Region:Asia

Author(s):Shubham

Product Code:KRAD5565

Pages:82

Published On:December 2025

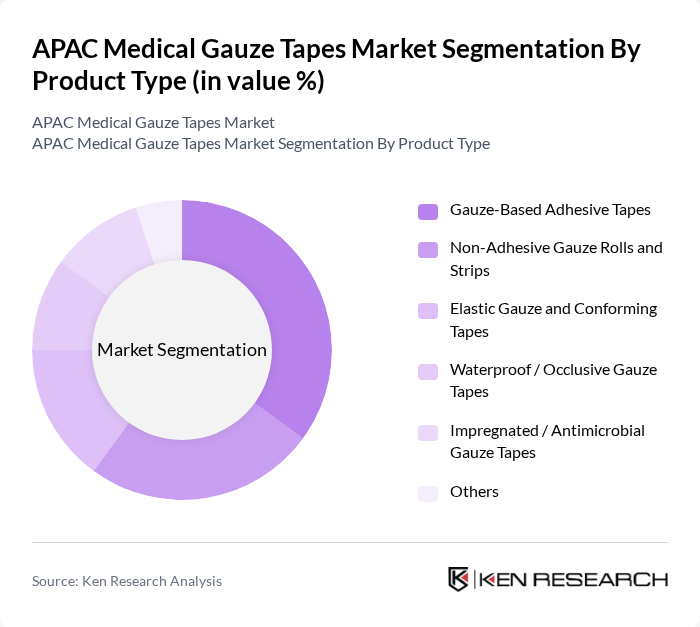

By Product Type:The product type segmentation includes various categories such as Gauze-Based Adhesive Tapes, Non-Adhesive Gauze Rolls and Strips, Elastic Gauze and Conforming Tapes, Waterproof / Occlusive Gauze Tapes, Impregnated / Antimicrobial Gauze Tapes, and Others. These categories broadly align with the way global and regional reports classify medical tapes and bandages, which distinguish between adhesive tapes, bandages, and specialty or antimicrobial products for wound care. Among these, Gauze-Based Adhesive Tapes are leading the market due to their versatility for securing dressings, catheters, and devices, ease of use across clinical and home settings, and wide availability through both hospital and retail channels. The demand for these tapes is driven by their effectiveness in wound management, the increasing shift toward home-based and outpatient care, and growing use in trauma, chronic wound, and post-operative dressing applications.

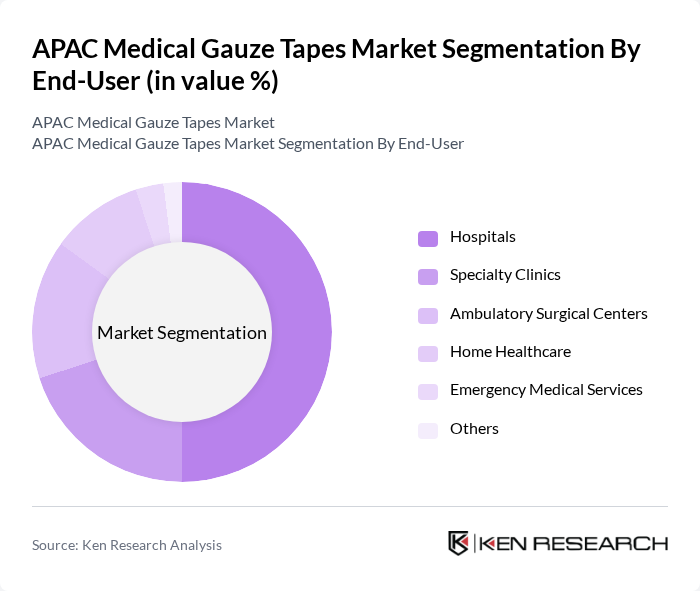

By End-User:The end-user segmentation includes Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Home Healthcare, Emergency Medical Services, and Others. This structure is consistent with leading industry analyses, which identify hospitals, clinics, ambulatory centers, and home care as primary end-use settings for medical tapes and bandages. Hospitals are the dominant end-user segment, driven by the high volume of surgical and trauma procedures, intensive wound care needs, and the use of gauze tapes for securing dressings, lines, and devices in inpatient settings. The increasing number of surgeries, expansion of day-care and ambulatory procedures, and a strong focus on patient safety, infection prevention, and standardized wound care protocols in hospitals contribute significantly to the demand for medical gauze tapes across APAC.

The APAC Medical Gauze Tapes Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Johnson & Johnson, Medtronic plc, Smith & Nephew plc, B. Braun Melsungen AG, Mölnlycke Health Care AB, Cardinal Health, Inc., Paul Hartmann AG, Nitto Denko Corporation, Nichiban Co., Ltd., Medline Industries, LP, Winner Medical Co., Ltd., Jiangsu Nanfang Medical Co., Ltd., Zhende Medical Co., Ltd., BSN medical GmbH (Essity) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC medical gauze tapes market is poised for substantial growth, driven by increasing healthcare expenditures and a focus on innovative product development. As governments in the region allocate more resources to healthcare, the demand for advanced wound care solutions will rise. Additionally, the integration of digital health solutions is expected to enhance patient outcomes, further propelling the market. Companies that adapt to these trends will likely capture significant market share in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Gauze-Based Adhesive Tapes Non-Adhesive Gauze Rolls and Strips Elastic Gauze and Conforming Tapes Waterproof / Occlusive Gauze Tapes Impregnated / Antimicrobial Gauze Tapes Others |

| By End-User | Hospitals Specialty Clinics Ambulatory Surgical Centers Home Healthcare Emergency Medical Services Others |

| By Application | Surgical Wound Management Traumatic and Acute Wound Care Chronic Wound and Ulcer Management IV Fixation and Catheter Stabilization Sports Injury and Orthopedic Support First Aid and OTC Use Others |

| By Material | Cotton Gauze Rayon / Viscose Gauze Polyester and Poly-Blend Gauze Nonwoven Gauze Tapes Others |

| By Adhesive Type | Acrylic-Based Adhesive Gauze Tapes Silicone-Based Adhesive Gauze Tapes Rubber / Latex-Based Adhesive Gauze Tapes Hypoallergenic and Sensitive-Skin Adhesive Tapes Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies and Drug Stores Online Pharmacies and E-commerce Platforms Medical Supply Distributors Others |

| By Country | China Japan India South Korea Australia & New Zealand Southeast Asia Rest of Asia Pacific |

| By Packaging Type | Individual Sterile Packs Multi-Unit / Bulk Hospital Packs Dispenser Box and Roll Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 120 | Procurement Managers, Supply Chain Coordinators |

| Clinics and Outpatient Facilities | 90 | Clinic Managers, Medical Assistants |

| Home Healthcare Providers | 60 | Home Care Coordinators, Nurses |

| Medical Distributors and Wholesalers | 70 | Sales Representatives, Distribution Managers |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Regulatory Affairs Specialists |

The APAC Medical Gauze Tapes Market is valued at approximately USD 1.3 billion, reflecting a significant growth trajectory driven by factors such as the increasing prevalence of chronic wounds and a rise in surgical procedures across the region.