Region:Asia

Author(s):Rebecca

Product Code:KRAA9301

Pages:87

Published On:November 2025

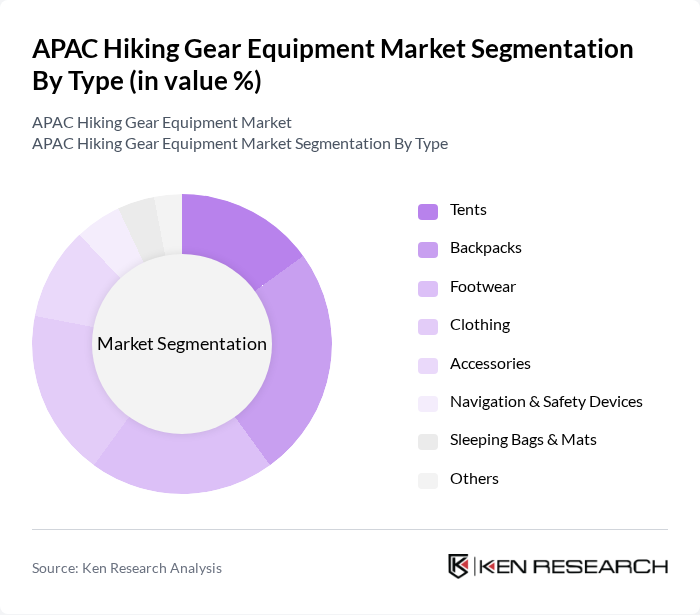

By Type:The hiking gear equipment market can be segmented into various types, including Tents, Backpacks, Footwear, Clothing, Accessories, Navigation & Safety Devices, Sleeping Bags & Mats, and Others. Each of these subsegments caters to specific needs of hikers, with varying levels of demand based on consumer preferences and outdoor activity trends. The market is witnessing increased demand for modular and multi-functional accessories, as well as rapid innovation in apparel segments with sustainable fibers and performance textiles.

The Backpacks subsegment is dominating the market due to the increasing trend of adventure tourism and outdoor activities. Consumers are increasingly seeking durable, lightweight, and functional backpacks that can accommodate various hiking needs. The rise in individual hiking and group trekking activities has further fueled the demand for high-quality backpacks, making them a staple in the hiking gear market.

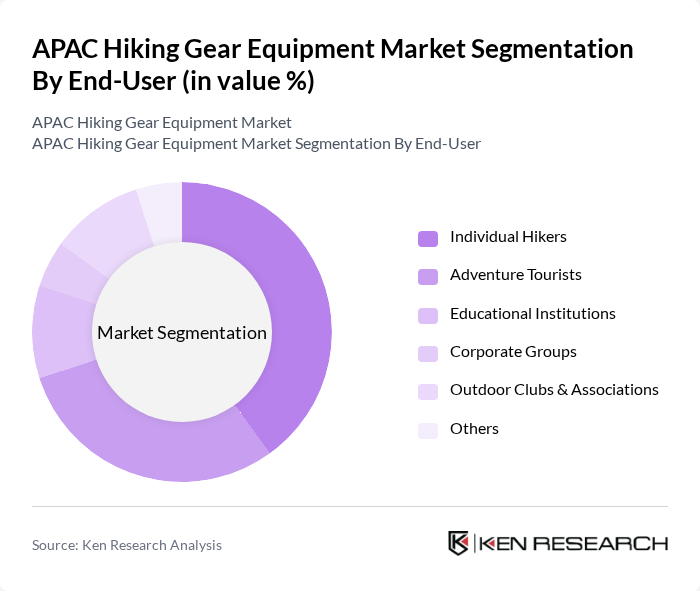

By End-User:The market can also be segmented based on end-users, including Individual Hikers, Adventure Tourists, Educational Institutions, Corporate Groups, Outdoor Clubs & Associations, and Others. Each segment reflects different consumer behaviors and preferences, influencing the types of products that are in demand. The market is seeing a notable increase in demand from individual consumers due to rising health consciousness and a preference for outdoor recreational activities.

The Individual Hikers segment is the largest due to the growing number of people engaging in hiking as a recreational activity. This trend is supported by increased health consciousness and the desire for outdoor experiences, leading to a higher demand for hiking gear tailored to individual needs.

The APAC Hiking Gear Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as The North Face, Columbia Sportswear, Patagonia, Merrell, Salomon, Arc'teryx, Kathmandu Holdings, Black Diamond Equipment, Mountain Hardwear, Osprey Packs, Mammut, MSR (Mountain Safety Research), Big Agnes, Sea to Summit, Outdoor Research, Montbell, Snow Peak, Toread Holdings Group, Kailas, Decathlon contribute to innovation, geographic expansion, and service delivery in this space.

The APAC hiking gear market is poised for dynamic growth, driven by increasing outdoor participation and a shift towards sustainable practices. As consumers become more environmentally conscious, brands that prioritize eco-friendly materials and production methods will likely gain a competitive edge. Additionally, the rise of digital platforms for retail is expected to enhance accessibility, allowing brands to reach a broader audience. Innovations in smart gear and customization options will further attract tech-savvy consumers, shaping the future landscape of the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Tents Backpacks Footwear Clothing Accessories (e.g., trekking poles, hydration gear, camp cookware, headlamps, water bottles, multi-tools, gaiters) Navigation & Safety Devices (e.g., GPS devices, compasses, emergency beacons) Sleeping Bags & Mats Others |

| By End-User | Individual Hikers Adventure Tourists Educational Institutions Corporate Groups Outdoor Clubs & Associations Others |

| By Region | China Japan India South Korea Australia Southeast Asia (e.g., Indonesia, Thailand, Vietnam, Malaysia, Singapore) Rest of APAC |

| By Material | Synthetic Fabrics (e.g., nylon, polyester) Natural Fabrics (e.g., cotton, wool) Composites (e.g., carbon fiber, advanced polymers) Recycled & Sustainable Materials Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Distribution Channel | Online Retail (e-commerce platforms, brand websites) Specialty Outdoor Stores General Retail Stores/Supermarkets Direct Sales Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hiking Gear Retailers | 100 | Store Managers, Sales Representatives |

| Outdoor Equipment Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Hiking Enthusiasts | 120 | Frequent Hikers, Outdoor Club Members |

| Tourism and Recreation Agencies | 60 | Policy Makers, Program Coordinators |

| Environmental Organizations | 40 | Sustainability Advocates, Research Analysts |

The APAC Hiking Gear Equipment Market is valued at approximately USD 6.2 billion, reflecting a significant growth trend driven by increased outdoor activities, rising disposable incomes, and heightened health awareness among consumers in the region.