Region:Asia

Author(s):Rebecca

Product Code:KRAC3293

Pages:86

Published On:October 2025

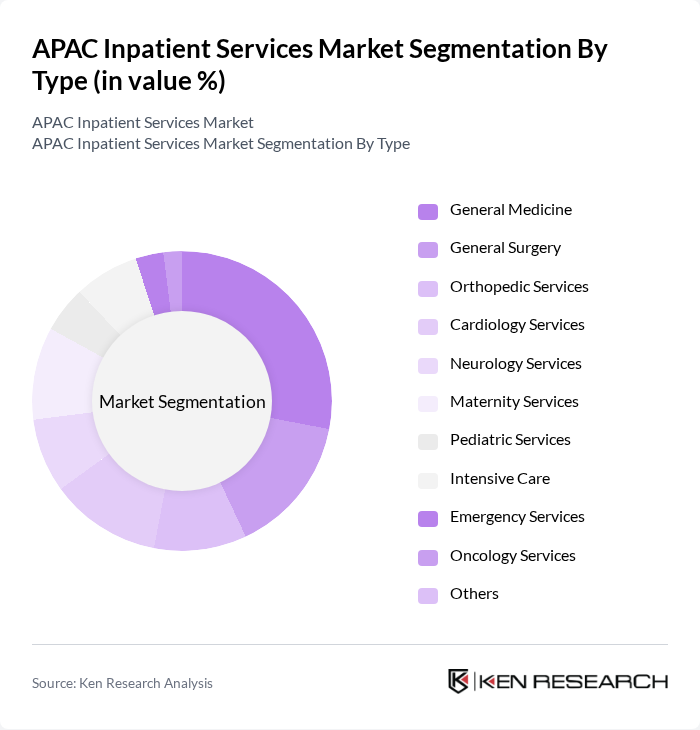

By Type:The market is segmented into various types of inpatient services, including General Medicine, General Surgery, Orthopedic Services, Cardiology Services, Neurology Services, Maternity Services, Pediatric Services, Intensive Care, Emergency Services, Oncology Services, and Others. Each of these segments addresses specific patient needs and conditions, contributing to the overall growth of the market. Notably, the General Medicine segment holds the largest share, reflecting the high burden of chronic and acute diseases requiring sustained inpatient care .

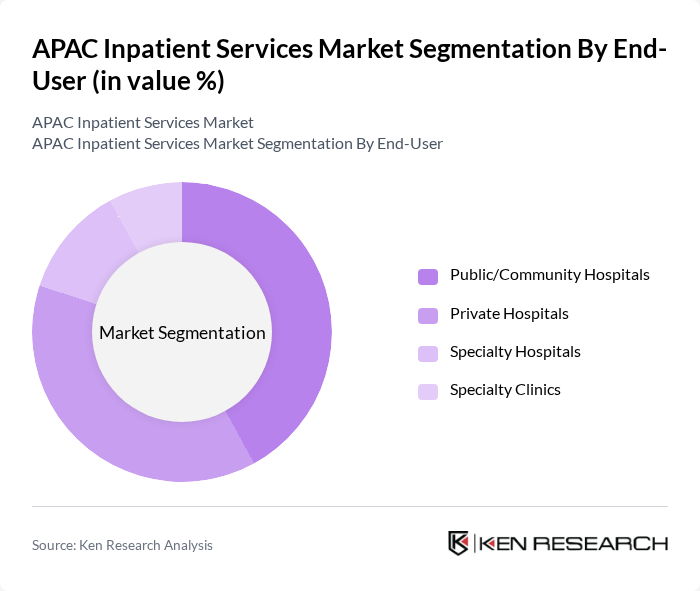

By End-User:The market is categorized based on end-users, including Public/Community Hospitals, Private Hospitals, Specialty Hospitals, and Specialty Clinics. Each end-user segment plays a crucial role in delivering inpatient services, with varying capacities and specialties that cater to different patient demographics. Public and private hospitals together account for the majority of inpatient admissions, reflecting their extensive network and service coverage .

The APAC Inpatient Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apollo Hospitals Enterprise Limited, Fortis Healthcare Limited, Max Healthcare Institute Limited, NMC Health PLC, Ramsay Health Care Limited, IHH Healthcare Berhad, Bangkok Dusit Medical Services Public Company Limited, KPJ Healthcare Berhad, Parkway Pantai Limited, Healthcare Global Enterprises Ltd., Manipal Health Enterprises Pvt Ltd, Columbia Asia Hospitals, Raffles Medical Group, Changi General Hospital, and Singapore General Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The APAC inpatient services market is poised for transformative growth driven by technological integration and demographic shifts. As healthcare providers increasingly adopt value-based care models, patient-centric services will become paramount. The integration of AI and big data analytics is expected to enhance operational efficiencies and patient outcomes. Furthermore, the expansion of telemedicine and outpatient services will reshape traditional inpatient care, allowing for more flexible and accessible healthcare solutions tailored to evolving patient needs.

| Segment | Sub-Segments |

|---|---|

| By Type | General Medicine General Surgery Orthopedic Services Cardiology Services Neurology Services Maternity Services Pediatric Services Intensive Care Emergency Services Oncology Services Others |

| By End-User | Public/Community Hospitals Private Hospitals Specialty Hospitals Specialty Clinics |

| By Region | China India Japan South Korea Southeast Asia Oceania |

| By Service Duration | Short-Term Admissions Long-Term Admissions |

| By Payment Model | Fee-for-Service Capitation Bundled Payments |

| By Patient Demographics | Adult Patients Pediatric Patients Geriatric Patients |

| By Insurance Type | Private Insurance Public Insurance Self-Pay |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Hospital Inpatient Services | 120 | Hospital Administrators, Medical Directors |

| Specialized Surgical Services | 90 | Surgeons, Operating Room Managers |

| Pediatric Inpatient Care | 60 | Pediatricians, Child Health Specialists |

| Geriatric Inpatient Services | 50 | Geriatricians, Nursing Home Administrators |

| Emergency Room Services | 70 | Emergency Physicians, ER Managers |

The APAC Inpatient Services Market is valued at approximately USD 740 billion, reflecting significant growth driven by factors such as the rising prevalence of chronic diseases, an aging population, and advancements in medical technology.