Region:Asia

Author(s):Geetanshi

Product Code:KRAD6034

Pages:90

Published On:December 2025

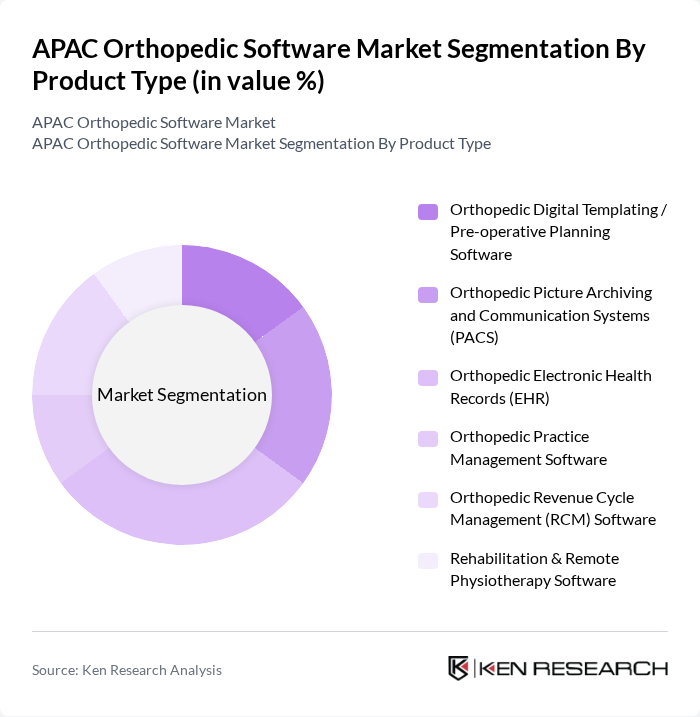

By Product Type:The product type segmentation includes various software solutions tailored for orthopedic practices. The subsegments are Orthopedic Digital Templating / Pre-operative Planning Software, Orthopedic Picture Archiving and Communication Systems (PACS), Orthopedic Electronic Health Records (EHR), Orthopedic Practice Management Software, Orthopedic Revenue Cycle Management (RCM) Software, and Rehabilitation & Remote Physiotherapy Software. Among these, Orthopedic Electronic Health Records (EHR) is currently dominating the market due to the increasing need for efficient patient data management and regulatory compliance. The trend towards digitization in healthcare is driving the adoption of EHR systems, which streamline workflows and improve patient care.

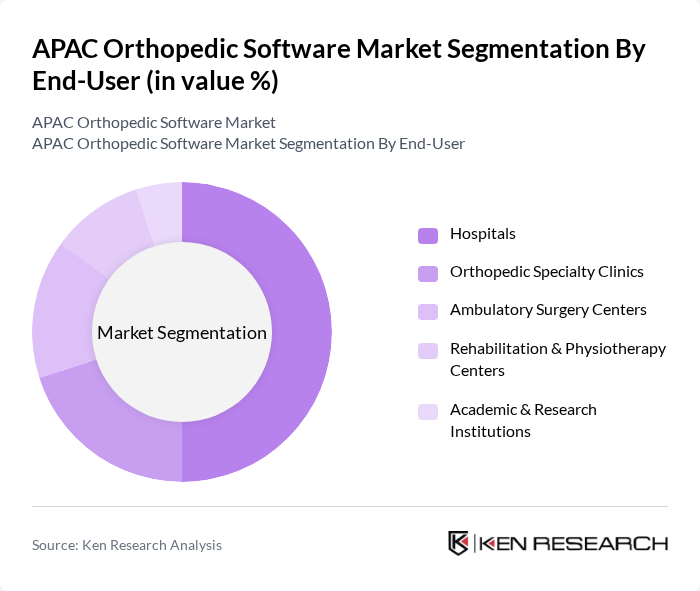

By End-User:The end-user segmentation encompasses various healthcare settings utilizing orthopedic software. The subsegments include Hospitals, Orthopedic Specialty Clinics, Ambulatory Surgery Centers, Rehabilitation & Physiotherapy Centers, and Academic & Research Institutions. Hospitals are the leading end-user segment, driven by the increasing number of orthopedic surgeries and the need for integrated software solutions to manage patient care efficiently. The growing trend of outpatient surgeries is also contributing to the rise of Ambulatory Surgery Centers, which are increasingly adopting orthopedic software.

The APAC Orthopedic Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, DePuy Synthes (Johnson & Johnson MedTech), Medtronic plc, Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Brainlab AG, Materialise NV, OrthAlign, Inc., EOS imaging (a subsidiary of Alphatec Holdings, Inc.), Carestream Health, Inc., Sectra AB, Merge Healthcare Solutions Inc. (an IBM Company) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC orthopedic software market is poised for significant transformation driven by technological advancements and changing patient expectations. As healthcare providers increasingly prioritize patient engagement and data analytics, the integration of AI and machine learning into orthopedic software will enhance decision-making and operational efficiency. Furthermore, the shift towards cloud-based solutions will facilitate real-time data access, improving collaboration among healthcare teams and ultimately leading to better patient outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Orthopedic Digital Templating / Pre-operative Planning Software Orthopedic Picture Archiving and Communication Systems (PACS) Orthopedic Electronic Health Records (EHR) Orthopedic Practice Management Software Orthopedic Revenue Cycle Management (RCM) Software Rehabilitation & Remote Physiotherapy Software |

| By End-User | Hospitals Orthopedic Specialty Clinics Ambulatory Surgery Centers Rehabilitation & Physiotherapy Centers Academic & Research Institutions |

| By Country / Sub-region | China Japan India South Korea Australia & New Zealand Southeast Asia (Thailand, Indonesia, Malaysia, Singapore, Vietnam, Others) Rest of Asia-Pacific |

| By Mode of Delivery / Technology | Cloud / Web-based Solutions On-premise Solutions Hybrid Deployment Mobile & Tablet-based Applications |

| By Clinical Application | Joint Replacement (Hip, Knee, Shoulder, Others) Fracture & Trauma Management Spine Surgery Planning & Navigation Pediatric Orthopedic Assessment Sports Injury & Arthroscopy Management Post-operative Monitoring & Outcomes Tracking |

| By Buyer / Investment Source | Public Hospitals & Government Health Systems Private Hospitals & Clinic Chains Independent Orthopedic Practices Venture-backed Digital Health & Health-tech Providers Others |

| By Policy & Reimbursement Support | National Digital Health & EHR Programs Reimbursement for Computer-assisted & Navigation-guided Surgery Grants and Incentives for Healthcare IT Adoption Data Protection & Interoperability Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgery Centers | 120 | Surgeons, Practice Managers |

| Hospital IT Departments | 90 | IT Directors, Health Informatics Specialists |

| Orthopedic Software Vendors | 70 | Product Managers, Sales Executives |

| Healthcare Consultants | 60 | Healthcare Analysts, Market Researchers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The APAC Orthopedic Software Market is valued at approximately USD 450 million, driven by the increasing prevalence of orthopedic disorders, advancements in technology, and the demand for efficient healthcare solutions.