APAC Manufacturing Execution Systems Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD10487

December 2024

87

About the Report

APAC Manufacturing Execution Systems Market Overview

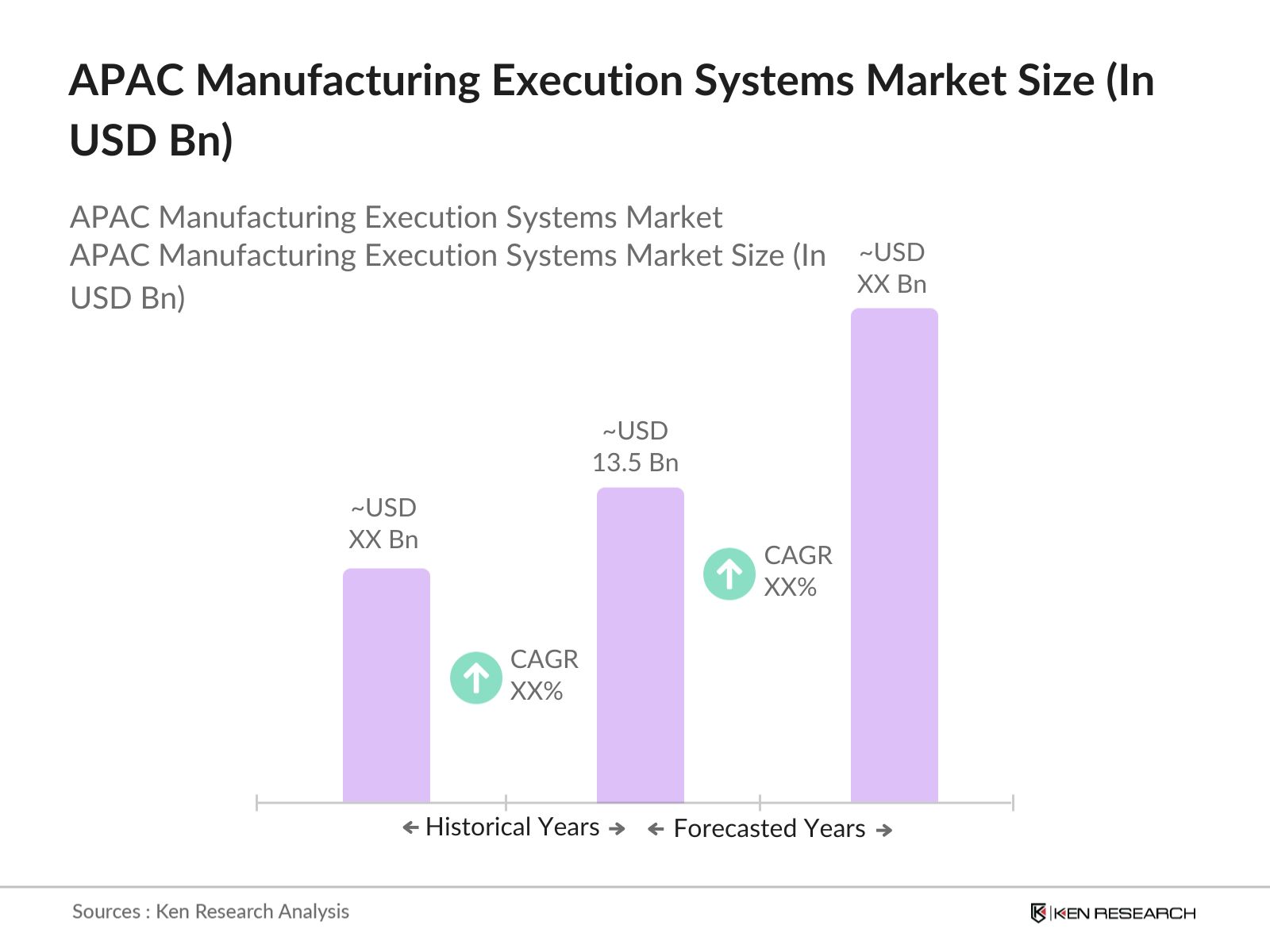

- The APAC Manufacturing Execution Systems market, valued at USD 13.5 billion based on a comprehensive five-year historical analysis, is primarily driven by rapid digitalization within manufacturing sectors across the region. This growth is a response to increasing demand for operational efficiency, real-time data management, and seamless production workflows. Key industries, including automotive, electronics, and pharmaceuticals, are embracing MES solutions to ensure compliance with quality standards, enhance production tracking, and minimize downtime.

- Countries like China, Japan, and South Korea dominate the MES market in APAC due to their established manufacturing ecosystems, technological infrastructure, and strong government support for industrial automation. China's vast industrial base, coupled with its push toward smart manufacturing, significantly contributes to the market's growth. Similarly, Japan's focus on Industry 4.0 initiatives and South Korea's investments in digital transformation bolster their MES adoption.

- The integration of artificial intelligence (AI) and machine learning (ML) into MES is transforming manufacturing operations. A report by the International Data Corporation noted that in 2023, 35% of APAC manufacturers implemented AI-driven analytics to enhance predictive maintenance and process optimization. This trend enables manufacturers to anticipate equipment failures, optimize production schedules, and improve product quality through data-driven insights.

APAC Manufacturing Execution Systems Market Segmentation

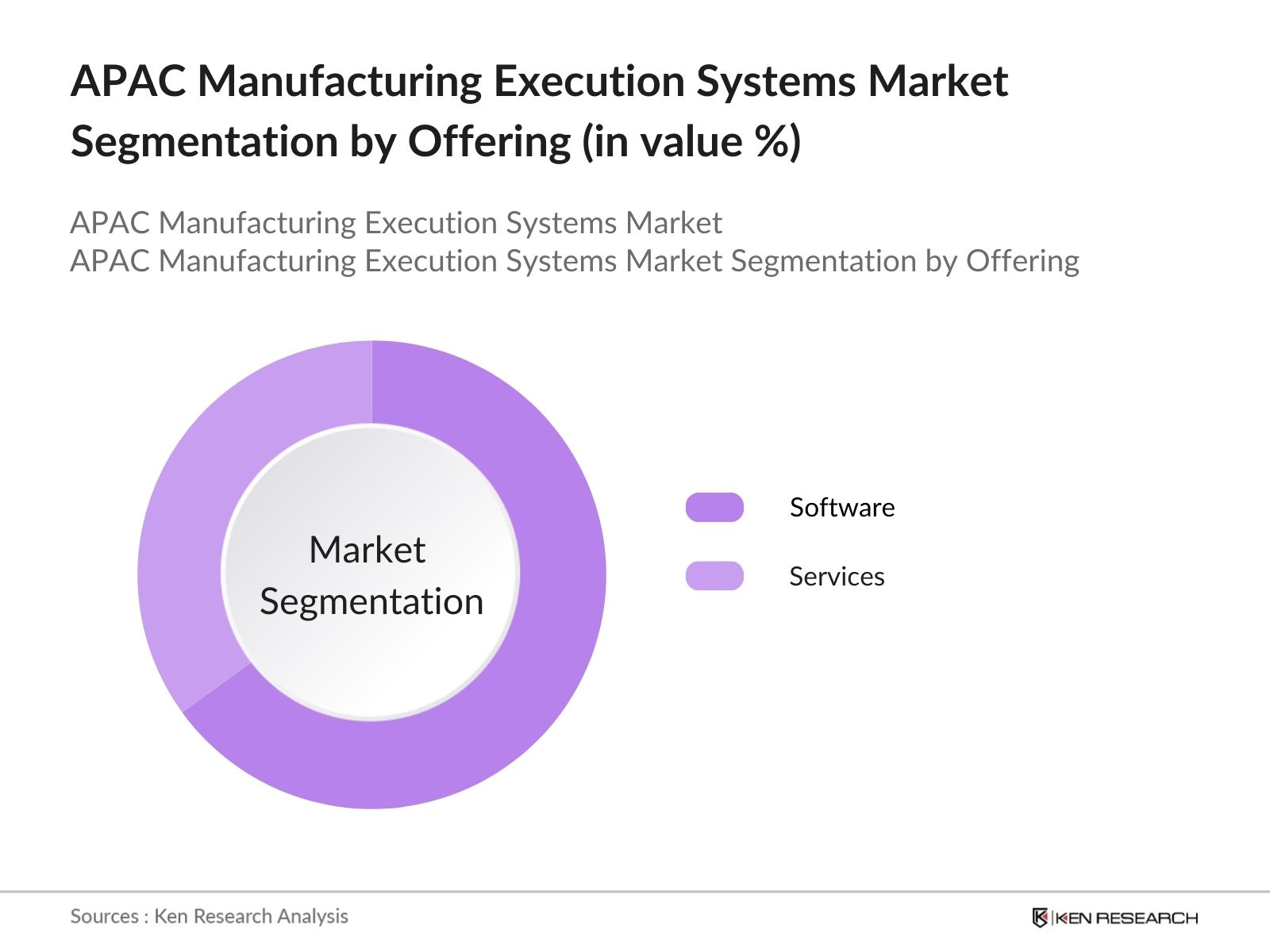

- By Offering: The APAC Manufacturing Execution Systems market is segmented by offering into Software and Services. Software solutions hold a dominant market share due to their integral role in automating and managing shop-floor operations. Real-time tracking, enhanced quality control, and data analytics capabilities make MES software indispensable for manufacturers striving to optimize production efficiency. Additionally, the transition from legacy systems to cloud-based solutions further drives software adoption in this market.

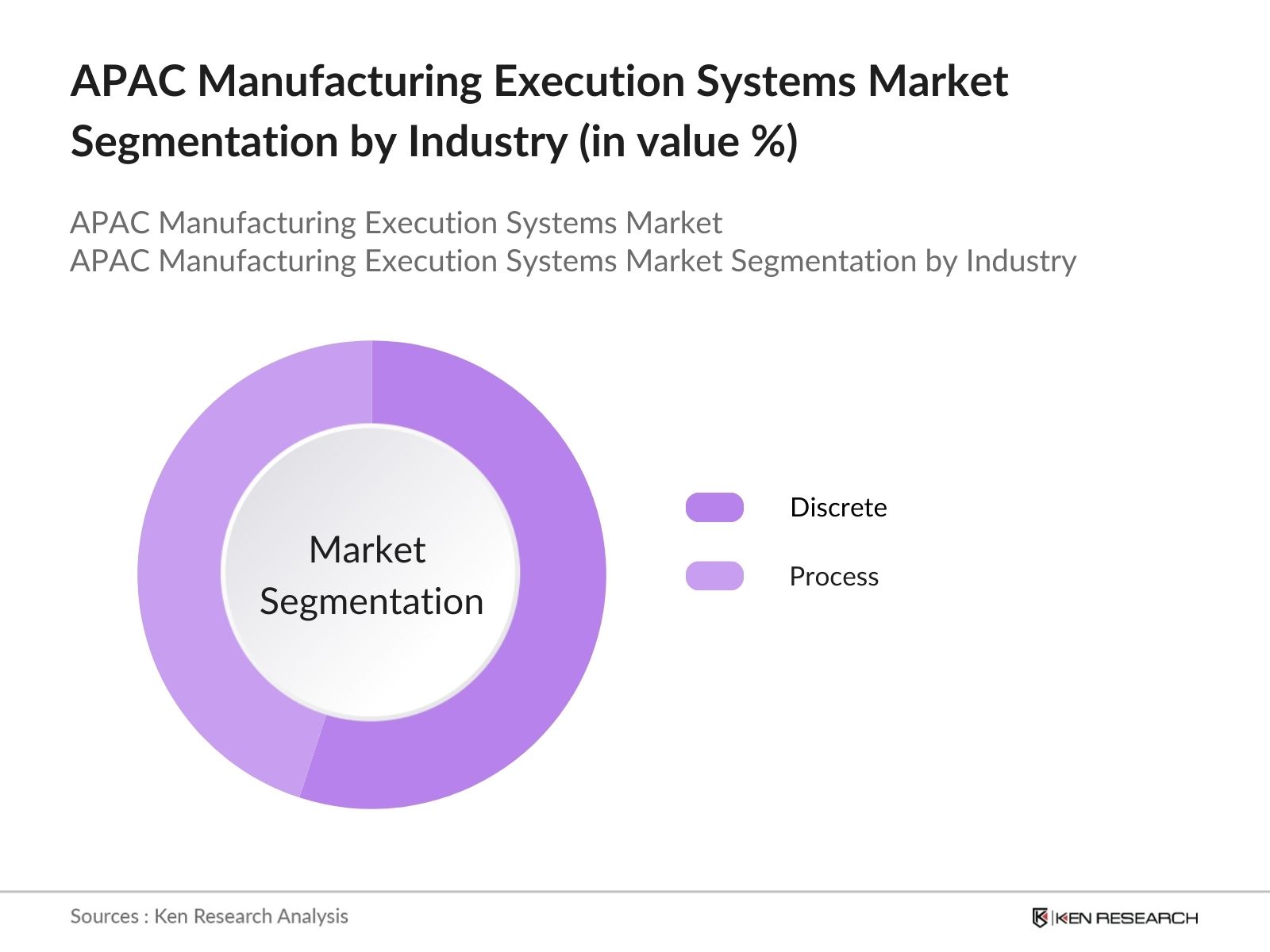

- By Industry: The market is also segmented by industry into Discrete Industries and Process Industries. Within discrete industries, automotive and electronics sectors lead due to the complexity of their production processes and the need for high-quality assurance. These sectors leverage MES to maintain a competitive edge by ensuring precision and reducing production errors. Meanwhile, in process industries, pharmaceuticals show a share, as MES systems help manage strict regulatory compliance and complex batch production requirements.

APAC Manufacturing Execution Systems Market Competitive Landscape

The APAC Manufacturing Execution Systems market is dominated by key players focusing on innovation and market expansion. The competitive landscape includes a mix of global giants and regional players who leverage technology advancements to meet evolving market needs.

APAC Manufacturing Execution Systems Market Analysis

Market Growth Drivers

- Industrial Automation Adoption: The Asia-Pacific (APAC) region has witnessed a significant surge in industrial automation, driven by the need to enhance manufacturing efficiency and reduce operational costs. According to the International Federation of Robotics, in 2021, China installed approximately 243,300 industrial robots, accounting for 49% of global installations. This substantial adoption underscores the region's commitment to automation, creating a conducive environment for Manufacturing Execution Systems (MES) to streamline and optimize production processes.

- Industry 4.0 Initiatives: Governments across APAC are actively promoting Industry 4.0 to modernize manufacturing sectors. For instance, Japan's 'Society 5.0' initiative aims to integrate advanced technologies into industries, enhancing productivity and addressing societal challenges. Similarly, South Korea's 'Manufacturing Innovation 3.0' strategy focuses on smart factories and digitalization. These initiatives drive the demand for MES solutions, which are integral to implementing smart manufacturing practices.

- Demand for Operational Efficiency: Manufacturers in APAC are increasingly focusing on operational efficiency to remain competitive in the global market. A report by the Asian Development Bank highlighted that enhancing productivity is crucial for sustaining economic growth in the region. MES solutions contribute to this goal by optimizing production workflows, reducing downtime, and improving resource utilization, thereby boosting overall efficiency.

Market Challenges

- High Implementation Costs: The initial investment required for MES implementation can be substantial, posing a barrier for small and medium-sized enterprises (SMEs). A study by the International Finance Corporation noted that SMEs in developing APAC countries often face financial constraints, limiting their ability to adopt advanced manufacturing technologies. This financial challenge hinders widespread MES adoption across the region.

- Integration Complexities: Integrating MES with existing enterprise systems such as ERP and SCM can be complex and time-consuming. The lack of standardized protocols and the diversity of legacy systems in APAC manufacturing industries exacerbate this issue. According to a report by the Asia-Pacific Economic Cooperation, interoperability challenges are a barrier to digital transformation in the region's manufacturing sector.

APAC Manufacturing Execution Systems Market Future Outlook

Over the next five years, the APAC Manufacturing Execution Systems market is anticipated to witness substantial growth, propelled by Industry 4.0 advancements, cloud technology integration, and demand for data-driven manufacturing. The push towards digital transformation and the adoption of smart factories are expected to drive further innovation within MES solutions, creating opportunities for both established players and new entrants in the market.

Market Opportunities

- Cloud-Based MES Solutions: The shift towards cloud computing offers a cost-effective and scalable alternative to traditional on-premises MES. The Asia Cloud Computing Association reported that cloud adoption in APAC grew by 25% in 2023, driven by the need for flexible and remote-accessible solutions. Cloud-based MES enables manufacturers to reduce upfront costs and benefit from real-time data access, facilitating informed decision-making and operational agility.

- SME Adoption: Small and medium-sized enterprises (SMEs) constitute a significant portion of APAC's manufacturing sector. The ASEAN SME Policy Index 2024 highlighted that SMEs account for over 90% of all enterprises in Southeast Asia. As these businesses seek to enhance competitiveness, there is a growing opportunity for MES providers to offer tailored, affordable solutions that address the unique needs of SMEs, thereby expanding their market reach.

Scope of the Report

|

Segment |

Sub-Segments |

|

Offering |

Software |

|

Deployment Type |

On-Premises |

|

Industry |

Discrete Industries: |

|

Functionality |

Production Tracking |

|

Country |

China |

Products

Key Target Audience

Automotive Manufacturers

Electronics & Semiconductor Companies

Pharmaceutical Companies

Food & Beverage Manufacturers

Government and Regulatory Bodies (e.g., Ministry of Industry and Information Technology, Japan's METI)

Investor and Venture Capitalist Firms

OEM Suppliers

Energy & Power Companies

Companies

Players Mentioned in the Report

Siemens AG

Honeywell International Inc.

Dassault Systmes SE

Rockwell Automation, Inc.

Yokogawa Electric Corporation

SAP SE

Emerson Electric Co.

Schneider Electric SE

ABB Ltd.

Oracle Corporation

Table of Contents

1. APAC Manufacturing Execution Systems Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. APAC Manufacturing Execution Systems Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. APAC Manufacturing Execution Systems Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation Adoption

3.1.2. Industry 4.0 Initiatives

3.1.3. Regulatory Compliance Requirements

3.1.4. Demand for Operational Efficiency

3.2. Market Challenges

3.2.1. High Implementation Costs

3.2.2. Integration Complexities

3.2.3. Data Security Concerns

3.3. Opportunities

3.3.1. Cloud-Based MES Solutions

3.3.2. SME Adoption

3.3.3. Emerging Markets Expansion

3.4. Trends

3.4.1. AI and Machine Learning Integration

3.4.2. IoT-Enabled MES

3.4.3. Real-Time Data Analytics

3.5. Government Regulations

3.5.1. Digital Transformation Policies

3.5.2. Smart Manufacturing Initiatives

3.5.3. Data Protection Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. APAC Manufacturing Execution Systems Market Segmentation

4.1. By Offering (In Value %)

4.1.1. Software

4.1.2. Services

4.2. By Deployment Type (In Value %)

4.2.1. On-Premises

4.2.2. Cloud-Based

4.2.3. Hybrid

4.3. By Industry (In Value %)

4.3.1. Discrete Industries

4.3.1.1. Automotive

4.3.1.2. Aerospace & Defense

4.3.1.3. Electronics & Semiconductors

4.3.1.4. Medical Devices

4.3.1.5. Consumer Packaged Goods

4.3.2. Process Industries

4.3.2.1. Food & Beverages

4.3.2.2. Pharmaceuticals & Life Sciences

4.3.2.3. Oil & Gas

4.3.2.4. Chemicals

4.3.2.5. Pulp & Paper

4.3.2.6. Energy & Power

4.3.2.7. Water & Wastewater Management

4.4. By Functionality (In Value %)

4.4.1. Production Tracking

4.4.2. Quality Management

4.4.3. Inventory Management

4.4.4. Performance Analysis

4.4.5. Document Control

4.5. By Country (In Value %)

4.5.1. China

4.5.2. Japan

4.5.3. India

4.5.4. South Korea

4.5.5. Australia

4.5.6. Rest of APAC

5. APAC Manufacturing Execution Systems Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. Honeywell International Inc.

5.1.3. General Electric Co.

5.1.4. Dassault Systmes SE

5.1.5. SAP SE

5.1.6. ABB Ltd.

5.1.7. Oracle Corporation

5.1.8. Applied Materials, Inc.

5.1.9. Emerson Electric Co.

5.1.10. Rockwell Automation, Inc.

5.1.11. Schneider Electric SE

5.1.12. Werum IT Solutions GmbH

5.1.13. Yokogawa Electric Corporation

5.1.14. Mitsubishi Electric Corporation

5.1.15. Fujitsu Limited

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Regional Presence, R&D Investment, Strategic Initiatives, Number of Employees, Year Established)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. APAC Manufacturing Execution Systems Market Regulatory Framework

6.1. Industry Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. APAC Manufacturing Execution Systems Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. APAC Manufacturing Execution Systems Future Market Segmentation

8.1. By Offering (In Value %)

8.2. By Deployment Type (In Value %)

8.3. By Industry (In Value %)

8.4. By Functionality (In Value %)

8.5. By Country (In Value %)

9. APAC Manufacturing Execution Systems Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping out the MES market ecosystem in APAC. Through extensive desk research and data from proprietary databases, we identify critical variables, including technological trends, regulatory requirements, and market demands, that influence MES adoption.

Step 2: Market Analysis and Construction

Here, we assess historical data, focusing on industry penetration, service provider networks, and revenue impact. Additionally, we examine key service quality metrics to validate revenue estimations and forecast accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated through interviews with industry experts via CATIs, ensuring that data insights reflect practical industry perspectives. This consultation enriches our understanding of operational trends and financial benchmarks.

Step 4: Research Synthesis and Final Output

We conduct in-depth analysis sessions with manufacturers to gather insights into product usage, sales metrics, and customer preferences. This approach ensures data integrity and presents an accurate, actionable analysis for the MES market.

Frequently Asked Questions

01. How big is the APAC Manufacturing Execution Systems market?

The APAC Manufacturing Execution Systems market is valued at USD 13.5 billion, driven by increased automation and demand for operational efficiency across industries like automotive and pharmaceuticals.

02. What are the challenges in the APAC Manufacturing Execution Systems market?

Challenges include high initial implementation costs, integration complexities with existing systems, and data security concerns, which can hinder small-scale adoption in some regions.

03. Who are the major players in the APAC Manufacturing Execution Systems market?

Key players include Siemens AG, Honeywell International, Rockwell Automation, and Yokogawa Electric, who dominate due to their advanced product offerings and established market presence.

04. What are the growth drivers for the APAC Manufacturing Execution Systems market?

The market's growth is fueled by Industry 4.0 initiatives, adoption of cloud-based solutions, and demand for real-time data in manufacturing operations, leading to streamlined processes and improved productivity.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.