Region:Asia

Author(s):Shubham

Product Code:KRAA8513

Pages:96

Published On:November 2025

Market.png)

By Component:The APAC HRM market is segmented intoSoftwareandService. The software segment is gaining traction due to the increasing need for automation in HR processes, while the service segment is essential for providing support, integration, and consulting to organizations implementing HRM solutions. The adoption of cloud-based HRM software and the need for ongoing compliance updates are further accelerating the demand for both components .

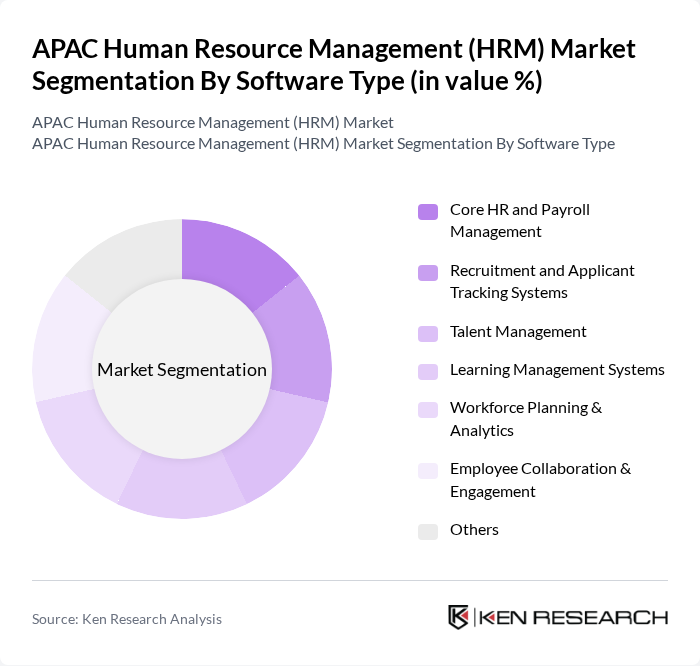

By Software Type:This segmentation includes Core HR and Payroll Management, Recruitment and Applicant Tracking Systems, Talent Management, Learning Management Systems, Workforce Planning & Analytics, Employee Collaboration & Engagement, and Others. The demand for integrated software solutions is driving growth in this segment, as organizations seek to enhance their HR capabilities, improve employee experience, and leverage analytics for workforce planning .

The APAC Human Resource Management (HRM) Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE (SuccessFactors), Oracle Corporation (Oracle HCM Cloud), Workday Inc. (Class A), Automatic Data Processing Inc. (ADP), Ceridian HCM Holding Inc. (Dayforce), International Business Machines Corp. (IBM), Mercer International Inc., Accenture PLC (Class A), CEGID, PwC (PricewaterhouseCoopers), Omni HR, Cezanne HR, UKG (Ultimate Kronos Group), Cornerstone OnDemand, and BambooHR contribute to innovation, geographic expansion, and service delivery in this space .

The APAC HRM market is poised for transformative growth, driven by technological advancements and evolving workforce dynamics. As organizations increasingly embrace digital solutions, the integration of artificial intelligence and data analytics will redefine HR practices. Furthermore, the emphasis on employee well-being and flexible work arrangements will shape HR strategies. Companies that adapt to these trends will likely enhance their competitive edge, fostering a more agile and responsive workforce capable of meeting future challenges.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Service |

| By Software Type | Core HR and Payroll Management Recruitment and Applicant Tracking Systems Talent Management Learning Management Systems Workforce Planning & Analytics Employee Collaboration & Engagement Others |

| By Service Type | Integration & Deployment Support & Maintenance Training & Consulting |

| By Deployment Model | Cloud-Based On-Premises Hybrid |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By End-User Industry | IT and Telecommunications Banking, Financial Services, and Insurance (BFSI) Healthcare Manufacturing Retail Government Education Others |

| By Country | China India Japan South Korea Australia Singapore Southeast Asia (Vietnam, Thailand, Philippines, Malaysia) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| IT Sector HRM Practices | 100 | HR Managers, Talent Acquisition Specialists |

| Manufacturing Industry Workforce Management | 70 | Operations Managers, HR Directors |

| Service Sector Employee Engagement Strategies | 80 | HR Business Partners, Employee Relations Managers |

| HR Technology Adoption Trends | 60 | HR Technology Managers, HR Technology Consultants |

| Workforce Diversity and Inclusion Initiatives | 50 | Diversity Officers, HR Strategy Leaders |

The APAC Human Resource Management (HRM) market is valued at approximately USD 6.4 billion, reflecting significant growth driven by the adoption of digital HR solutions and cloud-based technologies, as well as the demand for employee engagement and talent management tools.