Region:Asia

Author(s):Rebecca

Product Code:KRAD6286

Pages:90

Published On:December 2025

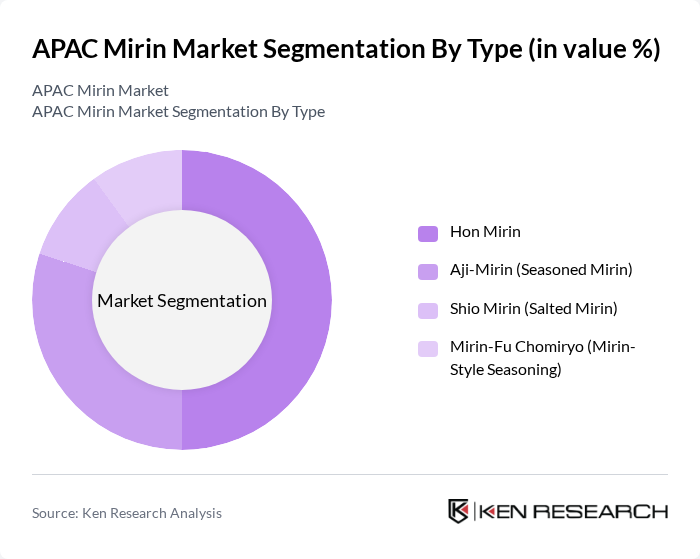

By Type:The mirin market can be segmented into four main types: Hon Mirin, Aji-Mirin (Seasoned Mirin), Shio Mirin (Salted Mirin), and Mirin-Fu Chomiryo (Mirin-Style Seasoning). Hon Mirin is the traditional form, while Aji-Mirin is a more affordable, seasoned variant. Shio Mirin is used for specific culinary applications, and Mirin-Fu is a non-alcoholic alternative. Aji-Mirin dominates the market due to its accessibility and widespread use in everyday cooking.

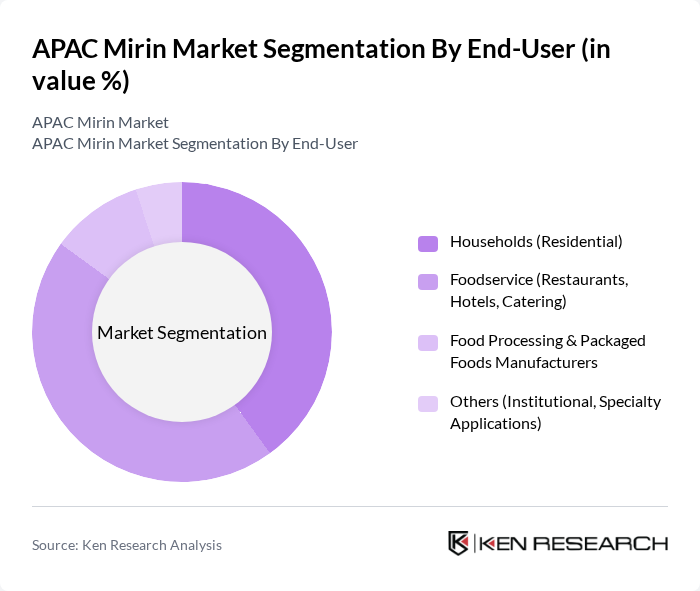

By End-User:The end-user segmentation includes Households (Residential), Foodservice (Restaurants, Hotels, Catering), Food Processing & Packaged Foods Manufacturers, and Others (Institutional, Specialty Applications). The Households sector is the leading segment, driven by the increasing number of Japanese restaurants and the growing trend of Asian cuisine in the region. Foodservice also represents a significant portion of the market as more consumers experiment with cooking at home.

The APAC Mirin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kikkoman Corporation, Mizkan Holdings Co., Ltd., Takara Shuzo Co., Ltd., Sempio Foods Company, Yamasa Corporation, Hinode Hon-Mirin Co., Ltd., Kondo Jozo Co., Ltd., Marukin Shoyu Co., Ltd., Ohsawa Japan Co., Ltd., Eden Foods, Inc., Wan Ja Shan Brewery Co., Ltd., Takara Sake USA Inc., Kamebishi Co., Ltd., Shoda Shoyu Co., Ltd., Yamaroku Shoyu Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC mirin market is poised for significant growth, driven by evolving consumer preferences towards authentic Asian flavors and the increasing integration of Japanese cuisine into mainstream dining. As e-commerce continues to expand, it will facilitate greater access to mirin products, enhancing consumer awareness and usage. Additionally, the trend towards health-conscious eating will likely encourage the development of low-sugar and organic mirin options, appealing to a broader audience and fostering innovation within the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hon Mirin Aji-Mirin (Seasoned Mirin) Shio Mirin (Salted Mirin) Mirin-Fu Chomiryo (Mirin-Style Seasoning) |

| By End-User | Households (Residential) Foodservice (Restaurants, Hotels, Catering) Food Processing & Packaged Foods Manufacturers Others (Institutional, Specialty Applications) |

| By Region | Japan China South Korea Southeast Asia |

| By Application | Sauces, Marinades, and Seasoning Blends Soups, Stews, and Noodle Dishes Glazes, Dressings, and Dips Ready-to-Eat & Convenience Foods |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail & E-commerce Specialty & Gourmet Stores |

| By Packaging Type | Glass Bottles Plastic Bottles Flexible & Pouch Packaging Bulk & Foodservice Packaging |

| By Price Range | Premium / Authentic Craft Mirin Mid-Range Branded Mirin Economy / Private Label Mirin Others (Organic, Specialty, Limited Edition) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Food Service Sector Analysis | 100 | Restaurant Owners, Executive Chefs |

| Consumer Preferences Survey | 150 | Home Cooks, Culinary Enthusiasts |

| Export Market Evaluation | 80 | Export Managers, Trade Analysts |

| Health and Wellness Trends | 70 | Nutritionists, Health Food Retailers |

The APAC Mirin Market is valued at approximately USD 145 million, reflecting a growing interest in Japanese cuisine and authentic cooking ingredients among consumers, driven by trends in home cooking and the expansion of the global food and beverage industry.