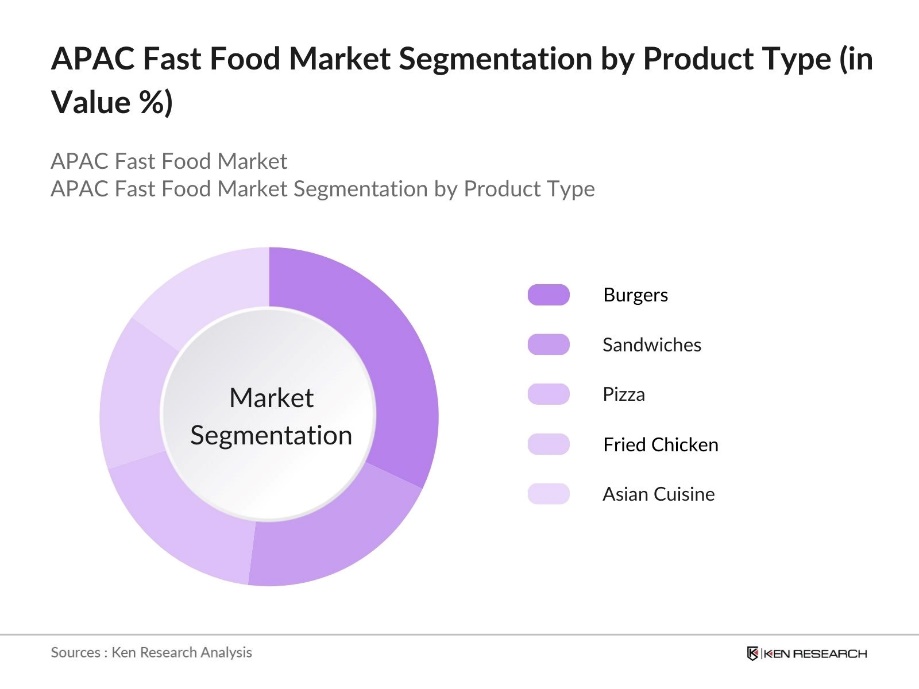

APAC Fast Food Market Segmentation

By Product Type: The APAC fast food market is segmented by product type into burgers, sandwiches, pizza, fried chicken, and Asian cuisine. Among these, burgers hold a dominant share of the market due to the widespread presence of established brands like McDonalds, Burger King, and Wendys. The appeal of burgers lies in their affordability, convenience, and adaptability to local tastes, making them a preferred option across a variety of age groups in both urban and suburban areas. Additionally, the increasing customization options and promotional deals offered by burger chains further contribute to their dominance.

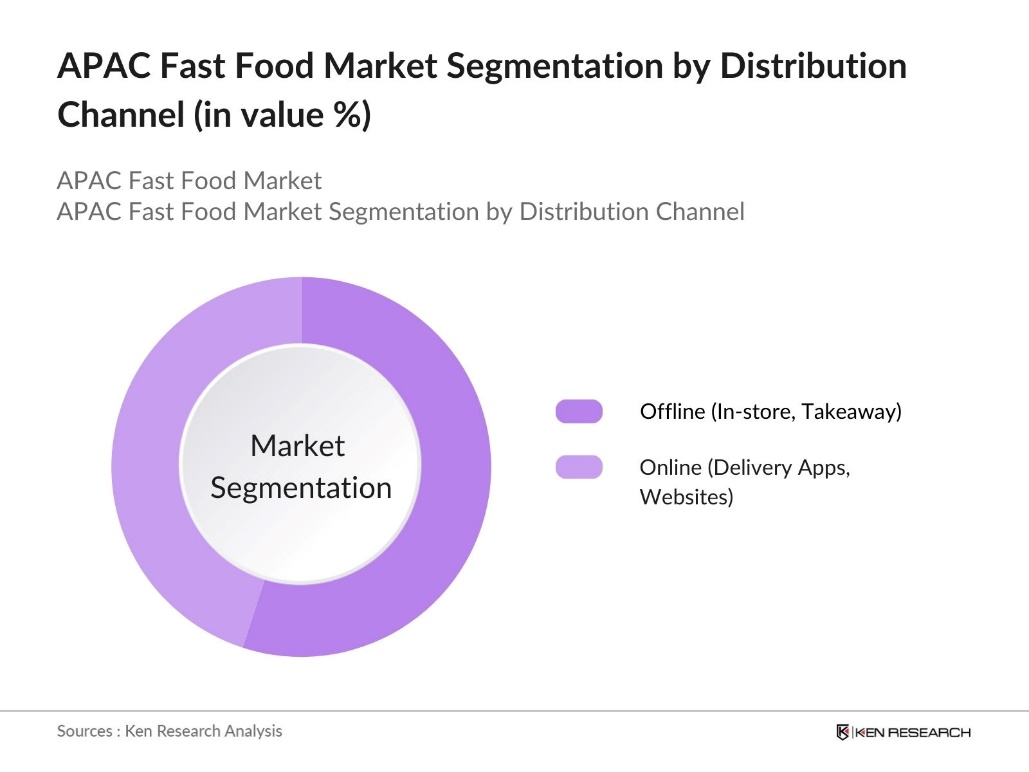

By Distribution Channel: In the APAC fast food market, distribution channels are divided into offline (in-store and takeaway) and online (delivery apps and websites). Online food delivery services have gained significant traction, accounting for a substantial portion of fast-food sales, driven by the increasing use of smartphones and the expansion of delivery platforms like GrabFood, Uber Eats, and Zomato. Particularly in highly urbanized areas such as Singapore, Tokyo, and Hong Kong, busy lifestyles and the desire for convenience have accelerated the growth of online channels, where discounts, promotions, and a wider variety of food options attract customers.

APAC Fast Food Market Competitive Landscape

The market is highly competitive, with both global giants and regional players vying for market share. International brands leverage their global presence and marketing budgets, while local brands appeal to regional tastes and preferences. The competitive landscape of the market is dominated by international players such as McDonalds and Yum! Brands (KFC, Pizza Hut), but regional chains like Jollibee and MOS Burger are also growing rapidly.

|

Company |

Establishment Year |

Headquarters |

No. of Outlets (2023) |

Revenue (2023) |

Market Reach (No. of Countries) |

Investment in Technology |

Menu Localization Efforts |

Sustainability Initiatives |

Employee Count |

|

McDonald's Corporation |

1940 |

USA |

|||||||

|

Yum! Brands (KFC, Pizza Hut) |

1997 |

USA |

|||||||

|

Jollibee Foods Corporation |

1978 |

Philippines |

|||||||

|

Domino's Pizza Enterprises |

1960 |

USA |

|||||||

|

MOS Burger |

1972 |

Japan |

APAC Fast Food Industry Analysis

Growth Drivers

- Increased Spending on Quick-Service Restaurants (QSR): In the Asia-Pacific region, increased consumer spending on food services, especially in Quick-Service Restaurants (QSRs), is evident from rising disposable income levels. India's per capita net national income (NNI) for 2022-23 was around 172,000 (USD 2,080 at current exchange rates) and is expected to rise slightly in 2023-24. The primarily driven by younger demographics opting for convenient dining options.

- Changing Lifestyle Patterns and Fast-Paced Urbanization: In 2022, urban population reached 56.9%, with the growth of the population going down to 1.55%. Rapid urbanization is leading to busier lifestyles, increasing demand for quick meal solutions. In countries like India and Indonesia, consumers are increasingly gravitating toward fast food due to its accessibility and affordability, reflecting a fast-paced urban lifestyle.

- Growth in the Young Population Demographic: Asia-Pacific has a large and rapidly growing young population that significantly drives fast food consumption. Younger consumers are inclined towards convenience, making fast food an appealing choice in their fast-paced lifestyles. This demographic, particularly in urban areas, prefers quick-service restaurants for their affordability and accessibility. The increasing purchasing power of this group, combined with their preference for digital ordering and food delivery platforms, has further propelled fast food sales.

Market Challenges

- Growing Awareness of Health Issues Linked to Fast Food: Health concerns have become a significant challenge for the APAC fast food market. Increasing consumer awareness about the risks associated with the consumption of high-calorie, low-nutrition fast food items is leading to shifts in dietary preferences. Consumers are becoming more mindful of their health and are actively seeking healthier alternatives, such as plant-based options or meals with lower fat and sugar content. This growing awareness is causing a reduction in frequent fast food consumption, as individuals prioritize their well-being and opt for more nutritious food choices.

- Supply Chain Disruptions and Increasing Raw Material Costs: The fast food industry in APAC is facing challenges due to disruptions in the supply chain and rising raw material costs. Factors such as inflation, logistical delays, and fluctuations in the availability of key ingredients have affected the industrys ability to maintain stable operations. Essential commodities used in fast food production, such as grains, vegetables, and meat, have seen price increases, creating pressure on fast food operators. These rising costs make it difficult for businesses to sustain profitability without raising menu prices, which can impact consumer demand.

APAC Fast Food Market Future Outlook

The APAC fast food market is set to continue its growth trajectory driven by several factors, including the increasing popularity of online food delivery, growing urbanization, and rising disposable incomes across the region. Over the next five years, we expect further market expansion as international chains invest in localization efforts, and new technology platforms such as AI-driven customer engagement and drone deliveries reshape the industry landscape.

Market Opportunities

- Increasing Penetration in Untapped Rural Markets: The expansion of fast food chains into rural areas offers a significant growth opportunity for the APAC fast food market. While urban areas have been the primary focus for fast food operators, rural regions, particularly in countries like India and Indonesia, remain largely underpenetrated. As infrastructure improves and disposable incomes rise in these areas, there is growing potential for fast food chains to tap into new customer bases.

- Rising Demand for Sustainable Packaging Solutions: Growing environmental consciousness among consumers has led to a rising demand for sustainable packaging solutions in the fast food industry. Customers are increasingly looking for eco-friendly options, driving fast food operators to adopt biodegradable, reusable, or recyclable materials in their packaging. Governments in the APAC region are also encouraging sustainability efforts by introducing regulations that promote the reduction of plastic waste.

Scope of the Report

|

By Product Type |

Burgers Sandwiches Pizza Chicken Asian Cuisine |

|

By Service Type |

Quick-Service Restaurants (QSR) Casual Dining Food Delivery Services |

|

By Distribution Channel |

Offline (In-Store, Takeaway) Online (Delivery Apps, Websites) |

|

By Ingredient Type |

Meat-Based Vegetarian Plant-Based Proteins Dairy-Free |

|

By Region |

China South Korea Japan India Australia Rest of APAC |

Products

Key Target Audience

Fast Food Industry

Online Food Delivery Platforms

Packaging Manufacturers (Sustainable Packaging Solutions Providers)

Equipment and Technology Providers (Restaurant Automation Technology)

Franchising Businesses

Quick Service Restaurant Operators

Venture Capital and Investment Firms

Government and Regulatory Bodies (APAC Food Safety Standards Authority)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

McDonalds Corporation

Yum! Brands (KFC, Pizza Hut)

Restaurant Brands International (Burger King)

Jollibee Foods Corporation

Subway

Starbucks Corporation

Dominos Pizza Enterprises

Dunkin Brands

Popeyes Louisiana Kitchen

Tim Hortons

Wendys

MOS Burger

Dicos

Lotteria

Burger King Japan

Table of Contents

1. APAC Fast Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Fast Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Fast Food Market Analysis

3.1. Growth Drivers (Rising Disposable Income, Urbanization, Shifting Consumer Preferences)

3.1.1. Increased Spending on Quick-Service Restaurants (QSR)

3.1.2. Changing Lifestyle Patterns and Fast-Paced Urbanization

3.1.3. Growth in the Young Population Demographic

3.1.4. Expansion of Online Food Delivery Platforms

3.2. Market Challenges (Health Concerns, Rising Ingredient Prices, Regulations)

3.2.1. Growing Awareness of Health Issues Linked to Fast Food

3.2.2. Supply Chain Disruptions and Increasing Raw Material Costs

3.2.3. Stringent Government Regulations on Nutrition and Food Safety

3.3. Opportunities (Market Expansion, Sustainability Trends, Technological Advancements)

3.3.1. Increasing Penetration in Untapped Rural Markets

3.3.2. Rising Demand for Sustainable Packaging Solutions

3.3.3. Integration of Automation and AI in Operations

3.4. Trends (Vegan and Plant-Based Menus, Contactless Delivery, Loyalty Programs)

3.4.1. Increasing Popularity of Plant-Based and Alternative Protein Fast Foods

3.4.2. Surge in Demand for Contactless Delivery and Digital Payments

3.4.3. Expansion of Loyalty and Membership Programs for Customer Retention

3.5. Government Regulation (Food Safety Standards, Environmental Regulations)

3.5.1. APAC Region-Specific Food Labeling Laws

3.5.2. Government Initiatives to Curb Single-Use Plastic Waste

3.5.3. Nutritional Guidelines for Fast Food Operators

3.5.4. Taxation Policies Affecting Fast Food Consumption

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Suppliers, Distributors, End-Users)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Industry Rivalry)

3.9. Competition Ecosystem (Industry Landscape)

4. APAC Fast Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Burgers

4.1.2. Sandwiches

4.1.3. Pizza

4.1.4. Chicken

4.1.5. Asian Cuisine

4.2. By Service Type (In Value %)

4.2.1. Quick-Service Restaurants (QSR)

4.2.2. Casual Dining

4.2.3. Food Delivery Services

4.3. By Distribution Channel (In Value %)

4.3.1. Offline (In-Store, Takeaway)

4.3.2. Online (Delivery Apps, Websites)

4.4. By Ingredient Type (In Value %)

4.4.1. Meat-Based

4.4.2. Vegetarian

4.4.3. Plant-Based Proteins

4.4.4. Dairy-Free

4.5. By Region (In Value %)

4.5.1. China

4.5.2. South Korea

4.5.3. Japan

4.5.4. India

4.5.5. Australia

4.5.6. Rest of APAC

5. APAC Fast Food Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. McDonalds Corporation

5.1.2. Yum! Brands (KFC, Pizza Hut)

5.1.3. Restaurant Brands International (Burger King)

5.1.4. Dominos Pizza Enterprises

5.1.5. Jollibee Foods Corporation

5.1.6. Subway

5.1.7. Starbucks Corporation

5.1.8. Chick-fil-A

5.1.9. Dunkin Brands

5.1.10. Popeyes Louisiana Kitchen

5.1.11. Tim Hortons

5.1.12. Wendys

5.1.13. MOS Burger

5.1.14. Dicos

5.1.15. Lotteria

5.2 Cross Comparison Parameters (Number of Outlets, Revenue, Employee Count, Market Share, Geographical Presence, Delivery Infrastructure, Sustainability Initiatives, Technology Integration)

5.3 Market Share Analysis (Top Competitors)

5.4 Strategic Initiatives (Partnerships, Franchising, Marketing Campaigns)

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. APAC Fast Food Market Regulatory Framework

6.1 Food Safety and Hygiene Standards

6.2 Labor Laws and Employment Regulations

6.3 Taxation and Import Regulations

6.4 Environmental Compliance (Waste Management, Packaging)

7. APAC Fast Food Market Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. APAC Fast Food Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Service Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Ingredient Type (In Value %)

8.5 By Region (In Value %)

9. APAC Fast Food Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Analysis

9.3 Marketing and Expansion Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we identified the core variables influencing the APAC fast food market, including urbanization rates, per capita disposable income, and technological adoption. This step involved a review of secondary data sources such as industry reports, governmental data, and proprietary databases to ensure accuracy.

Step 2: Market Analysis and Construction

During this phase, we conducted a comprehensive analysis of market segmentation by product type and distribution channel. Historical data was gathered to evaluate trends in consumer behavior and market dynamics, focusing on revenue streams from both in-store and online sales channels.

Step 3: Hypothesis Validation and Expert Consultation

To validate our hypotheses, we consulted industry experts through interviews, focusing on key companies in the APAC fast food market. Insights from these discussions helped refine market projections and understand operational and financial challenges faced by fast food operators.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing data from multiple fast-food chains and food delivery platforms to provide a detailed market overview. The result is a comprehensive analysis of current market conditions, growth drivers, and competitive dynamics, ensuring a reliable and actionable report for stakeholders.

Frequently Asked Questions

01. How big is the APAC Fast Food Market?

The APAC Fast Food Market is valued at USD 158.23 billion, driven by urbanization, increasing disposable income, and a growing preference for convenience food among consumers in major urban centers.

02. What are the key growth drivers in the APAC Fast Food Market?

The APAC Fast Food Market is driven by urbanization, increasing disposable income, a growing youth population, and the rising popularity of online food delivery platforms. These factors contribute to the demand for quick-service restaurant options across the region.

03. Which countries dominate the APAC Fast Food Market?

China, Japan, and India dominate the fast-food market due to their large populations, growing middle class, and rapid urbanization. International chains have found success by localizing their menus and leveraging online food delivery services.

04. Who are the major players in the APAC Fast Food Market?

The major players in APAC Fast Food Market include McDonald's Corporation, Yum! Brands (KFC, Pizza Hut), Jollibee Foods Corporation, and Restaurant Brands International (Burger King), with local chains such as MOS Burger and Dicos also gaining traction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.