APAC Learning Management System Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD3847

December 2024

89

About the Report

APAC Learning Management System Market Overview

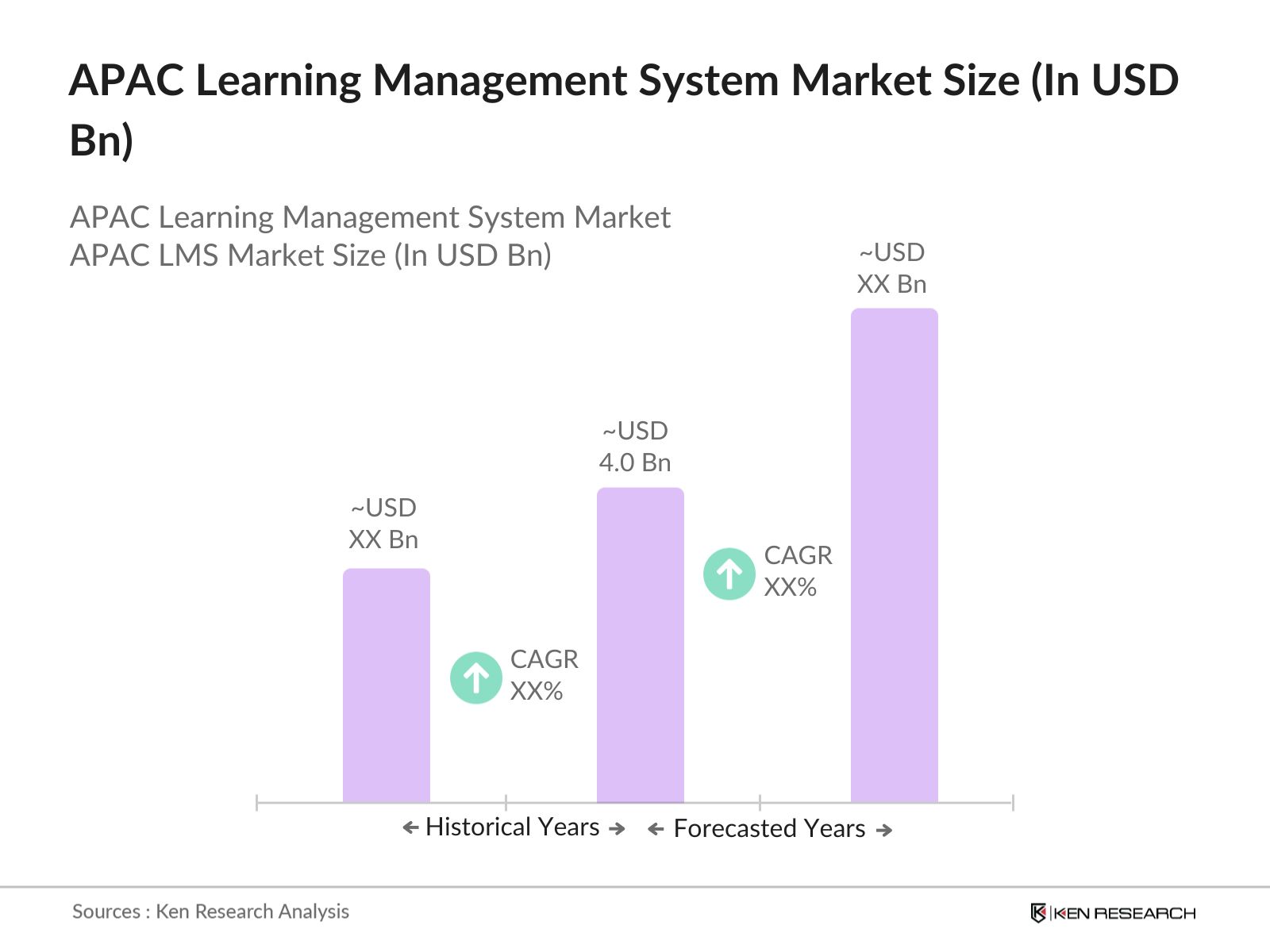

- The APAC Learning Management System (LMS) market is witnessing substantial growth, currently valued at USD 4 billion, driven by increasing digitalization in education and corporate sectors. The market is projected to experience robust growth as educational institutions and enterprises adopt digital learning tools. Countries such as China, India, Japan, and Australia are leading the way in embracing e-learning solutions. The growing need for personalized learning experiences and scalable educational platforms, particularly in the context of hybrid and remote learning, has fueled demand for LMS platforms across the region.

- China dominates the APAC LMS market due to its vast educational infrastructure and government-led initiatives promoting digital education. India follows closely, driven by its large student population and the rapid adoption of mobile-based learning platforms. Meanwhile, markets like Japan and South Korea are also making strides, particularly in corporate learning solutions, as organizations invest in employee training and upskilling using LMS platforms.

- Governments across APAC are tightening regulations on data protection to ensure the security of LMS platforms. In 2023, India introduced the Data Protection Bill, which mandates stringent security measures for any entity handling personal data, affecting LMS providers. Similarly, Japan's Personal Information Protection Law requires educational institutions to safeguard student data on LMS platforms, with fines reaching up to $1 million for non-compliance. These regulations are critical to ensuring secure adoption of LMS across the region.

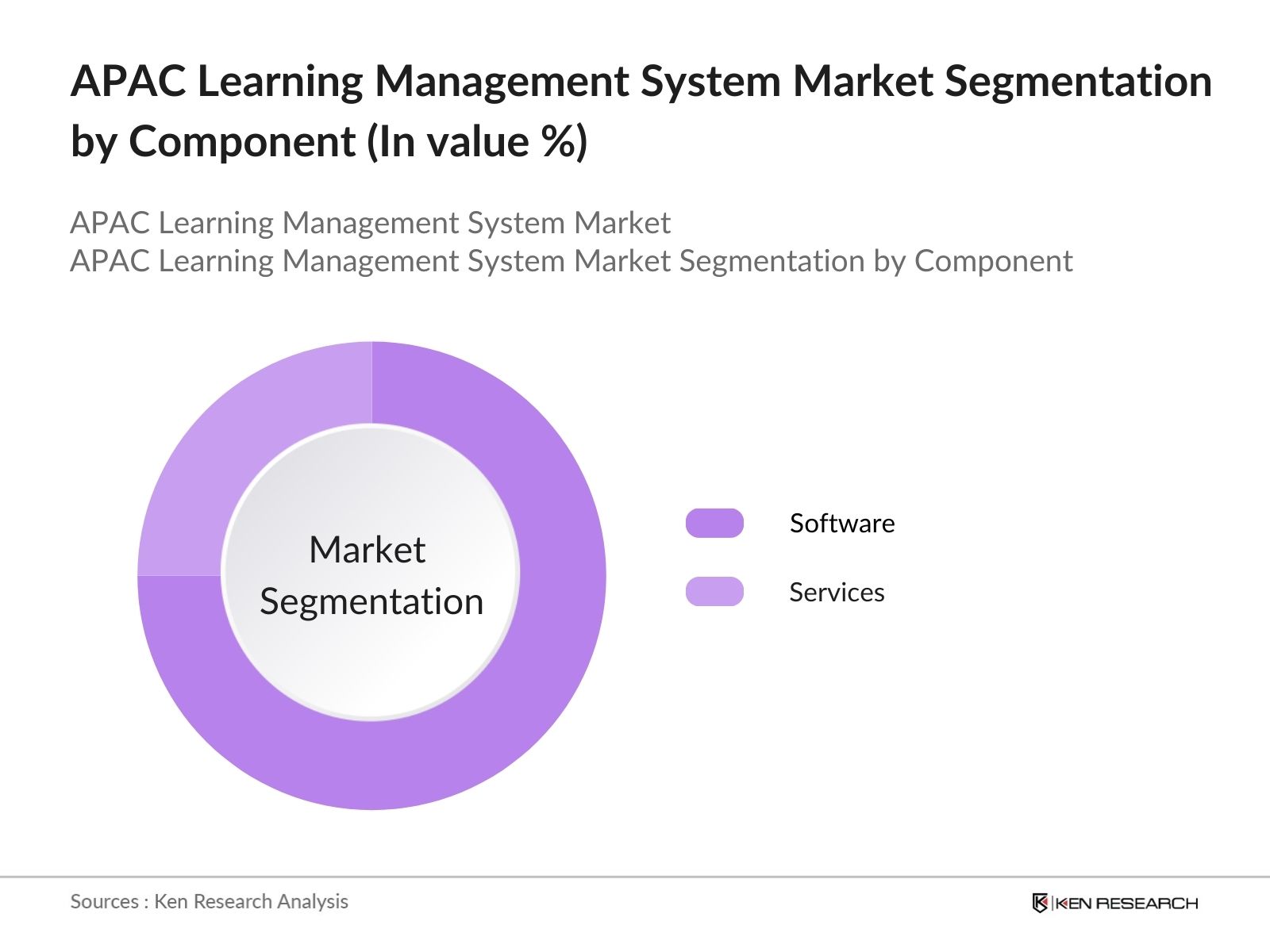

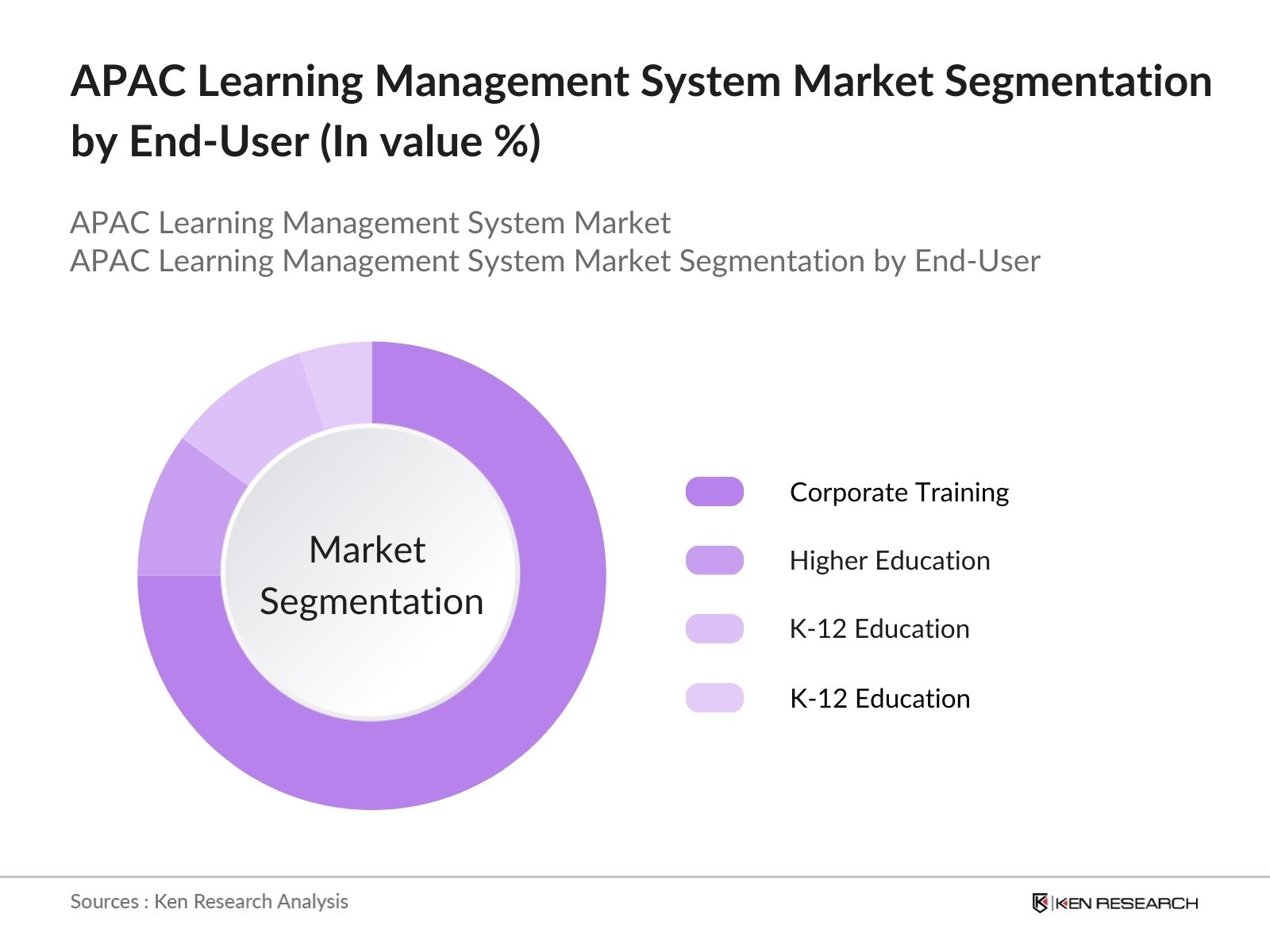

APAC Learning Management System Market Segmentation

- By Component: The market is segmented by component into software and services. The software segment dominates, comprising various platforms for e-learning, virtual classrooms, and training management. In contrast, services include implementation, integration, and consulting services. The increasing demand for customizable software solutions that can be tailored to the specific needs of educational institutions and businesses is driving the software segments growth. The services segment, although smaller, is witnessing steady growth as organizations seek end-to-end solutions to implement and manage LMS platforms effectively.

- By End-User: The market is further segmented by end-users into K-12 education, higher education, and corporate training. The corporate training segment holds the largest market share, with businesses increasingly adopting LMS platforms for employee onboarding, compliance training, and skill development. However, the K-12 and higher education segments are growing rapidly due to increased adoption of e-learning tools amidst the ongoing push towards digital classrooms. Governments across APAC are also focusing on improving educational standards through online platforms, further fueling growth in this segment.

APAC Learning Management System Market Competitive Landscape

The APAC LMS market is highly competitive, with global and regional players vying for market share. Major companies in the market include Blackboard, Inc., Cornerstone OnDemand, Moodle, and SAP Litmos. These companies are focusing on platform innovations, expanding their geographical presence, and entering into partnerships with educational institutions and enterprises to strengthen their market positions. The competitive landscape also includes several local players, such as D2L Corporation and Edmodo, which cater to specific regional needs by offering localized content and language support.

|

Company Name |

Establishment Year |

Headquarters |

No. of Users |

Revenue (2023) |

Key Clients |

Customization Capability |

Cloud/On-Premises |

Regional Focus |

Market Presence |

|

Blackboard, Inc. |

1997 |

Washington, USA |

|||||||

|

Cornerstone OnDemand |

1999 |

California, USA |

|||||||

|

Moodle |

2002 |

Perth, Australia |

|||||||

|

SAP Litmos |

2007 |

California, USA |

|||||||

|

Instructure (Canvas) |

2008 |

Utah, USA |

APAC Learning Management System Industry Analysis

Growth Drivers

- Rising Digital Transformation in Education and Corporates: The APAC region has seen a significant shift towards digital transformation in education and corporate sectors. In China, the Education Informatization 2.0 initiative has provided extensive funding, with a substantial amount allocated in 2022 to advance digital education systems. Indias National Education Policy 2020 has also accelerated digital learning by promoting the use of e-learning platforms across universities and corporates. In Japan, corporate investment in Learning Management Systems (LMS) reached all-time high in 2023, driven by the need for continuous employee development. This trend is pushing organizations to adopt LMS for enhanced digital training infrastructure.

- Increasing Mobile Penetration (Smartphones driving accessibility: Smartphone usage across the APAC region has fueled the growth of Learning Management Systems by making e-learning accessible to more people. In 2023, India had over 850 million smartphone users, with China following closely at 950 million. This mobile penetration rate is a crucial factor in the expansion of LMS platforms, especially in remote learning environments. making it easier for educational institutions to implement mobile-based LMS solutions.

- Government Support for Digital Learning: Governments in APAC are actively promoting digital learning through various policies. China's Education Informatization 2.0 plan, which emphasizes advanced technology integration in education, allocated a substantial amount in 2023 to boost e-learning across schools and universities. India's Digital India campaign allocated over $3 billion for digital education programs, enhancing access to e-learning tools across rural areas. Similarly, Japan's "Society 5.0" initiative fosters the use of LMS for professional and academic upskilling, supported by a various fund aimed at improving digital education infrastructure

Market Challenges

- High Implementation Costs: Implementing an LMS can be prohibitively expensive, particularly for small to mid-sized organizations in the APAC region. Many educational institutions in developing countries like Cambodia and Laos face challenges due to the high costs associated with digital transformation, including the integration of LMS systems. In Malaysia, for example, corporate LMS installations create financial burdens for mid-sized firms, posing a significant hurdle to broader market penetration and adoption.

- Data Security and Privacy Concerns: Data privacy is an issue in the adoption of LMS systems across APAC. A growing number of educational institutions have reported cyberattacks targeting student data. Countries like India and Indonesia are particularly vulnerable to cyber threats, leading governments to enforce stricter regulations such as India's Personal Data Protection Bill and China's Cybersecurity Law. However, the complexities of data compliance continue to impede widespread adoption of LMS systems in the region.

APAC Learning Management System Market Future Outlook

The APAC Learning Management System market is poised for substantial growth over the next five years, driven by increasing digitalization, government support for e-learning, and corporate training needs. The adoption of AI and machine learning within LMS platforms is expected to further enhance personalized learning experiences, allowing for more adaptive content delivery and performance tracking. As educational institutions and enterprises across APAC continue to embrace digital learning tools, the market for LMS platforms is set to expand rapidly.

Future Market Opportunities

- AI and Machine Learning Integration in LMS: AI and machine learning are becoming integral to LMS, enabling personalized learning experiences. In 2023, South Korea invested $1.5 billion in AI-based adaptive learning technologies for schools and universities, while China allocated noteworthy amount to integrate AI into their national LMS platforms. AI-based systems allow for tailored content delivery, boosting engagement and improving learning outcomes, particularly in STEM education. These technologies are expanding rapidly, providing lucrative opportunities for LMS providers targeting education and corporate training sectors.

- Expansion into Rural and Emerging Markets: There is untapped potential in rural and emerging markets across the APAC region. In 2023, the Indian government allocated $800 million to extend digital learning platforms to rural schools under the "Samagra Shiksha" program. Meanwhile, Indonesia's Ministry of Education invested agrresivelly to provide digital infrastructure in underserved regions. These investments are paving the way for LMS providers to expand into previously inaccessible markets, helping bridge the digital divide in education and providing long-term market opportunities

Scope of the Report

|

Component |

Software Services |

|

Deployment Model |

Cloud-Based On-Premises |

|

End-User |

K-12 Education Higher Education Corporate Training Government Organizations |

|

Industry Vertical |

Education Healthcare BFSI IT and Telecom Manufacturing |

|

Region |

China Japan South Korea Others |

Products

Key Target Audience

Investors and venture capitalist firms

Government and regulatory bodies (Chinas Ministry of Education, Indias National Digital Education Architecture)

Corporate training departments

E-learning software providers

Educational content providers

IT infrastructure companies

Large enterprises with remote workforces

Mobile device manufacturers

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Blackboard, Inc.

Cornerstone OnDemand

Moodle

SAP Litmos

Instructure (Canvas)

D2L Corporation

Edmodo

Google Classroom

Absorb LMS

TalentLMS

Mindflash

Schoology

Saba Software

Latitude Learning

Docebo

Table of Contents

1. APAC Learning Management System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Cloud-based LMS, On-premises LMS)

1.3. Market Growth Rate (Influence of digital transformation and e-learning adoption)

1.4. Market Segmentation Overview

2. APAC Learning Management System Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Key factors driving growth: EdTech boom, government support)

2.3. Key Market Developments and Milestones

3. APAC Learning Management System Market Analysis

3.1. Growth Drivers

3.1.1. Rising Digital Transformation in Education and Corporates

3.1.2. Increasing Mobile Penetration (Smartphones driving accessibility)

3.1.3. Government Support for Digital Learning (China's Education Informatization 2.0, Indias Digital Learning Initiatives)

3.1.4. Demand for Remote Learning and Upskilling

3.2. Market Challenges

3.2.1. High Cost of LMS Implementation

3.2.2. Data Privacy and Security Concerns

3.2.3. Limited IT Infrastructure in Developing Economies

3.3. Opportunities

3.3.1. AI and Machine Learning Integration in LMS

3.3.2. Expansion into Rural and Emerging Markets

3.3.3. Customizable LMS Platforms for Different Industries

3.4. Trends

3.4.1. Adoption of AI-Based Adaptive Learning Platforms

3.4.2. Integration of Learning Analytics for Data-Driven Education

3.4.3. Corporate LMS for Continuous Employee Development

3.5. Government Regulation

3.5.1. Data Protection and Privacy Regulations (APAC specific)

3.5.2. National Education Policies Promoting E-learning

3.5.3. Government Incentives for Digital Transformation (China, India, Japan)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Market positioning of key competitors)

4. APAC Learning Management System Market Segmentation

4.1. By Component (In Value %)

4.1.1. Software

4.1.2. Services

4.2. By Deployment Model (In Value %)

4.2.1. Cloud-Based

4.2.2. On-premises

4.3. By End-User (In Value %)

4.3.1. K-12 Education

4.3.2. Higher Education

4.3.3. Corporate Training

4.3.4. Government Organizations

4.4. By Industry Vertical (In Value %)

4.4.1. Education

4.4.2. Healthcare

4.4.3. BFSI (Banking, Financial Services, Insurance)

4.4.4. IT and Telecom

4.4.5. Manufacturing

4.5. By Region (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. South Korea

4.5.4. Others

5. APAC Learning Management System Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Blackboard, Inc.

5.1.2. Cornerstone OnDemand

5.1.3. Moodle

5.1.4. SAP Litmos

5.1.5. D2L Corporation

5.1.6. Edmodo

5.1.7. Google Classroom

5.1.8. Instructure (Canvas)

5.1.9. Absorb LMS

5.1.10. TalentLMS

5.1.11. Mindflash

5.1.12. Schoology

5.1.13. Saba Software

5.1.14. Latitude Learning

5.1.15. Docebo

5.2 Cross Comparison Parameters (Revenue, Cloud vs. On-premises Usage, Partnerships with Educational Institutions, Customization Capabilities, No. of Users, Pricing Model, Data Privacy Standards, Regional Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. APAC Learning Management System Market Regulatory Framework

6.1. Data Privacy Regulations (APAC Specific)

6.2. Compliance Requirements for Educational Institutions and Corporates

6.3. Certification Processes and Standards (SCORM, xAPI, AICC)

7. APAC Learning Management System Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Learning Management System Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Deployment Model (In Value %)

8.3. By End-User (In Value %)

8.4. By Industry Vertical (In Value %)

8.5. By Region (In Value %)

9. APAC Learning Management System Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the APAC Learning Management System Market. This step is supported by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the APAC LMS Market. This includes assessing market penetration, user base growth, and revenue generation across various regions. Additionally, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with LMS platform providers to acquire detailed insights into product segments, market competition, user preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the APAC LMS market.

Frequently Asked Questions

01. How big is the APAC Learning Management System market?

The APAC Learning Management System market is valued at USD 4 billion, driven by increasing digitalization in both educational institutions and corporate sectors.

02. What are the challenges in the APAC Learning Management System market?

Key challenges in the APAC LMS market include high implementation costs, data privacy concerns, and limited IT infrastructure in developing countries, which can hinder the adoption of e-learning platforms.

03. Who are the major players in the APAC Learning Management System market?

Key players in the APAC LMS market include Blackboard, Inc., Moodle, SAP Litmos, Instructure (Canvas), and Cornerstone OnDemand, all of which are focusing on innovations in cloud-based and mobile-first LMS platforms.

04. What are the growth drivers of the APAC Learning Management System market?

Growth in the APAC LMS market is propelled by increasing mobile device usage, expanding internet access, government initiatives promoting digital learning, and the need for corporate upskilling and compliance training.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.