Region:Asia

Author(s):Rebecca

Product Code:KRAD4901

Pages:93

Published On:December 2025

By Type:The market is segmented into various types, including Cold Chain Transportation, Non-Cold Chain Transportation, Specialized Pharmaceutical Transportation Services, and Value-Added Logistics Services (Packaging, Labelling, Kitting). Cold Chain Transportation is particularly significant due to the increasing need for temperature-controlled logistics for sensitive pharmaceuticals, including biologics, vaccines, cell and gene therapies, and high-value injectables that require validated temperature ranges throughout the shipment lifecycle.

Cold Chain Transportation is the leading subsegment, driven by the rising demand for biologics and vaccines that require strict temperature control during transit, as well as expanding use of temperature-sensitive oncology and autoimmune therapies. The increasing prevalence of chronic diseases and the growing biopharmaceutical sector are also contributing to the demand for specialized transportation services, including validated packaging, passive and active temperature-controlled containers, and GDP-compliant handling. As a result, companies are investing in advanced temperature-controlled logistics solutions such as real-time IoT tracking, lane qualification, and dedicated pharma hubs to ensure compliance with Good Distribution Practice standards and maintain product integrity across complex, multimodal supply chains.

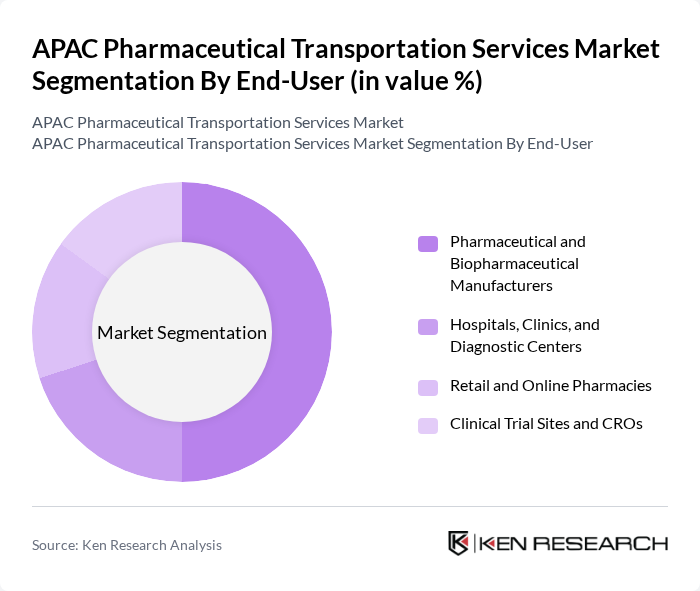

By End-User:The market is segmented by end-users, including Pharmaceutical and Biopharmaceutical Manufacturers, Hospitals, Clinics, and Diagnostic Centers, Retail and Online Pharmacies, and Clinical Trial Sites and CROs. Pharmaceutical and Biopharmaceutical Manufacturers represent a significant portion of the market due to their need for reliable transportation of sensitive products across bulk production, finished dosage distribution, and export flows.

Pharmaceutical and Biopharmaceutical Manufacturers dominate the market due to their extensive regional and global supply chains and the critical need for timely and secure transportation of products ranging from APIs and intermediates to finished formulations and biologics. The increasing focus on research and development in the biopharmaceutical sector is also driving demand for specialized logistics services, particularly for clinical trials, direct-to-patient models, controlled-room-temperature shipments, and time- and temperature-critical product launches across APAC.

The APAC Pharmaceutical Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding (DHL Global Forwarding, Freight), Kuehne + Nagel International AG, DB Schenker, UPS Healthcare (United Parcel Service, Inc.), FedEx Express, CEVA Logistics, Yusen Logistics Co., Ltd., Nippon Express Holdings, Inc., Kerry Logistics Network Limited, SF Express (SF Holding Co., Ltd.), Sinotrans Limited, CJ Logistics Corporation, SKYCELL AG, Zuellig Pharma Holdings Pte. Ltd., Bolloré Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The APAC pharmaceutical transportation services market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. The integration of IoT and AI in logistics is expected to enhance operational efficiency, while the shift towards sustainable practices will reshape transportation methods. Additionally, as personalized medicine gains traction, the demand for specialized logistics solutions will increase, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Cold Chain Transportation Non-Cold Chain Transportation Specialized Pharmaceutical Transportation Services Value-Added Logistics Services (Packaging, Labelling, Kitting) |

| By End-User | Pharmaceutical and Biopharmaceutical Manufacturers Hospitals, Clinics, and Diagnostic Centers Retail and Online Pharmacies Clinical Trial Sites and CROs |

| By Region | China India Japan South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam, Philippines, Others) Rest of Asia Pacific (Singapore, Hong Kong, Taiwan, Others) |

| By Service Type | Freight Forwarding (Air, Sea, Road, Rail) Last-Mile Delivery and Distribution Warehousing and Cold Storage Services Value-Added Services (Customs Clearance, Documentation, Consulting) |

| By Temperature Control | Ambient (15°C–25°C) Refrigerated (2°C–8°C) Frozen (-20°C and below) Deep-frozen / Cryogenic (below -60°C, including LN2) |

| By Packaging Type | Passive Packaging Solutions Active Temperature-Controlled Containers Insulated Shippers and Parcel Packaging Pallet Shippers and Bulk Containers |

| By Delivery Model | Direct-to-Distributor / Wholesaler Direct-to-Pharmacy / Hospital Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) and Control Tower Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Chain Logistics | 120 | Logistics Managers, Cold Chain Specialists |

| Regulatory Compliance in Transportation | 90 | Compliance Officers, Quality Assurance Managers |

| Pharmaceutical Freight Forwarding | 70 | Freight Managers, Operations Directors |

| Last-Mile Delivery Solutions | 60 | Delivery Managers, Supply Chain Analysts |

| Emerging Market Logistics Strategies | 80 | Market Analysts, Business Development Managers |

The APAC Pharmaceutical Transportation Services Market is valued at approximately USD 130 billion, reflecting significant growth driven by the increasing demand for temperature-sensitive pharmaceuticals, rising healthcare expenditure, and advancements in logistics technologies.