Region:Asia

Author(s):Dev

Product Code:KRAA9697

Pages:94

Published On:November 2025

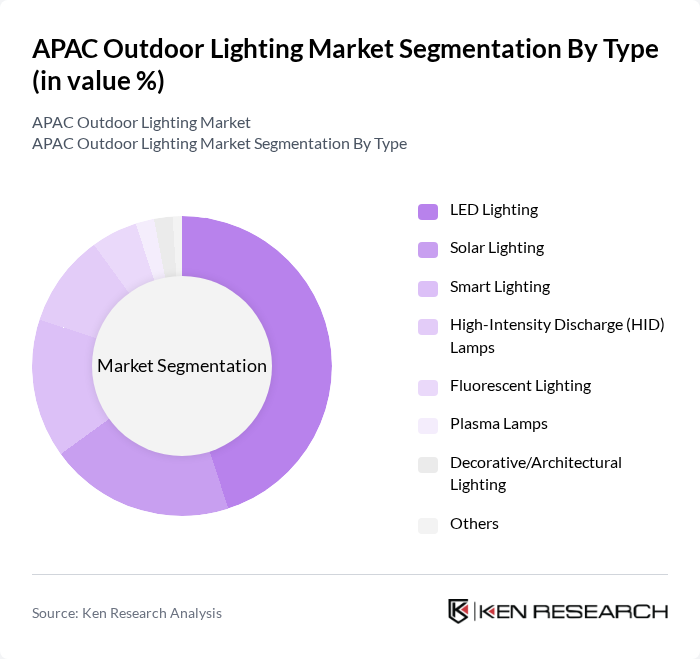

By Type:The outdoor lighting market in APAC is segmented into LED Lighting, Solar Lighting, Smart Lighting, High-Intensity Discharge (HID) Lamps, Fluorescent Lighting, Plasma Lamps, Decorative/Architectural Lighting, and Others. Among these,LED Lightingremains the dominant segment, driven by its high energy efficiency, long operational life, and declining costs, making it the preferred choice for both public infrastructure and private sector projects .

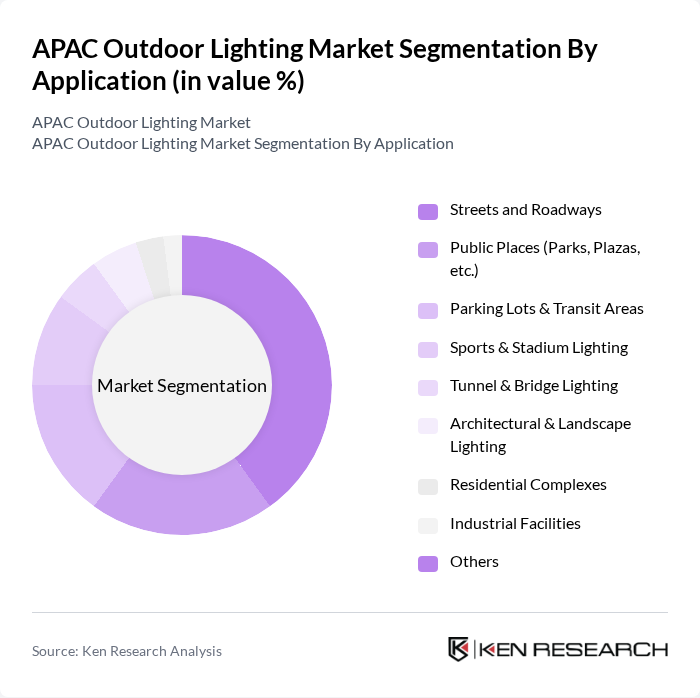

By Application:The market is also segmented by application, including Streets and Roadways, Public Places (Parks, Plazas, etc.), Parking Lots & Transit Areas, Sports & Stadium Lighting, Tunnel & Bridge Lighting, Architectural & Landscape Lighting, Residential Complexes, Industrial Facilities, and Others.Streets and Roadwayslighting is the leading application, supported by ongoing municipal upgrades and the need for improved safety and visibility in urban environments. Sports and stadium lighting is also experiencing notable growth due to increased investment in community and event infrastructure .

The APAC Outdoor Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify N.V. (formerly Philips Lighting), Osram Licht AG, Cree LED (a Smart Global Holdings company), GE Lighting, a Savant company, Acuity Brands, Inc., Zumtobel Group AG, Eaton Corporation plc, Hubbell Lighting, Inc., Panasonic Corporation, Nichia Corporation, Samsung Electronics Co., Ltd., Toshiba Corporation, Opple Lighting Co., Ltd., FSL (Foshan Electrical and Lighting Co., Ltd.), Seoul Semiconductor Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC outdoor lighting market is poised for significant transformation, driven by technological advancements and increasing environmental awareness. As cities continue to embrace smart technologies, the integration of IoT in lighting systems will enhance operational efficiency and user experience. Furthermore, the growing emphasis on sustainability will likely accelerate the development of eco-friendly lighting solutions, aligning with global energy conservation efforts. This evolving landscape presents a unique opportunity for stakeholders to innovate and adapt to changing consumer preferences and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | LED Lighting Solar Lighting Smart Lighting High-Intensity Discharge (HID) Lamps Fluorescent Lighting Plasma Lamps Decorative/Architectural Lighting Others |

| By Application | Streets and Roadways Public Places (Parks, Plazas, etc.) Parking Lots & Transit Areas Sports & Stadium Lighting Tunnel & Bridge Lighting Architectural & Landscape Lighting Residential Complexes Industrial Facilities Others |

| By Region | China Japan India South Korea Australia Southeast Asia (Indonesia, Malaysia, Singapore, Thailand, Vietnam, Philippines) Rest of APAC |

| By Distribution Channel | Offline Online |

| By End-User | Government & Municipalities Commercial Industrial Residential Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Street Lighting Projects | 100 | City Planners, Public Works Directors |

| Commercial Outdoor Lighting Solutions | 60 | Facility Managers, Retail Operations Heads |

| Smart Lighting Technology Adoption | 50 | IT Managers, Smart City Coordinators |

| Energy Efficiency Programs | 40 | Energy Auditors, Sustainability Consultants |

| Installation and Maintenance Services | 50 | Electrical Contractors, Service Managers |

The APAC Outdoor Lighting Market is valued at approximately USD 4.0 billion, driven by urbanization, government initiatives, and the demand for energy-efficient lighting solutions, particularly LED and solar technologies.